SunRun And Vivint: Continuing To Stay On The Sidelines by Enertuition

Summary

- Vivint Solar and SunRun continue to use metrics that show value beyond the initial contract period when there is little evidence that customers will stay with old systems.

- The problems that SolarCity is seeing in the field with customer complaints and fires show the unknown risks to value generation.

- We continue to see no realistic possibility of long-term cash flows to justify the valuation of the lease and PPA companies.

- This idea was discussed in more depth with members of my private investing community, Beyond The Hype. Get started today »

SunRun (RUN) and Vivint Solar (VSLR) Q2 earnings do not change the thesis for either of these companies. Of these two bad businesses, on a relative basis, SunRun continues to execute better and Vivint continues to flounder.

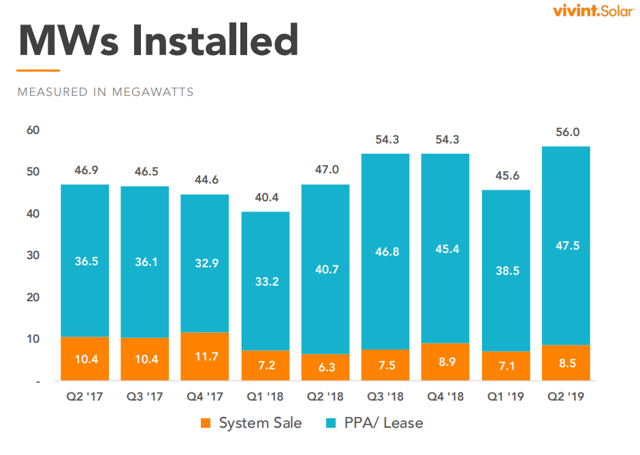

After years of non-existent growth, Vivint is finally showing some growth this year, thanks in part to ITC step down at the end of the year. The Company's installations reached a multi-year high of 56MW with 19% y-to-y growth (image below).

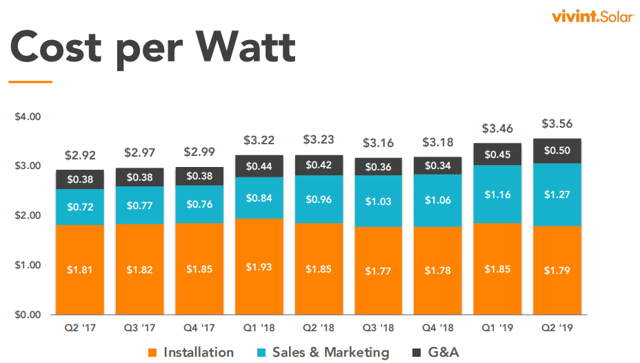

In spite of the installation growth, alarmingly, the Company's cost of installations continues to increase in an industry where price reduction and cost reduction are the name of the game (see below).

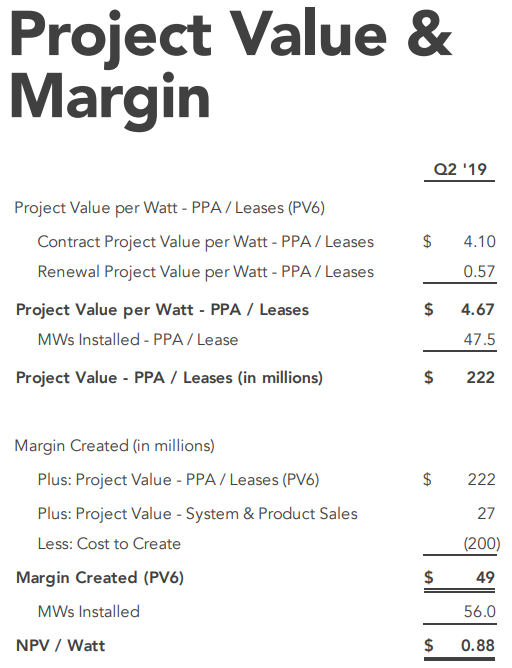

What is amusing is that the Company's NPV of installed over the first 20 years of contracted life is $3.67 (see image below). In other words, the Company is promising to make, with favorable assumptions, $0.11 per watt over a 20-year period ($3.56-3.67).

