SEC S17-W4 || Crypto Assets Diversification

Hello Steemians,

It's week 4 in the Steemit engagement challenge for season 17 and I'm delighted to participate in the Crypto Academy contest for the week. The topic says Crypto Assets Diversification and it indeed caught my attention and that is the main reason why I want to share my thoughts on it as well.

Image Edited on Canvas

To share my participation fully in this contest, I will be following the contest hints provided by the contest organizers below. So without further ado let's dive into the business of the day.

| What are the main reasons why crypto asset diversification is important in an investment portfolio? |

|---|

The saying "Do not gather all your eggs 🥚🥚 in one basket 🧺" is true when it comes to crypto asset diversification and also another aspect of life. Diversification in simple language means to distribute or share in different places or different tokens.

Image Edited on Canvas

So before we look at the main reason why crypto asset diversification is important in an investment portfolio, let's first know what it means to diversify an asset.

As earlier stated above, crypto asset diversification means investing in different assets instead of only investing in one or two. This means if you have $100, instead of using the entire $100 to buy Steem, you should consider buying another crypto asset alongside the Steem token.

With $100, you can buy Steem for $10, Hive for $10, TRX for $10, WAVES for $10, MATIC for $10, BNB for $10, FIL for $10, OP for $10, XRP for $10 and lastly $SOL for $10.

From the example above, instead of using the entire $100 to purchase a single coin, I have used it to purchase 10 different coins, and that is what we call diversification.

Now why is this important in an investment portfolio? You must diversify your assets because you never can tell which of the assets will do well and earn you profit and also which of them will do badly. So if you diversify, when one is doing bad another may be doing good, and losses made on one can be recovered from the one doing very good.

| Can you explain how you diversified your crypto assets in your portfolio? What strategies have you used to maximize diversification while minimizing risk? |

|---|

To diversify the crypto assets in my portfolio, I have used a very simple and common method that every trader who wants to make a profit will always use. It is common when you understand the principles guiding successful traders.

Image Edited on Canvas

Firstly, I choose my asset based on the use case of the asset. This means that I invest in assets that have many use cases already which means it will be difficult to fold no matter what.

Secondly, I look at the market cap of the token and the team behind the creation of the said asset. If the total supply is not much and there are reputable people behind the project then I go for it.

Also, I check the performance of the asset for the previous time i.e. I check the ATH, ATL, and how whales or the big boys manipulate it anytime they come to the market.

So after checking all of these and reading the white papers of the project and I'm satisfied with the token I go ahead to invest in it. So this way, I have full assurance that no matter how the market goes, it will recover because the project is designed on a solid foundation.

So the risk of the token folding and disappearing into thin air is not always there any longer because most of the tokens I invest in have a mechanism to push up the price of the asset. The case of the Steem token as we all know is the burnsteem25 strategy and we see how that helps the price no matter how dip other assets are going.

| How can diversifying crypto assets help mitigate market volatility? Can you give concrete examples of situations where diversification has had a positive impact on your portfolio? |

|---|

Diversifying your crypto asset can help to mitigate market volatility in the sense that since you didn't gather all your assets in one place or since investors don't just focus on a particular token then it will help to reduce their risk in case anything happens in the market.

Image Edited on Canvas

Volatility in the crypto market is caused when there is much pressure to buy or sell a crypto asset. When there is much buying or selling of a particular asset, you will notice that there is much volatility in the asset

So diversifying your assets will reduce this pressure meaning there will not be much money pumped into the asset which will make it fluctuate much leading to liquidations of assets for traders who are not just holders.

A good example of how diversification helped me was when I traded a pair of MANAUSDT, I was holding other tokens while trading this very pair. On that faithful day, I entered the market without placing a stop loss, and because I had already bought other assets the only money available for the trade was $10.

I wasn't close to monitoring the market because something else took my attention. On coming back I noticed that the $10 had been liquidated because I didn't place a stop loss. So I was still having money in the other tokens I was holding and that was what saved me that very day.

