SEC S17-W4 || Crypto Assets Diversification

|

|---|

INTRODUCTION |

It is said that human beings need to eat a balanced diet made of different classes of food to grow well? This is a common example of diversity, as they say, "Variety is Life".

Well, diversifying your crypto assets is also similar, but instead of meals, you invest in different types of cryptocurrencies instead of just investing all your money in one alone. So this week, we want to learn the importance of diversification of our crypto assets. As always, I hope you learn something new as I try to answer the questions given.

What are the main reasons why crypto asset diversification is important in an investment portfolio? |

|---|

An investment portfolio is all about having a different type of cryptocurrencies in our digital wallet, (just like a balanced diet is made of different classes of foods). However, diversifying our crypto assets helps us spread out our risks and increase our chances of making a profit because when some cryptocurrencies are going up in value, others may be going down, therefore by having a mix of them, we are not putting all our hopes in one investment.

Therefore, diversification is very important when it comes to our crypto investment portfolio for the following reasons;

Reducing Risks of Investment:

By diversifying my investments, I spread my risks across all my investments, which in turn helps me to reduce the risk of losing out completely. i.e., if I put all my money into buying just one cryptocurrency and it does not go as well as I hoped for, I could end up losing a lot. But if I have a mix of different cryptocurrencies, then any loss I encounter from one can be balanced using the gains from others therefore reducing the risk in my investments.

Potential for Higher Returns:

Different cryptocurrencies have different growth potentials, therefore by diversifying our investments, we have the chance to benefit from the ones that perform well to make up for the ones that do not.

Exposure to Different Markets:

Cryptocurrencies are influenced by different factors like technological advancements, industry trends, and market conditions, therefore by diversifying, we expose ourselves to different markets and sectors. This way, if one sector experiences a downturn, the others may still perform well and help us reduce the impact on our overall portfolio.

Encouraging Flexibility and Adaptability:

The crypto market in its volatile nature is very unpredictable, so by diversifying, we tend not to rely on just one cryptocurrency to make a profit, but rather we are giving ourselves the flexibility to adapt to market changes and take advantage of different opportunities that arise.

It Brings Peace of Mind:

Diversification brings peace of mind, knowing that we are not solely depending on the performance of just one cryptocurrency to make a profit.

Can you explain how you diversified your crypto assets in your personal portfolio? What strategies have you used to maximize diversification while minimizing risk? |

|---|

My cryptocurrency journey has been exciting so far as I continue to learn and grow, and I'm glad I learnt to diversify my portfolio I will tell you why as we continue on this discussion.

STEEM is my first love and the first cryptocurrency and I started holding it when I was introduced to the Steemit platform way back in 2021, making STEEM my trusted companion, that is always there to support me financially, and also having to hold STEEM gave me me me me a solid foundation for my portfolio.

But I knew that diversification was key, so I decided to explore other cryptocurrencies as well. One of the coins I added to my portfolio was Tron which I was equally earning on the Steemit platform before now but then the Tron rewards stopped coming even as it's still seen on our reward claims.

However, I hold other cryptocurrencies like Pepe, Ice, Core, OEX, Athenes etc in separate wallets which I've come to earn through mining. However, Steem, Tron and Pepe served as my primary focus for diversification so far, allowing me to spread out my risks, explore different blockchain ecosystems, and tap into various opportunities within the crypto space, with each cryptocurrency bringing its own unique value and added depth to my portfolio.

As I continue on this crypto journey, I will keep exploring new opportunities, and adjusting my portfolio accordingly as diversification has been a valuable lesson for me, and I look forward to more exciting possibilities that lie ahead.

What strategies have you used to maximize diversification while minimizing risk?

Spreading my Investment:

One strategy I have learned is to spread my investment across different types of assets. As you can see from the above section about my portfolio, you will notice there is a social-media-based token (STEEM), a decentralized governance token (TRON) and a Meme coin (PEPE).

Time is my friend:

I have learnt that diversification is not just about spreading my investments, but also about spreading them over time. So, instead of investing a large sum all at once, I consider investing smaller amounts regularly over time, a strategy popularly known as "dollar-cost averaging", and it helps me reduce the risk of investing at the wrong time and iron out the impact of market fluctuations.

Knowing the Relationship between my investments:

I need to understand the relationship (correlation) between my investments because if two assets are highly correlated like in the case of Steem and Bitcoin, they tend to move in the same direction most of the time. Therefore, to maximize my diversification, I look for assets that have low or negative correlations, so that when one asset is performing poorly, the other may perform well, reducing the overall risk in my portfolio.

