What Happens Next for Bitfinex and Tether?

This is an excerpt from a longer article distributed by Wave Financial and CryptoAM. Below is analysis and opinions from the author about the current state and future of this topic.

--

From a markets perspective, it doesn’t seem like the market cares. Right at the moment tether is trading at a .5% discount. Despite Bitcoin’s immediate crash, the price has held up well and is now trading within 4% of the pre-crash price indicating two things (1) the bear market is probably over (2) the market

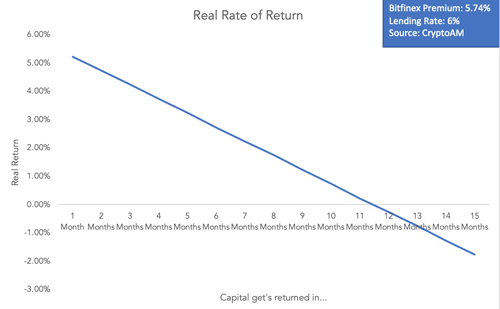

Bitfinex’s Bitcoin is still trading at a premium and represents an opportunity for those with long time preference. It’s unlikely that these funds will be lost, which means Bitfinex at some point in the future will regain access and offer fiat withdrawals since their balance sheet is only temporarily affected. If you can wait, you can probably make money. Here are the calculations for breakeven based on cost of capital (lending rate) being 6% a year.

This highlights infrastructure problems and the perverse nature of regulation. Due to stringent regulations and high scrutiny, banks cut off cryptocurrency companies. This by definition forces the hand of these companies to use shady solutions since they cannot access the professional operations. QuadrigaCX (the victim of a $200M dollar loss) also struggled to find banking relationships, which contributed to their use of shady platforms. This event should send a message to both regulators and to companies that there exists a gap that needs to be filled.

Tether was in fact backed one to one. It was only when recent issues with Bitfinex cropped up that they became a fractional reserve system. This bullish but also reminds us that we should probably introduce transparency standards for stablecoins, and why they should not be associated with any other business model (Glass Steagall anyone?)

The case for DAI just got that much stronger. Decentralized stablecoins by nature do not contain any of the risks outlined in this summary. While they do contain a host of other risks, those that value transparency will likely begin to migrate to DAI. DAI is now up about 3% and is back to dollar parity. This may be due to stability fee hikes, but I’m quite sure the Tether situation played a role. You can confirm this by looking at the DAI charts (DAI/USD spikes right after the press release)

This story originally appeared on BlockchainBeach.com. You can read it at https://www.blockchainbeach.com/what-happens-next-for-bitfinex-and-tether/