Short Term: CME’s Bitcoin Futures Should Be Bearish For Bitcoin

When the Chicago Mercantile Exchange (CME) announced they would launch Bitcoin futures on December 18, 2017 [1], most Bitcoiners and cryptocoiners thought Bitcoin and cryptocurrency overall was finally going mainstream. The establishment financial world has finally acknowledged Bitcoin and cryptocurrency after many years of trying to discredit it. Like many, I was excited about CME futures. In the long run, Bitcoin futures are a positive step in cryptocurrency adoption. But I think Bitcoin futures should be bearish for Bitcoin’s price in the very short term (e.g. before end of 2018). In this article, I will be laying out my reasons why I think the cryptocurrency market will experience a bear market after the launch of Bitcoin futures.

CME FUTURES FAIL TO LAUNCH

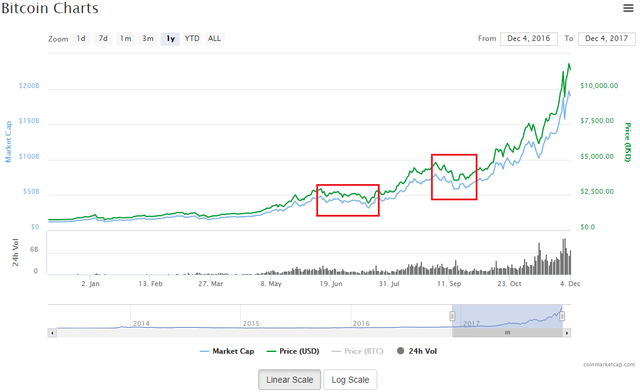

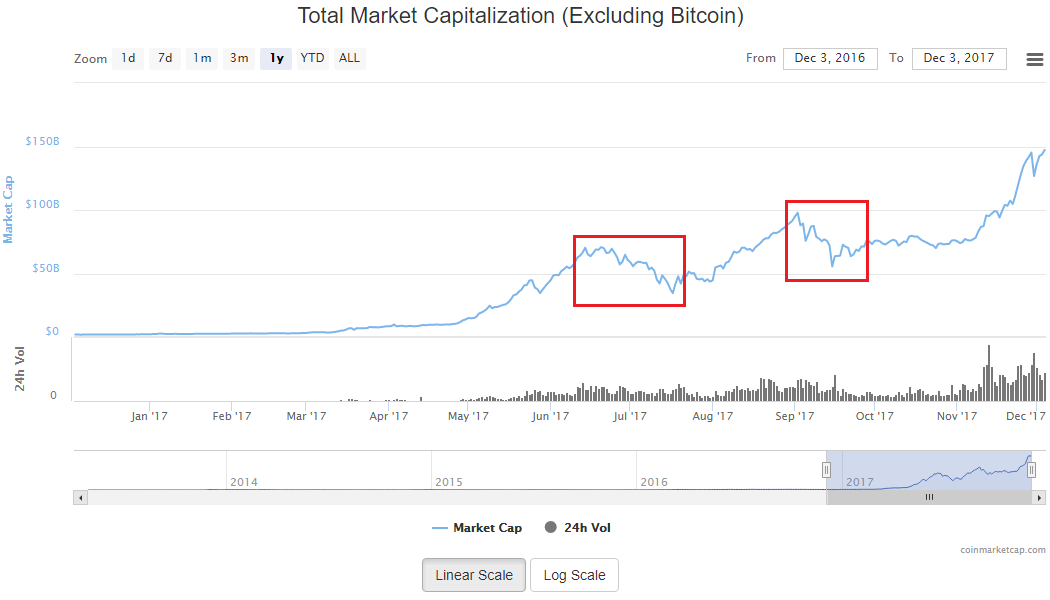

At this point, while I believe it’s unlikely that Bitcoin futures will fail to launch, it’s still a slim possibility. If this were to occur, Bitcoin’s price will collapse as the excitement and expectation of Bitcoin futures disappear. Even an initial drop of $1000 to $2000 could cause the market to panic and drop the price further. Since Bitcoin’s price is highly correlated with altcoin prices during bear markets [2][3], the entire cryptocurrency market can expect a massive contraction for a couple of days.

CME FUTURES SUCCESSFULLY LAUNCH

Many of you may be thinking right now how a successful launch of Bitcoin futures could cause a bear market in cryptocurrencies. It seems counterintuitive; futures should increase adoption and mainstream awareness of Bitcoin and cryptocurrencies! And I agree – in the long term, Bitcoin futures increases adoption. But I believe that in the very short term, Bitcoin’s price will fall as a result of the futures launch because futures temporarily give institutional investors a massive amount of power over the price of Bitcoin. Institutional investors and traders behave differently from retail investors. Unlike retail investors, professional investors never buy at all-time highs, and instead will see Bitcoin’s overextended pricing as an opportunity to short sell Bitcoin. In fact, institutional investors have an interest in collapsing the price of Bitcoin, so they can buy it at a discount. If Bitcoin rides up to $15,000 by December 18, 2018, I can almost guarantee a significant correction, driven by institutional investors, will occur.

CAVEAT…KIND OF

There are some exceptions to this scenario. The first exception is that Bitcoin’s price corrects below $7000 before CME launches futures. In this case, institutional investors are more likely to see that price as a buy opportunity, which will drive up the price. That being said, this scenario requires a correction to occur in the first place, meaning (again) that the futures launch should be a bearish event for Bitcoin.

DISCLAIMER

I have holdings in Bitcoin and other altcoins, and plan to maintain those holdings in the foreseeable future. This article is not meant to be investment or trading advice, so please do your own research and think for yourself! As always, I strongly encourage readers to stay calm and rational, and do not panic sell (FUD – Fear, Uncertainty, Doubt) or panic buy (FOMO – Fear Of Missing Out). Best wishes to all in investing and trading!

REFERENCES

- http://www.cmegroup.com/media-room/press-releases/2017/12/01/cme_group_self-certifiesbitcoinfuturestolaunchdec18.html

- https://coinmarketcap.com/currencies/bitcoin/

- https://coinmarketcap.com/charts/

CME and Cboe are all criminal. Of course they want in on the market