In another case, I bought the LUNA token alongside another token, and when the issue with LUNA started, I was so grateful that I didn't put my entire investment there. You can imagine where an asset worth $100 turns to less than $0.5, so those are the cases where diversification has helped me greatly.

| How does the STEEM token fit into your crypto asset diversification strategy? What is its role in your portfolio and how did you select it among other assets? |

|---|

As a Steemian, the Steem token is always going to be part of my portfolio because I earn it while writing on the Steemit platform. Like I said earlier before I select an asset to be part of my portfolio I study the asset's history through its white paper and be sure that the asset is worth investing in.

Image Edited on Canvas

The case of Steem as you know is a token that has stood the test of time and has a different use case. So such an asset shouldn't be one that someone will be scared to hold and keep in his portfolio.

So based on my strategy for diversification, the Steem token has all the requirements needed and that is why I have added it. Since the Steem is not very volatile and some rules are kept in place to reduce its circulation and increase its price, I feel that alone is enough for one to invest and hold the asset.

In situations where other assets are not doing well, the Steem token will cover up its lapses since its fluctuations are not that much. I selected it to be part of my portfolio because of the requirements it meets which include the use case, the team behind the project, and many other things.

With Steem in my portfolio, I won't cry when the crypto asset is going dip because there are mechanisms put in place to checkmate the price movement of the asset. Also with Steemit as a platform that rewards users for creating articles, I'm sure that the use case of Steem will continue for as long as cryptocurrency exists, so the fear of the asset folding is not there at all.

| Can you share a detailed analysis of your crypto assets, including their distribution, historical performance, and the criteria used to select these assets? How do these choices reflect your overall crypto asset diversification strategy? |

|---|

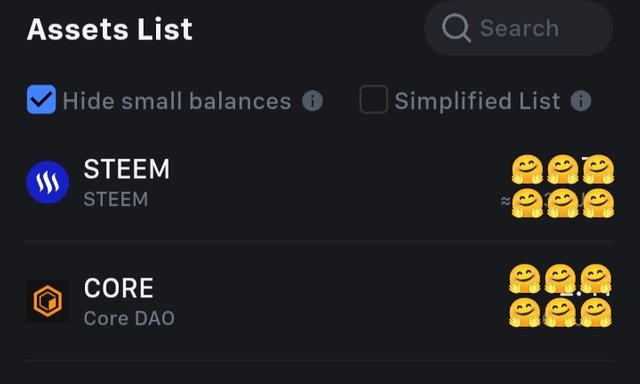

I will be sharing a detail of my crypto asset from one of my exchanges. I will take into consideration just two tokens because I will want to analyze and discuss more on them. Taking into consideration all of them and analyzing them we may not finish today.

Image from my exchange

The image above shows two assets that I'm holding in my portfolio and these assets as you can see are Steem and the Core token. I have chosen to hold these assets because, over the past few weeks, they have done marvelously very well.

Let's consider the chart of STEEMUSDT in a weekly timeframe to see how the asset has performed over the past few weeks. From the chart below, you will notice that the lowest low (LL) of the Steem token over the past few weeks was around $0.138, and the highest high was $0.39 whereas the price as of when I was writing this article is $0.294

Image from my exchange

You will agree with me that there has been no serious volatility in the price of the asset as the market is moving slowly and steadily. These are the types of assets one should invest in to avoid being liquidated and that is why I have decided to hold the Steem asset in my exchange 💱.

The next image I would like us to look at is the chart of COREUSDT on a daily timeframe. From the chart below, you will also notice that the highest high (HH) of the asset is around $4.38 the lowest low (LL) is around $0.511 and the current price is at $1.95 at the time of doing this analysis.

Image from my exchange

Like the case of the STEEM token, the CORE token also moves gradually with a steady gain. One can also invest here without issues because the fluctuations are not too much as well.

Now the criteria used to select these tokens to be part of my portfolio is that the team behind them is all working hard to maintain its prices. The core token is used as gas for all projects that are coming up within the core blockchain and the Steem token is used here on Steemit as a means of payment.

