Are trading contests worth taking part in?

A number of cryptocurrency exchanges (notably Binance and Kucoin) often have trading contests, most often for newly listed cryptocurrencies in an effort to drum up some publicity and interest in the projects. The amounts on offer quite be quite lucrative for people who manage to get into winning positions... however, to land in the top trader spots requires a vast amount of both capital and time.... or at the very least, a vast amount of capital and access to trading bots! However, more recently both Binance and Kucoin appear to have realised that most people aren't interested in the trading contests as the top spots are completely out of the reach of regular people... to that end, they have started introducing a different tiers of contest rewards to try and entice people to take part...

This post is a quick run down of the new contest styles and a quick and dirty analysis of how best to participate in them to get a return.... without making too much of a loss!

For an example of the trading contest style and parameters, see this recent contest at Kucoin: https://www.kucoin.com/news/en-credits-trading-competition

Contest Types

Volume based Rewards

Let's not kid ourselves... you will be competing against bots and some serious wash trading on the orders of magnitudes faster than a human trader is going to manage. Volume based trading is completely out of the reach of the small and casual trader. You need a serious amount of BTC to keep a constant flow of trades going... and you run a huge risk of making a large BTC loss (and holding lots of a worthless new coin...) as the initial listing of a coin is going to be extremely volatile. Usually the listing of a project on a major exchange such as Binance or Kucoin is a chance for early investors to dump their backs onto new and unsuspecting retail investors... don't be that guy holding the bags.

Profit based Rewards

Well.. the small trader has a better chance here... especially if you are savvy and pretty good with the trading, you can get lucky here. However, again the volatility is the key here... you might be able to get ahead of other retail investors... but the elephant in the room will the early investors aiming to dump a huge amount of crypto to recoup their initial investment. So, expect the price to plummet, with a huge sell pressure from early investors countered very briefly by retail investors with quick profit in their eyes (or a chance for the rewards...).

There are two ways that this reward tier can be structured. Total Net Profit and Percentage Profit.... Total Net Profit... avoid it, unless you have a huge amount of BTC that you can dump into the game (of which you are highly likely to take a huge BTC loss...), you don't stand a chance here... Percentage based profit is better... but again, you are running the pretty high risk that you are trading off your valuable Bitcoin for a crypto that is untested and is dumping fast! Not really a great proposition for a reward that is likely to be smaller than your losses!

Participation based Rewards

This is the best way for a casual and retail player to get some rewards... Often it is structered as a minimum trade amount over the set time. Read carefully... Sometimes it is total buys/sell... sometimes only total buying volume... sometimes you need to be holding a certain amount at a particular snapshot time.

For the Total Buy/Sells or buying volume (generally on the order of 50 euros)... it is probably best to just take the "taker" fee hit and buy and sell only a tiny bit above the minimum amount at the market price. Posting a limit order is fine... but due to the inherent volatility of a newly listed coin, you could find yourself on the wrong end of a 10-20% swing... or if you are lucky, you could find yourself on the right side! However, with the taker fee (0.2% twice for the buy and sell order....) and selling at a loss (on the order 0.5-1%)... you can make the minimum amount for a guaranteed small loss (on the order of 0.5 euro in Bitcoin)... for me that makes more sense than having the danger of holding a bag of unwanted coins.

For the holding snapshot type of contest... well, this is much more dangerous, as it requires you to be holding the bag of unwanted altcoin at a specific time.... and at that time, there WILL be a fast and furious dump as everyone wants to get rid of the coins... I would suggest avoiding these ones, UNLESS you actually want to hold the featured altcoin anyway, in which case it is an easy way to bolster your investment with a little bonus.

Advice and Conclusion

The critical thing to keep in mind when taking part in these contests... is the fact that most often, you are going to be trading valued Bitcoin (BTC) into and out of a random crypto with unknown (and likely less) worth. Thus, your objective is to exit the contest window with a minimal loss, which means that you are going to be minimising your risk against being caught by a sudden swing and finding yourself holding an amount of unknown and untested crypto at a large BTC loss.

There are few tips and tricks to avoid doing this...

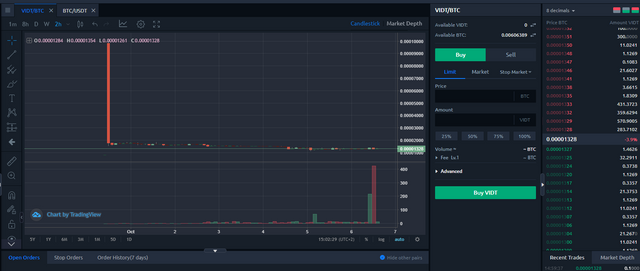

... don't trade in the first day or so of a contest opening up. When a new listing goes up on Binance or Kucoin it is a chance for initial investors and the project team to recover investments or to get some project capital flow going. Both these reasons for dumping the coin are entirely legitimate, investors must try to recoup their initial investment... that is the sane thing to do... and project teams need "real" USDT or BTC or something with tested value to keep the project running. Seen from this perspective, a huge dump at the start of a listing is to be expected. Of course, this is matched against the desire of new investors to try and get a foothold into the last hyped moon-coin... however, in general, the weight of selling is going to be outweighing the desire to enter. So, that picture above... Nope, you don't want to be the lucky fool who got in at the top of that starting red candle!

