Grow your Business with Scalable, Instant, Secure and Easy Payment/Exchange Services of the Liquidity Network plus lots of Benefits to Enjoy!

Introduction

Since the inception of Bitcoin by Satoshi Nakamoto in the year 2008, there has been lots of ups and down in its adoption. Some notable achievements such as the implementation of decentralized banking has come into place. Bitcoin allows trading between users without having to rely on any third party such as finacial institutions (e.g Bank). Following the path of Bitcoin, we've seen other blockchains such as Etherium come into place.

Since the adoption of the new blockchain technology is still at its infant stage, There has been quite a lot of ongoing challenges in the system. One of the major challenges that has been torturing the decentralized blockchain ledgers such as Bitcoin and Etherium is the scaling of the transaction throughput of the decentralized blockchain ledgers. One of the benefits of Bitcoin is the offering of a payment system where users do not need a trusted financial institution to handle their funds. Users are rather the custodians of their own funds. For instance, such a limited range of transactions in unauthorized block schemes leads to irregular transaction costs that rarely follow traditional service level agreements that are required by professional institutions and that do not give into microtransaction.

The members of a team recognised the ongoing challenges in the decentralized blockchain ledgers and its payment system, thus, they decided to be a saviour in this situation. In their strive towards solving this, They came up with a project named "Liquidity Nework".

Before we go on to discuss Liquidity Network, I would like us to have an understanding of On-chain and off-chain transactions, as well as their advantages and disadvantages.

On-chain vs Off-chain Transaction

On-Chain Transaction

On-chain transactions are those transactions of cryptocurrency that take place on the blockchain which is on the blockchain's record, and is maintained based on the state of the blockchain for their action. When a partial change is brought on the blockchain to ensure the transactions on the records of the public ledger is shown, that is when we can say the transactions are valid. Real-time on-chain transaction must be performed for secure, fast, transparent, and verifiable blockchain transaction. However, this does not always happen, and on-chain transactions happen with some flaws. The execution of on-chain transactions is very slow. This is mainly because the confirmation of the transaction is triggered by the accumulation of enough number of authentications and verifications from users of the network at a random duration of time. The on-chain transaction is not free, because there is need to meet miners rates to provide verification and certification services to verify transactions on the blockchain as soon as possible. The anonymity feature of the blockchain and security of its participants are at stake in an on-chain transaction.

Off-chain Transactions

Off-chain transactions are those transactions that take place on a network of cryptocurrency which shift the value outside of the blockchain. Off-chain transactions are becoming the most widely used among cryptocurrency users due to their zero/low cost. The following are the advantages of Off-chain transactions.

They are Cheaper: Since there is no requirement for participant or users to validate the transactions, theh are usually free

They are Faster: They are faster than on-chain transactions because the recording of transactions are carried out at an instant without having to wait for the confirmations of network.

They offer more Privacy: They offer more privacy and secured transaction to their users or participants simply because transfers can not be seen on the public blockchain.

What is the Liquidity Nework?

