Pay attention, do not look over there!

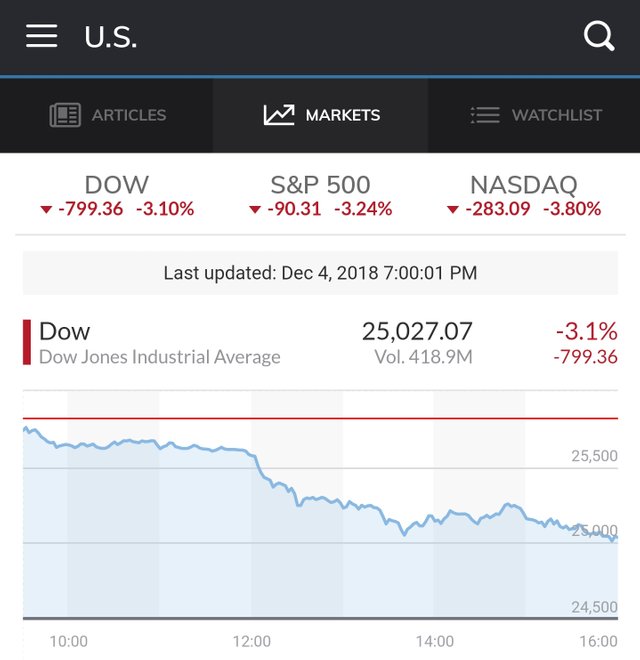

Well has the meltdown started? A lot of experts are saying it has, today the stock market saw a loss of 799 points and was at 818 at one point today.

Now I know there are some rumors floating around about he said, no I didn't, and shit who really knows which one of the 2 are lying. They both probably are, but here is something that is not lying and most people don't understand.

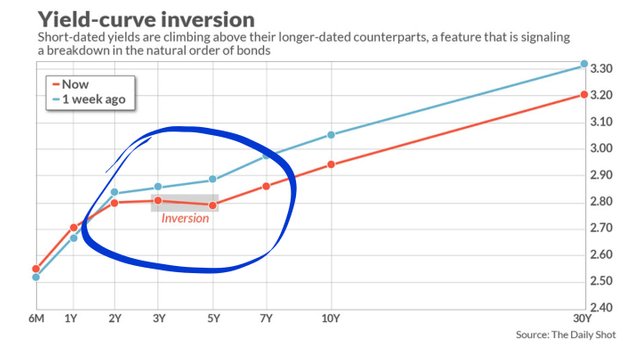

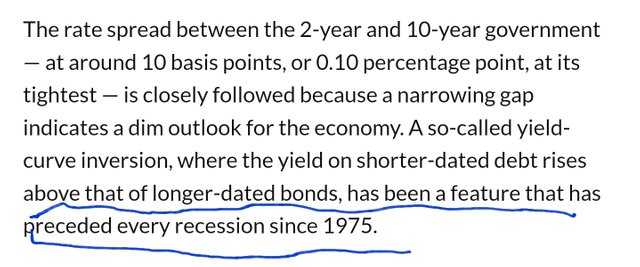

Now from what I understand this is bad, very bad, when the 2 year bond yeilds higher than the 5 year bond. They call it a yeild curve inversion. And guess what, it has happened before every recession since the early 70's

This is causing some major concern and is probably what is tanking this market more than thr leaders of the worlds. Wow 800 points in one day, thats pretty serious. This week is diffently shaping up as "one to remember"

