Grim Reaper, Meet The FANG Stocks

FANG is the acronym for four high-performing technology stocks of Facebook, Amazon, Netflix and Google. The term was coined by CNBC's Mad Money host Jim Cramer and used first an episode of Mad Money back on February of 2013.

The acronym was later changed to FAANG to include Apple.

The FAANG stocks have delivered unheard of returns over the past several years with Facebook and Netflix leading the pack with five-year gains of more than 700% and 900%, respectively. The group makes up about 15% of the S&P 500 and their collective valuation matches the GDP of Japan and Germany.

I have been talking about the death cross lately in multiple posts and Grim Reaper introduced himself to Facebook, Google and Netflix in recent weeks.

and Grim Reaper introduced himself to Facebook, Google and Netflix in recent weeks. The only two stocks that still have a soul left and haven’t seen the death cross on the charts are Amazon and Apple.

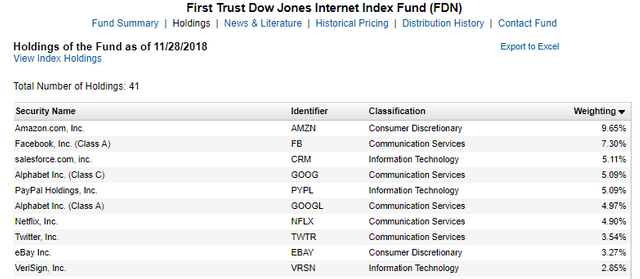

Nevertheless, the Grim Reaper has sucked the life out of FAANG collectively though the ETF, First Trust Dow Jones Internet Index Fund (FDN) which has most of the FAANG stocks within the top 10 holdings.

Since 2008, there have been four death crosses for FDN, which began trading in June 2006. After those signals, the fund was up an average of 4.59% one month later, and was positive 75% of the time. That's even better than the ETF's average one-month return of 3.31% after a "golden cross" -- when the 50-day moves atop the 200-day trendline -- thought to be a bullish technical signal.

But this time is different…now I know we often say that a lot when investing/trading. Last month was the first time all the FAANG stocks sold off at the same time after announcing quarter earnings. This told me the sentiment in technology stocks changed from being positive for so many years to negative almost overnight.

So where do I see FDN heading next, lets go to the charts?

Based on the monthly chart, the chart suggests price can fall all the way down to $67 over the next couple of years.

The charts suggests a pull back to the $134 level , would be a nice entry to short price.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Could play for bounces but otherwise, it would be catching a falling knife which we know can be painful...

Posted using Partiko iOS

I want to call the top in FAANG, but can't yet...need to see more breakdown in Amazon.

Yeah, amazon is a beast and is the only thing I'm scared of in the group. I still want to short bounces on tech stocks. The G20 has me on the sideline to end the week, was contemplating a short otherwise. Be interesting to see what the summit brings tomorrow.

Yes, the G20 is the X factor...makes for a great day trading environment in all asset classes, but I'm looking at things from a macro level at this time.