How can diversifying crypto assets help mitigate market volatility? Can you give concrete examples of situations where diversification has had a positive impact on your portfolio? |

|---|

Market Volatility is all about the unpredictable ups and downs in the value of cryptocurrencies in the market. Therefore if we have all of our money invested in just one cryptocurrency, let's say Bitcoin, if Bitcoin experiences a sudden drop in value, we may end up losing a significant portion of our investment and this is where diversification comes in to help us mitigate market Volatility.

Diversifying our crypto assets across different cryptocurrencies means that if one coin experiences a decline, there's a chance that other coins in our portfolio may not be affected in the same way or even, or we might experience some of them going up in value.

Therefore, if we have multiple cryptocurrencies in our portfolio, the positive performance of some coins can help balance out the negative performance of others, thereby improving the overall impact of market volatility and minimizing the risk of losing our investment due to the decline of a single coin.

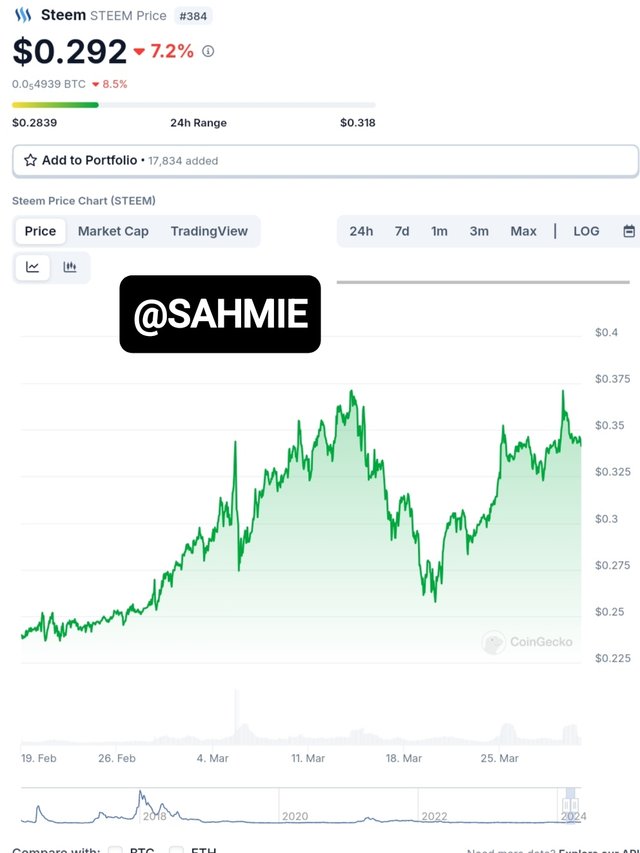

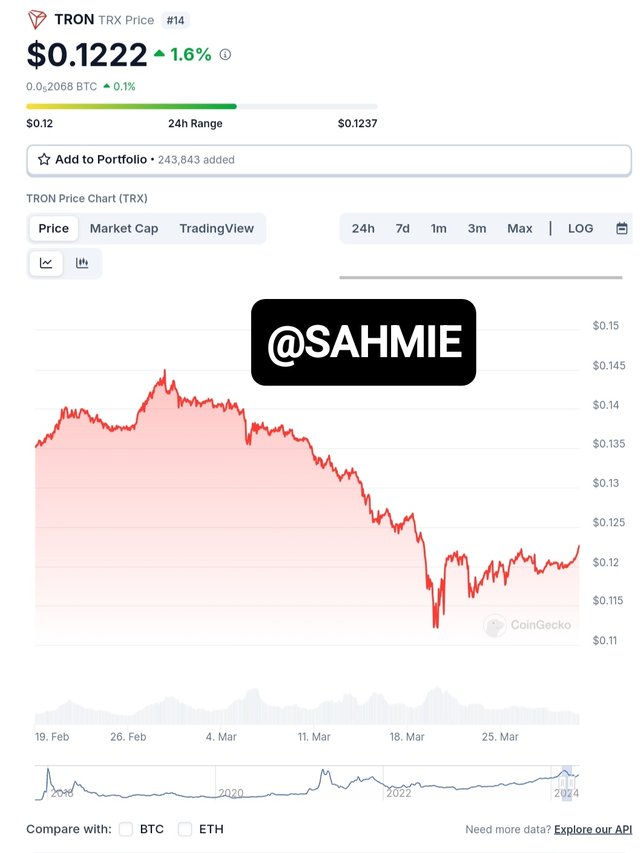

A concrete example of this is what happened in my portfolio between the 19th of February and to 30th of March 2024. Where within this period, I observed that the assets (STEEM, TRON and PEPE) in my portfolio had different trends as shown below.

|  |  |

|---|---|---|

From the screenshots provided above, you can see that while TRON was observed to be on a downward trend during this said period, the likes of STEEM and PEPE were on an upward trend. In fact, I made an unimaginable profit from trading PEPE in that period as it was observed to make over 500% rise.

