How to win at Bitcoin?

Easy: start dollar cost averaging (DCA) now

Or if not dollars whatever fiat money you fancy. For me it's euros. Cost averaging is dead simple and deep down we know it works. I did quite well using this psychological investment technique, when I stuck to it, during 2004-2008 where I accumulated most of my gold and silver.

Why does it work?

DCA is throwing a fixed amount of money at pre-determined regular intervals over a reasonably long period into an asset you want to own. And, crucially, sticking to it! DCA is ideal if like me you're a terrible trader or market timer. It's also ideal if you don't have a giant pot of cash to start with but rather a steady paycheque or income source. Right now that's where I am. There are 3 key benefits as I see it:

(1) emotional detachment

(2) emotional detachment

(3) emotional detachment

LOL... but there's also the simplicity of it and you naturally get more when prices dip, and less when they rally.

Sounds easy right?

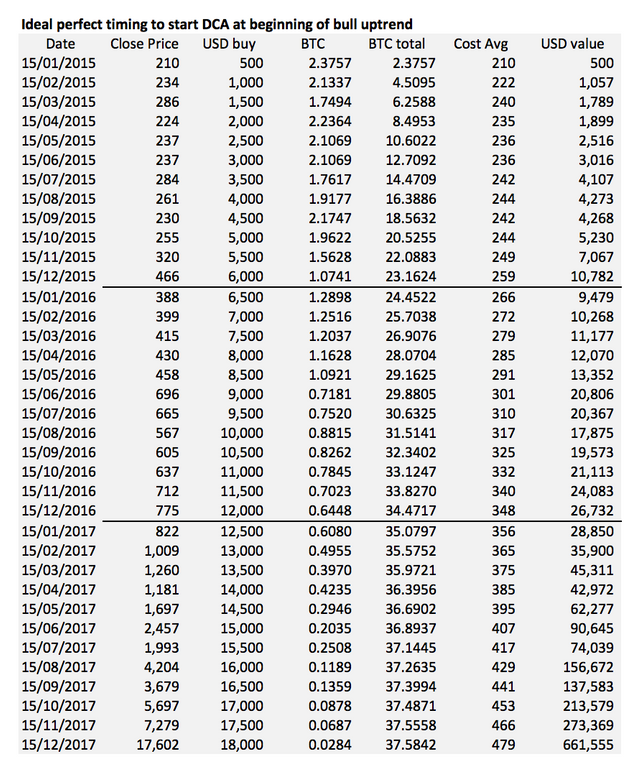

This technique works best in the early stages of an emerging bull market. Look at this example of hypothetically starting a $500 per month DCA plan back in January 2015. Every month, on the 15th like clockwork, another $500. Bang.

Wouldn't 2017 have been an amazing year :-) Notice how the BTC total grows so slowly in 2017 as the price rise but the monthly purchase stays fixed.

I reckon cost averaging works anytime because it's removes the biggest barrier to successful investing, emotions. I like to think I'm level headed and rational but sadly the record suggests otherwise. I tend to buy more and more often when prices are high and the complete opposite when prices slump. Without a cost averaging plan I make haphazard, emotions-driven purchases.

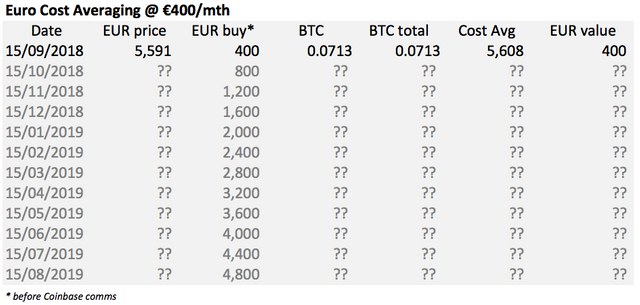

12-month DCA plan

So it's gonna be €400 (approx US$480 today) every 15th of the month for the next 12 months, starting today Saturday September 15th. Specifically here's what I'm committing myself to and why:

Same Day: Commitment to that particular day and that day only. The 15th. Even if the price has rallied previous 3 days and looks ripe for a pullback. Nope. Same day. No more checking my Blockfolio app every 15 minutes like a demented junkie! One simple purchase, done.

Equal Value: Again, I might be tempted to deviate by spending less (or more) if I feel the price has temporarily gotten ahead of itself or vice versa. Or car need new battery yadda yadda. Nope. Same fiat amount everytime!

12 Purchases: No if's and's or but's. I have thought through all the fear uncertainty and doubt scenarios. Well yeah OK if the SHA-256 cryptography algorithm is cracked all bets are off!! But baring something crazy like that I will only stop and re-evaluate after my last purchase on August 15th 2019.

I'll post the results every 15th of the month until then.

So let's see what happens shall we?

Thanks for reading and hey why not join me, even if it's only a hundred bucks!

Check out my apps here:

Android - Silver Coin Valuer PRO and Gold Coin Valuer PRO

iOS - Silver Coin Valuer PRO and Gold Coin Valuer PRO

Congratulations @walktothewater! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!