Even after a few days... the volatility is going to be a bit strong.... choppy graphs will be the norm (like the rest of the crypto ecosystem....) and volume is mostly generated only by the contest! Look at both the graphs... volume is pretty much non-existent... which means that the price can swing pretty hard and unexpectedly with little notice. Again, keep our central tenet in mind... DON'T LOSE BTC! DON't be tempted by the chance to make a profit... there is NO VOLUME! This means that posted limit orders might never execute and be stuck a long way away from the market price when a move is on.

So, with that in mind.... it is best to stick to market orders and fast trades.... to minimise any time exposure whilst holding the bags of altcoin... even if that means selling at a small loss as fast as possible and eating the higher fees due to placing taker orders rather than posting maker limit orders. After all, you could sell at a 1% loss (probably less) and a 0.2%*2 fee making for a total of around 1.5% percent loss on a roughly 50 euro order. This is a guaranteed loss, but the rewards are generally higher than this loss... and it is infinitely preferable to holding a bag of altcoin with a 10-20% swing against you!

The last tip is to trade no more than a bit above the minimum for participation... you won't get much more by doubling your exposure...

There is a bit of a word of advice here... this tactic... whilst being as safe as possible still can see you on the wrong side of a swing.... we all know that these things can happen on the order of seconds... so, there is some risk. Before initating the trade pair (buy and sell), study the order book.... and see that there are enough buy orders to soak up your market sell order... othewise, it won't fully execute... leaving you with a partial bag of altcoins.

Keep in mind, this is technically akin to a wash trade and not really in the spirit of a real marketplace trade... and so there is a chance that the exchange will deem you trade to not comply with the rules of the contest. In which case, you won't collect a reward... however, in the past, I have found it to be reliable... and it is an easy way to pick up about 5-20 euros worth of an altcoin for relatively little effort. After which, you can just hold it as a long shot bet... or immediately cash out for BTC/USDT.

Anyway, usual disclaimers... do your own research, and make sure you understand that you are RISKING capital by taking part in these contests. DON'T think it is a guaranteed way to make a profit.

Referral Links for Exchanges running contests

Coin Tracking

Looking for a quick and easy way to keep track of your cryptocurrencies? Coin Tracking offers a free service that includes manual tracking or automatic tracking via APIs to exchanges, allowing you to easily track and declare your cryptocurrencies for taxation reports. Coin Tracking can easily prepare tax information sheets that are catered to each countries individual taxation requirements (capital gains, asset taxation, FIFO). Best to declare legally and not be caught out when your crypto moons and you are faced with an unexpected taxation bill (unless you are hyper secure and never attach any crypto with traceable personal information, good luck with that!).

Keep Your Crypto Holdings Safe with Ledger

Ledger is one of the leading providers of hardware wallets with the Ledger Nano S being one of the most popular choices for protecting your crypto currencies. Leaving your holdings on a crypto exchange means that you don’t actually own the digital assets, instead you are given an IOU that may or may not be honoured when you call upon it. Software and web based wallets have their weakness in your own personal online security, with your private keys being vulnerable in transit or whilst being stored upon your computer. Paper wallets are incredibly tiresome and still vulnerable to digital attacks (in transit) and are also open to real world attacks (such as theft/photography).

Supporting a wide range of top tokens and coins, the Ledger hardware wallet ensures that your private keys are secure and not exposed to either real world or digital actors. Finding a happy medium of security and usability, Ledger is the leading company in providing safe and secure access to your tokenised future!

Account banner by jimramones

.gif)

Wow! You truly are my hero! All of this was way more than I was capable of figuring this all out, especially the when and how.

Thank you!

Spreading you around!

Upped and steemed

!tip

Well, it is still a gamble... and to honest, only worth it for a minor amount... too much danger of getting caught in the wrong position!

It would definitely be for me! :)

it's gambling, that's why they call it whales :) but i'm sure the sharks will tell you it's because of the huge waves they make , heh ... maybe the benefit in contests like these is the data mined , not the bit of cash they spend (if at all due to the fees they take on every tx ... i doubt they will leave the fees for the duration of the contest - someone here mentioned fees already i see and yes indeed)

and then i wonder and always have

how is an 'offline wallet' tool keeping you safe if the data is inevitably linked 'IN'to the chain (or it wont be there) but i keep weird notions all the time :)

(dont wait up, im more than a month behind on replies, im sure ill get back to it someday)

Off-line is for security against key compromise against internet or on computer vectors. As for public transactions and how they remain private, this is done by not reusing addresses, which was implemented by BIP-0032 as Hierarchical Deterministic wallets which every modern crypto wallet that uses bitcoin-based cryptocurrencies should automatically default to.

Something for everyone to keep in mind: the exchange takes a commission from each trade. This lowers your effective profit. High volumes of trading can erase the benefits of creating a winning portfolio.

Posted using Partiko Android

Yep, the 0.1 and 0.2 percent maker/taker fees are already factored into the participation loss in the post. As for assuming for the volume or profit tiers... Well, I figure if you are gunning for these you should already know your basics!

This post has been resteemed by @original.content.

Follow me to keep up-to-date with posts tagged #oc and the author on ocdb's follow list.

If you don't like this message, please reply

STOPand I'll cease notifying you ASAP.Powered by witness untersatz!

This post was curated by @theluvbug

and has received an upvote and a resteem to hopefully generate some ❤ extra love ❤ for your post!

JOIN ME ON TWITTER

In Proud Collaboration with The Power House Creatives

and their founder @jaynie

🎁 Hi @bengy! You have received 0.1 STEEM tip from @dswigle!

Check out @dswigle blog here and follow if you like the content :)

Sending tips with @tipU - how to guide.

Congratulations @bengy! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!