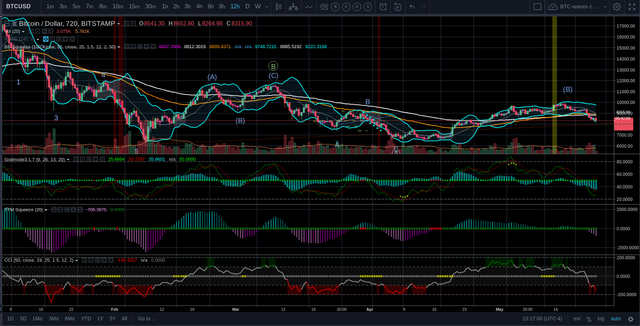

70/280 DMA Death Cross today. The Bitcoin crash pattern continues to unfold. Buckle your sphincters...

Bitcoin: Short

The Bears are firmly in control right now. Crash pattern continues to unfold as in 2014.

Mid term target: 7200

Longer term target:

- Best case for culls is 5000.

- 3000 also possible and likely.

- Worst case for the bulls is 1800.

In stock markets, a death/golden cross refers to the crossing of the 50-day and 200-day moving averages. Why 50 and 200 days? 50 days is 10 weeks of price action, and 200 - 40 weeks. This makes sense - in a market that is only open 5 days a week. Since cryptocurrency markets trade 24/7/365, 70-day and 280-day moving averages are the equivalents of 50/200 in the stock market.

The BTC 70 and 280 day moving averages death crossed today, after the price was pinched between the moving average yesterday leading to a breakdown - this itself is a very high probability short setup, THE setup you want when trading a death cross.

The price action looks very bearish - just look at those daily and 12h currently in the works. The buy signal on the 12h (yellow column of light) has not misfired since July of last year. A CCI value less than -100 on sich a high timeframe suggests the probability. Another thing that's frightening about this is that shorts have been closing through this last price decline - and without shorts there's no rocket fuel to break through 10k.

At the same time, Bitcoin Cash has been looking rather bullish...

BCHBTC appears to have begun it's next bullish impulse sequence. New all time highs in BTC terms are expected in the coming months.

While it falls with BTC, it has also been recovering more than BTC after each dump with the BCHBTC ratio steadily growing.

It feels to me it is the end of BTC let's hope it will rise from it's ashes. To be honest I have doubts about that. Bitcoin is the biggest threat to the rich ones (Cabal).

The Tree of Life, or Etz haChayim (עץ החיים) has upvoted you with divine emanations of G-ds creation itself ex nihilo. We reveal Light by transforming our Desire to Receive for Ourselves to a Desire to Receive for Others. I am part of the Curators Guild (Sephiroth), through which Ein Sof (The Infinite) reveals Itself!

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvote this reply.

I can almost guarantee BCH will never exceed the price of Bitcoin... especially with the amount of advertising Roger Ver does for Bitcoin Cash with still no major upward movement in price 🤣🤣.

I believe the price will not go lower than $7,000. Too much positive news ahead of us for a bull...especially with goldman sachs starting a trading desk for Bitcoin. 🚀🚀

It could stop at 7200 if the bullish scenario is unfolding. 60-40 in favor of the bears here IMO. Look at the 12h with volume enabled. If it was bullish, volume on the price rallies would climax at at the end of the rally. Instead we see volume fall away while the price rises - the behavior typically observed in corrections. We are correcting to the upside in a larger bear market, which of course itself is within a much larger bull market.

It's an unfortunate result of the fact that no one among the Core Devs knows economics or understands game theory and incentive structures. Trying to create the future of money with "the best cryptographers in the world" but without anyone who understands economics is the equivalent of trying to build a skyscraper with the best interior designers in the world but no architects or structural engineers. The absolute train wreck that was the "fee market" is a direct result of their approach. Unless, of course, it was intentional and malicious - I can think of

71151 million reasons that might be the case.If this thing isn't just a bubble, then the coin that gets adopted will win in the end. The coin that gets adopted in the end will be the one that is useful as money, with predictably low fees. Bitcoin trading desks can become Cryptocurrency desks - and will, if the market demands it. For BTC to become a store of value it needs to be adopted as money, it won't just become a store of value right away. Gold is a store of value as a result of it's multi-millenia track record of being exceptionally useful as analog money. It's unlikely to work the other way around, mainly because adoption of it as money is what will eventually stabilize the price (probably after price discovery works itself out more) by giving the market much greater depth.

Mentioning him with an obviously negative connotation in this context is a straw man followed up with ad hominem.

That's the thing "it could" We could use that for numerous amount of scenarios. Bitcoin could go to $100,000. Bitcoin could go to 1 million. Even with the volume indicators, which doesn't hurt to display...But if news comes out that Bitcoin is going to plummet because a Billionaire said something bad about the coin, it wouldn't impact it.

As far the trading desk, it could be held as a security such as Gold, stocks, etc... not just as store value. Billionaires most likely wouldn't mind dumping in millions or 100s of millions of dollars in Bitcoin knowing that there rent will still be covered, and all their expenses are paid forever covered.

As far as the coins adopted, I agree not all coins will survive, but there will be coins that will survive in certain industries, which is what's fascinating about crypto. The blockchain technology could be used in many different industries. The total market cap of Gold is at roughly 7.8 trillion which is an insurmountable amount, but if Cryptocurrency reached a market cap of $700 billion in a month, who's to say that crypto can't reach the market cap of trillions anytime soon, especially knowing that most of the population isn't informed about it.

This post has received a 11.35 % upvote from @boomerang.

Congratulations @ashaman! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!