Bear Trap in Trading.

|

|---|

Hello guys! Good to have you around once again. Trust you're keeping well.. I hope you enjoyed the last post I made about Mimblewimble. Well I believe you must have gotten so much value from the post.

Today, I decided to look into something else and this is gonna be useful for traders, and those hoping to be active traders someday. It's a topic you would like to take your time to digest as understanding it would save you a lot of headache in the market. Let's get in.

It's no more news that there are so many foul play and manipulations in the market which includes the topic of discussion today, Bear Trap and you know, one must have been around in this space for quite sometime to identify and steer clear from this manipulation or trap which are targeted at traders, especially small and naive traders in the market.

Manipulations and foul plays will continue, it's actually hard to curb but to be on a safer side, you will need to equip yourself with relevant knowledge on how to avoid these curves in the market. I hope by the end of today discussion you would be able to understand what Bear trap is and how to avoid being trapped.

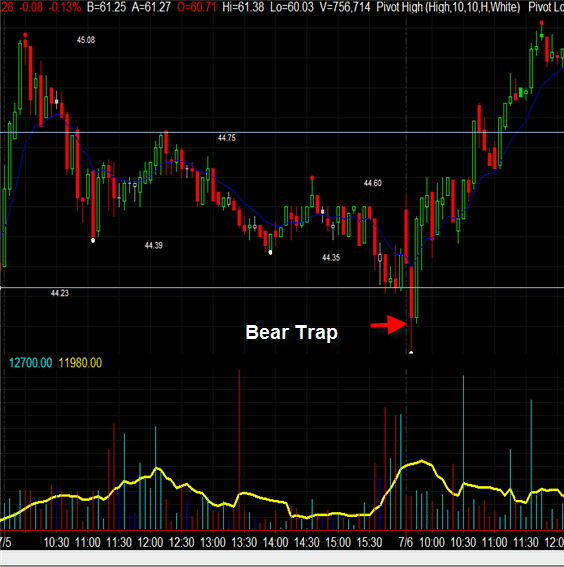

A bear trap is a trap aimed at luring investors into taking a trading decision that end ups trapping him and putting him at a loss. This trap is set when there is a steady fall in the price of an asset, the reaction of most trader/investor at this point is to short-sell hoping to profit from the steady fall in price or the continuing downtrend.

The worst , more like their nightmare then happens shortly after what they see in the market and that's a sudden reversal upward. This then leads to a whole lot of loss for those who have opened a sell position in the hope of benefitting from the falling market. The sudden reversal happens so fast that it leaves them trapped in the market which later ends up leaving with losses.

Bear trap occurs most times in situation where there is a lot of volatility in the market, that state of the market where it's erratic and difficult to predict.

It could also occured at the peak point where asset have been oversold and it just about warming up to rebound. The players take advantage of these point where traders tend to take premature decision which should land you into loss.

|

|---|

Kindly note that this image was extracted from the referenced source for educational purpose and does not belong to me.Link can also be found below thus post

Identifying a bear trap can be very easy sometimes as it occur around the support line just as mentioned earlier...price could break through the support line only for it to rebound and then continue it upward movement and if by any means, You're caught down there, you would end up incurring losses.

The very first mistake is getting carried away after a breakout below the support level. Many traders would take a short position at that moment because they feel the market will continue to travel downwards and this they do without confirming with other tools or indicators such as volume and RSI and then they get caught up.

Another mistake some trader and investor make is that they have the habit of chasing the market. One could walk right into the bear trap if one is not careful. And sometimes because of their quest to get profit outta of the market, they enter late trade which also gets them trapped in. A very good trader takes his or her time by ensuring there is enough potential to earn either upwards or downward, this help reduce their risk and exposure in the market.

|

|---|

In addition, most traders make the mistake of not factoring in fundamentals analysis into their trading plans and decision, fundamentals analysis such as news might affect the behaviour of investors in the market making the market very unpredictable because of different sentiment and response. Failing to factor this in can get you into the trap when you least expect.

Finally, not using stop loss order can get investors trapped in the market. Stop loss order helps minimize loss especially when it's placed strategically at a level above the entry point. This will help you caution your loss in the case of unexpected reversal. Now just imagine there was no stop loss order, one would end up losing more than he can bear.

Oh yeah! I think I need to draw the curtain at this point so I don't make this lesson unnecessarily long when j can afford to break it into a considerable length.

Bear trap would always be a manipulative strategy by the bears, we just have to carefully approach the market and not be in a haste to jump into the market without confirming the market movement or trend.

I want to believe you've gotten so much from this piece. As my usual custom is, I would always encourage that you DYOR to be sure of every financial step you would want to take as I won't be liable for any form of loss encountered by you.

Feel free to share with me your thoughts in the comment section. Thanks for your time once again. Gracias!

Disclaimer: This post is made as an education and not investment advice. Digital asset prices are subject to change. All forms of crypto investment have a high risk. I am not a financial advisor, before jumping to any conclusions in this matter please do your own research and consult a financial advisor.

Regards

@lhorgic♥️

https://x.com/lhorgic1/status/1791909174374232186

Upvoted! Thank you for supporting witness @jswit.

Note:- Try some unique topic, this is a very common topic and posted multiple times.

Regards,

@theentertainer