So the use case of the tokens and the project team are enough reasons why one should invest and hold these tokens for a longer time because no matter the amount of blood in the street of crypto, these tokens won't go too deep to cause the liquidation of your account.

These assets reflect my entire asset diversification in the sense that they help to keep the actual account value no matter how the volatility in the crypto space, these assets don't move much. So the difference when the asset is going deep is always minimal and I'm always positive about the asset because it doesn't cause the liquidation of my account.

Crypto Assets Diversification is a topic that every crypto lover should have a first hand knowledge about. Crypto Assets Diversification means to share your money within different assets instead of gathering the entire money in just one asset.

The essence of crypto asset diversification is so that when something happens to one of the token you are holding, you will still bounce back because it is not the only token you are holding. In situations where it is the only token you are holding, it may cause you blood pressure because all your investment disappeard into a thin air.

Also diversification is important because even when one of the token you are holding is not doing so well, another maybe doing well and that will compliment that one that is not doing so well. So there friends if you haven't start diversifying your crypto assets, please do so because you never can tell which among will make you a million within the shortest period.

I want to invite @patjewell, @solaymann and @ngoenyi to also share their participation if they haven't done so.

Curated by : @patjewell

Thanks for the support mam @patjewell, it is highly appreciated.

The pleasure is mine.

I enjoyed your easy reading post.

Well done! A great post to learn from.

I do believe not to "put those eggs in one basket," as you have mentioned in any investment portfolio. There must be diversification. Over the years, I have seen growth based on this. When one investment is performing poorly, the other is rising to the occasion, and vice versa.

Make no mistake. I have also experienced times when they would do the same, good or bad.

When it is the latter, it is the times that you pray at your hardest.

Good luck with the contest, and thank you for the invitation.

Thank you so much mam for finding time to honor my invitation your comments on this post are highly appreciated.

Pleasure!☕

I appreciate how you explained it simply making it easy to understand. Diversifying seems like a smart move to protect our investments in this volatile market. Your examples really drive the point home. Wishing you good luck

Thanks dear friend for your valuable comments on my post.

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Sir, the best crypto investment plan we can do for ourselves is to diversify our investment which you have discussed so well in your publication. Portfolio diversification is what many investors believe in because it doesn't expose someone to risk, and it is a profitable means of investment. Good luck to you sir.

Yes, my friend diversification of assets is the best way to protect our investment. Thanks for your valuable comments.

Literally, I was also one of those lucky ones who were not affected too much during that crash. Just like you, I also divided my funds in different tokens at that time and this thing also helped me a lot.

Diversification is always a very important thing and especially when we are investing in the highly volatile market of the cryptocurrency. It makes our investment portfolio less risky.

Good luck in the contest 🤞

Thanks dear friend for your valuable comments. It's much appreciated.

I must say, your post really covers all the important points about why and how to diversify our cryptocurrency investments. It's great that you go into detail about how to effectively handle and assess portfolios, and sharing your personal experience behind makes it more practical. Your insights are definitely valuable for anyone looking to make their cryptocurrency investments more diverse and successful.

Thanks, dear friend for your valuable comments it is much appreciated 👍

It was a delight I couldn't resist as I look up to you for inspiration. Thank you

Your definition of what diversification is seems very accurate to me, and your reasons also seem accurate about the convenience for any investor to diversify their investment portfolio.

As for the way you focus your attention on the points that truly strengthen the projects before investing in a crypto asset, it also seems correct to me. Every successful investor should consider what you just say to avoid unpleasant surprises in the market.

I really liked reading your post. Good luck and I wish you much prosperity and abundance.

Thank you dear friend for your comment on my post it keeps me motivated.

Hello friend greetings to you, hope you are doing well and good there.

Don't put all your eggs in one basket. This example best match the phenomena of diversification. Diversification is too much important in life and in my 4 years experience with crypto it helped me alot. You have shared the graph of Core coin, which makes your argument strong.

I wish you best of luck in the contest dear friend. Keep blessing.

Thanks for your valuable comments my friend.