Conventional stock markets, do you watch them?

Who here as a 401k account at their workplace? Is it invested 100% into mutual funds that are tied to the conventional stock market? Does anyone invest in mutual funds? Individual stocks? ETF's? Has anyone ever attempted to trade stocks or ETF's? Like Gold, Oil, Banking, Technology, Biotech sectors?

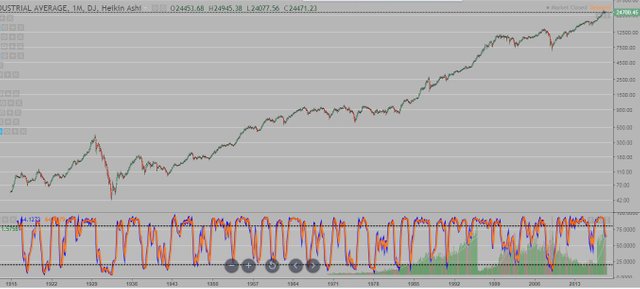

Here is a monthly chart of the Dow Jones Industrial average from ~1915. Apparently, if you hold any of the Dow 30 stocks long term, it will appreciate in value. At least that is the way it appears based on the chart.

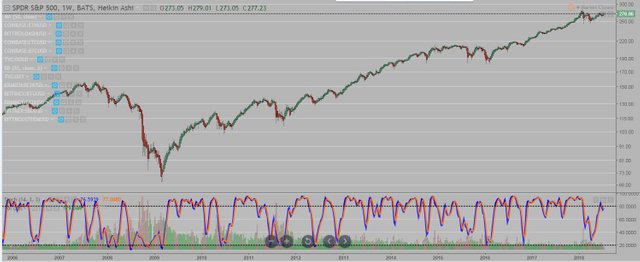

Here is a monthly chart of the SPX from 1993 which is an index of the 500 largest companies in the United States. It is a good representation of the stock market and many use it as a 'barometer' of how the market is doing.

A weekly chart of the SPX from ~2006. You can clearly see the 2008/09 recession/crash which sent a lot of people in panic mode, especially those that were on the verge of retiring. The market dropped over 50% from the peak, so if you had a 401k with $300k, it was down to <$150k. More if someone had it invested in the higher risk mutual funds.

You can also see that it has not only recovered all of the losses, but has had some great yearly gains since then.

I placed a fibonacci retracement on the weekly SPX chart from the high in 2007 to the low in 2009. (Blue lines)

This gave a projected 1.618 level which you can see provided resistance at first before breaking through.

The next major level is 2.618 which is ~308 on the SPX. The current level is ~276.85

Will it reach that level and pull back from there? Have you used the fibonacci tool before? Can it project potential resistance and support levels?

If you have a 401k or a large amount invested in the conventional markets, how often do you watch them? Are you concerned about the next crash? It's not a matter of if, it is when...

I think stocks do better than inflation but regardless stocks are generally WAY better to own than cash over the long haul.

Are you not afraid of a market crash? Since it has been on an uptrend for 9 years...

They have it pretty well rigged now although I'm mainly a trader and not a long term investor.

Maybe the market will go up higher than anyone expects, push out all of the shorts. When it does crack, there will be a ton of shorting.... I speculate that it will drop more than the 08/09 crash.

It won't ever crash again. They have it very well rigged. Check out @marketreport.

I know it's rigged via the QE program that the FED/Treasury installed after 08/09. But IMO, the banks will all pile on the shorts and I think the crash is inevitable, no one knows when.

Where was the plunge protection team in 08/09?

I think it's more perfected now and the bond market is even bigger so it's easier to rig.

Nice and good information provided to the steemit community.

You got a 3.17% upvote from @postpromoter courtesy of @glennolua!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

Free Upvotes

ENJOY !