Stock Market Analysis Report 6-7-18...Are The Markets Peaches & Cream Again???

The S&P 500 is approaching three-month highs. The Nasdaq and Russell 2000 index are at new all-time records. Cboe Volatility Index is under 15. The yield on the US ten year bond is under 3.0%. Oil has retreated from $72 to $65. So are the Markets “Peaches and Cream” again? Well before we make that determination, it’s important to know where the Markets just came from.

Two months ago I posted and stated:

We are approaching earnings season for first-quarter where companies announce their performance for the first three months of the year and provide forward guidance (at least for the rest of 2018). Because of recent trade tariff discussions and company profits potential decreasing due to rising interest rates and employee wages, in my opinion the next 2 months of earnings announcements will be the only thing that resuscitates the Markets.

Two months ago I also posted and stated:

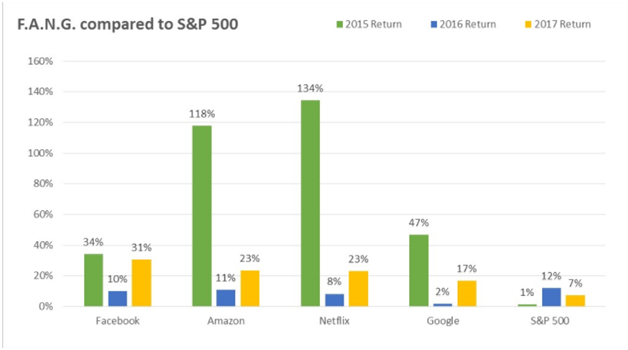

We need to take our cues on where the Market is heading from the FANG stocks because they have played a major role in the Markets performance over the last several years as indicated by the charts.

One month ago I posted and stated:

I'm watching the price action on the Russell 2000 like a hawk. Often we can get an early indication of when the market will change direction by watching the Russell 2000. The Russell 2000, which is the small company index, tends to lead the broader markets. Smaller companies are more volatile and tend to react and respond to changes in economic conditions and changes in investor sentiment first.

I'm also watching oil like a hawk. As oil continues to rise, it will cancel out any tax cut US citizens may have seen and actually start serving as an increase in taxes. Each $0.10 rise in gasoline is going to cost the average driver about $130 per year. My 1st target on oil is $82.

I'm watching the yield on the 10 year bond. My target is 3.5%, if the yield gets this high, I think this will be the ultimate breaking point for the Markets.

Nevertheless, we are in a risk off environment at this time. The Russell 2000 is making all-time highs every day.

These small-cap stocks do not have much exposure to the risk in the global markets because their performance is tied to the domestic economy. When you consider Trump’s tax shaving these stocks corporate tax rate from 32% to 21%, that’s a significant amount of money going to the bottom line.

The NASDAQ just broke out to all-time new highs. Just in the past 30 days: Facebook is up 7%, Amazon is up 7%, Apple is up 7%, Netflix is up 14% and Google is up 9%.

However, when you look at the DOW and the S&P 500, they are both lagging behind.

These two charts tells me their isn’t enough positive market breath in the Markets. The DOW and the S&P 500 chart tells me the Industrials, among other sectors are lagging behind. Also, the Financial stocks (which should be performing well in a high interest rate environment) haven’t participated in the recent run-up.

The U.S. expansion is close to nine years old and is now the second longest in U.S. history. While economic indicators are strong, they were also strong just before past recessions. Prakash Loungani, an economist at the IMF, showed in a study that professional forecasters missed 148 out of 153 world recessions.

However, I’m not a profession forecaster. I’m just a guy who likes to analyze charts. When I look at the charts, they tell me the house withstood the earthquake, but there are some cracks in the foundation now. The charts tell me passive investing doesn’t work anymore in this environment. I believe we are in a stock pickers Market and there is money to still be made. Technology is your friend, until the bend at the end. The Dow and S&P are lagging so much that they aren’t even in a position for the Smart Money to set up Bull Traps yet.

