Short Selling Trading strategy - Potentials and Risks

It's interesting to know that most of us here trading crypto know of the buy and sell options on the futures trading. Most of us focus on the buy aspect of trading. We take into buying in pursuit of the asset or coin going up so we'll profit.

We use different analysis, triangles etc to analyse the market of a particular crypto to know what moves to make in the market. Most people trade on sentiments.

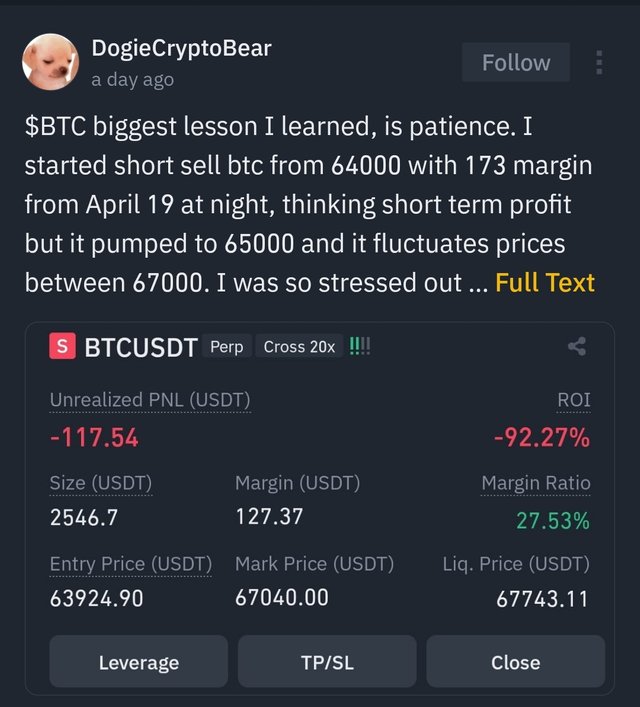

Trading the seller option is not really that common as the market can be very volatile and your expectations come to realised losses. This is what happened in the case of a crypto trader who lost almost $200 because of this. Does it mean this trading option is that bad? Let's see the advantages and disadvantages if any. Let's first understand what it means to short sell a trade.

Short Selling |

|---|

This is actually a complex and high risk taking strategy that traders have employed in the market. Unlike normal investments where profits can be made majorly or solely on riding assets prices, this short selling strategy allows individuals to profits from falling assets prices as well, when the market declines. This is a strategy many have been running especially those who trade and have incur huge losses on the space.

Short selling involves selling borrowed assets with the expectation of buying them back at a lower price to refund to those borrowed from and then make profits from the differences in price. This strategy is risky but also beneficial. It can be very profitable if the asset declines as anticipated.

The mechanics of this short selling is explained using the aspect of borrowed funds. A trader would first borrow the shares from a broker of which a fee is attached. They'll then sell these borrowed shares they got on the open market taking a short position in the asset.

The trader's goal is to purchase this asset back at a lower price in the future and return them to the lender of the asset. The differences in price between the sake initially and then buyback is what the trader profits. These are profits I've made from a short sell signal lately.

|  |

|---|

This short selling plays a major role in providing liquidity and allows traders express negative views on some assets. Short selling may be advantageous but it has its own risks and considerations which are stated below with illustrations for clarity.

Market Risks

Market risk is one of the major concern involved in short selling and asset. The price of that asset may move against a short seller, liquidating all his funds in the trade which results to potential losses. Under this, there's high volatility in the price of the asset traded which can increase the risk of selling short by causing a sharp pump in the price of an asset, sometimes may be a retest of a full increase or pump.

Timing the market is very crucial in short selling as you won't leave it as you would do when you want to open a long position. There are some positions you can choose to hold for as long as your margin is there to keep you in the market as they'll be increase in prices soonest or later. Predicting entry price and exit can be essential and will require careful analysis in times like this.

Low liquidity can also lead to wider bid-ask spreads which can be very challenging for trader who placed their trades on short sell position. It may be challenging to enter and exit positions at desired prices . Also, the sentiment in the market can change which can Impact short selling strategies.

If the market is positive or there's high optimism, they'll be serious losses for short sellers. If the sentiments in the market is negative, it can cause sharp declines which would be very beneficial for traders to tap from the profits as a result of the decline.

Unlimited losses

Unlimited losses In short selling is one of the major dangers. Short selling losses are quite unlimited. If the price of an asset keeps increasing, a short seller must buy shares at higher prices to cover the short position which would result to increased losses, less liquidations and still have a chance of seeing a pump that favours you.

|  |

|---|

Margin calls or liquidations happens when a short seller's margin account falls below the certain threshold due to losses he or she incur which keeps increasing. To meet the requirements for margin call, the trader have to deposit additional funds to hold him in the market. Analysis must also be made to be sure if the decision is a wise one or may even add to more losses and then boom, you're out. It would be better to leave the market instead of holding as it may not favour you.

I know of a crypto trader who placed a short sell trade for bitcoin the night of the halving. He actually expected bitcoin price to dump and unfortunately, it pumped to $66k and his losses was quite sufficient. His fear that bitcoin might surge and may not drop made it quit the market in search for other good entries. Can regulatory and timing be a risk? We'll discuss this in our next post.

All screenshots are from my binance account

Disclaimer :Any financial and crypto market information provided in this post was written for informational purposes only and does not constitute 100% investment advice. It's just basic knowledge every crypto trader or investor should have

!upvote 20

💯⚜2️⃣0️⃣2️⃣4️⃣ Participate in the "Seven Network" Community2️⃣0️⃣2️⃣4️⃣ ⚜💯.

This post was manually selected to be voted on by "Seven Network Project". (Manual Curation of Steem Seven). Also your post was promoted on 🧵"X"🧵 by the account josluds

the post has been upvoted successfully! Remaining bandwidth: 100%

Your post has been rewarded by the Seven Team.

Support partner witnesses

We are the hope!

Where is your Twitter promotion link

Done Sir

https://twitter.com/bossj23Mod/status/1787477732848185641?t=CobEvPlE8OC1Fr3xgLjpHw&s=19