Unusual Options Activity In Johnson & Johnson

Johnson & Johnson (JNJ) has taken a hit in recent weeks, when allegations surfaced that the talc in its baby powder contained asbestos, which could cause cancer and that Management had known about it for many years. The selloff resulted in JNJ stock price going from $147 to a low of $122, one of the worst selloffs in JNJ’s history.

I guess the selloff is understandable because of all the pending lawsuits worth billions of dollars that have been filed since the allegation.

The Markets are very emotional, with a sell now, ask later mentality. To show Wall Street that JNJ was strong than ever, on Dec. 17th, management announced a $5 billion buyback to counter the selloff. This was on top of a strong third quarterly report prior to the allegations hitting the internet. For the third quarter, the company beat earnings and revenue estimates with. For the quarter, sales grew 3.6% to $20.3 billion. JNJ earned $1.44 a share, or $3.9 billion, up from $1.37 a year ago.

The Smart Money thinks JNJ’s operations and diversification across medical devices, pharmaceuticals and consumer goods, will more than withstand this asbestos story and the fall in the stock has created buying opportunity.

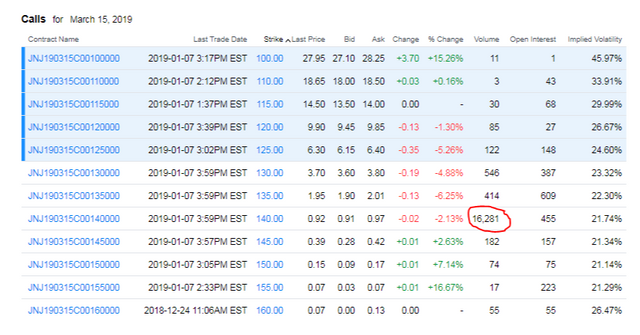

On Monday, I noticed unusual trading activity in JNJ. The Smart Money bought more than 7000 March 140 calls.

These options expire in less than 70 days, but the Smart Money thinks JNJ’s stock price will increase by 8% over this period.

However, their fourth quarter earnings will be announced within this time frame as well.

With all the uncertainty near term, only the Smart Money would place a bet like this with so little time to be right. Will they be right, only time will tell?

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Very interesting options datas. Thank you 🙏

Posted using Partiko iOS

You are quite well come @vlemon

Agree with the long term opportunity as these liabilities could be easily be transfered via insurance. Despite having a cost, it will be a short term impact to a long term story!

Posted using Partiko iOS

Definitely a buying opportunity.