Introducing Accounting Blockchain - Connecting businesses and Empowering People

Businesses around the globe record their transactions separately from one another, creating duplication of work all along the supply chain, incurring great reconciliation costs, and are subject to fraud and error in each link of the chain. Accounting Blockchain will enable accounting software used by businesses to become integrated, hence removing this isolated accounting effect that is estimated cost the global industry billions of dollars a year and impedes accountants from dedicating their full potential in value creation work.

AB Fingertips Suite provides a seamless marriage of blockchain technology into the way business is done today, preparing businesses for tomorrow, and saving all types of businesses lots of time and money in the process. AB Fingertips suite is the way forward for businesses wanting to integrate into the supply chain through blockchain and to introduce the future way of doing business through crypto currencies seamlessly into their current business model and accounting practice.

AB Taxavance provides reduced dependency on tax accountants by serving as a 24/7 taxation assistant, intelligently updated with tax parameters by taxation industry leaders while being continuously updated with crypto trading data.

UNDAMENTAL STATISTICS

- 1 blockchain dedicated to businesses/accounting - TAB

- 2 initial applications utilizing AB Tokens

- 155bn estimated token usage in 2020 based on:

- 770k AB Taxavance users (4% market share)

- 780k users (less than 1% global market share)

- 6.5bn transactions on blockchain (<0.01% of global B2B transactions)

THE ACCOUNTING BLOCKCHAIN

Accounting data is very sensitive and needs to be stored in a secure, trustworthy place. More so when this data involves multiple parties as the data needs to be stored in a secure place that is trusted by all parties. Mutability, malicious attacks, transactions costs, scams, lack of assurance of authenticity have all been barriers in providing a trusted common ground to store B2B entries that can be trusted by all parties. Thus the status quo prevails, and companies remain operating in relative isolation accounting-wise spending billions in reconciliation costs.

A trusted, secure common ground where to store triple entry information is the key to connecting businesses though triple entries. The Accounting Blockchain - a tailor made blockchain infrastructure built specifically for accounting and for triple entries. A platform available for everyone to be able to use without having to pay hefty subscription fees to any particular software company. A distributed, trustworthy, fast, secure common ground where businesses feel confident to connect with. This is only possible with the advancements in Blockchain technology.

AB PLATFORMS

AB FINGERTIPS SUITE

Reconciliation of transactions between companies is a multibillion dollar problem. A small to medium sized company has hundreds/thousands of transactions between its suppliers and its customers, let alone large corporations. Each company must reconcile each and every transaction and the balances due have to be agreed upon. For a small company it’s a nuisance and a waste of valuable time, for a medium sized enterprise its about employing a few accountants for reconciliations with costs running into hundreds of thousands, and for a large corporation it’s about having huge reconciliation departments with hundreds of employees and millions in expenses.

Introducing a viable way to have triple entries that automatically connect businesses in their transactions. An accounting software platform built around the triple entry concept. A user friendly, really easy to use accounting platform that drastically reduces the costs of reconciliations by using the power and trustworthiness of blockchain to store triple entries. A catalyst in connecting businesses together and in incorporating the much needed blockchain technology into the accounting world.

AB TAXAVANCE

Being proactive in tax decisions when making crypto investments is of the utmost importance to any sensible investor. Regulation and enforcement in this sector is gathering pace. Investments and trades are global and subject to a myriad of tax frameworks globally. The tricky part in this is finding all the information needed in one place to make wise decisions fast. Regulations are changing quickly, and it is imperative to have the correct knowledge while and after doing trades. Preparing tax reports and gathering all the information from exchanges is time consuming and very expensive when done manually by a tax accountant.

A really easy to use platform that keeps track of your trades and their tax implications. A platform with tax parameters fed by a global network of tax experts that is able to work out in real time the tax exposure of your crypto trades and investments. A global network of tax experts and collaborators at your fingertips. Pre-trading information including trade simulations to make proactive decisions. Keeping record of your trades and their current tax exposure should you buy more, hold, or sell. Issuing end-term tax reports of your trades and investments. AI assisted report input that may read reports from exchanges and setting up a common protocol to interface with exchanges. A true global 247 tax assistant.