The same can be said for International Markets as well. All the international markets are lagging too, except the Shaghai Composite, it’s in a downtrend.

So are the Markets

again….NO, NOT YET & MAY NOT BE FOR A WHILE? But if you understand Sector Rotation and Intermarket Analysis, you will be fine.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Upvoted ($0.17) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

fine work...I am seeing (even today) bulls jumping in rather quickly here. 1.) we have a nasty set back quite soon , 2.) we still go near or to new highs (Dow) before real trouble sets in later in the year...thanks for your support as well.

Thanks, I enjoy reading your post daily as well, you provide me a new way or looking at things. Keep the great work coming.

My concern is that these type of markets are made for large institutional investors convincing the smaller retail investors to buy while they unload their positions. Thia leaves the smaller guys with a bag of assets that could potentially be cut in half in most cases given valuations, inflation and interest rates.

Agree, the easy money was made the last couple of years. I'm already long oil, any additional longs I would consider are tech only and I have a watch list of about 20-30 stocks I'm waiting to short. However, an overbought Market can become more overbought. Things should get real interesting soon.

Great analysis @rollandthomas. How do you think the upcoming proposed tariffs will affect the market? China's threatening a trade war, as well as some of our allies. Love him or hate him...I think many of Trump's policies have been great for the economy. Particularly deregulation and tax cuts. That said, I strongly disagree with the massive tariffs he's proposing. It may help a few industries at the expense of many. History has proven that over and over. Any thoughts?

Thanks. Regarding the tariffs, I agree with you. It's going to benefit a couple of industries, but will hurt economic growth. Big picture, I think the tariffs is biting off the hand that feeds us. We buy china products and in return they buy our debt in the form of bonds to finance our standard of living.

Regarding his tax cuts. I never heard of a tax cut in a growing economy. But this tax cut really really just benefits corporations. Employees will see very little...what is $1000 bonus....nothing. Corporations will add to their war chest and buy back more stock...and artificially inflating the stock market. So we will pay for this in shortly.

It will be cool when steemit has a way to verbally communicate. There is so much to talk discuss...did this response somewhat answer your questions?

Thanks for the response. As I said, I agree, tariffs are a terrible idea. China buying our debt is one aspect. An even bigger consideration is the major increase in cost for American consumers and industry. Tariffs are basically an indirect tax on American consumers and businesses. If history is any guide, business owners may stop expanding due to uncertain overhead. Consumers like you and I pay more for goods we use everyday. You would've thought history would've taught us this...but I guess not.

I'm just wondering if you think it will greatly affect the stock market.

I'd have to respectfully disagree on tax cuts. America had the largest corporate tax rate in the world. I think tax cuts were great for the economy and long overdue. It's not just companies buying back their stocks. The've been doing that for 10 years with bailout money. Companies are now investing in expansion and innovation. We also have new businesses opening up creating more competition...which is greatly needed. This is the life blood of a healthy economy, and always benefits the consumer in the end. For the first time in decades there are more job openings than workers to fill them.

Anyway...we can agree to disagree on tax cuts. My real question was on tariffs and how they may affect the market. I'm hoping this administration isn't foolish enough to create a trade war. Guess we'll see how it goes.

With the national debt as high as it is, I feel we're just delaying the inevitable anyway. No one thinks hyperinflation can happen in the US. I think it's mathematically certain, giving our current debt and rate of spending. We can no longer grow our way out of debt without cutting spending MASSIVELY...and we all know that's political suicide. I truly fear for out kids and grand kids. Unless we cut spending and start attacking out national debt, we're digging a hole that's going to be impossible to climb out of.

Nicely put, with many great points about the tax cuts. But how do we get out of debt, where is that money coming from, companies have very deep pockets, the tax cuts is just forcing more behavior.

Nevertheless, good healthy debate, I wish we could verbally discuss the topic more, but one day.

I'd love to have a healthy debate some day my friend. As I said, I have a great deal of respect for your market analysis. To answer your question on getting out of debt....

