Interesting "Flash Crash" Buy Order Almost filled.

Many moons ago I set up flash-crash buy orders on Binance to buy Steem in the event that a super good deal became available.

https://steemit.com/acidyo/@edicted/acidyo-gave-me-2500-steem

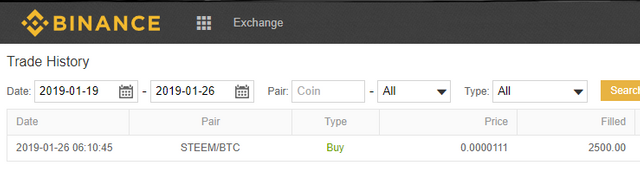

My Steem/BTC order actually went through! And I bought 2500 Steem for $100 worth of Bitcoin. 4 cents a coin. It was hilarious. Some Steem whale really fucked up there.

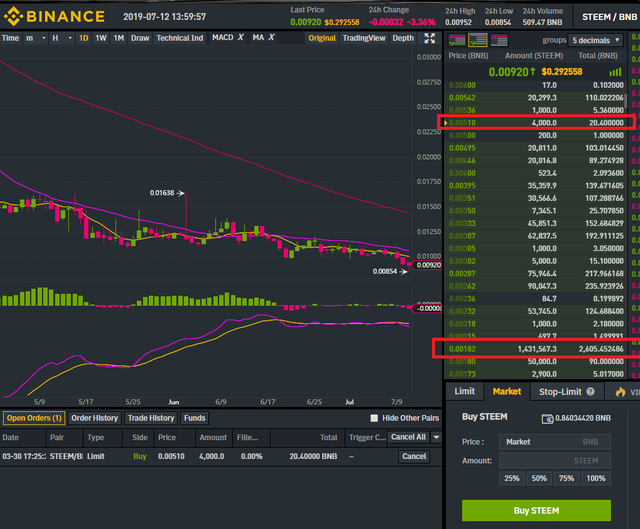

However, my Steem/BNB order never went through. It has been up on the market for 6 months now. I was randomly thinking about it when I realized the order might get filled soon. Not because of a flash crash, but because BNB has been steadily gaining value and Steem has been steadily losing value.

Lo and Behold!

I was right.

I'm still trying to trade 20.4 BNB for 4000 Steem at a ratio of 0.0051 : 1

I gave a sigh of relief as I scrolled to click the cancel button.

But I just said "fuck it"

Let it ride.

If the difference between Steem and BNB doubles again...

Let it happen.

A lot of people think there isn't demand to buy Steem. Well what about that order for 1.4 million coins at 0.00182? Plenty of people want to buy Steem, just not at these prices; myself included.

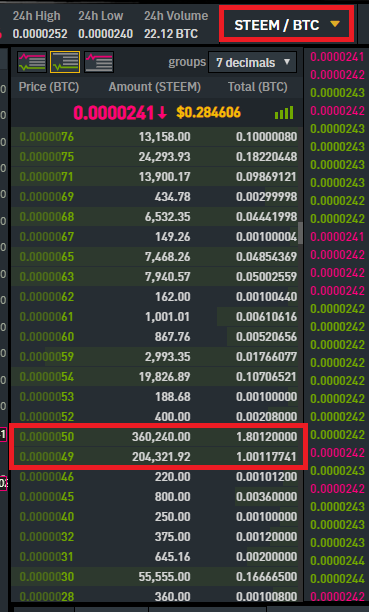

Liquidity on Binance's Steem/BTC pair looks weak as well. If a couple hundred thousand coins get dumped the price would flash crash down to those 0.0000050 orders. Undercut those orders by setting your flash crash buy at 0.0000051, and we might all cash in on the next flash crash like I did 5 months ago, like a boss:

Seriously, it doesn't get anymore perfect than that.

I'll be moving my BTC to Binance to make this play at 0.000051.

I encourage you to do the same.

It's literally free money if it happens.

I can see the wheels turning:

Some of you are thinking:

Nice, you bought Steem at a ratio of 0.0000110 (110 Satoshi), but Steem has since crashed organically to a ratio of 239 Satoshi, so your gains have been undermined.

This is totally 100% false and need to be addressed immediately.

If I fold pocket 2's in Texas Holdem and then a 2 comes on the flop, do I tell myself I should have called? No, I tell myself good job because on average I'm going to get totally fucked calling that garbage.

