Which Way? Bitcoin's Low Volatility May Force Big Move

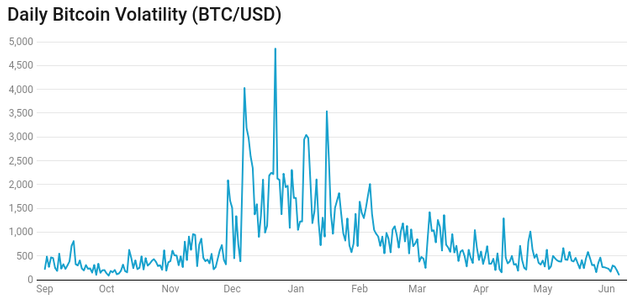

Bitcoin has been pressed into an inexorably restricted range for over two weeks and is presently encountering unpredictability not seen for eight months.

Accordingly, it's looking likely that bitcoin could soon make a solid move, yet the heading it will take when that happens is not as much as clear. Since May 24, the cryptographic money has been limited to a scope of $7,000– $7,800 territory, which is now tight, however the cost has scarcely moved over the most recent 36 hours, likely showing an ambivalent market.

Day by day unpredictability, as showed by the spread between the day by day value high and day by day value low, tumbled to $107.63 on Thursday – the most reduced level since Oct. 2, 2017 and down 86 percent from the 2018 normal of $793, as indicated by CoinDesk's Bitcoin Price Index (BPI).

As of composing, costs on CoinDesk's Bitcoin Price Index (BPI) are at $7,580, stamping around a $100 drop more than 24 hours.

Every day Bitcoin Volatility (BTC/USD)

While all is quiet now it may not proceed with that path for long, as an expanded time of sideways activity is regularly trailed by a savage proceed onward either side. As specialized hypothesis expresses, the more extensive the range and the more drawn out the time of the union, the more rough a breakout has a tendency to be.

In this way, bitcoin could see an expedient $800 move soon – in either course.

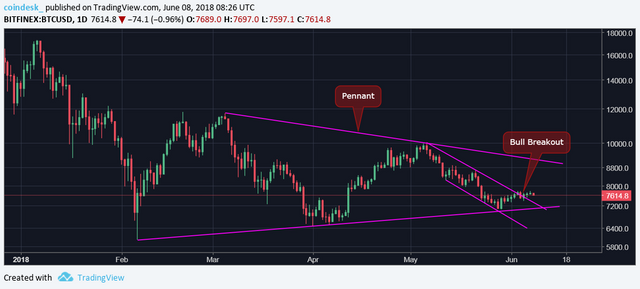

Day by day outline

Bitcoin had gazed set upward for a noteworthy bullish move prior this week, following an upside break of the falling channel. Presently the bull's inability to cross obstruction at $7,780 has left the entryways open for the bears to make a rebound.

Accordingly, the likelihood of bitcoin finishing the time of combination with a drawback break is the more probable of the two conceivable outcomes. To be sure, costs are beginning to drop at squeeze time.

View

A move above $7,819 (50-week moving normal) would flag a bullish breakout and would set the tone for a rally to flag opposition situated at $8,880.

On the drawback, a break beneath $7,090 (flag bolster) would infer a bearish breakdown. For this situation, BTC could conceivably dip under $6,000 (Feb low).