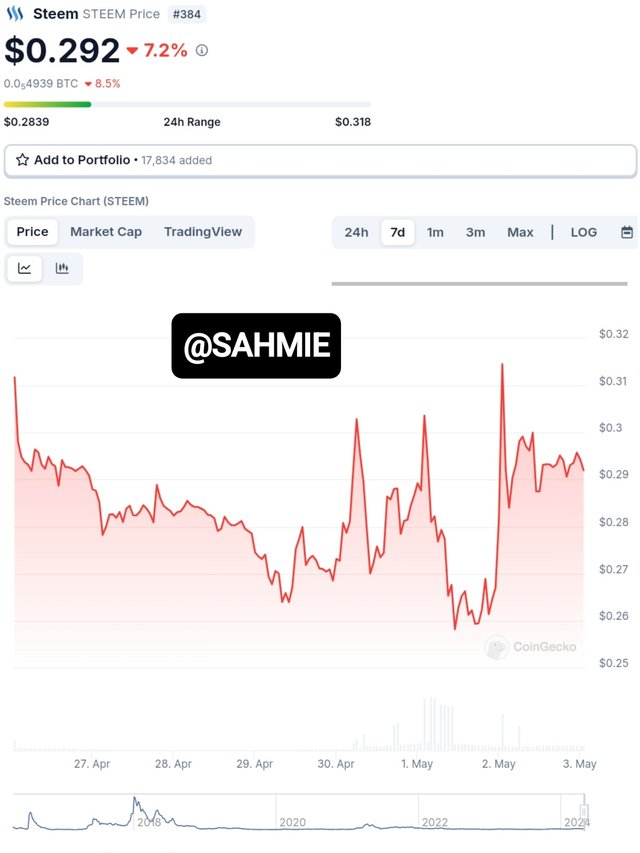

Another example will be, the last seven days, as shown in the screenshot below where STEEM and PEPE are experiencing downward trends, and TRON is on an upward trend.

|  |  |

|---|---|---|

I can say this is possible because, whereas STEEM and PEPE seem to be friends (correlated), this can't be said of TRON as it is observed to have negative correlations to the former two hence going in the opposite direction.

Therefore, diversification also allows us to take advantage of different moments like this. As you have seen, not all cryptocurrencies move in the same direction at the same time because they are influenced by different factors. So, by diversifying, I got to increase my chances of benefiting from the growth potential of my different assets.

How does the STEEM token fit into your crypto asset diversification strategy? What is its role in your portfolio and how did you select it among other assets? |

|---|

STEEM is a big part of my crypto journey being the first crypto I ever earned and it is not like any other cryptocurrency in my portfolio as I only get to earn it by participating in the Steemit community and not necessarily buying with my money, therefore removing the risk of losing my investment. But then, Steem is actually the one I have invested (time) the most in.

Being able to earn STEEM tokens through Steemit made it my biggest investment serving even as the capital to acquire other cryptocurrencies of my choice and by holding onto my Steem tokens (SP), it means that I have a stake in the success of the Steem ecosystem and also have the chance of making more profit if the value of STEEM goes up.

Having STEEM in my investment portfolio made it diverse and interesting because it is not just about investing in cryptocurrencies but about being part of a community, earning rewards, and contributing to the growth of a special platform.

Can you share a detailed analysis of your crypto assets, including their distribution, historical performance and the criteria used to select these assets? How do these choices reflect your overall crypto asset diversification strategy? |

|---|

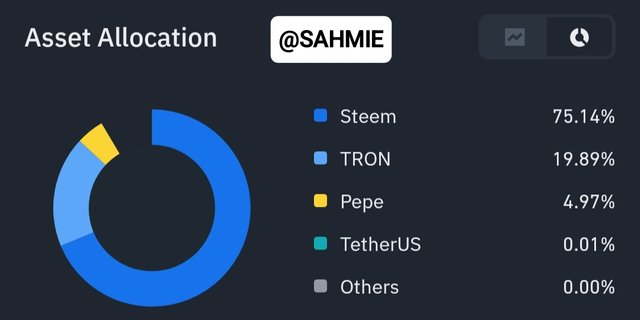

|

|---|

The screenshot above shows my current portfolio. Among so many cryptocurrencies, I wanted to choose assets that are different in nature and also affordable compared to the more popular cryptocurrencies out there.

