NO BLOCKCHAIN AS SAFE AS BITCOIN

Security is an essential characteristic for every blockchain. Satoshi Nakamoto, in the Bitcoin White Paper, explained that "the system is safe as honest nodes collectively control more processing power (CPU) than any group of cooperating attackers". In this sense, Bitcoin, by adding the highest processing power collectively controlled among all distributed accounting platforms, which increases the improbability of external or internal attacks, is emerging as the safest blockchain in the ecosystem.

The opposite, that attackers control a dangerous majority of the processing power in a chain of blocks, has materialized in different blockchain projects, which have been prey to attacks of 51% and block retention (for which it is necessary to concentrate about 30% of the processing power of the network). Recently, malicious miners attacked Bitcoin Gold , Verge and ZenCash , taking control of their networks and forcing other miners to double spend by imposing a chain of blocks that has been secretly mined to propagate, in such a way that a minibifurcation is created that invalidates previous transactions.

Meanwhile Bitcoin, the original blockchain and therefore the oldest one, has not been attacked under this type of modality , despite the fact that the condition for executing them has been given on different occasions. In the last 24 hours, three mining pools concentrate more than 50% of processing power (BTC.com with 23.4%, SlushPool with 14.8% and ViaBTC with 12.4%), of which only one of they are close to the percentage required for a block retention attack (BTC.com). However, attacking this blockchain does not seem so easy or viable.

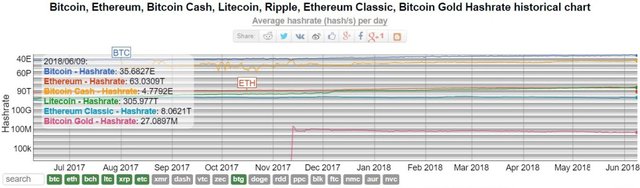

Currently, the highest processing rate is that of Bitcoin , with a hashrate of 35,683 PH / s for June 9, which has been increasing rapidly during the last weeks. As can be seen in the following graph, although its behavior has been high and low, it has also been rare the occasion when some other blockchain has reached its processing power, although Bitcoin Cash did it at some point with the alternative migration of miners between both networks due to the temporary fluctuation in the value of the mining rewards in the early times of existence of this altcoin that arose from a Bitcoin bifurcation.

As seen in the previous graph, Bitcoin's processing power is much greater than that of other blockchains. Some of them also operate with the same SHA-256 mining algorithm or use the same ASIC hardware. Therefore, a miner who holds a fraction of the processing power in Bitcoin could take control of another blockchain that mines with SHA-256, and thus execute 51% attacks or block retention. This reality encourages attacking smaller blockchains instead of attacking Bitcoin .

For example, Bitcoin Cash at the same date, has a processing power of 4,779 PH / s, which represents 13.39% of the processing power of the network, a percentage that is almost doubled by just one pool of mining in Bitcoin, and to which other mining pools of the first block chain approach. On the other hand, blockchains of the likes of Litecoin and Ethereum have a processing power of 305.98 TH / s and 63.03 TH / s, respectively, values that are well below 1% of Bitcoin's processing power. Much lower is the rate of Bitcoin Gold processing, blockchain that was recently attacked, whose computational speed is 27.0987 MH / s, about 27 million hashes per second compared to the 35.683 quadrillion hashes per second of Bitcoin.

An external attack against Bitcoin is practically impossible to execute , since it would require approximately 2,300 million dollars between electricity and mining equipment, while in the smaller blockchains, these attacks would be cheaper. This is demonstrated by the list of costs of Crypto51to rent computational power in markets like NiceHash to attack a blockchain for an hour. The list shows that Bitcoin is the one that requires the most capital; In addition, cloud mining markets such as NiceHash have only 1 to 2% of processing power required to attack it, while for other smaller blockchains, NiceHash has available to rent more than 100% processing power required for a 51% attack or block retention. In fact, for Bitcoin Gold, NiceHash offers the rent of the equivalent of 140% of the processing power for a 51% attack, in exchange for about $ 3,000.

