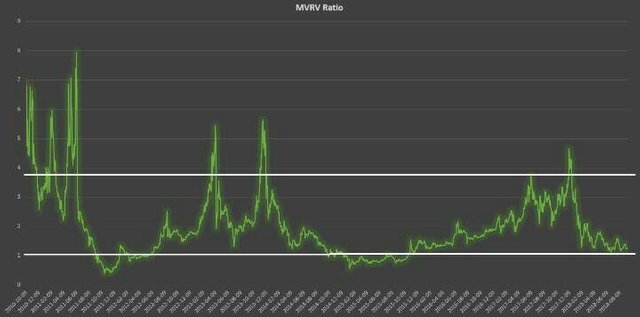

Bitcoin Market Value and Realized Value (MVRV) Ratio

Nic Carter from Castle Island Ventures (in a co-exertion with Antoine Le Calves from Blockchain.info) has as of late exhibited his recently named idea of acknowledged top at Riga Baltic Honey Badger 2018 gathering, propelled by some past thoughts of Pierre Richard. Nic was sufficiently benevolent to share a portion of his discoveries and information with us after the meeting, and we needed to dive into some investigation of the data accessible to us. For the motivations behind this article, how about we characterize two or three terms:

Market esteem

Also called aggregate market capitalization, it applies to Bitcoin if you somehow happened to increase the most recent accessible BTC USD exchanging cost on trades by the quantity of bitcoins mined up to this point (at present remaining at 17,299,787 BTC as of Oct. 1, 2018).

Acknowledged esteem

Rather than tallying the majority of the mined coins at equivalent, current value, the UTXOs are amassed and doled out a cost dependent on the BTC USD advertise cost when said UTXOs last moved.

The Logic Behind Realized Value

Understood top's adequacy naturally appears to modify for two parts of BTC's inclination: (1) lost mint pieces, and (2) currencies utilized for hodling, setting up the group mental aggregate of passages when clients started seeing Bitcoin's esteem and long haul potential. Acknowledged top appears to propose the last layer of individuals' combined cost premise and, in late history, a definitive line of "focus of mass" where 2017 in number purchasers remain unrattled by transient vulnerability.

One method for taking a gander at acknowledged esteem is that it causes us dispense with a portion of the lost, unused, unclaimed coins from our aggregate esteem computations. Another way is considering it to be a pointer of the entirety of levels where gatherings of long haul, genuine, purchaser hodlers went into their Bitcoin positions, with nearby and prompt feelings and insanities stripped out.

MVRV Ratio

MVRV is determined by essentially separating business sector esteem by acknowledged an incentive every day (for this situation from Oct. 9, 2010 to Sept. 14, 2018). This equation gives the accompanying oscillator:

From this count, two chronicled edges rise: 3.7, which means overvaluation, and 1, which indicates undervaluation. It is additionally fascinating to perceive how MVRV inspires both the Mayer Multiple and Dmitry Kalichkin's NVT motion without the requirement for a moving normal.

Market Dichotomy?

A hypothetical system for this proportion would reverberate a polarity that can be best communicated in the accompanying:

Examiners versus hodlers.

High time inclination versus low time inclination (as contended by Saifedean Ammous in part 5 of The Bitcoin Standard).

Unreasonable richness versus vulnerability acclimation (as contended by Jimmy Song in "The Antifragility of Bitcoin" introduction).

We trust that both market ideas and members are significant at Bitcoin's diversion hypothesis and cost activity, since the blasts appear to grow the system by means of an overflowing viral prattle component that communicates the presence of Bitcoin to the total populace; while the busts, over the long haul, appear to remunerate people who postponed momentary monetary delight in the look for sound cash. This very polarity, as we would like to think, additionally clarifies the significance and adequacy of MVRV proportion. System esteem, to return to Willy Woo's wording, is to us both market esteem and acknowledged esteem.

Like Woo's NVT rule, MVRV seems to follow the connection between the market on-screen characters that best portray the previously mentioned polarity. It recommends the on occasion significant disparity between value disclosure at trades and the "sounder," all the more relentless ascent of unaffected coins — either lost or utilized for hodling.

It is quite compelling at whatever point showcase esteem goes underneath a 1:1 proportion to acknowledged esteem. We recommend that these periods represent both undervaluation and the capitulation-misery phases of market brain science. Similarly as the upper dimensions of MVRV propose the peak of rapture, overshooting it's "reasonable" esteem at the pinnacles, value activity as found at trades will in general undershoot past BTC's "genuine" esteem at the bottoms. Glancing back at the previous two Bitcoin bear cycles, we can state point of fact that the two events ended up being the most helpful periods to amass bitcoins.

At the point when plotted as time goes on a log outline, the acknowledged esteem line of Bitcoin (orange above) is increasingly like a stepwise capacity, with close vertical moves upwards amid pinnacle a very long time of positively trending business sector, at that point a drawn out time of level levelness. That being stated, every evenness level could be generally translated as Bitcoin's newly discovered stable reasonable esteem limit. The customary market top, in any case, is all the more forcefully articulated by the feeling of the groups, specifically extreme elation when showcase esteem strongly veers upwards far from acknowledged esteem, and, on the other hand, over the top dread when advertise esteem dips under acknowledged an incentive for a multi-month time frame.

Current Environment

Basically, we anticipate that advertise esteem will slip underneath acknowledged an incentive on a mid-term premise, which thusly would build up an auxiliary hole between them, to be filled after a gathering time of possibly up to a while.

Posted using Partiko Android

If you have any queries then comment below I will reply immediately

Posted using Partiko Android

hi, just wondered why you have downvoted my post?

Ok" I just give you upvot

Posted using Partiko Android