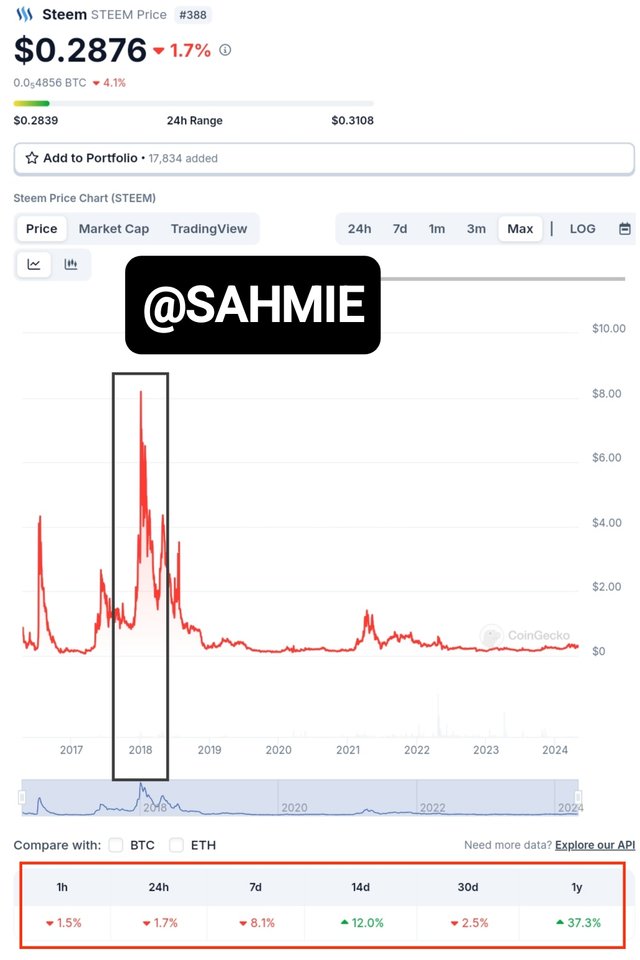

STEEM; 75.14%

Steem is like the heart and soul of my crypto investments as I have stated earlier, I earn Steem as a reward by being active on Steemit, It is like being paid for sharing my thoughts and engaging with others and I love the idea of being a part of a community and earning rewards at the same time.

|

|---|

From the screenshot above, we can see the historical data of the Steem token from the inception till date, also showing that Steem enjoyed its best year in 2018, having it's all time highest valuation at > $8 (in the dark rectangle) before crumbling down to what it is today. However, looking at the red rectangular marking, shows that Steem is improving, and has made over 37.7% increase compared to this day last year even as the current market seems downward.

