Liquidity.Network || 12 properties that make it the best off-chain solution for the transfer and exchange of digital assets

Liquidity.Network is a network that operates on blockchain Ethereum that allows to carry out off-chain hundreds of transactions at a higher processing speed and with zero processing fees.

But to really understand the real capacity of Liquidity.Network we are going to break it down through 12 properties that draw this off-chain solution as an efficient network that simplifies and shields the operations of millions of Ethereum users, turning it into the leading network over other networks of payment channels.

Liquidity.Network key properties

| 1.- Enabling micropayments and small value transfer (SVT). |

|---|

Currently, the main block chains such as Bitcoin and Ethereum face a problem of scalability due to the increase in users that are discovering the benefits of using a cryptocurrency that is not only controlled by third parties, but also the protection of their funds are in the safety of their own hands.

Ethereum has a processing capacity of 15 transactions per second and, each computational work requires a minimum expenditure of 21,000 GAS, but that can be increased depending on the volume of data to be processed.

This GAS is the compensation that the nodes (miners) that form the Ethereum network require for work and resources (electrical expenses, computers, time, etc.) that they use to process operations and add it to a block.

This is why it is said that GAS is the fuel that makes the Ethereum network work. Therefore, each operation generates a commission (GAS). And these commissions unfortunately limit small value transactions.

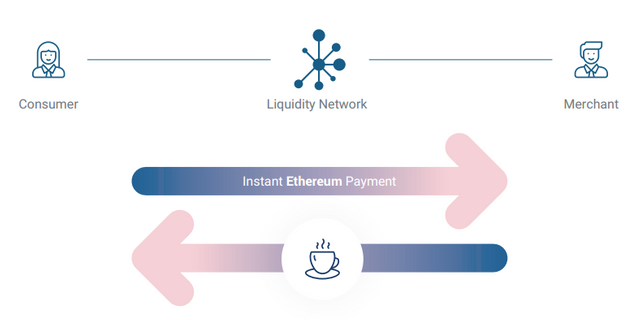

For example, if we wanted to pay for a coffee with Ether, the cost of the operation could be more expensive than the product itself. It is not necessary to have formal financial knowledge to recognize that we would not be acting with intelligence.

Liquidity.Network solves this dilemma by using a payment channel that operates outside the blockchain. By not being inside the Blockchain, the commissions are reduced to compensate the nodes and the time that is consumed for the validation of these transactions. It is this property that makes it possible for thousands of micropayments and small value transfers to be executed.

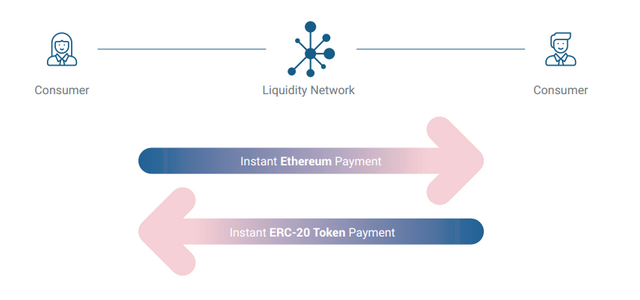

| 2.- Changes and instant payments. |

|---|

Since the chain of blocks Ethereum came to light in 2015, it has been gaining popularity and this has caused the number of transactions to grow. By January 2017, a history of 1,349,890 transactions was processed.

Let's remember that Ethereum only processes 15 transactions per second and the increase in operations by users means that transaction validations -depending also on the complexity of the computation- can take hours or even days.

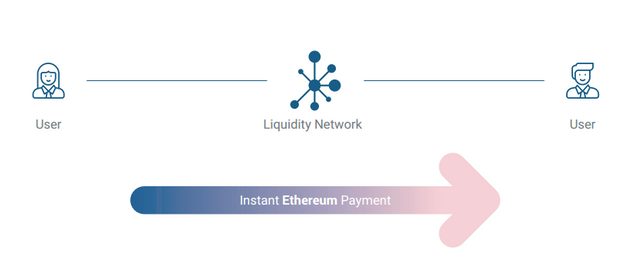

Liquidity.Network allows users to execute their transactions -Chain Off, reducing processing times.

When opening a channel outside the Blockchain, the validation times that it would take the nodes to register these transactions are eliminated. That is, these transactions at first do not go through the confirmation of the miners and this makes the operations are processed without delay and immediately.

Stakeholders rely on intelligent contracts to ensure that the transaction is carried out under the premises of honesty and commitment. When the parties involved in the operation agree to close the channel, all transactions that were carried out in the channel are recorded in the Blockchain.

| 3.- No rigid locked funds |

|---|

This is a capacity that differentiates Liquidity.Network from other payment channels. For example, in other networks, funds that are registered as a deposit when two participants agree to exchange, are reserved as collateral and can not be touched unless each participant signs their release.

