Bitcoin Shines Like Technology When Its Price Falls

"Bitcoin is dead", is a phrase that all bitcoiners often hear the times when the price plummets from new historical highs. And this time, with the ecosystem still getting used to the idea of having gone from a glorious $ 20,000 in December of 2017 to a disappointing $ 6,000 six months later, it has not been the exception.

In spite of everything, it is as usual to hear that phrase as to forget how many times it has been heard before. The truth is that it seems to have the ability to cause the same panic every time, especially among bitcoiners not so experienced, as if the general idea was that bitcoin is a fragile floor that increasingly cracks and that, at some point, Inevitably, it's going to break completely. Although in reality it is not like this: bitcoin suffers bubbles every so often, but it is far from being one.

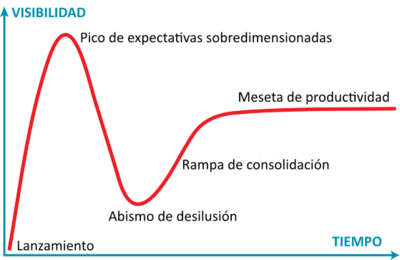

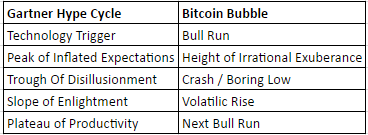

The Bitcoin enthusiast, Michael B. Casey, published in 2016 what he considers the price cycle of this cryptocurrency, relating it to the usual adoption stages for any new technology according to the Gartner over - exposure cycle . In this analysis we can see that Bitcoin has a marked tendency to suffer great bubbles (Casey counts 5 until that date), whose stages can be assimilated to the Gartner cycle.

Casey, on the other hand, also describes five stages in the bitcoin price: Bull Run (exuberant rise in price), Irrational Exuberance (peak of the rise), Crash (fall), Boring Low (the price stabilizes for a while ) and the Volatile Increase (steps towards a new rise). For him, each of these steps, in order, is like a mirror of the Gartner cycle.

However, a complete adoption and a consolidated technology still seem only a goal for Bitcoin, which continues to present difficulties despite all the improvements that have been made, and whose adoption, although it has grown exponentially, still has to overcome many challenges , among them, the regulatory ones .

And why is this? Well, unlike other technologies, we must admit that bitcoin, by the mere fact of being an economic tool, is quite speculative.

MEANWHILE, IN THE BORING LOW ...

Right now we can say that we are in the boring low of the price of bitcoin, one that shows that during this stage really develops its background technology.

The bull run always attracts new users and companies because of the money that moves and you can start to "pay their interest." Of course, not all of them are positive additions and not all of them will remain: many will turn out to be scammers, hackers or temporary traders who only look for an immediate gain when switching to fiat currency. But, among those negative or temporary additions, there are also true interested in technology, who had the opportunity to discover it thanks to the commotion and who stayed as hodlers or as long-term developers. This is reflected in the price of the cryptocurrency: after a crash of the bull run, this is always greater than the previous record, although less than the new one.

Once over-exposed, almost silently, these people and organizations are dedicated to improving technology. Not only for altruism: in reality, they are building, many times, the bases of their own companies or profits for the next bull run , in the case of hodlers. Then this stage, the boring low, results in a kind of mixture between the abyss of disappointment (if we talk about price) and the launch of new tests and improvements.

Right now we have a photograph of that panorama. While the price of bitcoin has been kept down, Lightning Network, a micropayment solution outside the blockchain that has been developed for some time, was finally launched to the main network in March. Since then, it has only grown exponentially.

Also, new improvement proposals for Bitcoin continue to arrive: the Schnorr and BLS signatures and the BIP174 to send transactions without connection, for example. This is coupled with the development of sidechains (side chains) aimed at adding new features to the Bitcoin blockchain, such as the RGB and Liquid initiatives to create tokens; and the almost sudden historical increase in the hashrate of the network, showing that more and more miners are joining to protect it, regardless of the price of the cryptocurrency.

Something similar happened in the previous boring low, between 2014 and 2017. During this period, large adoptions took place, such as Microsoft and Ernst & Young, new payment services were created such as Living Room of Satoshi and Zebpay and new scalability solutions were developed. , especially SegWit , which ended up being implemented successfully. Hence the basis for the historical bull run of $ 20,000: although it did have much speculation about its real base, that price did not come out of nowhere.

Although the departures of the "temporary stakeholders" really lower the price after the historical record, many hodlers and developers stay, increasing in number over time and with the arrival of new records for which many more are attracted. So no, bitcoin does not die every time its price falls, but it is strengthened in silence thanks to what is gathering almost unnoticed, preparing for its next stage and for a true plateau of stable productivity in a not so distant future .

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by alfonzo5 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

@alfonzo5 You can read ....

@alfonzo5, you are interesting to read!