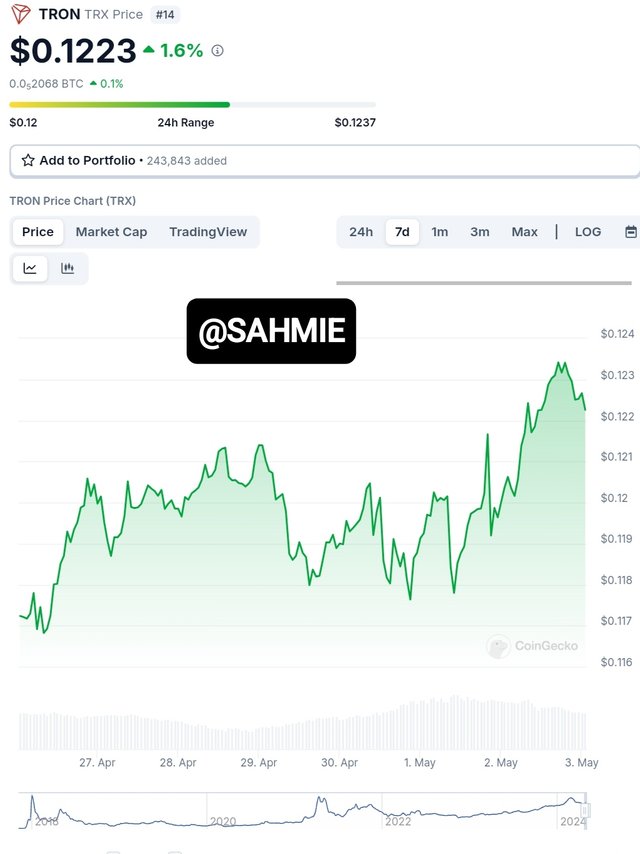

TRON; 19.89%

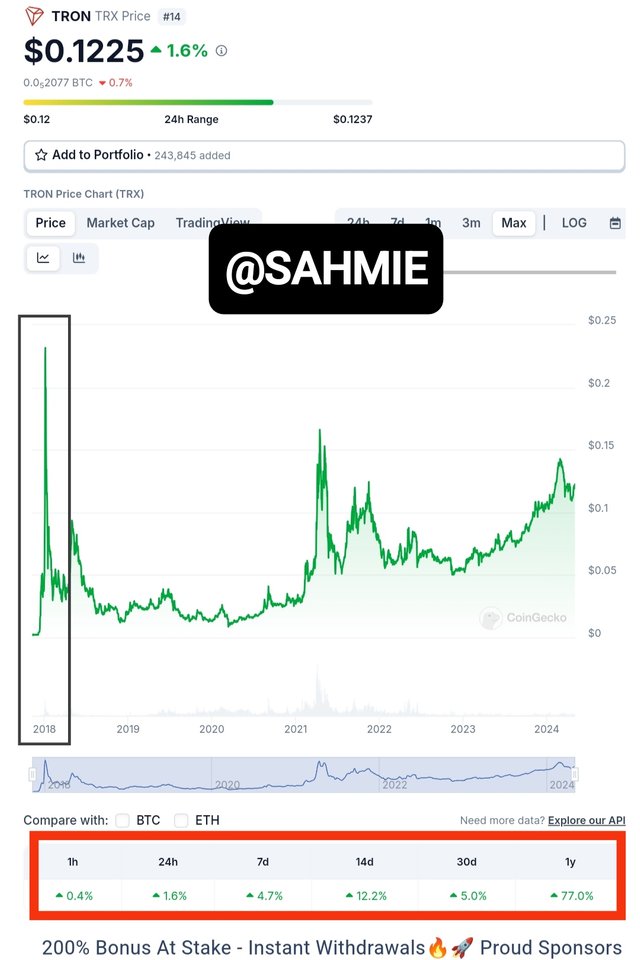

A cryptocurrency that caught my attention as it is all about creating a decentralized platform for entertainment. Like Steem I find this concept fascinating because it gives power back to the creators and allows them to have more control over their content. Plus, Tron has some exciting partnerships and projects in the entertainment industry, which grew my interest.

|

|---|

The screenshot above also shows the historical data of the Tron token over time, showing it best year also to be 2018, where it was > $0.2, but unlike steem, it has experienced a gradual upward trend since back 2021 till date with some hike in value in-between. However, looking at the area enclosed on the Red rectangle, we can see that Tron is on a upward trend for;