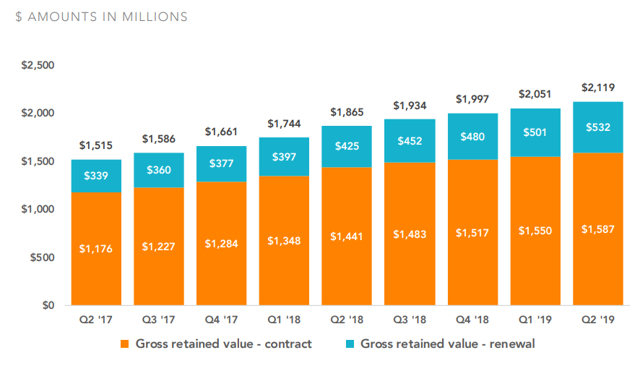

The "retained value" created is almost entirely in the 10-year extension of the contract past the initial 20 years. Note that all the numbers, including the numbers in the chart below, are "gross" numbers, and, net numbers will be much worse.

Moving on to SunRun, the story is marginally better. It is better because SunRun hustles more in getting unaware customers to sign up for more unfavorable contracts with storage and does a better job of containing cost.

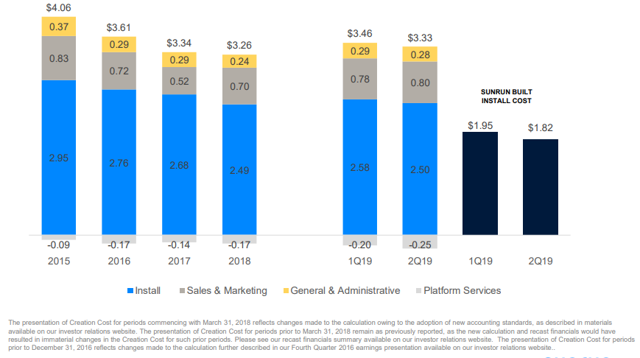

Compared to Vivint's $3.56 per watt, SunRun is getting the job done at $3.33 (image below).

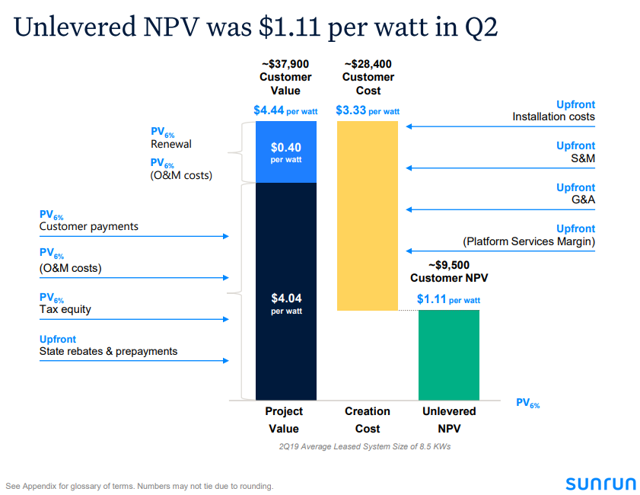

Thanks to the lower costs, the Company has a more optimistic spin on value creation (image below).

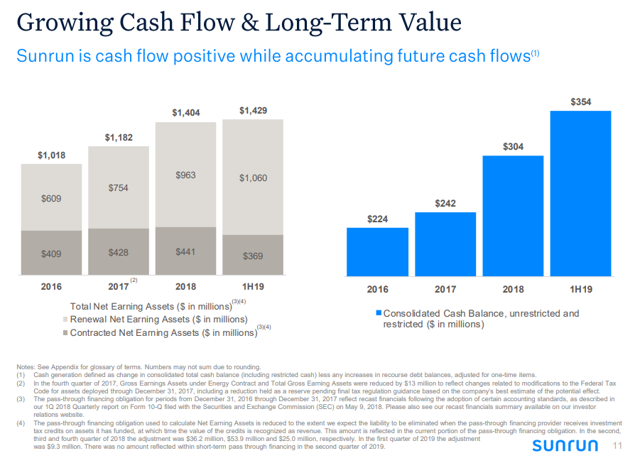

Consequently, the Company reports more optimistic "retained value" numbers. However, note the retained value that the Company claims from Renewal compared to the contracted term (image below).

However, SunRun realizes that, increasingly, showing the Company making more money in the renewal term is not good optics. Consequently, the Company has introduced 25-year contracts now to reduce the amount of value in renewal. It is distasteful how unethical companies like SunRun, with the benefit of ITC, are getting customers to sign these increasingly longer-term contracts where the customers do not understand the consequences.

...Read the Full Article On Seeking Alpha

Author Bio:

Steem Account: @enertuition

Twitter Account: enertuition

Learn more about EnerTuition on Seeking Alpha

Steem Account Status: Unclaimed

Are you EnerTuition? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

Thank you for posting from the https://steemleo.com interface 🦁

Which is why Elon had no choice but to launched a new rental option for its solar panels in a bid to revive its slumping home solar business.