"How Much Worse Will It Get?" That's What Goldman's Clients Want To Know

Content adapted from this Zerohedge.com article : Source

The worst week for the stock market in a long time.

Many are asking is this 1987 all over again?

Goldman's response, as delivered by the bank's chief equity strategist David Kostin, predictably was 'don't panic, things are very different than they were 31 years ago.'

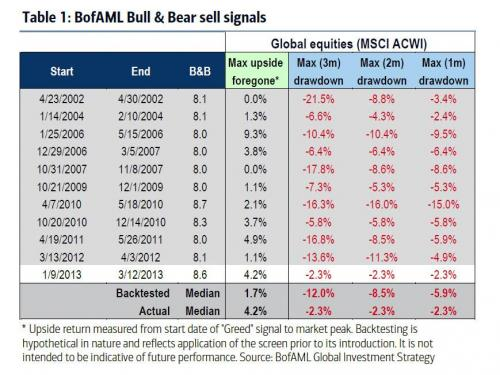

BOA disagrees:

In retrospect, and considering the immediate market plunge that followed, what happened next certainly certainly had the feel of 1987, Goldman's clients should have been asking Bank of America , which on payrolls Friday correctly predicted that a 12% plunge was imminent.

This week Goldman Sachs was wrong.

So yes, to all those clients who are wondering how the smartest FDIC-backed hedge fund investment bank could get it so wrong, we suggest you read "Goldman Does It Again: Crude Crashes 11% After "Most Bullish In A Decade" Call."

Here is the reason for maintaining the bullish prediction.

It will probably not shock readers, to learn that once again Kostin - like JPM's Marko Kolanovic two weeks ago - has just one job: to prevent a liquidation panic, and to restore confidence that the 10% correction which just happened seemingly out of nowhere was a one off event, or - in the parlance of Wall Street - a "healthy correction."

More downside on the way?

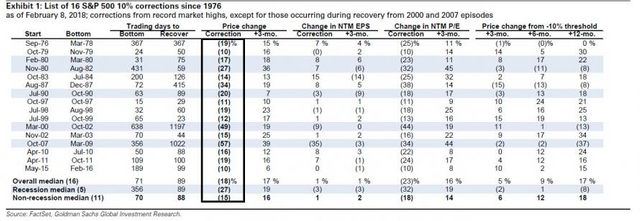

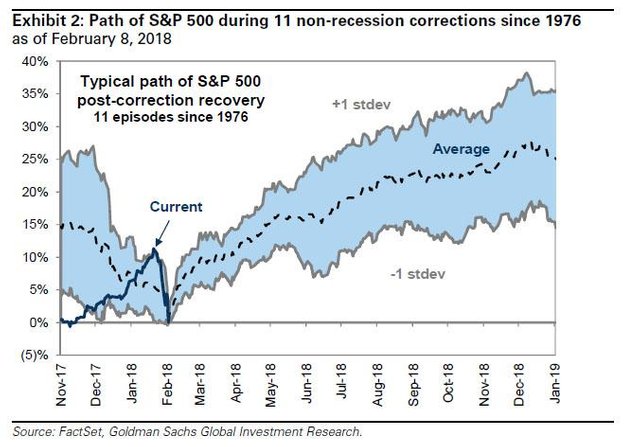

Some other facts: The typical correction took 70 trading days to trough and 88 days to recover. However, an investor who bought the S&P 500 10% below its peak without waiting for a bottom would have experienced median 3-, 6-, and 12-month returns of 6%, 12%, and 18%.

There answer to the question "how much worse will it get" is not clear at this time. The next couple weeks should reveal if Goldman or BOA is right.

Non-adapted content of this Zerohedge.com article:

https://www.zerohedge.com/news/2018-02-10/what-goldmans-clients-want-know-how-much-worse-will-it-get

the profit taking sell off must pay capital gain, increased tax revenues from winning, but if the market declines to a certain point, then the loss is a tax write off, this would neutralize the profit taking sell off capital gain, tax revenue.

Friday's buying was evidence there is still robust demand. Now the demand could have come from the Fed's plunge protection team. If one believes the Fed intervenes in markets to prevent a crash.

But things are happening, and it's early, we really can't make run away inflation predictions based upon a small up tick in velocity of money and greater employment and wage growth

Economist often use 18 months as the length of time to see results from an economic input. It will be interesting to see the tax reforms results in 18 months. That's an expectation. The continued equity buying in the face of doom and gloom hype could be driven by the expectation of greater economic growth over the next two years. This is the trend driving the market, could there still be robust demand from this trend?

I am trying to follow quality.. thanks

I am not sure why anyone is really making a big deal out of this. Maybe it is because I am into cryptocurrencies and a 10% decline is a lunch break.

That said, a correction after such a long run up was long overdue. It is nothing to worry about. The bull is still charging. After this pullback, we will see another run up. The Fed hasnt starting moving to the point, yet, where it will stick a fork in the economy. That will take another year or so...

Give it time, we will get a major collapse at some point, but not at this point.

hell if equities fell like cryptos.. they would have gone to 0 already.

Interest rate derivatives will be the spark... and maybe the fire is already burning... heard a rumor that two major banks will not open for business Monday... one in Europe, one in the USA. If that happens, BOOOOOM!

Wonder why Trump's SEC head has done nothing about HFT or derivatives.

you just need some liquidity to dry. boom!!!! fire sale

Well this is not the first time Golman is wrong. Last year Goldman Sachs group inc. incorrectly called commodity prices.

I feel the stock market correction is temporary. It will soon get back up. This isn't the first time it's happening.

There is no need for panic at this stage.

I think the risk of further downside is high for a variety of reasons:

Be careful out there.

#4 has the most impact short term.

Agreed, but I think the market could be looking ahead to 2, 3 and 5 as well.

giving the average joe getting 2k is the headline. The truth is its 2k added on the credit card. economically getting 2k, by borrowing it dont change the bottom line. A little voodoo economics. while the amount to borrow money rises. A slide of hand.. The average joe gets 20% of the loan (as a group), but now owes that 20% + 80% more. Tacking 1.5 trillion onto a 20 trillion dollar deficit, alone tacks on 7.5% to the deficit. markets had this crash reaction in 87, dot. com and 2008. that 7.5% is hung around our neck.

It won't get tremendously worse unless some hidden, massive problem in the economy like a housing debt crisis suddenly unwinds.

i hope the crypto market does not get worse

i think this is the beginning of new collapse , life will get hard after this collapse that's for sure , economist are predicting an all time down fall of the market.

So amazing job, thanks for enlighting .

The stock market correction at least this time isn't because of any major global negative sentiment and looks more like a profit booking exercise that triggered a larger correction. IF that's the case, the rebound should happen befofe long.

this isn't like the 2008 subprime crisis thankfully.