SEC-S17/W4 | Crypto Assets Diversification

Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

Crypto diversification means not putting all your money into just one or a few coins. It's like spreading your bets so that if one coin goes down, you won't lose everything. By investing in different types of crypto, you can lower the risk of big losses and maybe even make some gains when others are falling.

If you're used to investing in stocks and are curious about crypto, diversification can be a good way to dip your toes in without diving headfirst. You can still stick to the regulated world of stocks but add a bit of crypto to your investment mix.

However, there are ways for diversification your assets if you're ready to delve deeper into the realm of cryptocurrencies. It's similar to taking different methods inside the cryptocurrency market, which may eventually enable you to increase your investment and more successfully navigate the fluctuations that happen.

You can diversify, for instance, by holding assets other than just digital tokens. Another option is to investigate conventional assets that are related to bitcoin and other cryptocurrencies such as equities or bonds.

What are the main reasons why crypto asset diversification is important in an investment portfolio? |

|---|

Diversifying your crypto assets is like having different tools in a toolbox. If one tool breaks, you still have others to rely on. Similarly, by spreading your investments across different coins like Bitcoin, Ethereum, and others, you lower the risk of losing everything if one coin crashes.

.jpg)

Kucoin It's a way to protect your investments and avoid putting all your money into one thing.

Exploring Opportunities

You can investigate prospects across the cryptocurrency market by using diversification. Every coin possesses the capacity to develop and perform differently. Investing in multiple coins raises your probability of profiting from various projects' triumphs. It's similar to taking various paths to get somewhere; you might discover a quicker or more picturesque route.

Balancing Returns and Risks

A diverse portfolio aids in establishing a balance among risks and profits. At certain times, certain coins were capable of performing better than others. You can lessen overall risk and potentially boost the overall earnings despite moderating ups and downs by diversifying your holdings. Similar to having a mix of bonds and stocks in your financial portfolio of products, you want to strike a balance between both stability and development potential.

Ensuring Long-Term Stability

Finally, diversifying your bitcoin investments is essential for long-term stability. Spreading out your financial resources will help you reduce the detrimental effect of market fluctuations on your entire portfolio of products, even if the cryptocurrency sector is known for its volatility. It's like building a solid foundation over your finances, which should withstand fluctuations in the market as well as the test of time.

Can you explain how you diversified your crypto assets in your personal portfolio? What strategies have you used to maximize diversification while minimizing risk? |

|---|

In my personal portfolio, I have employed several strategies to diversify my crypto assets while minimizing risk. One approach I have taken is to allocate a portion of my investment across different types of cryptocurrencies.

For example, I might allocate a certain percentage to well-established coins like Bitcoin& Ethereum, another portion to mid-cap coins with potential for growth,& a smaller portion to high-risk, high-reward altcoins.

- Let Suppose

Let Suppose I have $3000 in my crypto wallet. I might allocate $1500 to Bitcoin, $1000 to Ethereum, and the remaining $500 to a mix of altcoins such as Chainlink and Cardano. This way, I'm not overly exposed to the performance of any single coin, and I have a diversified portfolio that can potentially withstand market volatility.

Investing in crypto-related commodities other than just digital tokens is another tactic I've employed. This involves making investments in blockchain-based technologies firms or cryptocurrency mining equities.

I'm extending my risk throughout several crypto industry sectors by diversifying into different periods connected assets.

I also make certain that the my portfolio is in line with my investing objectives and level of risk tolerance by reviewing and rebalancing it on a regular basis. This could entail reallocating funds to assets with a greater potential for expansion and selling off those assets that have performed well.

- Different Exchanges:

A well-known approach of risk diversification is to store investments across exchanges.

One explanation supporting this is to reduce the possibility of a single exchange witnessing a hack, similar to what happened with "Mt. Gox" in the past. One way to lessen their influence of such incidents is to distribute assets over multiple platforms.

For instance, there are currently speculations that Binance may have difficulties with the US government.

Having funds distributed across several exchanges can assist reduce possible harm or access problems in the unfortunate circumstance that Binance faces regulatory obstacles or operational difficulties.