The decision to hold the Steem after I acquired it was totally separate from the flash crash limit order. A lot of people find themselves playing the coulda-shoulda-woulda after-the-fact game when they gamble, and people that do this find themselves getting destroyed and have no idea why.

If I flip a coin 10 times and they all land heads, what is the chance that the 11th time is also heads? The answer is 50%, the same as all the other flips, and if you aren't willing to bet your life on that fact, you're going to have a very hard time successfully gambling. Previous outcomes do not affect subsequent ones.

Liquidity on ETH is also not great.

Set flash crash buys to 0.000217 to undercut the 1.5M buy order.

If it happens, you look like a genius.

If it doesn't, it doesn't.

This is a zero risk situation in the short-term.

I have 2 Liquid ETH on Coinbase. If the flash crash happened I would get 9216 Steem. It's a no-brainer, and a good way to support Steem.

Transferring my tokens to Binance now.

But what about other exchanges?

One reason why I'm excited that I finally completed KYC on Bittrex is they are the best exchange to actually have an SBD/BTC pair. When SBD trades lower than $1, that's just free money on the table.

Look at how bad that Liquidity is! 0.23 Bitcoin worth of SBD getting dumped would flash-crash the price to 78 cents per SBD. Literally just free money staring you in the face if you get lucky. The problem here is that you have to be more vigilant in the event that Bitcoin value spikes up and someone (a bot) realizes it's smart to buyout your position. Still though, not that big of a deal; you're checking the price of BTC daily anyway.

Last but not least

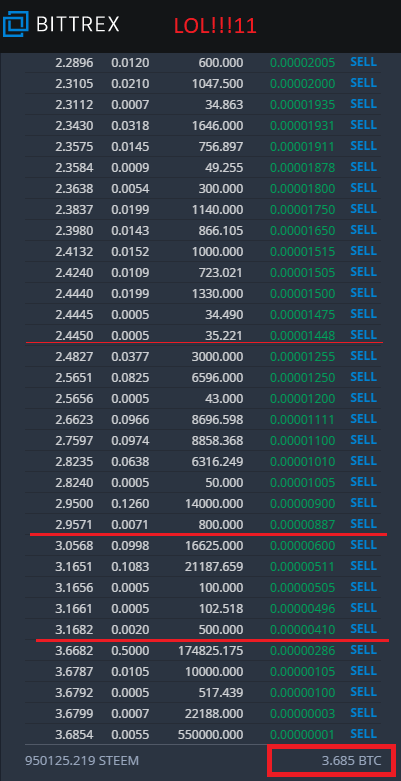

The Bittrex Steem/BTC pair is also a riot. If 3.7 Bitcoin worth of Steem was dumped on this market, the value of a Steem coin would literally flash crash to ZERO. How's that for ROI?

I drew the red lines there because that's where I would think about undercutting.

At these prices, assuming a Bitcoin value of 12k:

| Ratio | Cents per Steem |

|---|---|

| 0.00001256 | 15 |

| 0.00000601 | 7.2 |

| 0.00000287 | 3.4 |

| 0.00000104 | 1.2 |

Conclusion

Don't think it's possible to buy Steem at 1.2 cents per coin? Flash crashes happen all the time. If you have Bitcoin, Ethereum, or BNB just sitting around not working for you, consider adding liquidity to an exchange and possibly getting paid out fat.

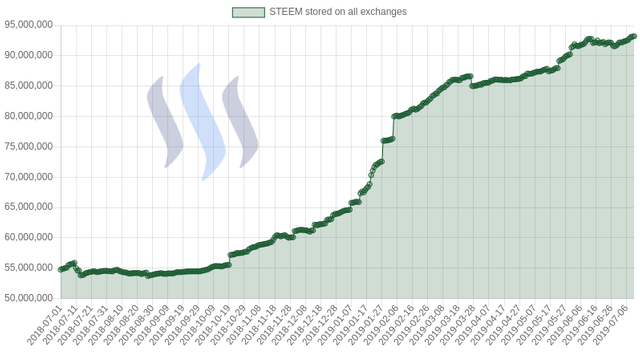

Looking at exchange liquidity in this way, it's also easy to see why Steem value keeps crashing even in the face of our fundamentals improving. This is especially true in light of the programmatic selling sourced at Steemit Inc.

