Exploring the Concept of Taxing Cryptocurrency

It's not easy to impose capital gains tax on cryptocurrency. The reasons are obvious:

- Know Your Customer (KYC) regulations can only be enforced on centralized exchanges

- Cryptocurrency constantly pushes toward decentralization.

- Privacy coins compound the problem making money even harder to track.

- Crypto exists worldwide without borders or red-tape.

- There is no official source that determines the value of cryptocurrency.

I was thinking about that last bullet point last night and it really got to me. How am I supposed to pay taxes on gains that are subjective? The value of Bitcoin on Binance is different than the value of Bitcoin on Coinbase. Hell, the value of Bitcoin on Binance is different than the value of itself because there are so many trading pairs; each one has it's own value and liquidity. No one can tell me the value of my holdings, so how can I be expected to pay taxes on them?

What about premiums on crypto? The Kimchi Premium is the gap in cryptocurrency prices for South Korean exchanges. What happens if a premium appears in conjunction with USD? Am I then expected to pay taxes on those "gains"? What happens if the country one lives in experiences hyper inflation? Are citizens in Venezuela expected to pay a capital gains tax on assets that actually lost value simply because the native currency lost even more value? It's not hard to poke holes in the logic here.

The extreme volatility of crypto is also an issue. If I lose 99% of my investment one year but the next it goes x100 I'm expected to pay taxes on that even though I broke even. This is an issue with any asset, but the volatility of crypto compounds the problem by several factors.

If you've ever looked into what it takes to legitimately pay your taxes by the book you know it's ridiculous. You're expected to keep track of every buy and every sell. For some people this is thousands of transactions that they are expected to do the math on at the end of the year.

What about Steem? Am I supposed to keep track of the time/date/amount of every single reward I receive? The law says yes, but I'm guessing not a single person here actually does that because it's a completely unreasonable command.

Obviously, most people ignore these rules because they are so antiquated and overly complicated. Most will simply cash out to USD and pay the capital gains on that because that math is a thousand times easier and almost just as accurate.

Another question we have to ask ourselves is: Does the government even have a legitimate claim to cryptocurrency gains in the first place? Taxes used to make sense. You do business in America so you pay taxes to America. This money is used to pay for the infrastructure that we all use. However, now that we have this borderless and worldwide pseudo anonymous asset the lines are very blurred.

A physical company uses the infrastructure of the country it's located in. They drive on the roads. They sell to the people in that location. It makes sense that taxes would have to be paid. With crypto it makes no sense at all. A dev team could create a product that everyone in the world uses and none of that physical infrastructure is being utilized. Why should they then be responsible for paying for the upkeep of the country that they reside in?

What about the politics of paying taxes? Megacorps like Amazon, Apple, and Microsoft have all found loopholes to not pay their fair share, while all the little guys are still stuck with the bill.

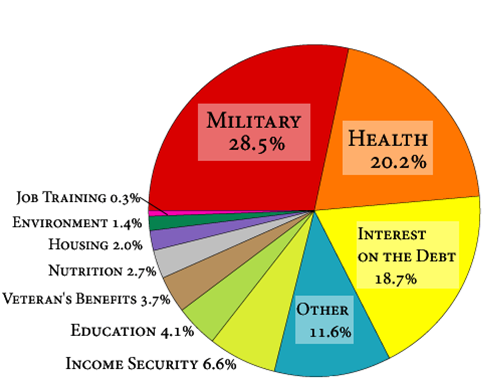

How much of your paycheck goes to endless warfare and incompetent politicians? There are plenty of legitimate reasons as to why a person wouldn't want their money to flow in that direction.

What is the benefit of even being a citizen at this point? Seems to me that the more time goes by the more outdated and nonsensical this system will become. Citizenship has been slowly moving from a privilege to a burden over time. I won't be surprised if in 2 or 3 more crypto bubbles cycles we see people renouncing their citizenship to live in one of those crypto city-states that seem to be popping up.

The IRS is not to be trifled with

I'm not promoting tax evasion. On the contrary, a 15% capital gains tax is not worth going to jail for. However, it is very bothersome that traditional governments can't keep up with technology. There is a very good chance that these beacons of authority will use their incompetence as a weapon, especially as time progresses and more power gets ripped from their clutches. By making it near impossible to comply with their outdated laws they can literally target anyone for incarceration. Ah, who am I kidding? The Patriot Act has already smeared our constitution beyond recognition.

