On the SEC's EOS Fine & Other Market Chatter by Michael Creadon

A relief rally broke out in crypto after the SEC fined EOS $24 million for securities violations during their capital raise. This is a classic case of the market telling investors the core, base expectation was likely far worse than $24 million. And remember - they raised $4 billion in their ICO.

As a trader, generally speaking, you don't have time to read long legal briefs. You're too busy staring at your screen to do hardly anything else. So let the attorneys debate whether it's too much, too little, or just right. Watch the market: what does the market think.

Hey, Mikey, he likes it.

Now, now, now. Don't conclude that the market will like it forever. The market can change her mind whenever. Maybe a civil suit will forth-come; perhaps other jurisdictions or regulators will weigh in; it's possible alt-coins will plumber or rally. We don't know. Frankly, traders mostly don't care.

But if EOS survives the SEC glare; will others? Is it possible an alt-coin thaw is in the offing? What does that translate to?

Investors sometimes love - not loathe - "bad news" because it suggests a closure; it indicates clarity; and a 1% fine - in this case; if my math is right - is both manageable and even palatable. And certainly an outcome that keeps this experiment alive for that much longer.

The Japanese bond market had a hiccup this week and the world took notice. Interest rates have been at or below zero in Tokyo for 30 years; and then one weekday buyers shockingly didn't show up to buy more negative-infinity bonds.

I don't know when the fantasy of negative rates will disappear as a workable concept: maybe today; tomorrow; or in 1,000 years. But if you can find me a noted economist alive or dead who believes penalizing savers with upside-down bonds heralding a deflationary quicksand trap makes sense, let me know.

Look at it this way: if we have convulsions in the US repo, or overnight lending market, and now the bond market in Japan, it makes you wonder how much longer Greater Fools will step in to buy Greek & Portuguese debt roughly on par with American government debt. How laughable is BTC in a world where currencies are falling down against the mighty buck in a paralyzing capital-flight situation that, once it begins, might be irreversible.

Maybe it's nothing.

I will say suddenly the concept of modern-monetary theory, or MMT, is gripping analysts & commentators' thought process: if the biggest governments - like ours - chase dirt-cheap rates forever & hand out money to their minions, when is enough going to be enough.

And how will all that affect BTC?

You know me; I like to keep the decibel level low whenever possible. I'm not always successful at it but I try.

I watch social media chatter on bitcoin and contribute to it. But i gotta tell you: I'm increasingly alarmed at some startling, outlandish, borderline hysterical comments about bitcoin taking over the world.

To me, it's the classic used-car salesman shtick. "You don't wanna miss out on this one, baby." Worse: BTC will be worth a million dollars next Christmas.

Bottom rung: usurping the dollar.

Right. And my son, 7, will be the New York Yankees first pick in the 2033 draft. Hey, he's a heck of a ball player.

Noel used to talk about First Principles. A good 1st principle is sanity. Beyond that let's review basic facts: a lot of currencies & economies are failing; negative interest rates are an unexplored frontier long term - no one knows their consequences; technology is rapidly re-changing the world; politicians everywhere are increasingly distrusted & disliked.

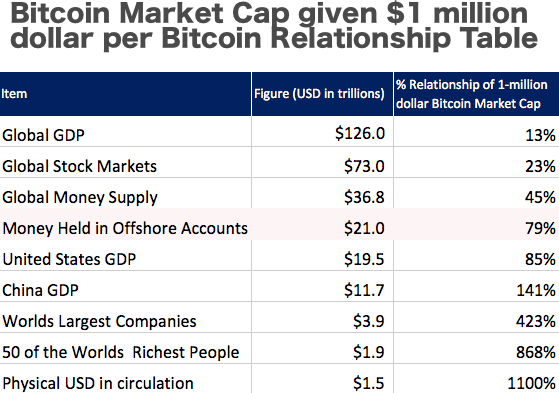

So yeah; against that backdrop, change is in the air. Bitcoin represents some of that change. But BTC is minuscule in global finance at present. It's a quarter the size of Google, Apple & Amazon.

My kid can play; you never know. But please; let's all keep it real and see how the "kid" grows. Read: bitcoin.

We had a raucous two weeks of conferences in town recently and besides phenomenal weather & terrific people, I have to say the conferences were across-the-board simply fantastic on every imaginable level. What a difference only a year makes: last year I traveled to conferences on three continents in a half dozen countries and a dozen US states, and while I had a lot of fun, last year's confabs were almost entirely about alt-coins and all the associated garbage that goes with that passing fad and fancy. Lots of nice people; lots of completely bankrupt projects and ideas.

Fast forward twelve months and this new crypto industry feels a lot like the trading business I was in for many years: transactional, professional, real. I know some commentators are lamenting this shift, and they'd like to go back to the days of the Silk Road and privacy coins and all that, but you know what: I like the fact this industry is both growing up and still here. To me, that's progress, that's change, and that's promising. I am kinda wondering what next year's trade shows will start to look like. It'll be here before you know it.

A coin called Centrality has rallied 86% in the past 24 hours, and the beauty of it is this garners almost no media attention - even in the crypto press.

Remember those crazy days when coins & tokens exploded for Lord only knows what reason - or no reason at all - before crypto winter set in? And you know what happened next.

I gotta tell you, on balance, I think the SEC's fine of "only" $24 million for EOS' ICO raise is encouraging any way you look at it. A lot of people have told me the SEC is looking for "blatant fraud" & when the mistakes aren't so glaringly obnoxious, they're willing to show some flexibility. I wouldn't take that to mean the leading regulatory agency won't take tougher stances in the future - hardly. I just think one way to look at this is you have a nascent industry, perhaps there was some ambiguity in years' past over rules interpretations, mistakes were made, fines were levied - but they were done so in a way that wasn't meant to destroy the entire ecosystem. We'll see. Maybe I'm misinterpreting this; it wouldn't be the 1st time.

But I think there's likely a very clear roadmap moving forward about what is & what is not acceptable in this country regarding digital asset sales, and that's a good thing - even if the rules were clear to begin with all along.

...Originally Posted By Michael Creadon on LinkedIn

Author Bio:

Steem Account: @michaelcreadon

LinkedIn Account: Michael Creadon (32,000+ Followers)

Steem Account Status: Claimed

@shanghaipreneur contacted Michael Creadon on LinkedIn before we started syndicating his content. He is interested in Steem and the Steemleo platform and has graciously given us the green light to cross-post his content on his behalf as he learns more about Steem/Steemleo.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

@remind-me on 13 october 2019 10:00

Hey @khaleelkazi, I will notify you on October 13th 2019, 10:00:00 am (UTC)

Later! ( read more... )

Hi @khaleelkazi!

You asked me in this comment to create a reminder.

It seems the time has passed!

Thank you for posting from the https://steemleo.com interface 🦁

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.