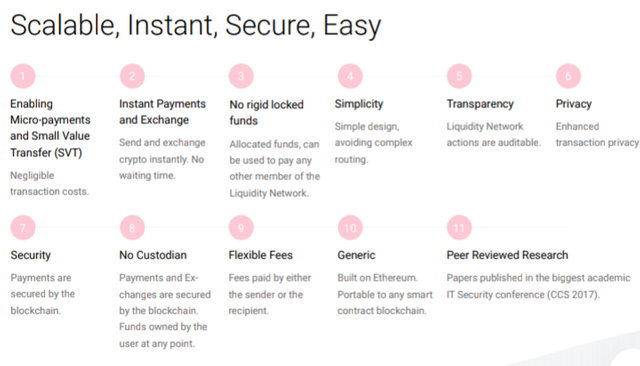

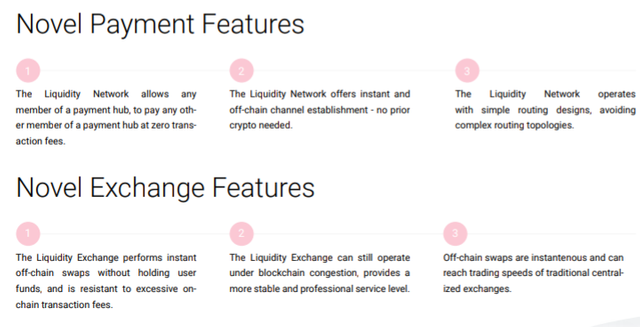

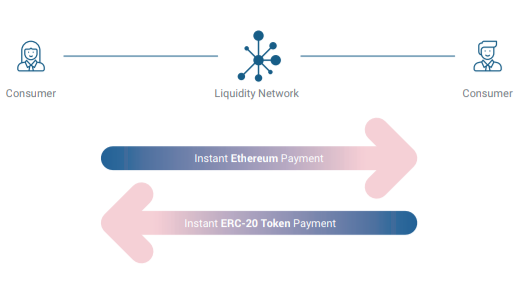

The Liquidity Nework is a network with the basic features of simplicity, transparency, scalability and privacy built on top of the Etherium Blockchain. It is designed to provide support for large number of users and improve adoption from local to mainstream. The full benefits and features of the Liquidity Network and Exchanges, as well as its Novelty are stated below:

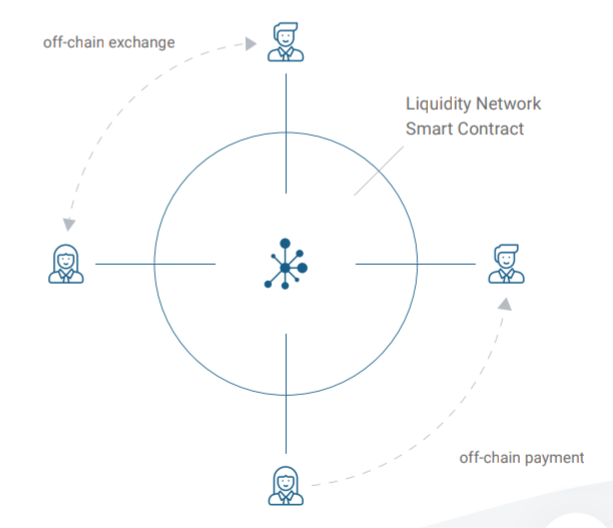

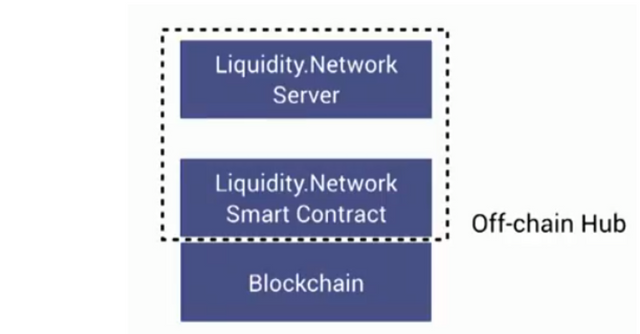

The Architecture - How Liquidity Nework achieve its benefits as an off-chain hub

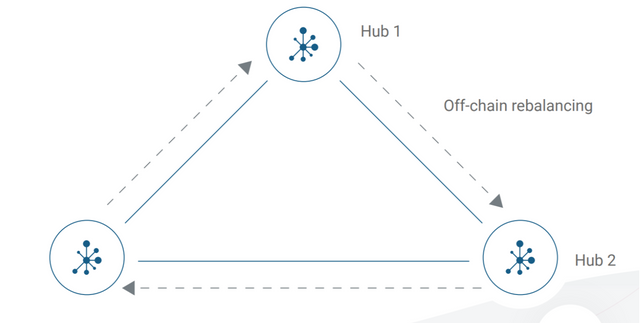

The notion of universal hub is the driving force of the design of the Liquidity Nework and Exchange. As a result, hub subscribers can immediately transact funds off-chain with other members of the hub at a very cheap amount compared to on-chain transactions. The hub architecture is novel due to the fact that accessibility of funds is available to thousands of other users on the same hub imstead of its lock down to just two users. Moreover, funds created for a user cannot be stoled by other users because the funds are efficiently secured by the blockchain. The Ecosystem of Liquidity now applies to Ethereum and it allows easy exchange of cryptocurrecies among millions of consumers and payment systems. The network of Liquidity benefits from the existing community of researchers and developers mainly because it is built into the Ethereum blockchain. The architecture of Liquidity Network implements its novel design to provide solutions to various challenges of existing payment channels. The advantages of its architecture are shown below.