How can diversifying crypto assets help mitigate market volatility? Can you give concrete examples of situations where diversification has had a positive impact on your portfolio? |

|---|

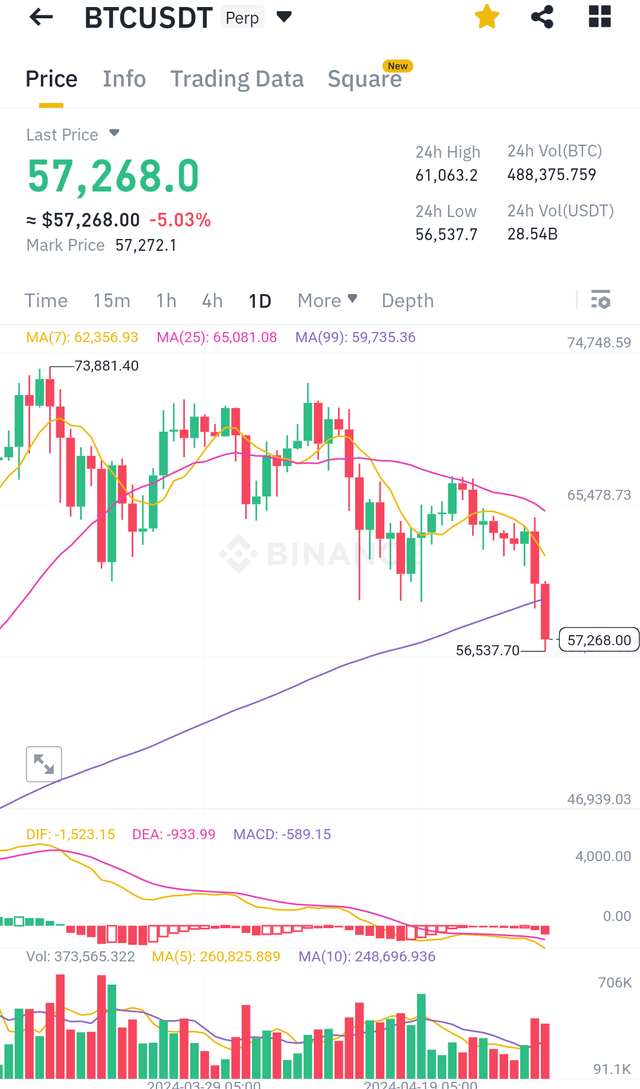

Haha, I would answer this question in an awesome way, just like yesterday when we witnessed significant liquidity in the market.

So if you people are taking a look at cryptocurrency prices, I'm sure you're almost surprised by the market volatility, especially over the last two weeks since the Iran attack on Israel.

You can take a look at the chart of Ethereum, and see how surprising the dump was, going from $3300 to $3000, and then down to $2800.

It's like riding a crazy wave in the crypto ocean! These sudden drops can be nerve-wracking, but they also remind us of the importance of diversifying our portfolios.

Binance Binance |

|---|

Dear friend, as we know, BTC is the father of all crypto coins. Once BTC starts dumping, other altcoins follow suit. This is a common phenomenon in the crypto market.

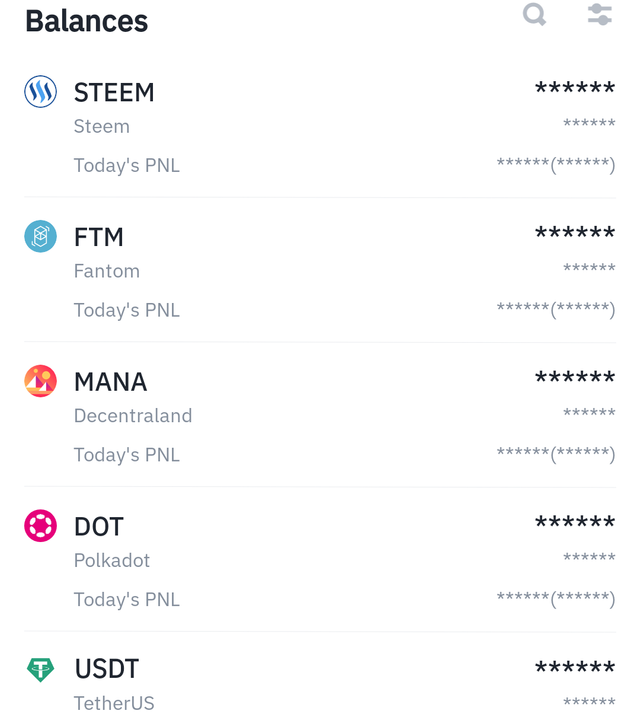

Dear friend, honestly, over the last two weeks, I witnessed a nightmare for altcoins. Sadly, most of my wallet was holding spot positions, with the majority invested in altcoins. The only exception was Matic, as I opened a future trade at 0.72.

Bitcoin dropped; however, altcoins dropped by 2x compared to BTC. Let me show you a few currencies on the Binance interface, where the red candle is clearly showing.

|  |

|---|---|

|  |

During this latest dump, some of the coins in my portfolio of diversified assets fell apart. But I have no doubt that things will clear up shortly and that the vast majority of the coins will appreciate.

My assets are unaffected because of these short-term changes since I have long-term goals for my trades. My plans aren't going to change. In the future, I are considering hiring averaging tactics in order to recover any losses when the market has returned to equilibrium and the situation has become more apparent.