It only takes one panicking whale to crash any of these markets.

Seriously, no joke, one person can move these markets easily. I can tell you from experience, it feels pretty good to wake up in the morning and realize you just made $1000 for setting a zero-risk flash-crash buy order.

HF21 might turn out to be an utter disaster (COUGH HF20 COUGH COUGH). Wouldn't it be nice to get something out of that potential cluster fuck? There have been a lot of powerdowns lately, less than 200M coins are powered up.

The air is charged for Steem to flash crash.

Don't say you weren't warned.

That's some excellent luck, I'm glad your strategy paid off! It was however not without risk when you consider the cost of holding the bitcoin and the chance of your funds locked in the bid not being #safu. I would never suggest someone keeps liquid tokens on Malta Based Cryptocurrency Exchange without understanding the risks.

Why doesn't Binance have market makers to profit off of user ignorance?

I was wondering who would be the first to mention this.

Stop ruining my shill tactics :D

You are way too smart for me. May you profit greatly.

comment section literally explains why wealth is distributed the way it is. Flash crashes are highly frequent. The operational risk of having money on an exchange can be reduced by having money on a decentralized exchange and by splitting the positions. With asymmetric payoffs in non-ergodic games, it's enough to have small positions like kelly criterion based position sizes.

Tell me more about real dex if there are any

Also people who have experience in code will probably have some nice flash-crash-liquidity-bots

I dont think it's easy for the masses

Nothing is easy for the masses. But why? They don't want to use their brain and instead expect things to be done for them. This is why governments and also shadow governments like elites have an easy play (they really work hard and smart to stay in power or to accumulate money)

Bitshares is the only dex I consider as decentralized enough.

PS. when you make an automatic buy order at level x it is programming. You can make it move, etc.

We have the luck that programming skills cant predict market movements either, so there is not much predictive advantage in trading bots, they just scale your abilities (high-frequency trading).

Not really fair bro. Half of people have an IQ in the double digits, after all.

this is exactly what I thought before making the statement :D But then I remembered to all those "double-digit" goys and görls and how they use new technologies like bosses. Even small kids. People who can install pc games and use photoshop for Instagram can set up a trade. They are digital-natives, but there is just no need for them, nor do they care. - I must admit that Im often lazy too ^^

There's a pretty significant difference between posting pics that make you look like a catgirl in Insta, and being confident you are competent to invest a paycheck in cryptocurrency. Not saying that they couldn't click the right buttons, just that getting there is a whole nuther order of intelligence.

I still remember that day! The problem for me is leaving money on an exchange for extended periods of time and given how regulation and KYC continues to broaden there as well is a concern. But it may be worth it!

Nice. I guess I just don't have patience when it comes to buying Steem. If I'm ready to buy Steem, I want it NOW so I can power it up and do things with it. That these things happen regularly is cray cray to me.

And... there you are.

Long ago people were selling IBM when it was priced lower than its physical assets.

I really do not know what is going to happen with STEEM prices...

i see 10x moves (but in a market that has many 100x), i see HFork playing shit, and then levelling out... again, i see a lot of interest coming in at some point.

Its a bloody mess, and these futures are no where to be seen in the charts.

In it to win it.. the drop was expected and it's not over until the fat lady flash crashes and stays there.

Also wanted to mention that I've been watching BTC/USD very closely today and think there is a fair chance it bounces off the 12k line and heads back downward. I've been thinking about this for a couple days now. With a break above 12k, the market is looking a bit more bullish.

Your's truly

--- Captain Obvious

ok cool

I see you primarily trade based on technicals, which clearly works. It doesn't really consider fundamentals, however, and as you point out is basically gambling based on mathematical probability instead.

I don't see fundamentals improving at all. User retention, token price, and market cap indicate the reverse. Those things I reckon fundamental to Steem value are all about to dramatically worsen, because HF21. The most fundamental driver of Steem price is probably user retention, and the downvote pool is unlikely to improve new user's reasons to stay on Steem, and neither are halving author rewards and throwing in a 10% tax on rewards for SPS.

The benefits of all those things inure to substantial stake, not new content creators. Taking a meta view of benefit doesn't indicate actual benefit to stakeholders once the reduction in market is reflected in potential gains IMHO.