| Time interval | ∆ in percentage |

|---|---|

| Last 1 hour | +0.4 |

| Last 24 hours | +1.6 |

| Last 7 days | +4.7 |

| Last 14 days | +12.2 |

| Last 30 days | +5.0 |

| Last 1 Year | +77.0 |

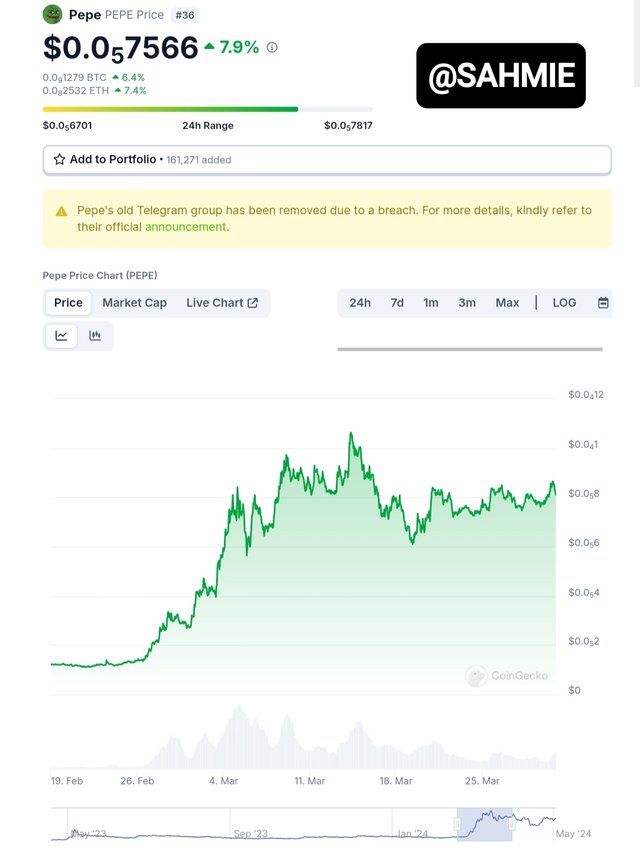

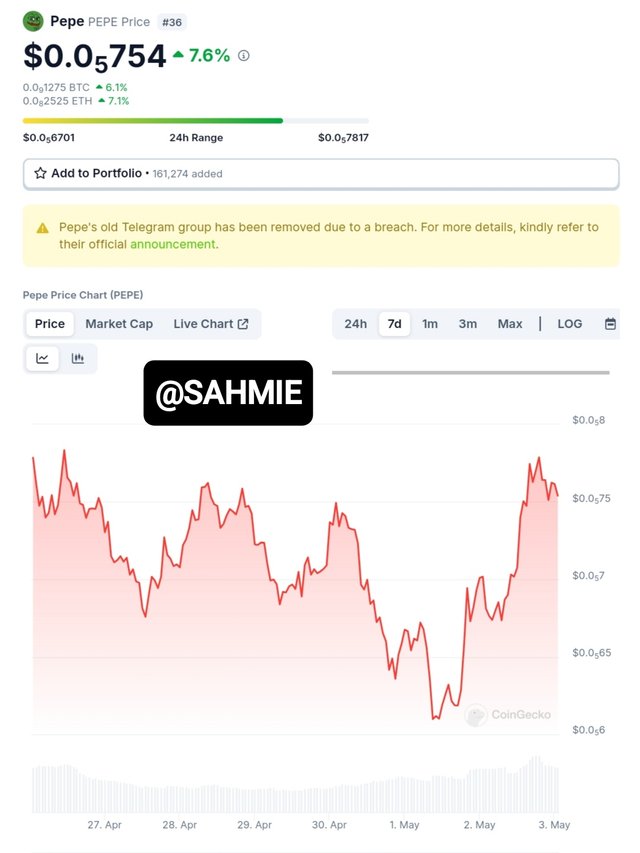

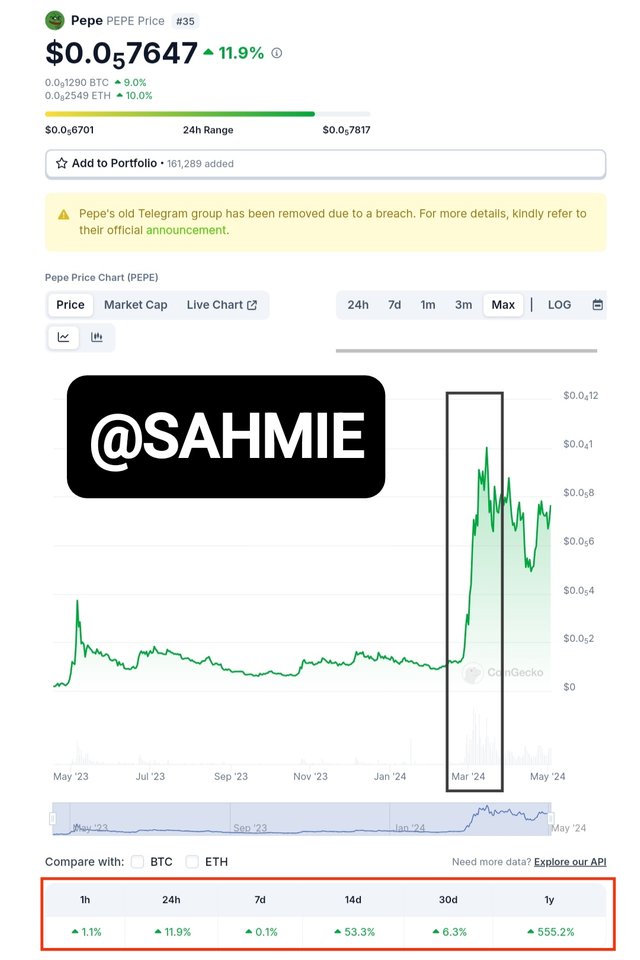

PEPE; 4.79%

With the noise coming from meme coins, PEPE attracted me with its unique Pepe the Frog meme which gained a lot of popularity in the crypto world, so I decided to include PEPE in my portfolio because it adds a touch of fun and uniqueness but most especially was because it was practically free as I earned most from the PEPE Faucet app, before converting some of my Steem reward to increase the percentage.