The Liquidity Nework works by leveraging the benefits of decentralized nature of blockchain and centralized computational power so as to bring forth an exchange that can operate as a centralized exchanges and decentralized exchange in terms of their speed and security respectively. The Exchange of the Liquidity Network is scalable and secure and this is because it never holds any fund while performing atomic swaps off-chain. You can learn more about the architecture of Liquidity from their Stanford BPASE Talk in the video below:

The Challenges of existing payment channel designs

- Fragmented Collateral

There is requirement for collateral in the lock up of existing payment channels for every channels. There would be need for quite a good amount of collateral to be locked up by the operator of the hub before the construction of a payment hub with 2-party payment channels can be done.

- Expensive channel setup

Just as the name implies, it is very expensive setup channels. Let's say for instance, a hub operator has 2 million users; such operator would definitely need to setup on-chain transactions no less than 2 million for each channel setup.

- Costly routing

The direct usage of locked up funds with other nodes in the network is impossible in existing payment channels. This issue is made less severe by routing payment but the available funds can't get to a wide range of routes. One of the major challenges in the realization of two-party payment channel networks is the finding of route. In a bid to making things work, the users will be required to divert payments over newer routes which most times can be more costly.

- Online Watchdog requirements

There is need for the two parties of a traditional payment channel to keep online to be on the lookout for their channel state without pause. This should be so because one party could make an attempt to close the channel with a state that is out of date and efficiently double-spend an unsettled amount if the other party were to change offline. To make this online presence requirement less severe, a third party might be assigned by the users and this may lead to another issue of trust and additional cost.

- Reduced Privacy

It is beleived that Payment channel networks are more efficient than on-chain transactions when it comes to privacy simply because there is no record of the off-chain transactions in the readable blockchain.

- Double-Spending Attacks on Blockchain Congestion

A bidding war could erupt in a payment channel between a set of participants when there is termination of a channel under a congested blockchain. When we have a situation of mass-exit, where a lot of participants want to close their payment channels, the termination of a channel in the wrong way can be made even more severe, and this can activate a more severe blockchain congestion.

The Solutions of the Liquidity Network

Liquidity Nework NOCUST Hub

NOCUST is a novel off-chain payment hub construction which makes the makes it possible for a non-custodial finance to act as an intermediate in its operation, which can function effieciently as traditional custodians in terms of its transaction throughput in its design. There is no need for a user to initiates transactions via costly on-chain channel since he can easily open a payment channel with a NOCUST hub off-chain in a direct manner. With NOCUST, transactions can be securely carried out over a single payment hub by a set of participants. The allocated funds of this participants can then be freely utilized among the hub's members. The burden on the off-chain network to route payment is made less severe by the structure of NOCUST, at a time when the interconnection of more than one NOCUST hubs can be activated. The crucial engagement of the Liquidity Network team are as follows:

They made available for off blockchain payments, a novel payment hub construction NOCUST. This then bring about the existence of N-party off-chain payment channels where a novel commitment scheme is brought in place for the facilitation of accouting for the balance of users.

The reliability of the payment hub is that entity that determines whether the hub will require no additional locked up funds per additional user or an incresing amount of collateral, with an upper limit of the respective volume of transaction of an unsettled time window. In comparism to the traditional payment channels, an outline of how this collateral can be effectively managed in bulk is shown by the team.

Payment to any other member of the payment hub by a user can be done making use of his allocated funds within the payment hub. As a result of this, the complexity of the routing and network of existing payment channel designs can be severely reduced.

They also give an outline of how users of a payment hub can ensure optimum security over their funds even when the hub is not available or it is under its hostile behaviour.

Usability of NOCUST as an off-chain payment solution

Collateral Lockup: There is an effective isolation of the locked collateral in each channel in a payment channel based network. Due to this, the pre-allocation of collateral by a microtransaction service to each recipient who are eagerly waiting for their expected transaction volume to get rid of the risk that may brought upon by other party and also avoid classification as a credit network. The retrieval of funds by the hub would have to be done from other channels when the collateral mentioned above has been used up. The hub will then consolidate it into recipient channels either through a rebalancing operation which is well coordinated or through withdrawal in a direct manner. The first operation is much more cheaper than the second procedure. The proportionality of on-chain operations to the number of users is the basic requirement of the second procedure while the driving force of the second procedure is the channel clients, which can not be trusted and will not give assurance on the effective consolidation of all funds. The network become predisposed to more fragmentation of collateral as we experience more influx of user.