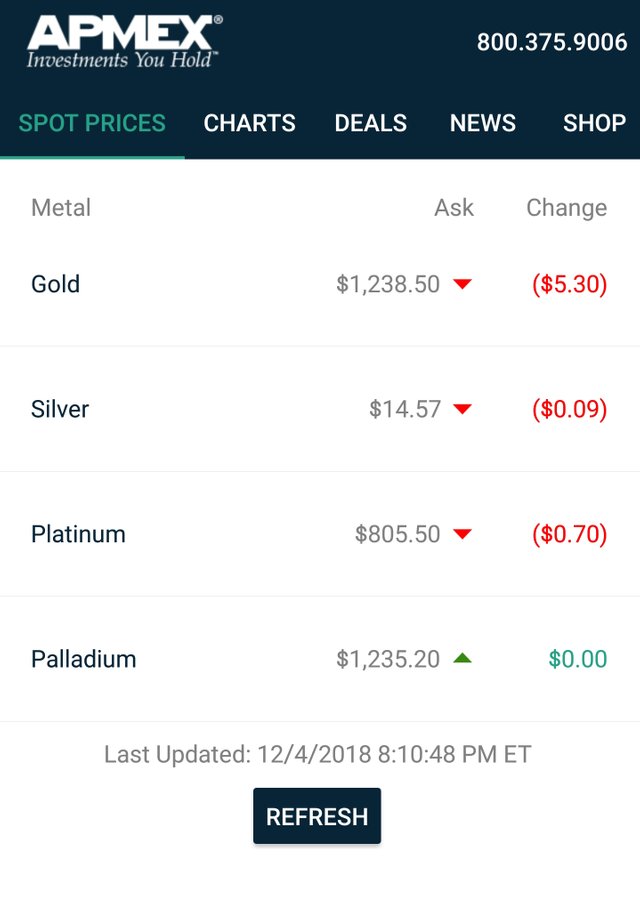

Now unfortunately, this has not helped the precious metals yet! I stress yet. So get out there and buy some metals.

STACK HARD, STACK HIGH AND STACK FAST

Have you noticed that premiums on precious metals seem to have been rising, in general, for the last 2 or 3 months? Not counting the recent Black Friday & Cyber Monday sales, it seems premiums have nearly doubled or tripled, and more and more I see bullion dealers with "OUT OF STOCK" notices on their products. Even with $2.00 - $3.00 premiums, silver is a steal right now. I'm getting closer to my stacking goal with every passing paycheck...

I have noticed, it seems to be all across the board to. I would and could only assume that the deficit on silver is getting worse.

I hate to say it but I hope that this Silver deficit continues. The primary Silver miners are just being beaten into the ground. The other miners that just pick up Silver as " other metals they get "will just keep selling there metal whatever the price is up or down. When the Silver orders cannot be filled in a timely manner........ That's when all Hell will break loose!!!

Keep Stacking!!

Resteemed!!

I came across some interesting analysis the other day regarding silver mining reports. The guy was examining mining costs & production across 12 of the 15 largest silver mines in the world and two things stood out to me: #1 - all 12 mines are running into ore which is less rich in silver content, and #2 - mining operations costs are projected to begin rising over the next few years. So, increased cost to mine less rich ore can only mean a decrease in supply in an environment of increasing demand. If you throw a massive increase in silver investor demand on top of that say, a currency crisis or a stock market crash... Silver is only going up and up in the future. How fast? IDK, but anybody measuring their worth in ounces, instead of price, is going to be very happy in a couple of years.

Yes this is true I have read the same, and I think you are correct. The problem for now is, for example copper miners that also pull Silver and Gold out when they mine they will sell at any price because it’s just extra money. Silver could go to $5.00 oz ...... ( I don’t see this happening) and they would not care they would just sell into the market. This is Silvers problem at the moment. I own Silver and Gold mining stocks and they are being pummeled 🙃

Everything will be chaotic during the coming panic, so all asset classes could be effected by major volatility. The main thing to remember about markets is the fact they are driven by fear and greed. When the fear sets in, commodities like precious metals will, 100%, be perceived as the "safe haven" assets they have always been. Right now, the ridiculously low prices on silver and gold can not be denied, seeing as how they are priced right around their mining costs - maybe slightly above or below. Mining stocks are a super great place to be - even if they seem to be taking a beating at the moment - they will go up, massively, over the next crisis period. The continual selling of silver into the markets has to be done for industry to continue to operate - but it is nothing short of a "fire sale" for investors. As long as silver stays under $20 oz., I'm buying as much as possible. I've been "poor" all of my life, and see this as a once-in-a-lifetime opportunity for me to take my piece of the pie. I hope to convert metals into real estate when they become overvalued. It seems contrary, but I will set my price target and sell into the rising metals prices when they get a leg up.

Yikes!!!

Thank you for your continued support of SteemSilverGold

Keep stacking!!!

Yep. Hard to believe Gold and Silver aren't spiking in the face of a potential market meltdown.

This precedes a recession and the 2s and 10s is the big one but guess what, that is going to happen.

And i want to reiterate that we will see a 1000+ down day in the Dow.

Posted using Partiko iOS

Ahhh.. 😲 Better keep stacking and stacking and... Ohhh.. More stacking! 👍

Thank you for sharing this my friend. Cheers! 🌹

I've only just started, but I'm slowly but surely growing my little stack!

Ounce by ounce, a giant will be created.

I can't wait! I am keeping an eye out for bargains and trying not to rush things!