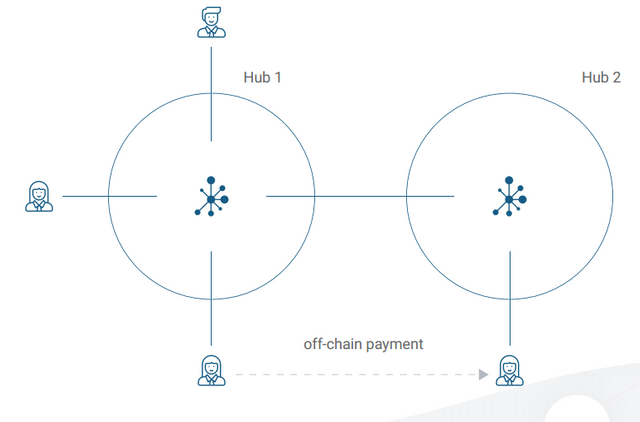

Liquidity.Network, uses a universal concentrator design, so that everyone who belongs to the network can make transactions with each other.

"...The hub architecture is novel because funds are no longer locked between only two users, but accessible to thousands of other users on the same hub. At the same time, the funds are secured by the blockchain, other users can’t steal other user’s allocated funds..."

| 4.- Simplicity |

|---|

Liquidity.Network, operates with simple routing designs. It is not necessary to open individual channels for each receiver. These payments can be routed using the network of payment channels to reach other users.

| 5.- Transparency. |

|---|

The operations that are carried out on the Blockchain Ethereum are traceable, allowing transparent and auditable movements. Liquidity.Network adheres to this principle, and although the operations are carried out in private channels, when the channel closes, the transaction summary is replicated in the Ethereum network.

| 6.- Privacy |

|---|

Liquidity.Network, allows to open private payment channels and safeguard the identity of the participants. Only store the data that is strictly necessary.

| 7.- Security |

|---|

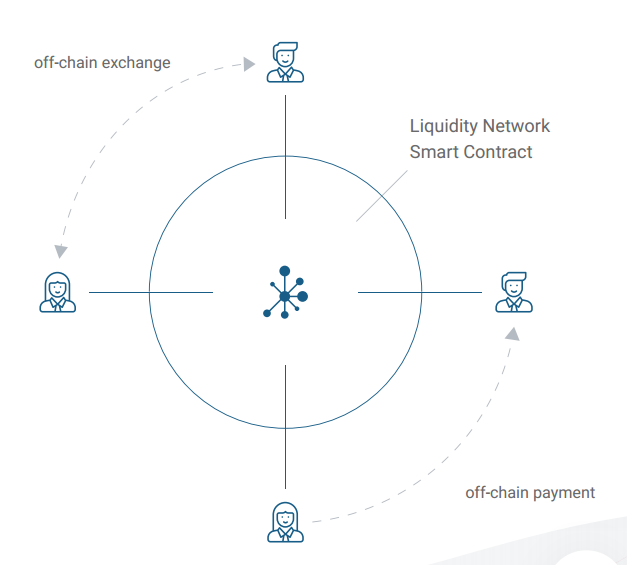

Liquidity.Network, shields the operations among the participants by relying on an intermediary composed of two fundamental blocks, such as the SMART CONTRACT and a concentrator operator.

Customers keep their private keys to sign off-chain messages, while communicating with intermediaries.

Your funds remain under your own guard and you can dispose of them at any time. The funds can not be negotiated without the authorization of this.

| 8.- No Custodian. NOCUST |

|---|

Liquidity.Network, uses a non-custodial second tier financial intermediary called NOCUST. NOSCUST is an intelligent contract that is designed to reduce the validation times of transactions and commissions, as well as for any participant in the network -point neuralgic- to be custodian of their own funds.

According to the principle of balance custody. A participant maintains custody of his balance in the system because he can always resort to the Smart Contract in case the operator server does not provide a "set of off-chain transactions sent or received" valid for any eon -the amount of time so that a fixed number of blocks is generated.

In addition, the NOCUST properties allow:

"...(i) users can join the payment hub without the need for a costly on-chain transaction, (ii) locked up collateral in the hub can be zero up to the transaction volume of a disputable time window (to achieve trustless operation), (iii) the hub’s collateral can be effectively managed in bulk, signifcantly reducing the management costs of the operator, compared to a twoparty payment channel hub..."

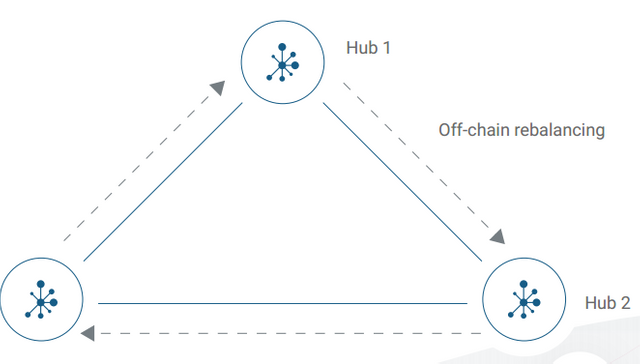

| 9.- Scheme of rebalancing of the Off-Chain payment networks: REVIVE |

|---|

This scheme allows:

Change the balances between payment channels in a secure way. Changes are made to the credits to which the participant is entitled.

Relive a channel securely by reallocating or chain the funds you have assigned to your payment channels.