Entry Barrier: Unlike in payment channel networks, another important feature of NOCUST as an off-chain payment solution is that an honest participant is not required to relate any messages to blockchain before making an entry into a non-custodial intermediary construction NOCUST, after which he/she immediately start receiving payments. The ease with which participants can enter into a NOCUST system makes it quite easy for them to be a member of any number of hubs that they want, without the fear of being exposed to any risk or costs.

Potential Throughput: The amount of off-chain transactions per seconds (which is the productivity rate) that can be accomplished within a NOCUST system can only has some certain limits placed upon it by the implementation of the participant specifications and operator server, which may be in form of an apportioned system that possess similar rate of performance of today's commercial custodian payment solutions.

The Liquidity Network REVIVE

The solution of the Liquidity Network makes it possible for many members of the payment system to transfer funds securely between payment channels. Their solution also provide participants with the basic ability of reviving a channel in a safe manner by distributing the funds they provide to their payment channels off-chain, which in turn help in avoiding the introduction of a predetermined channel closure and reconstruction. The amount that can be reallocated has some restrictions placed on it, and rebalancing is naturally limited as a result of this. This is mainly because the credits which is the right of the participant is what we shift and we do not move the money invested within the payment channel. During rebalancing, there is an assurance that the funds of participants that are honest are highly secured and they would not lose any of their funds. The crucial engagement of the Liquidity Network team via REVIVE are as follows:

With Revive, rebalancing is free if only honest or responsive participants participates in the rebalancing. As a result of this, the transaction scalability of permissionless blockchains is increased by a reduction in the frequency at which on-chain refunding is unavoidable. At the same time, The costs of payment channels is decreased by reducing the incentive to pay through expensive payment routes that possessthe capability of rebalancing channels and routes at low rates

It is believed that Revive is the first rebalancing scheme for payment channels that makes it possible for a user to rebalance one channel using one of his channel.

The application of Revive with various underlying payment networks is very much achievable especially the ones that operate using smart contracts.

They made use of the Sprite payment channel to bring about an implementation and assessment of Revive for the network of Etherium.

Users are provided by Revive with the ability to reduce the costs of carrying out a rebalancing of their payment channels compared to when they carry out transactions in an inexperienced manner towards the quick fulfilment of similar goals on the blockchain.

Usability of Revive

Context: Making use of off-solutions such as payment channels or other protocols (such as Revive) shows the level of trust between the parties concerned. However, it is quite important that trust in the structure of the systems should be minimized and that improvement is brought upon its reliability. In REVIVE, If party A agrees to take part in a rebalancing with another party B, it implies that A actually thinks that B can use the protocol so that it does not violate the protocol prematurely. In addition, if the current leader in the round is B, then A considers that B does not reject sending the full signature to A. There is an operational risk accompanying these two expectation. In the first case, The only risk with A is the collateral it has frozen for the advancement of the protocol. If a premature termination of the protocol is triggered by B, then the collateral tbat could have been used elsewhere becomes a waste. In the latter case, A risks paying a fee for issuing an application for access to the signature on-chain due to the lack of cooperation with B. Therefore, it is advisable to make use of Revive in the context of putting the trust of depositors at the forefront which is involved in preventing unnecessary collateral or repetitive expenses. There is great expectation to face the problem of Revive in order to help in the establishment of relationships that facilitate the work of payment routers and establish a stable payment network. In the worst case, there is definitely no way to steal the promised funds since they are covered by insurance policy. However, due to a fault or malfunction from the parties, the service provided by Revive may be rejected or the quality degraded. There is a strong recommendation to.make use of Revive in situations where the participant is responsible for past confidence towards the implementation of the Protocol and is dependent on reputation that can be approved or disapproved for future rebalancing instances.

Scaling and Associated Costs: Revive's design looks forward to creating an exchange of funds that is trust-free to restore the payment network and efficiently deliver payments. However, this design that is trust-free and supported by the blockchain requires sufficient and enough information in the situation of disagreement in order to obtain fair results. At aperiod of time that guarantee the commitments of funds, the availability of the minimum amount of information required to safely bring about rebalancing is produced by an illustrative example of Revive. There will be dissemination of more information as more users or several payment channels join, which might bring about a costly or even impossible on-chain enforcement. For this reason, there is a recommendation to make use of Ethereum, as a real backup example, to improve the integrity of Revive without exceeding the limit of blockchain backup.