|

|---|

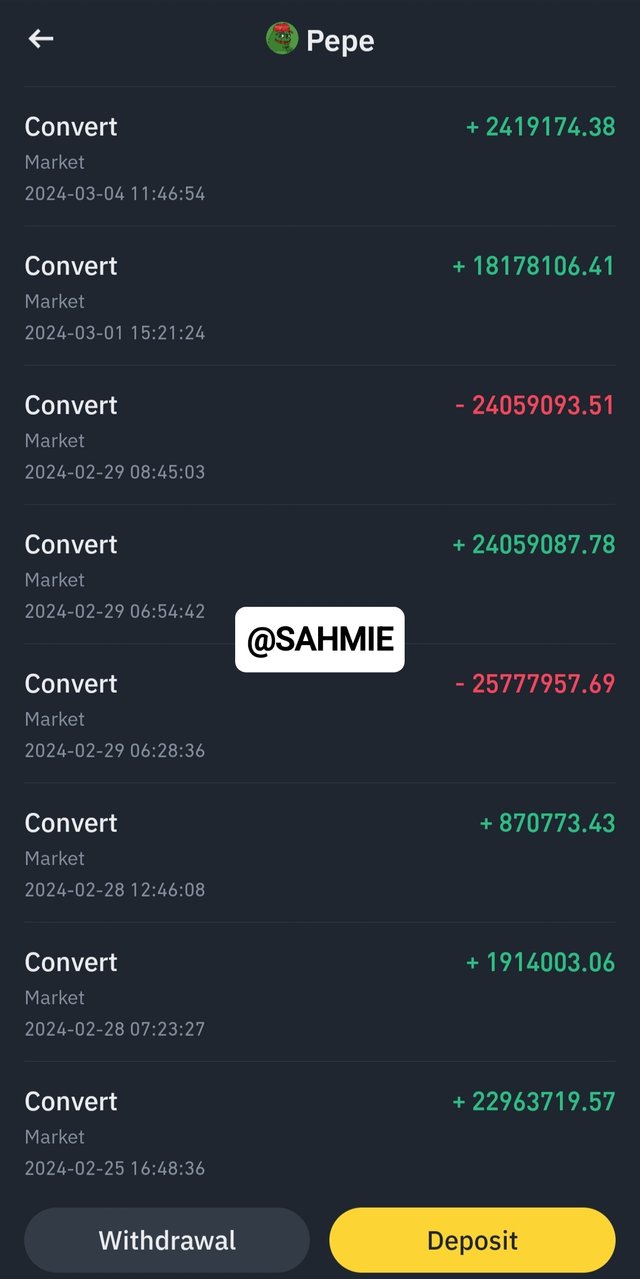

The screenshot shows the historical data of the Pepe token over time, with it's highest ever value barely a month ago where it went up > $0.00001, an appreciation worth over 500% since being a new token, it was barely tangible. But then, it was in this period that I made over 300% profit as I only started holding the Pepe coin from February 25th, as shown in the screenshot below.

|

|---|

However, looking at the area enclosed on the Red rectangle, we can see that Pepe is on a upward trend for;

| Time interval | ∆ in percentage |

|---|---|

| Last 1 hour | +1.1 |

| Last 24 hours | +11.9 |

| Last 7 days | +0.7 |

| Last 14 days | +53.3 |

| Last 30 days | +6.3 |

| Last 1 Year | +555.2 |

The tiny percentage of the USDT as seen from screenshots is a leftover from my previous trading activities of converting and selling in the P2P market to support myself financially.

Therefore, by selecting these assets, I get to create a diversified portfolio with each asset having its unique characteristics allowing me to spread out the risks and increase any potential benefit from these different markets.

The most important factor in my selecting this asset was affordability as I wanted to invest in assets that were more affordable and pocket-friendly compared to popular ones like Bitcoin, Ethereum, Solana etc.

CONCLUSION |

In conclusion, diversifying your crypto assets is a wise strategy to minimize risk and maximize potential gains because by investing in different types of cryptocurrencies, you are not putting all your eggs in one basket. And, this approach allows you to benefit from the growth of different cryptocurrencies while reducing the impact of any individual cryptocurrency's volatility.

I wish to invite @starrchris, @casv, @ngoenyi, and @ruthjoe.

Thank You for your Time

NOTE: Always have a smile on your face, as you are never fully dressed without one.

A detailed post you have shared here on asset diversification and the reasons why this is necessary for our crypto Journey. Indeed when you diversify your assets, you will have peace of mind because you have reduced the risk that ordinarily you could have incurred.

Your portfolio looks beautiful as you took at time to select among thousands of crypto assets to hold. You also shared details of the assets selected. I wish you success in this contest my friend.

Thank you so much for your kind words, I'm glad you found my post on asset diversification helpful. It's true, diversifying our crypto assets can bring peace of mind and reduce risk. I'm excited about the opportunities that STEEM has brought into my live, and I'm grateful to be a part of this journey even as I look up to people like you and our professors to learn more from. Thank you for your support.

La diversificación es tan necesaria para mitigar los riesgos, poner los huevos en una misma canasta es asumir un alto riesgo de perderlos todos.

Bienvenida siempre serán las ganancias pero todos odiamos las pérdidas.