The key is to maintain your attention on the objectives for the future and to avoid allowing the overarching strategy to fall apart when derailed by transient market fluctuations.

How does the STEEM token fit into your crypto asset diversification strategy? What is its role in your portfolio and how did you select it among other assets? |

|---|

In my crypto portfolio, I have different types of coins to make sure I don't put all my eggs in one basket. One of these coins is STEEM. It's like having different flavors of ice cream – each one adds something unique to the mix. I chose STEEM because it has its own community and platform for content creators, which I think is pretty cool.

CoinGecko.com CoinGecko.com |

|---|

Why STEEM Fits Into My Strategy

A particular place for STEEM in my work in progress. It's similar like adding fragrance to a recipe with a particular ingredient. I chose STEEM because I think they have room to expand in the future. In addition, it diversifies my portfolio, therefore lessens the risk. STEEM is one in particular of many tools in a toolbox; every tool has a certain use.

Selecting STEEM Among Other Assets

I looked into STEEM's characteristics as well as where it fits into the larger cryptocurrency industry prior to deciding on it. It's similar consisting of purchasing the best fruit that's on the market; you want everything luscious and fresh. I considered things like its implementation case, community, and long-term growth prospects. STEEM was an excellent fit for my portfolio, I determined after comparing it to other assets.

How i am assure

All in all, STEEM gives my cryptocurrency portfolio more flavor and diversity. Similar to eating a balanced meal, supporting your health includes a variety of micronutrients. I'm not placing every single one of my cryptocurrency eggs in one basket with STEEM, and I maintain faith in the capacity of it to increase my portfolio over time.

Can you share a detailed analysis of your crypto assets, including their distribution, historical performance and the criteria used to select these assets? How do these choices reflect your overall crypto asset diversification strategy? |

|---|

Certainly! Let's delve into a detailed analysis of my crypto assets and the strategy behind their selection for diversification.

|  |

|---|

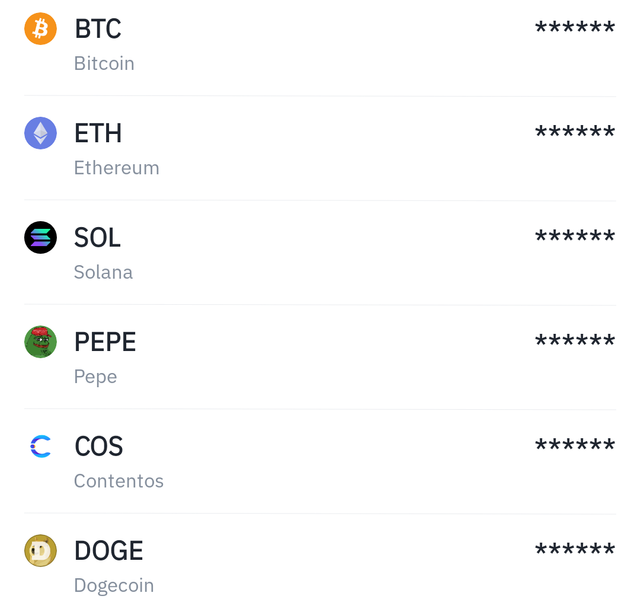

Asset Distribution

My crypto portfolio comprises a variety of assets carefully selected to spread risk and maximize potential returns. Among these are Bitcoin (BTC), Ethereum (ETH), Fhantom (FTM), MANA, Polkadot (DOT), BNB, Solana (Sol) . Each asset is allocated based on its market potential, utility, and historical performance.

Historical Performance

Analyzing past performance might assist you better understand each asset's risk profile and the possibility of advancements. For instance, Bitcoin has shown over the years to be a reliable as well as worthwhile store, while recently launched tasks, like as Solana, have grown and developed swiftly.

Selection Criteria

Diversification Strategy

Investing in a variety of asset classes, including large-cap cryptocurrency like BTC and ETH and promising alternatives like FTM, SOL,MANA BNB, and DOT, is part of my diversification approach. The method aids in reducing risk and seizing chances in a number of cryptocurrency market sectors.

In conclusion , my approach to crypto asset analysis and diversification is based on careful investigation and a dedication to minimizing risks and optimizing gains.

I want to take advantage of possibilities in many areas of the cryptocurrency market by diversifying among a number of assets, such as Bitcoin, Ethereum, fontom , BNB ,Cardano, Solana, and Polkadot. Every asset is chosen according to its past performance, potential in the market, and compatibility with new developments in Web3 technology and decentralized finance.

Using this method enables me to create a robust portfolio that can survive market fluctuations and take advantage of long-term development prospects.

With Best Regards

@artist1111

Goodbye, friends. It's been a pleasure getting to know you all participating in this community. I will miss interacting with all of you, but it is time for me to move on. Take care & I hope to see you all again very soon , Best of Luck .