Off-Chain Transaction Settlements

There are two main categories of Off-chain transactions. They are stated below:

1. 2 party payment channels

2. N-party payment hubs

1. 2-party payment channels

Just as the name implies, 2 party payment channels is a category of off-chain transactions that are between 2 users. There are four major types of 2-party payment channels as stated below:

One-way Channel: One-way channel is a 2-party payment channel which is between two parties, where by one of the parties make a deposit of some collateral (for example, ether). The deposit is a guarantee that helps provide optimum security for the transfer of maximum amount through an off-chain channel. In a one-way channel, the movement of fund can only be in one direction.

Bi-directional Channel: A bi-directional channel is a type of 2-party payment channel between two parties that both make a deposit of collateral. The transfer of funds can be done in two ways via this channel. The major diasadvantage of bidirectional off-chain transactions is that an illegal node on a channel (any party) can lead to a cancellation of a previous agreement and stealing of funds from other party.

Linked Payment Channel: Linked payment channels are used where there is direct disconnection of two colleagues. In this network, each member make a deposit of some collateral. There are some factors taken into consideration alongside linked payment topography which includes:channel maintenance, congestion balancing, transaction security and route discovery.

2-party payment Hubs: A 2-party payment hub is an extension of the types of 2-party payment channel stated above that includes two or more people involved in the transfer of funds in a direct manner.

2. N-Party Payment Hubs

The N-Page Payment hubs eliminates many of the tasks that are computational in nature required by the 2-party hubs towards the achievement of collateral rebalancing. This makes the transfer faster, less expensive and allows more users to join the hub. off-chain registration in can be done at no cost on the channel via Liquidity Network Hub. Liquidity Hub provides simple routing when compared to a 2-party payment channel with the basic requirement of a complex routing topology. One of the functions of Payment hubs is that it enables the transfer of funds to be done among users only and is never stored on the server. However, since the server is used to calculate transactions, it is usually faster and cheaper for the hub at large. In addition, the user saves the fund at a period when the server is calculating transactions, so that the safety of the user's fund in the payment hub is assured or guaranteed. There is reduction in the entry barriers required for forming a connection with a hub and trigger the creation of more liquidity.

Decentralization of the Liquidity Network Nocust Hub

Hub's users save their funds through their private key. The interconnection of hubs is in the same way as that of Raidens and Lightning Network. Users possess all the rights and freedom to withdraw their funds from the hub without any restriction and then select a different hub entirely. The advanve of Revive protocol grant users the power to transfer funds as they deem fit. The driving force in the operation of the Liquidity Network is towards effective management of these payment hubs which includes: lower installation costs, lower maintenance, processing costs regardless of blockchain overload. Millions of users per hub can be controlled by Liquidity. Surprisigly, a simple solution to Liquidity is to make sure an off-chain is possessing a standalone server that operates with smart contracts. All users can run their own hub server, and the users can make use of the private key in their possesion to gain access and have control over the funds of the account of which private key they possess in a given server.