MISSION STATEMENT, VISION

AB mission is to empower the global accounting community with the numerous advantages and great trustworthiness of blockchain technology through products that fully integrate advancements in the blockchain field in the most efficient and practical way.

The vision is to introduce trustworthy platforms where all parties being big or small can embrace the advantages of blockchain technology without entry barriers and without discrimination, be it size, complexity or geographical location.

AB COMMITMENT:

AB has gone through great lengths to explore the complexities of the challenges encountered by businesses and investors today and providing innovative and game-changing solutions with the sole purpose of creating a better accounting infrastructure to service the global economy. AB is committed towards creating a business environment without borders, connecting the accounting world through trustworthy blockchain based solutions.

AB TOKEN

Token Name: AB Token

Ticker: TAB

Token Standard: ERC20

Exchange Rate: 1 AB Token = $0.01 in the Initial Token Offering

Soft Cap: $4,000,000

Hard Cap: $64,000,000

Founder Vesting: Vesting ensures a long-term commitment from the founders towards the success of the project. Founders have a 3-year vesting schedule with a 6-month cliff. This means one sixth of the tokens will be matured every six months.

Unsold AB Tokens: Unallocated tokens that were available for sale in the ICO will be burnt.

Pre-registration & KYC: Preregistration for Phase I of the public token offer will begin in 2018. Preregistration and KYC procedures will be mandatory for all participants.

Get 500 AB Token Free

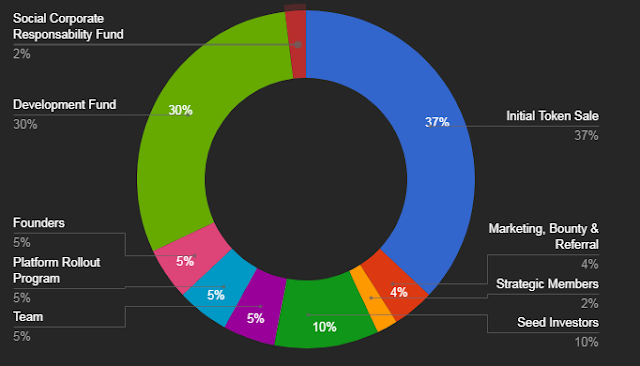

Distribution:

Use of ico funds:

Token ecosystem

HOW THE AB TOKENS WORK

AB Tokens can be used in 3 different ways. You can either subscribe to any one of the services offered by Accounting Blockchain, record accounting entries (triple entries) on The Accounting Blockchain and users can use AB Tokens to settle amounts due to each other.

Subscribing to the platforms offered by accounting blockchain

You can subscribe to all of the platforms offered by Accounting Blockchain. As per our roadmap, the first two available platforms will be:

- AB Taxavance

- AB Fingertips Suite

Whoever would like to subscribe to the above platforms, can make monthly payments to Accounting Blockchain by using AB Tokens.

Recording Triple Entries

Businesses can opt to record their B2B entries, irrelevant if they use Sage, Quickbooks or any other accounting software. Trillions of trillions of transactions can be recorded on blockchain technology. The more businesses record their transactions on The Accounting Blockchain, the bigger their savings in the form of professional fees such as accountancy and auditing.

Settle Amount Due

When transactions are recorded on The Accounting Blockchain, businesses can use AB Tokens to settle the amounts due to each other, which payments would be instantaneously and immediately recorded in the books of the parties sending and receiving the payment.

TEAM

More Information

Website: https://www.theaccountingblockchain.io

Whitepage: https://www.theaccountingblockchain.io/pdfs/whitepaper.pdf

ANN: https://bitcointalk.org/index.php?topic=4430029

Facebook: http://www.facebook.com/accountingblockchain

Twitter: https://twitter.com/ABblockchain

Telegram: https://t.me/accountingblockchain

Author: hoangbinmcc

Bitcointalk: https://bitcointalk.org/index.php?action=profile;u=1330327

Get your post resteemed to 72,000 followers. Go here https://steemit.com/@a-a-a