Does the AT&T-Time Warner Merger Signal A Market Top???

The last Time Warner merged with a company, it signified a top in the Markets (and became was the worst merger in history). In 2000, AOL announced they were buying Time Warner for $160 billion and in January 2001 the deal became final. With the deal, Time Warner established a much needed online presence and could deliver its content to an additional 20 million online customers and AOL now had access to Time Warner’s content and cable lines, a far upgrade from the telephone dialup connections.

The merger was to signify an important step in the internet revolution where old and new media were joined at the hip now. That same year the Markets reached a top, the dot com bubble popped, the NASDAQ dropped 80% from the high and the economy went into recession.

Fast forward to October 2016. AT&T announces they are acquiring Time Warner. This time it's about the convergence of the media and communications industry. Again, two companies with complementary strengths. Time Warner has the largest film/TV library of content and AT&T has the TV, mobile and broadband distribution direct to consumers. Well, the $85 billion merger between AT&T and Time Warner was approved yesterday.

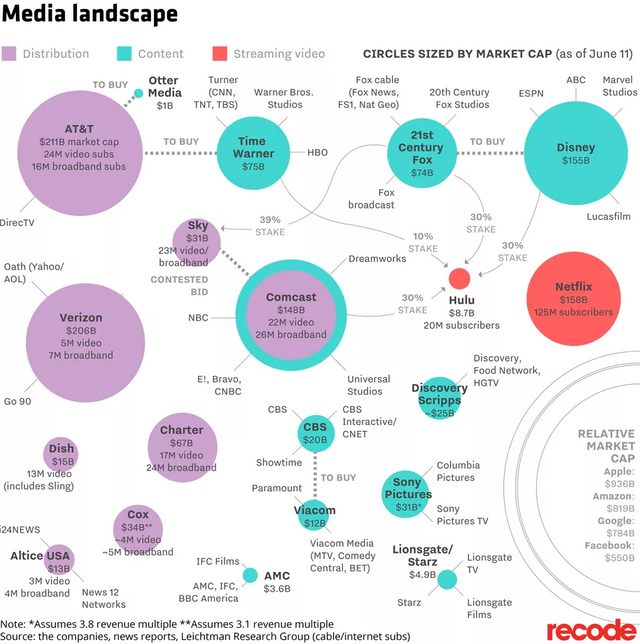

This case was closely watched because whatever decision was made, it was going to heavily impact the media industry. A key argument in the case was the merger was considered a vertical merger (and not a horizontal integrated merger where a larger company buys up the smaller competition), meaning two companies do not produce competing products…AT&T, the largest telecommunication company in the US is going to distribute Timer Warner’s content. And in the blink of an eye, the competition just increased for Netflix, Amazon and Apple.

Now the fun begins because every other company has to now keep up or die trying. With the AT&T-Time Warner merger approved, look for an immediate battle between Comcast and Disney as they duke it out for Twenty-First Century Fox, Inc.’s content as early as today.

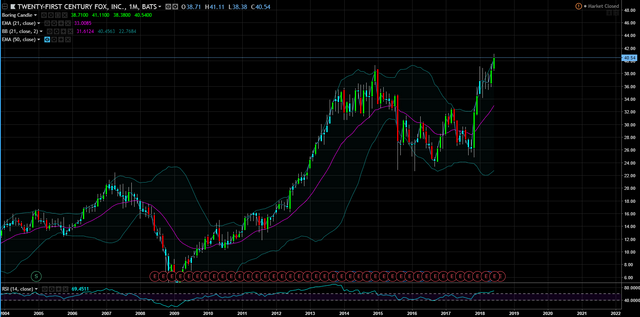

But Twenty-First Century Fox is already at an all-time high, rising almost 100% in less than eight months. This will be the first of several battles to come as the rest of the competition in the media space attempts to keep up.

Twenty-First Century Fox, isn’t a technology company, but is already trading at a very rich premium, which is only going to increase as the bidding war begins and continues.

The landscape looks a lot different today, relative to 2000. Just look at the spider web I’m talking about below. This is just one bidding war with several more to start as early as today and best believe the acquirers are going to overpay.

Which brings me to my initial question…does the AT&T-Time Warner merger signal a market top, what do you think?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Upvoted ($0.14) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

To the question in your title, my Magic 8-Ball says:

Hi! I'm a bot, and this answer was posted automatically. Check this post out for more information.

I remember that AOL deal and what came after is similar to the pain being seen in the Crypto space! I think it coukd mark a turn point for the stock market as the debt load being taken on by AT&T is huge and will increase the risk of its balance sheet if the assets do not perform accordingly.

Yes, cheap debt will cause havoc on the debt laden companies as interest rates continue to rise.

This is sort of like the skyscraper index. Easy money policies make these kinds of deals possible.

I've been expecting a top for a while now. I think we will see it within the next 12 months.

I agree, things are getting a bit ridiculous out there.