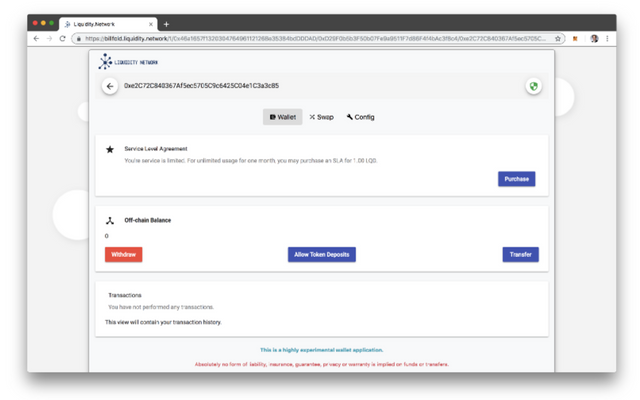

The Application and Interface of Liquidity Network

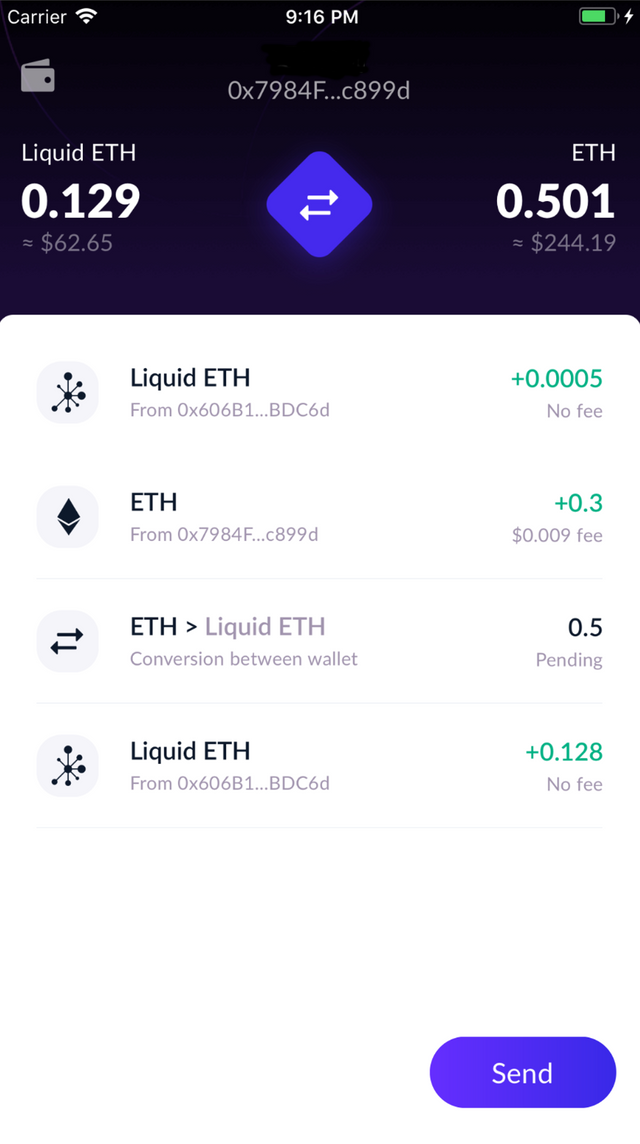

Applications for mobile and desktop devices are being developed based on the technology of Liquidity Network. Below is a wallet of Liquidity Network.

- Desktop

- Mobile

The Wallet of Liquidity Nework can be accessed through IOS and Android mobile devices.

Liquidity Network VS Others

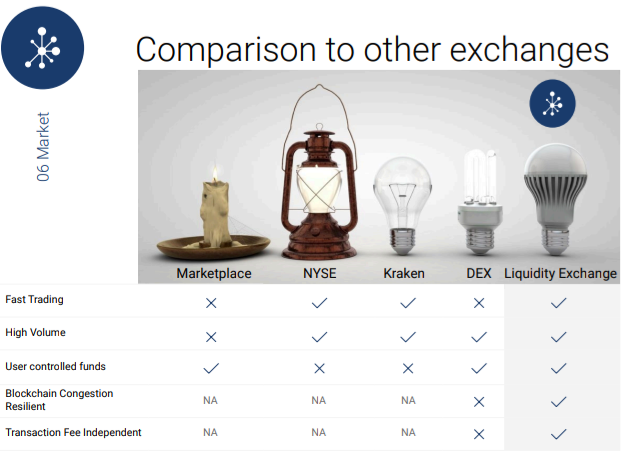

Liquidity Nework VS other exchanges

Liquid Network Exchange brings together the most crucial aspects of centralized and decentralized exchanges. The following comparison shows the difference between how widely used exchanges and the Exchange of Liquidity Network can support the benefits of both worlds in its performance.

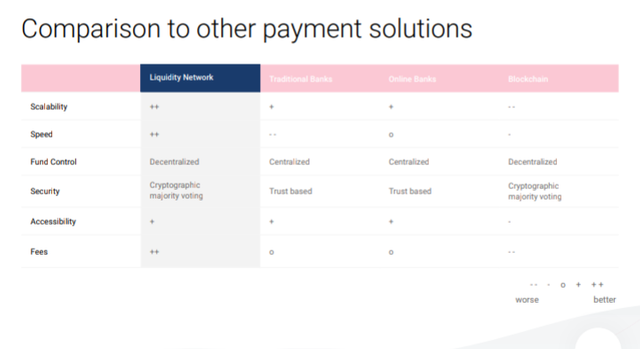

Liquidity Nework VS other payment solutions

Liquidity Nework VS other off-chain solutions

Use-Cases

1. Business

Mr James is a business enthusiast who is always ready to venture into any kind of business that will bring in profit for him. He has heard a lot about how digital currencies such as bitcoin can help amass fortune if you are good at it. He did his findings and decided to invest in bitcoin. As a businessman who is only after making profits, He was very careful with his dealing in the cryptocurrency market. Due to all the news he has heard about the cryptocurrency market, he was very careful in choosing the best exchange that will guarantee a secured custody of his funds and other important benefits, just so much as we know that your first entry into the cryptocurrency world will most likely happen through an exchange. After running his search for a while, he found out about the Liquidity Nework Exchange.