El aprendizaje se logra paulatinamente con la experiencia, ya que el mundo de criptomonedas es muy volátil e impredecible, por tanto se requieren estrategias para maximizar la diversificación y minimizar los riesgos.

Seleccionar criptomonedas con correlaciones divergentes y naturalezas diferentes pueden mitigar los riesgos, estoy de acuerdo, porque de eso se trata la diversificación.

Excelente explicación la composición de tu cartera, lo que facilita la comprensión de la discusión.

Gracias amigo por tu publicación como siempre aportando tu conocimiento y experiencia.

¡Saludos deseándote el mayor de los éxitos!

Diversification is super important to reduce risks. Putting all our eggs in one basket means we could lose everything if something goes wrong. We all love making profits, but nobody likes losses.

In the world of cryptocurrencies, things can change really quickly and it's hard to predict what will happen. That's why it's important to have strategies in place to maximize diversification and minimize risks. By selecting cryptocurrencies that have different behaviours and characteristics, we can lower the chances of losing everything. That's what diversification is all about.

I'm glad you found my explanation of portfolio composition helpful. Thank you for your kind words and for always sharing your knowledge and experience. I wish you the greatest success too.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

AssalamuAlaikum, brother, I really enjoyed reading your post. In your post it was very easy to enjoy and explain the method of dividing your crypto asset. I hope others along with me would also have understood this. Ofcourse by investing crypto assets in different cryptocurrencies the risk can be reduced and the profit possibilities can be increased.It is very educative for me to understand your experiences and personal strategies because your senior and it will give me alot of knowledge im very thankful to you for this article.

Thanks a lot for your kind words, brother. I'm really glad you enjoyed reading my post. I tried my best to make it easy to understand the method of dividing your crypto assets. I hope others, including yourself, found it helpful too.

You are absolutely right. By investing your crypto assets in different cryptocurrencies, you can reduce the risk and increase the possibilities of making profits. It's great to hear that you found it educational to learn about my experiences and personal strategies. I'm happy to share my knowledge with you, grateful for your appreciation and thankful that you found value in it.

You don't need to be thanks boss your post is always learnable for me

Hello Sahmie brother,

Just like always, you have presently very impressive entry this week as well. Every trader or investor should focus to diversify his total portfolio in order to minimize the risks involved with the highly volatile market of cryptocurrency.

Steem, Tron and the Pepe coins are the major tokens of your Crypto portfolio and these tokens had also helped you a lot to keep a balance of your portfolio in different market conditions.

Thanks a lot for sharing your post and I wish good luck to you in the contest.

Thanks for sharing your thoughts. I appreciate your kind words about my entry this week. It's true that diversifying your portfolio is crucial in the cryptocurrency market to minimize risks. Thank you for sharing your thoughts and wonderful feedback.

I share with you your vision of the reasons why it is good and convenient to diversify our crypto asset portfolio, but I especially agree with what you say about how this gives us peace of mind. Because it is truly true that our investments must be well distributed to protect our capital adequately and to be able to have peace of mind.

I appreciate your perspective on the importance of diversifying our crypto asset portfolio. It's great that you also emphasize the peace of mind that comes with having a well-distributed investment. Indeed, by spreading our investments across different assets, we can protect our capital and feel more secure about our financial future. It's always wise to have a diversified portfolio to minimize risks and maximize opportunities. Thank you so much for dropping by.

@sahmie Your analogy of diversifying crypto assets to maintaining a balanced diet is spot on Just like eating different foods keeps us healthy investing in various cryptocurrencies protects our investments. Your detailed explanations and personal experiences make the concept easy to grasp. Good luck

Indeed, just like eating different foods keeps us healthy, investing in different cryptocurrencies help keep our investments healthy. Thank you so much for your support and good wishes. All the best.

Hello sahmie you've written a phenomenal article in which you explained clearly the significance diversification holds while trading. Your explanation about the minimizing losses through CAD in on point. It was a comprehensive article which I enjoyed reading. Best of luck

Thanks for your message. I really appreciate your kind words about my article on diversification in trading. I'm glad you found it helpful and that my explanation about minimizing losses through diversification was on point. It was my goal to make the article comprehensive and easy to understand, so I'm thrilled to hear that you enjoyed reading it. Best of luck to you too.

An Investor who truly understand the financial markets, or the concepts of trading would always aim of diversifying his or her portfolio to avoid risking his or her investment. You have make us to understand what crypto portfolio diversification means. Good luck.

It's true that a smart investor who knows about the financial markets and trading would always want to diversify their portfolio. By doing this, they can avoid putting all their eggs in one basket and reduce the risk of losing their investment. I'm glad I could help you understand the concept of crypto portfolio diversification. Good luck to you as well.