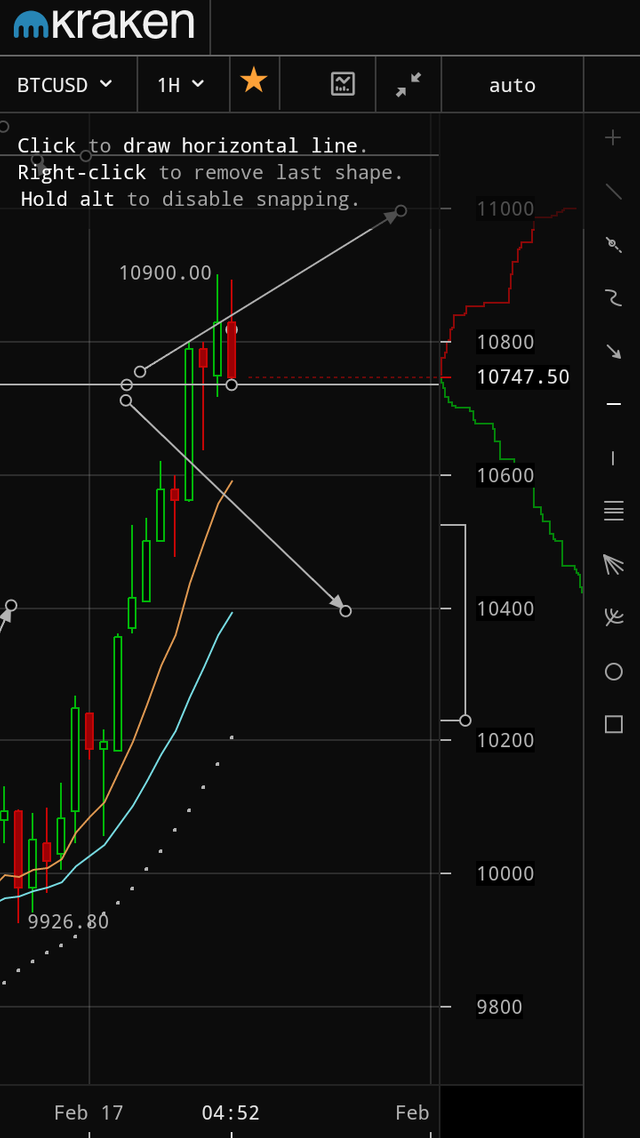

Bitcoin Trend / 17- 02- 2018 / Uptrend Likely Persist

Expected trading for today is between 9400 support and 11000 resistance.

technical indicators show the uptrend would likely persist.

Breaching 11000 level and hold above it, will push the price toward 11200 followed by 11500.00 level, and might take to the price to 12000level.

Note; Breaking 9400 level and hold below it, will push the price to test 9200 level, and even further go down to 10000 followed by testing 9800 before any new attempt to raise.

Expected trading for today:

is between 9400 support and 11000 resistance.

The low of 2018:

5947.00 / H&S bottom.

The high of 2018:

25000.00 level.

MAXIMIZE PROFTS WITH VOLATILITY STOPSProfits

Active traders survive because they use initial stop loss protection as well as trailing stops to break even or to lock in profits. Many traders spend hours perfecting what they consider to be the perfect entry point, but few spend the same amount of time creating a sound exit point. This creates a situation where traders are right about the market's direction, but fail to participate in any huge gains because their trailing stop was hit before the market rallied or broke in their direction. These stops are usually hit prematurely because the trader usually places it according to a chart formation or a dollar amount.

The purpose of this post is to introduce the reader to the concept of placing a stop according to the market.

Exit Methodology

The three keys to developing a sound exit methodology are to determine which volatility indicator to use for proper stop placement, why the stop should be placed this way and how this particular volatility stop works. Finally, to keep the post balanced I will discuss the advantages and disadvantages of the various types of stops.

There are essentially two types of stop orders. The initial stop and the trailing stop. The initial stop order is placed immediately after the entry order is executed. This initial stop is usually placed under or over a price level that if violated would negate the purpose of being in the trade. For example, if a buy order is executed because the closing price was over a moving average then the initial stop is usually placed in reference to the moving average. In this example, the initial stop may be placed at a predetermined point under the moving average. Another example would be entering a trade when the market crossed a swing top and placing the initial stop under the last swing bottom or buying on an uptrend line with an initial stop under the trend line. In each case the initial stop is related to the entry signal.

A trailing stop is usually placed after the market moves in the direction of your trade. Using the moving average as an example, a trailing stop would follow under the moving average as the original entry appreciated in value. For a long position based on the swing chart entry, the trailing stop would be placed under each subsequent higher bottom. Finally, if the buy signal was generated on an uptrend line then a trailing stop would follow the trend line up at a point under the trend line.

Determining a Stop

In each example the stop was placed at a price based on a predetermined amount under a reference point (i.e. moving average, swing and trend line). The logic behind the stop is that if the reference point is violated by a predetermined amount then the original reason the trade was executed in the first place has been violated. The predetermined point is usually decided by extensive back-testing.

Stops placed in this manner usually lead to better trading results because, at a minimum, they are placed in a logical manner. Some traders enter positions then place stops based on specific dollar amounts. For example, they go long a market and place a stop at a fixed dollar amount under the entry. This type of stop is usually hit most often because there is no logic behind it. The trader is basing the stop on a dollar amount which may have nothing to do with the entry. Some traders feel this is the best way to keep losses at a consistent level but in reality it results in stops getting hit more frequently.

If you study a market close enough, you should be able to observe that each market has its own unique volatility. In other words, it has normal measurable movement. This movement can be with the trend or against the trend. Most often it is used in reference to moves that are against the trend. This movement is referred to as a market's noise. The best trading systems respect the noise, and the best stops are placed outside of the noise. One of the best methods of determining a market's noise is to study a market's volatility.

What to Expect

Volatility is basically the amount of movement to expect from a market over a certain period of time. One of the best measures of volatility for traders to use is the average true range (ATR). A volatility stop takes a multiple of the ATR, adds or subtracts it from the close, and places the stop at this price. The stop can only move higher during uptrends, lower during downtrends or sideways. Once the trailing stop has been established, it should never be moved to a worse position. The logic behind the stop is that the trader accepts the fact that the market will have noise against the trend, but by multiplying this noise as measured by the ATR by a factor of, for example, two or three and adding or subtracting it from the close, the stop will be kept out of the noise. By completing this step, the trader may be able to maintain his/her position longer, thereby, giving the trade a better chance of success.

When working with volatility stops, one has to clearly define the objectives of the trading strategy. Each volatility indicator has its own characteristics especially regarding the amount of open profit that is given back in an effort to stay with the trend.

Conclusion

By nature, a trend trading system will always give back some of the open profits when used with a trailing stop. The only way to prevent this is to set profit targets. However, setting profit targets can limit the amount of gains on the trade. Some trailing stops based on volatility can prevent capturing a large trend if the stops are moved too frequently. Other volatility based trailing stops may "give back" too much of the open profits. Through study and experimentation with these various forms of trailing stops, one can optimize which stop best meets his or her trading objectives.

Upvoted Bro :)