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

AsslamuAlikum @artist1111 mena sabki post ko read kiya hai lakn Mja dil kiya k ma ap ki post pr comment kru Q k mja ap ki post sa e clearly kuch mila hai in questions k bara ma k kesa answer krna hai mena . Or ap ki is post sa jo learning mili hai us ki base pr ma participate kru ga ab contest ma inshAllah Aj sa likhna shuru kru ga or kl ma apni entry drop kru ga inshAllah.

Jaisa ap na apna risk management k liya example de hai wo such ma kmal the us sa mja clear hu gya k question k answer ma hm na kesa jawab dena hai. Or is k ilawa ap na jo btc or alt coin k chart share kr k un k dump k mtabik difference ptaya tu mja Bohat asani mili us ko deakhna k bad Apka bohat shukriya k ap na keemti wakt nikal k itni achi information hamary sath share ki .

Congratulations! This post has been upvoted through steemcurator04. We support quality posts, good comments anywhere, and any tags.

@artist1111 Your detailed insights into crypto asset diversification are impressive! Diversifying across different coins is like having backup plans for your investments ensuring stability even if one coin drops. I admire your strategic approach especially in including STEEM for its unique platform. Your analysis of historical performance and selection criteria shows a thoughtful investment strategy. Good luck

You're a lucky guy if your assets are unaffected in this dip almost unbelievable as all the coins wer affected due to this btc correction. One of thr benefits of doing spot trading is that you don't get liquidated even when the market doesn't move in our favour. Were you able to make any money in today's uptrend movement of btc? There were some coins that followed the btc movement and had 10-15% gains

Reading your reasons of choosing steem as an asset in your portfolio is somewhat similar to mine.

I do believe that controlling one's emotions and practicing proper risk management in futures trading can prevent losses, unless there's extreme misfortune.

Yeah, currently, there's a positive sign for altcoins, and I've been observing positivity in the market for the last 24 days. However, since the dump, a red candle on my Binance was flickering... 😅.

However, the picture for BTC isn't clear yet, but I remain optimistic about it, what about you ?

Yeah , probably might see a move of up to 15% in major altcoins.

I haven't noticed any similarity with your content and that particular part, but I must commend your content. It's a masterpiece! 👏

I am very calm at the moment as this breakdown was much needed for the long run of BTC. You must have noticed that BTC was ranging between 60k to 66k and this flash crash was much needed to liquidate the long positions. There was an aggressive green candle breaking the 59k yesterday but I still believe we ned to break the 60k mark to get the next ATH.

Two strong levels at the moment are 56k and the strongest support is at 52k. If these levels are broken, we might go as low as 30k but the bounce back from here would be something to keep an eye on. Im still strong on my 100k position. let's see

TI might have mixed up your article with someone else's. Your article is very well written as well.

Hello friend greetings to you, hope you are doing well and good there.

You have given a beautiful definition of diversification. You said diversification means not putting all of your money into just one or a few coins. It actually means spreading or diversifying your portfolio. We select many coins to avoid any sufficient lost to our portfolio.

I agree to you that diversification greatly helps us safe our portfolio and even we can earn good profit using that option. You have a long list of coins in your favorite list, most of them are those I m holding in wallet too. Your post is sublime, thank you so much for such an informative post.

I wish you best of luck in the contest dear friend. Keep blessing.

Greetings @artist1111,

I'm really impressed with your in-depth understanding of diversifying one's crypto assets and investments over all. Diversification is like having backup plans for your investments, so that even if one coin doesn't perform well, you still have other coins to rely on for stability. Wishing you the best of luck.

Hey friend it's so sad to see that your also fell for that bearish trend, this is because I was also affected by the little bitcoin crash that affected 90% of the crypto assets the crypto market. The good things that most of this asset including Bitcoin has started recovering and as of this money bitcoin was around 64,000 dollars which gave hope back to all investors worldwide.

Although as bitcoin was having that issue I put to you that some assets and altcoin didn't experience very serious bearish trend . For example steem pumped a little bit before it dropped with a very low speed and pressure making the bearish trend

no to intese to traders who practiced diversification.

Thank you for sharing please engage on my entry through the link below https://steemit.com/hive-108451/@starrchris/sec-s17-w4-or-or-crypto-assets-diversification

Hello artist ,

I also like the steems better and I think that Steem fits very well in my strategy. The reason for this is that Steem is very handy. It is a good asset. Along with that, it is also flexible. We can deal with it whenever we want. Yes, but the price of any cryptocurrency is not fixed, so it is a common thing but in Steem it is much more flexible.I gained a lot of knowledge by reading your post. Keep writing such posts, thank you!