In the rebalancing the funds are kept safe.

The rebalancing is free.

Disincentives the routing of payments through expensive payment routes, reducing costs.

Application in different underlying payment networks.

| 10.- Wallets for mobil and Web |

|---|

Liquidity.Network facilitates the experience of its network of payment to the users putting at your disposal purses with presentation for cellular telephones -IOS and Android- and web platform.

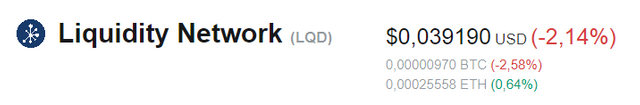

| 11.- LQD Token |

|---|

Liquidity.Network has its own tab called LQD Token.

This token will be used primarily to access Premium features. However, the use of tokens will not be mandatory to interact with the network in regular transactions.

Since October 2018, it has been listed on the LATOKEN, Hobbit and Coinmarketcap exchange platforms.

Value trade to the date of the post

| 12.- Airdrop powered by Liquidity Network |

|---|

Airdrops are a marketing strategy that Startups use to promote their project.

How does it work? In general, they ask the community to fulfill tasks such as sharing on social networks (Facebook, Instagram, Medium, Twitter, Telegram, among others) informative advertising in order to reach more people and interest potential investors in exchange for a number of cryptocurrencies or tokens that can be exchanged in turn by other cryptocurrencies such as Bitcoin, Dash, Ether or Fiat coins.

These tokens are sent to the participants' wallets.

Liquidity.Network is the best alternative for Startups to support them in the process of distributing the tokens. Its Off-Chain escalation solution allows the massive distribution of tokens without transaction costs. In addition, it is possible to segment the population where it is required to focus the launch.

Here is a video that gives a quick overview:

Liquidity Network vs other payment solutions

| Liquidity Network | Traditional Banks | Online Banks | Blockchain | |

|---|---|---|---|---|

| Scalability | ++ | + | + | - - |

| Speed | ++ | - - | o | - |

| Fund Control | Decentralized | Centralized | Centralized | Decentralized |

| Security | Cryptographic majority voting | Trust based | Trust based | Cryptographic majority voting |

| Accessibility | + | + | + | - |

| Fees | ++ | o | o | - - |

Liquidity Network vs other Off-Chain solutions

| Liquidity Network | Raiden | Lightning | COMIT | |

|---|---|---|---|---|

| Blockchain Support | Ethereum, Bitcoin (with RSK), others | Ethereum, Bitcoin(with RSK) | Bitcoin | Ethereum, Bitcoin(with RSK |

| Prototype | v | v | v | x |

| No rigid funds locked | v | x | x | x |

| Free off-chain Registration | v | x | x | x |

| Users in funds control | v | v | v | v |

| Easy Routing | v | x | x | x |

| Token Support | v | v | x | ? |

| Ether support | v | x | BTC | ? |

| Open Platform | v | v | v | v |

| Secured by blockchain | v | v | v | v |

| Mobile Application | v | x | v (only unidirectional) | x |

Liquidity Network vs otras Exhanges

| Marketplace | NYSE | Kraken | DEX | Liquidity Exchange | |

|---|---|---|---|---|---|

| Fast Trading | x | v | v | x | v |

| High Volume | x | v | v | v | v |

| User controlled funds | v | x | x | v | v |

| Blockchain Congestion Resilient | NA | NA | NA | x | v |

| Transaction Fee Independent | NA | NA | NA | x | v |

Team

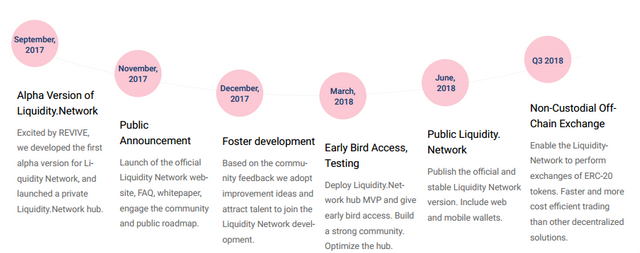

Roadmap

More information and resources:

Liquidity.Network web

Billfold.liquidity.network

Liquidity.Network WhitePaper

Liquidity.Network WhitePaper NOCUST

Liquidity.Network WhitePaper REVIVE

Liquidity.Network Apple App Store (IOS)

Liquidity.Network Google Play Store (Android)

Liquidity.Network Telegram

Liquidity.Network Telegram news

Liquidity.Network Twitter

Liquidity.Network Github

Liquidity.Network blog

Liquidity.Network Medium

Airdrops.liquidity.network

Contest sponsored by @originalworks

Know the conditions to participate in

2500 STEEM ~ Sponsored Writing Contest: Liquidity Network

Source of images and bibliography

Liquidity.Network WhitePaper

Liquidity.Network WhitePaper NOCUST

Liquidity.Network WhitePaper REVIVE

Liquidity.Network Medium

Link to Twitter

lqd2019

lqdtwitter2019

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

This post got an extra 5 power for following us

Follow @elsurtidor to get biggest votes in your next posts

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Thaishps from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

!sbi status

Hi @thaishps!