Considering an internal attack, from the Bitcoin mining pools to its blockchain, the picture is different. In spite of the fact that there is government decentralization in Bitcoin and that it has 9,933 public nodes connected to each other and each with a replica of the chain of blocks, the fact that the processing power necessary for an attack is concentrated among three mining entities It is fitting to think that Bitcoin mining, vital for its sustainability, is centralized by these mining pools , which could lead to negative scenarios. For example, that these entities agree to carry out a 51% attack on the network or block retention.

Actually, if they wanted to, these pools could attack Bitcoin . In this way, the centralizing miners of the hash could revert and block transactions at discretion; use the same cryptocurrency twice to pay different debtors -such as, in the case of ZenCash, exchange houses- among other operations that would profoundly affect Bitcoin's reputation as a project and blockchain as technology, as Bitcoin is the most popular blockchain and public. This, because the miners would have control of the network, as has happened in the blockchains affected these months. In one of them, the attack has been of such magnitude that the attackers managed to steal more than 500 thousand dollars in a matter of hours, a figure not so high in monetary terms, but with a high cost for the legitimacy and confidence in such a blockchain.

Thinking about this scenario, many hypotheses could be posed about what would be triggered in case Bitcoin was hacked; scenarios in which, however high the profit of the attack, the dishonest miners involved would not benefit in the long term. First, they could not execute the attack without going unnoticed by the advertising inherent in the Bitcoin blockchain . After detecting the attack, it is almost certain that the bitcoin value would fall, affecting your own income. Of course, the attackers could migrate to another cryptocurrency. But the implications of an attack on Bitcoin, the mother of all the blockchain, would very likely have an impact on the legitimacy of distributed accounting as technology, which would ultimately affect the entire crypto market - mostly guided by Bitcoin movements. .

In the face of attacks against Bitcoin, those committed to the philosophy of the project would not sit idly by seeing the project compromised in which many have been working since 2009 and in which they trust that it will revolutionize global finance. The pool or the attacking mining pools could be abandoned by many participants due to their attack on the network, thus losing the contribution of processing power of these participants and the money they suppose for the pool .

The community formed by developers, miners and users committed to the Bitcoin project would surely express their rejection when an attack against Bitcoin becomes evident, and is likely to promote a fork to continue in the reliable chain along with the rest of honest mining pools , regardless of of the attacking miners. In this scenario, the team of dishonest miners would be left out of the blockchain project with greater market capitalization and also with greater adoption of the world, in addition to receiving the rejection of wallets and exchanges that support Bitcoin.

Although they could attack the network, the miners have not yet shown intentions to do so, and they have rather good reasons to protect it, whether for philosophical and / or economic reasons . The miners have no incentives to carry out an attack , because in all possible scenarios that trigger the losses would be greater. So it is more profitable to continue mining in Bitcoin, where even after issuing the 21 million bitcoins in the year 2140 approximately, they would still receive a reward for their contribution in the network.

While it is possible that mining pools that concentrate the power required can control the network for malicious purposes, it would not be feasible to do so because it would mean finishing themselves with your business.

From all these arguments it is clear that Bitcoin is not only the first of all block chains, nor is it only the one leading the market and the most adopted, but it is also the one that emerges as the most robust before this type of attacks. Bitcoin has proven to be, until now, a secure system beyond having a centralized mining to some extent and from a certain point of view, guaranteeing the legitimacy of blockchain as a trustworthy financial technology and destined to revolutionize finances.

Bitcoin concentrates the greatest collective processing power of all blockchains, representing miners who have demonstrated their honesty and commitment to technology for almost ten years. In this way, Bitcoin appears as the safest blockchain against internal or external attacks, presenting itself as the safest of all blockchain, responsible for protecting the history of blockchain and its legitimacy as a technology.

Coins mentioned in post:

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by alfonzo5 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.