How Much Bitcoin Should You Have in Your Portfolio?

With bitcoin losing nearly $10,000 per coin of its value in this current collapse, many people are asking how much bitcoin they should hold in their portfolios. Is it better to take the risk and have an aggressive amount of bitcoin or is it better to hold a conservative amount of bitcoin?

While there is no definitive answer to this, this article discusses some of the factors that can you make up your own mind about bitcoin investment. Ultimately, only you can decide how much bitcoin is right for you and how much risk exposure you are willing to have in your portfolio.

Understanding Risk

As a start, you should understand that bitcoin - and, for that matter, all currency-type altcoins - is a high-risk investment vehicle. Not tethered to a physical asset, the price of currency-type altcoins is based solely on the market demand the altcoin is currently experiencing. Should demand evaporate, the altcoin becomes worthless.

As seen with the recent bitcoin price drop, the volatility of bitcoin demand can mean large price swings. Positive press about bitcoin can trigger a runaway buying spree because news of bitcoin's price increase would lead naturally to more speculative buying. Conversely, negative press - or even neutral press - can break demand enough to trigger significant speculative sell-off. Without an internal "shock-absorbing" mechanism, such as a bitcoin reserve, there is no way to control such volatility.

While it may be likely that bitcoin's price will recover and rally, this rally could potentially be temporary and become subject to future sell-offs. As explained in previous articles, the price of bitcoin likely will never hit zero, as the idea of bitcoin itself now holds value. Eventually, bitcoin will hit its plateau price, the price where supply and demand will reach natural equilibrium without the influence of speculative buying. However, it must be recognized that this plateau price may be in the hundreds of dollars, and not in the thousands.

Measuring Your Tolerance to Risk

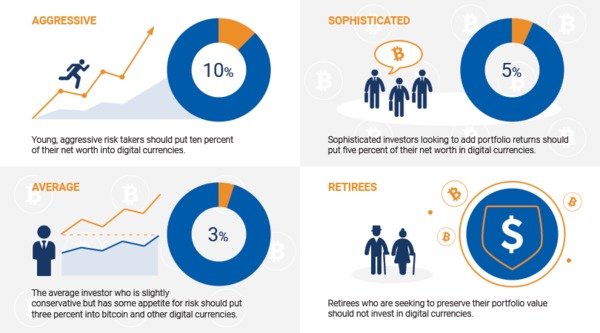

The amount of bitcoin you should have in your portfolio depends on your investment style. Typically, the younger you are, the more your portfolio should have risky investments. A retiree, for example, should completely avoid bitcoin and currency-type altcoins, while a new college graduate should consider allocating five percent of his or her portfolio - and up to ten percent - to risky investments.

This is, of course, dependent on your tolerance for portfolio price fluctuations. If you can accept large swings in your portfolio's positions, you may be better positioned to take on more risky investments. Likewise, if you prefer stable positioning, it may be better to take on less and focus on guaranteed return vehicles, such as bonds.

Also, a large bitcoin investment will require a lot of portfolio tending. If you wish to have assets that you can leave alone and expect them to grow without your intervention, avoid bitcoin. Due to high volatility, bitcoin investment will require constant, consistent monitoring.

A census of investing advice reflects this. Generally, it is felt that if the price is low, one should go for bitcoin, but you should only invest what you can afford to lose.

- Allan Roth of AARP suggests limiting your investment to two percent of your portfolio.

- Evan Tarver of FitSmallBusiness.com suggests a buy-and-hold or high-frequency day-trading type of strategy for any extra non-portfolio related cash a person may wish to use of altcoin investing.

- Tama Churchouse of Stansberry Churchouse Research recommends a five percent investment in altcoins only for those with advanced experience with portfolio management, with bitcoin constituting 30 to 70 percent of that five percent.

While there is an argument that bitcoin is the modern equivalent to tulip speculation in Holland in the 17th century, it should be noted that some did get rich off of "tulip mania". When investing in bitcoin, it is best to be cautious and aware that the floor may collapse from beneath you at any moment. Depending on your risk tolerance, that prospect is either exciting or terrifying.

Want to stay informed about the latest and greatest bitcoin investor news? Sign up for the Bitcoin Market Journal investor newsletter!

You are obviously talking about a portfolio including non-crypto currency assets, just reading the headline I imagined the article was about how much bitcoin you should have in your crypto currency portfolio and in which case I would have replied bitcoin is king and therefore 50% is ideal.

I would like to see a post explaining how to track performance in crypto from a risk management point of view. The amount of BTC in your portfolio, given a certain tolerance to risk (let's say 2-5% of your portfolio), is not determined by the rest of the portfolio or by bitcoin itself because you've additional risk that doesn't show clearly: you might win in alts/btc but loose in overall FIAT currencys.

I used to have 99% of my investment in Bitcoin, times have changed, whatever it dose nest, i'm OUT! Just SOLD almost everything and Bought myself a brand new ford Mustang 😍

I vlogged it here: https://d.tube/v/quby/6iceb4f7

P.S.

I hope it goes up again to 19k $, that was the best time ever for me.

It fluctuate very high everyday,cant make it into fiat money

It is one of the current issue related to bitcoin and very informative post.

In my opinion keeping only affordable risk amount of bitcoin in my portfolio is the better soulution.

Good post,

I'm pretty optimistic that we can see Bitcoin at 50.000 $ by the end of 2018 but it's definitely a good idea to diversify your portfolio.

the amount that you can afford to loose!

thank you very thought provoking and the stock market can fall anytime too so I don’t worry so much —

I would like to see a post explaining how to track performance in crypto from a risk management point of view. The amount of BTC in your portfolio, given a certain tolerance to risk (let's say 2-5% of your portfolio), is not determined by the rest of the portfolio or by bitcoin itself because you've additional risk that doesn't show clearly: you might win in alts/btc but loose in overall FIAT currencys.

Yes agree with you, and in my opinion also every Cryptocurrency and Cryptocurrency market is really volatile and have the dynamic nature, so we cannot judge the exact situation no matter if we are also an expert. So in my opinion, we should invest in Cryptocurrencies that much, which we can afford lose. Thanks for sharing.

Stay Blessed. 🙂

Hmm. Thanks for writing. Made me consider possibly switching/exchanging few coins in a portfolio.

Regarding Bitcoin itself - for now, it's probably to coin to hold money in. Yeah, it is volatile, but look at its history. Drop that is happening now is nothing surprising. But because Bitcoin is top-one & most of other coins follow it.

Thus no matter how big % of all your coins are in Bitcoin, it's definitely not more risky than rest of coins..png)