At least we won't have to worry about gains tax this year amirite?

Let me put my tax preparer hat on:

Here's what you are supposed to do. If you can't determine an actual USD price for your cryptocurrency purchases and sales because of trading pairs or whatever, then you take a HLC (high-low-close) average for the day and use that. Use whatever exchange you are trading on and be consistent.

If things go down and up and you are caught on the wrong side of the transaction, that's life.

The bigger issue is when you actually use your crypto as currency. Because then you create a taxable event and then don't have any money in exchange since you used it to purchase goods or services. From an article I wrote for my tax clients about a year ago:

Apparently, I say "so" a lot.

This does not address your points about legitimacy, but nothing about tax law is about legitimacy.

Great things to consider. I plan on paying taxes on my Steem earnings as a form of royalty much like my royalties in self publishing. As far as the capital gains, that won't come into play until you sell, then it depends on if it is a short or long term capital gain. I would recommend anyone thinking of cashing out wait at least one year to lower the taxable rate from 50% to 20%.

For Steem, most of what I have earned has come since it has fallen below 1.00, so will overpay my earnings here and just average it out at 1.00 per Steem. Best to play it safe.

Just before the comment section will be flooded with “tax is fraud” statements or “change your residence” proposals, I would like to point to FairTax proposal, where all income, gains, payroll and other taxes are replaced with consumption tax.

Basically, when you pay crypto at a coffee shop they must use a publicly displayed address (QR code at the counter) for all customer payments. And a set portion of all collected payments will be paid to a tax account.

This is pretty much the only feasible outcome of mass crypto adoption - dramatic simplification of the tax code.

For now you can use paid tools/services that assemble all your transactions for proper accounting of taxes. Have fun!

It’s a great ideal but with how taxes are a sham throughout the world I doubt it will materialize. Taxes are used to confuse and create loopholes, this proposal is too easy to ever be applied to a government entity! I am all for a flat tax no matter your age income or anything but that is equally as ludicrous to ever happen. I like your concept for sure.

You have missed some very big underlying issues.

The Infernal Revolting Syndicate is a terrorizing organization.

Every dollar they collect is shoved into a furnace.

It does not go to pay for anything.

So, what you owe this Infernal Revolting Syndicate is the maximum you will pay before you will go scorched earth on their asses. Their rules mean nothing. There is no way to file a tax return that is iron clad. Something that was deductible last year, may or may not be deductible this year, and it is enforced on a whim.

There is no laws to handle cyrpto-currencies yet.

Things need to be worked out, such that we know

What the infernal Revolting Syndicate will do is make some high profile cases where they abuse someone's rights and then thrown them in a cage for daring to have some digits on their computer.

They will invoke fear, and hope people pay them.

Remember, when you file a 1040, you are declaring that this is your income, even though it may not be income at all. You said so, so it is.

It will be a long time before they can track anything.

Sure, they can put a team onto a single person.

But, they don't have the personnel to go over every transaction.

I've always speculated that privacy coins will gain a lot of value when they start wrongfully making examples of citizens. It's certainly something to lookout for, no matter the price-action.

My feeling on privacy coins is that they won't take off...

Part of the sales pitch of bitcoin is that the transactions are transparent.

And, the privacy coins will be looked at as shady, in a world that is kinda hesitant to dip their toes.

There will be a weird split between staying legal and doing the right thing.

Such as, in the near future, most americans will just stop paying taxes.

They will see that their taxes aren't used for anything good. In fact, they are only used for bad, and people will just stop sending money.

There are some things in there I have not even considered. "There is a very good chance that these beacons of authority will use their incompetence as a weapon" is a very powerful statement for sure.

I am not sure why you don't just sum up your profit/loss for the year like you would trading stocks and pay taxes on the profit like a commodity. Tax reporting is on the honors system and they have to make it feasible to be honourable.....and beef up forensic capabilities to investigate.

Regarding first point, some decentralized exchanges are running towards kyc too.

Posted using Partiko Android

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Edicted from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.