With Liquidity Network Exchange, Mr James as an honest participant can securely maintain custody of its funds and make sure that his transfers are delivered in a correct manner within non-custodial intermediary construction NOCUST. Moreover, the Liquidity Network Exchange is an exchange that is resistant to blockchain congestion and the transactiom fees is very low. It is also scalable to the throughput of centralized exchange and beyond.

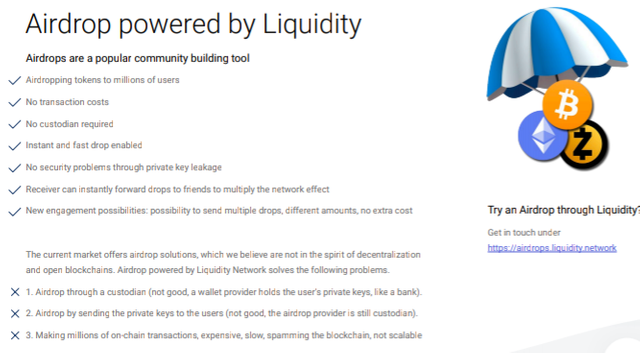

2. Airdrops

Airdrop is one of the blockchain technological application that is so good, or so innovative, that is irresistible to potential customers that the Liquidity network has put in place. Making reference to Liquidity, It has been established that the solutions of modern airdrop are lost in the spirit of decentralization as against the way an open initiative should get fired up in that spirit. Airdrops have been known to acts through a custodian in its present form. The funds are stored in the wallet of some employee. The private keys is released to the users by the custodian, that which poses a threat to security of his funds. The transaction of giving out the private keys is very slow, inefficient and costly since it is carried out on-chain.

With the airdrop function of Liquidity Network: the payment of transaction fees is eliminated, no custodian is required, and lots of transactions can be done instantly and efficiently without wasting time; thus, causing the airdrop to spread from person to person even faster. Quite a lot of drops can be launched by the users of Liquidity Network to various groups of users, thereby bringing about an improvement in marketing while focusing mainly focused on the target market.

Summary

The Liquidity Network is a non-custodial, financial intermediary that provides the services of payments and exchanges. The Liquidity Network provide supports for millions of users in terms of security. It also assist in reducing the costs of transaction and enabling the mainstream adoption of blockchain from local. The driving force of the Liquidity Ecosystem is the two novel academic innovations which are; the Liquidity Hub NOCUST and REVIVE. The Liquidity Exchange is a non-custodial off-chain exchange which operates mainly based on the Liquidity Network.

LGD Token

Team

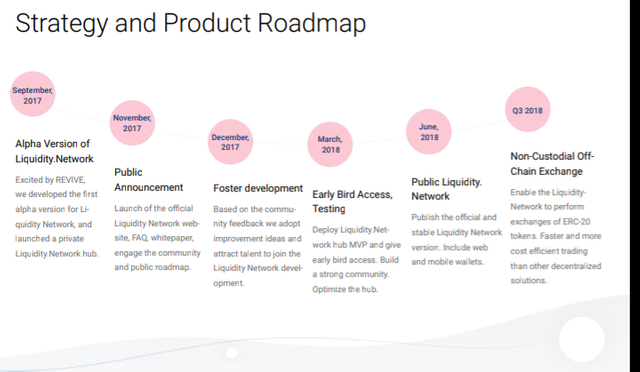

Roadmap

References - For More Information about Liquidity Network, Check this out.

- Liquidity Network Website

- Liquidity Network Wallet

- Liquidity Network Whitepaper

- Liquidity Network REVIVE Paper

- Liquidity Network NOCUST Paper

- Liquidity Network Apple App Store (IOS)

- Liquidity Network Google Play Store (Android)

Twitter Share Link: https://mobile.twitter.com/dimsamogun/status/1083166329031389185

lqdtwitter2019

lqd2019

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!