Risks associated with short selling and how to mitigate these risks

In our last class, we talked about the risks involved in short selling in the crypto ecosystem. Some of the risks involved are the margin call which is one major risk involved. Placing a short position can be beneficial if there's a decline in the price of an asset and can be very risky if there's a huge pump in the price of that asset, leading to Losses that are extreme.

This is where the margin call comes in. You'll be warned of liquidation when it reaches 80% and if you probability didn't set your stop loss and there's a surge, you'll be liquidated like what happened during the halving. There was a major sentiment in the market that the bitcoin halving will bring an increase or decrease in the price of an asset. The following are some of the risks involved added to the ones mentioned.

Time risk in short selling is a challenge of predicting the right time to enter and exit the market of those short positions. The short sellers get their profits from prices that are on a decline. If mistimed, can lead to losses and missed opportunities.

Short traders must assess the market conditions, manipulations and price trends to determine the timing for placing short positions. Like what happened early this morning. The price of BTC was really selling and shorters really profited from this decline. Those who placed their trades on long actually lost or were out of the market as their margin was enough to hold.

This timing can be very challenging ass the market is influenced by unpredictable factors and this timing risk can increase around earning announcements news. The volatility in the market can introduce timing risk for shorters as the movements in price of an asset can be unpredictable.

These volatile markets usually experience a reversal or sharp fluctuations which may contribute. So in whatever trade a short seller places, he or she must strategize to minimise time risk losses and should also be prepared for volatility in the market.

Short Squeeze Risk |

|---|

This is a short selling risk associated with an increase in a heavily shorted asset which may trigger short sellers to cover their positions by buying back some shares. This type of risk usually involve higher losses and can create upward price movement driven by short covering as mentioned earlier.

When many traders have short position in a asset or stock, an news that's positive can trigger the price momentum of that stock, leading to a surge in demand. Such squeezes can also be driven by FOMO among investors, observing a rapid rising in stock. This risks can be mitigated in various ways of which they are listed below.

- Discipline in trading is very essential to avoid potential losses in the market. These disciplines include avoiding emotional decisions when placing trade on short selling positions. Emotions can cloud our minds into making decisions that aren't worthwhile and it's said that when you see losses, don't rush back into trading to recover these losses and you may see more Losses. You'll need to take your time and analyse the market, probably stay off from it that day.

- Those who trade short positions should always monitor their margins to ensure they aren't liquidated by the market. If they open trades that are against them, they can add more funds to their trades to avoid margin calls which occurs when the value of the short positions exceeds the available margin. Most times it's advisable to quit the market to avoid incurring more losses as a result of adding funds.

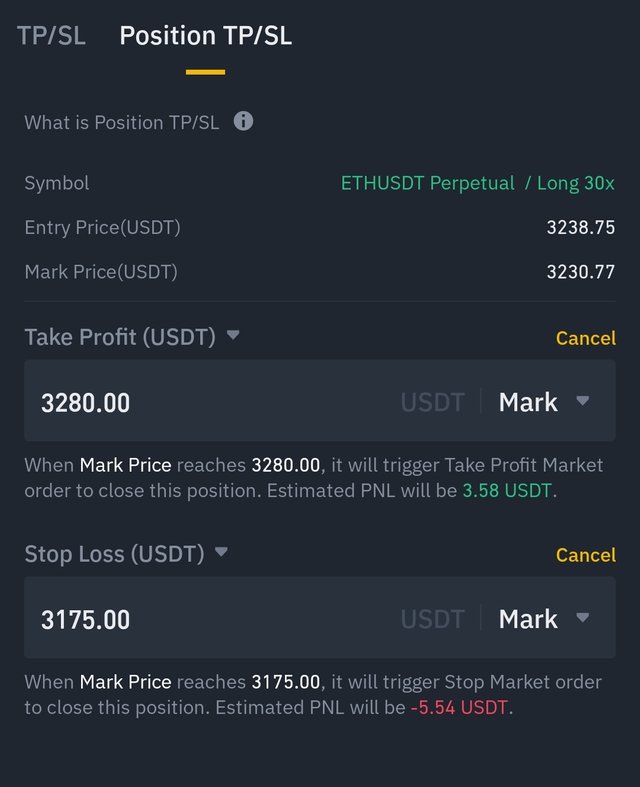

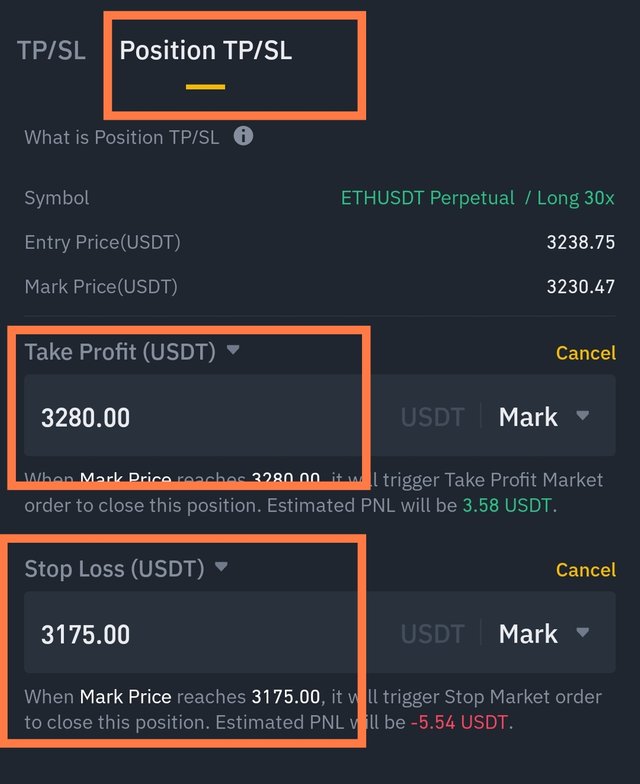

- They also need to evaluate their risk-reward ratio before placing short positions. This will help them determine how viable short-selling opportunities are and also help them set realistic take profit and stop-loss levels.

- Setting stop-loss orders is very crucial as well as it's a setting that exit your positions when the market go against your trade. This helps limit your losses by triggering a buy-to-cover order when the price you specified is reached.

- Short traders also need to diversify their short selling activities across multiple stocks which can help reduce risk. This diversification helps to mitigate the impact of adverse movement in prices of an asset. Professional advice can give you more insight and boost your trading strategy.

|  |

|---|

These are some of the ways that can help you mitigate risks involved in short selling. Whenever the price of an asset is going down, this doesn't mean you should rush into taking a leap by short selling a position. The market may be doing a retest but not a guarantee opportunity to place a short trade. This may not be a financial advise but will help you on the long run.

All screenshots from my binance account

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

Where is your Twitter promotion bro, please do not forget to include your twitter promotion link again.

It's here Sir. Ohkay

https://twitter.com/bossj23Mod/status/1788186822574588045?t=Uezerkq-8H7IEIEEHHexSA&s=19