We certainly can't tax our way out of debt. I think every communist/socialist society in history has proven that to be a complete disaster. You can only tax so much before people just stop producing and innovating. So at a point, increasing tax rates will actually DECREASE overall tax revenue. Conversely, decreasing the tax rate can actually increase overall tax revenue...again, to a point.

I believe the sweet spot is around 20%. Generally, a tax rate higher than that, revenue goes down...and a tax rate lower than that, revenue also goes down. This could not be more obvious when looking at tax cuts in the past...going all the way back to JFK. Every time there was a major tax cut, overall take revenue either increased or remained the same. Why?

The reason should be obvious. While each individual may be paying less tax, the private sector is investing that extra money into growing and innovating. This leads to more jobs and more people paying taxes. That is the hallmark of a great economy. It also allows government to reduce spending as people become less dependent...which many in power do NOT want to see. Since when does any politician like to give up power? Answer...never in history outside of George Washington.

So to answer your question, the ONLY way to get out of debt is to continue incentivizing economic growth and innovation (i.e, less red tape/low tax rates), while massively reducing government spending.

If you look at overall tax revenue, the U.S govt is currently taking in more tax revenue in the last 10 years than at any other point in history...yet our national debt EXPLODED. Clearly this is not a tax revenue problem, but a spending problem.

Bush spent a ton...and then, as if not to be out done, Obama came in and spent MORE THAN EVERY PRESIDENT IN HISTORY COMBINED. Our national debt literally doubled from 2009-2016. Now Trump is starting to follow in those footsteps by just signing another massive spending bill. THIS CYCLE HAS TO STOP.

The only way to reduce the debt is unleash the private sector, while reducing government spending...which means reducing the size of government. Of course, politicians and govt bureaucrats will never vote to give themselves less control/power. Instead they find a boogy man called, "the evil 1%". Here's what they don't tell you...

Even if government taxed EVERY person in the U.S who makes $200,000 or more per year, at a 100% tax rate, they''d still only be able to fund the federal government for 253 days. And that was at 2012 levels of spending. We're far past that now. But hey...it's just easier to blame the 1% instead of solving the spending problem.

We have government departments within departments, within departments. Unless we reduce government spending, there is no hope to reduce the national debt. It just mathematically can't work.

Great post @workin2005 and I don't really disagree with any of your comments. My issue is our lack of discipline for fiscal responsibility from the government down to us the people. I truly believe the only way to fix this massive issue is a total default of the system, which is horrible to think and consider because we would all suffer. As long as we lack financial responsibility, I don't see a way out.

In the years to come things will only get more complicated when the robots start taking 40% of the jobs in the US, but that's a whole separate conversation.

Do you see ever see the system going back on to the gold standard?

We never should have left the gold standard. That's what began this whole trip down the rabbit hole. I agree..until people return to fiscal responsibility, we're doomed.

Do I see us returning to the gold standard? Not before the system implodes. The thing is, it's so predictable.

I think it was Ben Franklin who said, “When the people find that they can vote themselves money that will herald the end of the republic.”

He's exactly right of course. The problem is, no one wants to take responsibility....so they kick the can down the road. Well, it's been kicked so far now that we've entered into the denial phase. This is why I think crypto is so fascinating. I think it has the opportunity to be the new "gold standard" once the dusts settles. I realize we've got a way to go, but look how far we've come. What choice do we have?

I wrote an article on BTC vs BCH which indirectly explains why I feel crypto is so important right now. If you're interested, I'll post it below. Bottom line, unless people start electing fiscally responsible politicians, who tell the truth about our financial crisis, we'll continue down this path. We're heading towards hyperinflation and a complete melt down of the economy as we know it. For this reason, I'm investing in things I feel will have value once the system implodes...and the dollar isn't one of them.

https://steemit.com/cryptocurrency/@workin2005/bitcoin-vs-bitcoin-cash-the-debate-that-demands-a-verdict