All Of The World's Money And Markets In One Visualization

Content adapted from this Zerohedge.com article : Source

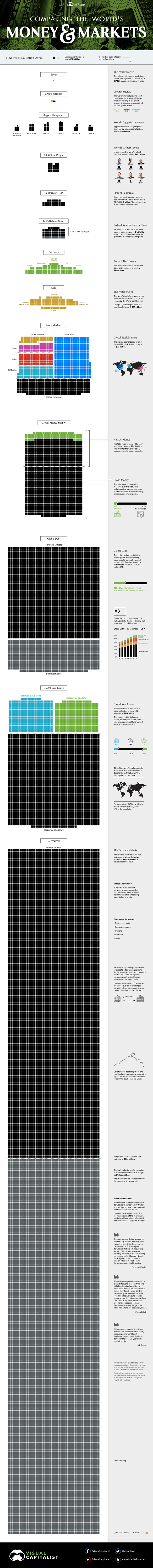

Millions, billions, and trillions...

When we talk about the giant size of Apple, the fortune of Warren Buffett, or the massive amount of global debt accumulated – all of these things sound large, but they are actually extremely different in magnitude.

That's why, as Visual Capitalists' Jeff Desjardins explains, visualizing things spatially can give us a better perspective on money and markets.

How Much Money Exists?

This infographic was initially created to show how much money exists in its different forms. For example, to highlight how much physical cash there is in comparison to broader measures of money which include saving and checking account deposits.

Interestingly, what is considered "money" depends on who you are asking.

Are the abstractions created by Central Banks really money? What about gold, bitcoins, or other hard assets?

A New Meaning

However, since we first released this infographic in 2015, "All the World's Money and Markets" has taken on a different meaning to us and many others. It's a way of simplifying a complex universe of currencies, assets, and other financial instruments in a way that people can understand.

Numbers represented in the data visualization range from the size of the above-ground silver market ($17 billion) to the notional value of all derivatives ($1.2 quadrillion as a high-end estimate). In between those two extremes, we've added many other familiar measures, such as the GDP of California, the value of equities, the real estate market, along with different money supply metrics to give perspective.

The end result? A visually pleasing, but enlightening new way to understand the vast universe of global assets.

Courtesy of: Visual Capitalist

To get "All the World's Money" in book or poster form, go to the Kickstarter page now. Deadline: Oct. 31, 2017

I can't believe ethereum is worth more than all the silver in the world now! Silver has the second most use cases in the world after oil. I am not saying ethereum is overvalued but silver is most definitely undervalued. Time to increase the stack!

Silver has been manipulated for decades (or so the accusations go). There are many who believe the silver market is intentionally kept down by the establishment.

This could be the case since it is illogical for a commodity with so many uses to be priced as such.

But then again, that is the power of Wall Street.

I hope it is being manipulated downwards. I do like a sale!

The derivatives is really amazing to see... and scary too.

The criptocurrency market is really small in comparison to anything like that, however, we need to see that this market have just 10 years, or not even that! That is amazing... and scary too. haha!

The size of the cryptocurrency market is a joke compared to anything else out there so that I´m as well convinced that we´re not at the top of any bubble after all but just at the very beginning.

A lot more people will throw their money into this new market and I see it grasp full acceptance one day on the wall street. I mean hey, they already started to speculate on it so they won´t give away their new toy that easily anymore :)

This is also early Wall Street money....

The bulk of Wall Street isnt even involved...we are seeing a few specialized hedge funds which were set up for this purpose. Wait until the average person can drop a few dollars in a crypt mutual fund or ETF.

Either way, we are going to see a much greater explosion. This party is just getting started. You are right, a little money in their pockets means they want more....the first run resulted in nice gains, that means they will open up round 2.

Exactly, especially as it´s quite hard to put money into the market these days for an average investor. There are basically just a few places that trade fiat to crypto and vise versa.

Round 2 will be different but still not the huge run of the masses. The whole market is just still to unmature for that to happen. This bubble, in case it even is one, is just about to get started :)

we are in the early stages , most of the rest are way older than they look, except for face book, cryptos are the youngest , so in a few years we will be hallenging some of these industries or they will be operating using cryptos

The derivatives market is simply astounding. It is incredible that it is only a rough estimate since few to nobody even knows what is out there. We saw what Wall Street created products can do to the world wide economy a decade ago. Something that few were looking for took everything down with it.

Does anyone even know what most of that stuff is? The banksters keep churning that stuff out like it is candy to those who have no idea what they are buying. The commission for the banks was good though.

Crypto is moving up the charts. It is going to catch gold at some point $8T in the next couple years. I predict we will be at $1T the next run up after this present pullback.

the bankster are scared of cryptos and they will do anything to get it out of the way before it eats out their market, but a day is coming when this will happen and cryptos will rule the world

Derivatives market. I think these guys will never learn. It fascinates me how little is really needed to crash the whole thing to the ground, but the markets and everyone don't really seem to care. Nasdaq and SPY, Emerging markets are making high after high. The global debt is constantly growing, they just can't stop printing money.

$1.2 quadrillion? I don't even know how many zeros that has! I am guessing that's 1200 x 1 trillion dollars which suggests that someone who owns these crazy things is at least a trillionaire. If you had a trillion dollars @ 5% interest = $4million a month - pocket change!

Where do you find 5% return for that amount of money ?

I guess you would have to ask a trillionaire that question ; )

GREAT ANSWER. I love it :)

Financial Markets There are different divisions of the financial markets, which can be summarized as follows: 1. Capital Market: The securities trading markets in which money transfers from individuals, companies and savings to companies investing through long-term financial instruments,

If I am interpreting this data correctly (which I'm probably not) the numbers don't add up at all.

Event taking fiat currencies and balances in regular banks along with gold doesn't come close to the supposed value of artificial financial products.

If I'm not mistaken this graphs mean that there is supposedly more value stored in derivatives than in the actual currencies of all the countries in the world put togather.

On top of that, is scares to think about what exactly gives value to the stock market. Unless stocks are giving huge dividends, those seem to be extremely overpriced.

Somebody please correct me if I'm wrong

Money isn't 'stored' in derivatives. The notional value of derivatives (what is displayed in the graph) is the potential value the derivatives could have, if the transactions they are hedging go bust.

The face value of derivatives is about $20T, which is the value 'stored', or expended for them, in the normal course of business - meaning the markets they are hedging don't go bust.

That's a very simplified explanation of derivatives, which is hampered by the very diverse nature of the instruments. I hope it helps you to understand how there can be such a huge 'notional' value of derivatives.

@zer0hedge...bro Yeah ..its really a very happy moment to see the all currencies like money currencies and crypto and all of other econimical realted value coins in the one site..now a days technology in increses a very high day by day and its a very usefull to us to made a transitions and conversation very easylyy...present also there are so many sites are availble to made a transtions of the cryptos only but we are less having change and exchanges of country currencies if we want to exchange crypto there are so many ways but want to exchange usd to euro or ruppes there are only less are there..so thats the range of crypto craze occupies the world..and rules the world with out any restrictions ..in future also there are so many ways will be devoloped and make a user handle i hope...

The concept of money and how much there is is very abstract because we have to take into account the definition of currency.

CURRENCY is anything that can serve to buy a good or service or be used for the payment of a debt. Needs general acceptability and immediate availability.

And this concept is what is getting disturbed with this new coins and futuristic things :D