BITCOIN PRICE ANALYSIS, BUY THE RUMOR, SELL THE NEWS

RKET OVERVIEW

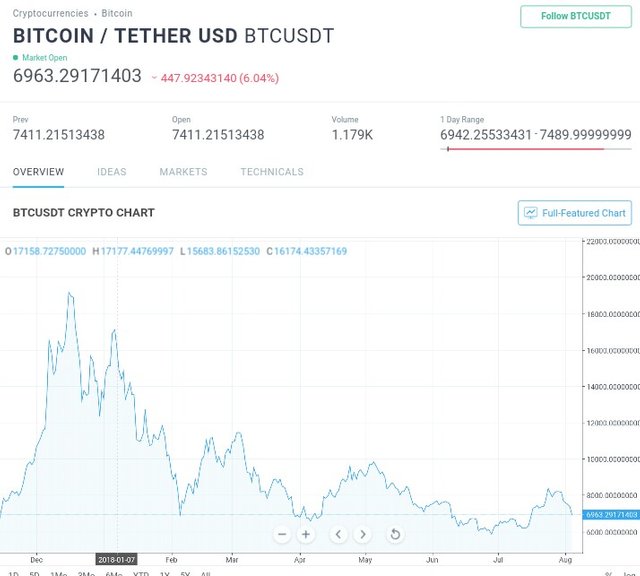

Some time ago the scarcest gossip sent tremors through the market and supported even the most incomprehensible altcoin by 20% least. Oh dear, it gives the idea that those days have since quite a while ago passed. Outside of the current month's Bitcoin ETF promotion and disappointment, next to no of the current week's certain bitcoin news meant development in cost.

The news that a Starbucks organization with Microsoft which in the end could prompt clients paying for their frappes with Bitcoin appears have created a fly above $7,400 Friday morning. Notwithstanding, BTC $7028.64 - 0.05% immediately pulled back. It appears real purchase an espresso with Bitcoin idea isn't as clear as it appears. An auxiliary organization will get a digital money promptly changed over to fiat for Starbucks. In any case, a win is a win, and digital forms of money require promote reconciliation into current installment frameworks so as to goad more extensive reception.

Elsewhere in the world, Robert Sluymer of Fundstrat says that Bitcoin is in a "significant stage" as it will either bob off late lows and continue moving or disintegrate under strain and come back to $6,000.

The week likewise gave a dash of discussion as a few financial specialists will endure a shot once OKEx sanctions their "mingled hook back" approach after the constrained liquidation of an enormous $433 million fates exchange.

Furthermore, to finish things off, the Central Bank of Denmark guarantees that Bitcoin isn't 'genuine cash,' while a UBS think about recommends that Bitcoin requires a $213,000 per coin valuation to supplant the U.S. Dollar.

FUD or not, Bitcoin has all the earmarks of being stuck in a bearish groove and it will take a touch of steady buying volume to winch her out.

Presently, how about we have a snappy take a gander at the outlines

day CHART

itcoin tumbled to a multi week low at $7,288, and the week after week diagram demonstrates that a lower high was set.

Bitcoin tumbled to a multi week low at $7,288 and the week after week diagram demonstrates that a lower high was set and BTC seems, by all accounts, to be fixing as it combines in anticipation of a conceivable breakout to $7,576 which beforehand worked as a help and lines up with the 23.6% Fib retracement level.

Increases above $7,576 are probably going to reach out to $7,753 which likewise filled in as a solid help and lines up with the 38.2% Fib retracement yet the 100-day MA is sits marginally over this rack at $7,800 and could push back against additionally picks up as this was a firmly challenged opposition half a month back.

The 20-day MA has sunk far beneath the 100 and 50-day MA, recommending that bulls are in charge. However, the blend of a rising trendline from the present low and a RSI that is currently moving out of a bearish area indications at the likelihood of a breakout that could extend from $7,550 to $7,750.

On the other hand, a less blushing translation of a similar 4-hour outline demonstrates BTC reliably being rejected at the short and long haul moving midpoints, and also the pattern of 4-hour bring down highs showing that bears are in charge. BTC could spike to the 23.6% or 38.2% opposition, however this would require a move over the 20 and 100-day moving midpoints.

This could end up being a testing circumstance as the 20 MA is underneath the $7,575 obstruction and the 100 MA is over the 38.2% Fib retracement level. Underneath the amazing failure, $7,200 fills in as a delicate help and is trailed by a stiffer help at $6,750.

Every day CHART

Like the 4-hour graph, BTC is stuck between the $7,400 bolster and the $7,500 obstruction overhead.

Like the 4-hour graph, BTC is stuck between the $7,400 bolster and the $7,500 opposition overhead. A similar example of dismissals at the moving midpoints can be viewed as BTC keeps on meeting obstruction at the 20 and 100-day MA. At the season of composing the RSI has flatlined comfortable while the Stoch is long oversold, yet an audit of the two oscillators on the 4-hour graph bolsters the likelihood of a breakout as depicted previously.

The 55 EMA and 20 MA on the day by day diagram keep on ascending which loans encourage legitimacy to the elucidation of the present pullback being a transient bearish pattern, yet there are few backings underneath $7,350 – $7,200 so a dip under these point could lead BTC to return to $6,750.

LOOKING AHEAD

BTC could break out to $7,550 – $7,750 throughout the following 24 hours yet is probably going to experience obstruction at $7,800 where the 100-day MA is arranged.

Those exchanging on the 30 minute, 1 hour and 4-hour outline may set their undercut arranges a tad of the moving midpoints and previous backings as there is an example of dismissal at these focuses on the 4-hour diagram.

This 1-hour diagram recommends that inability to hold the $7,400 support will drop BTC to $7,100 – $6,800 however most outlines indicate little help under $7,350 until $6,750.

dear arjun9, this year has a big dumping gap in alt and bitcoin, but i fully hope it will touch his peak again.

Hope bitcoin pomp agent $20k

I just have no idea what is going to happen but I am glad I am in this space. If crypto gets the big wins so do I!

Thanks for comment

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by arjun9 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.