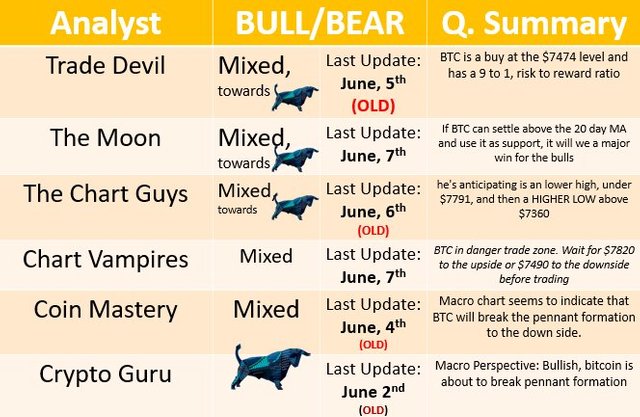

BTC TA (Technical Analysis) - ANALYSTS DAILY SUMMARY - JUNE, 7th

JD Marshall (NO NEW UPDATE)

Type of Trader: Medium/Long Term Trader

Primary argument that BTC is consolodating at these levels and building steam for higher highs in the FUTURE is still his macro perspective. In his opinion we're not seeing BTC reaching all time high any time soon. BTC next big resistance is the top of $9990.

Since Feb. BTC's seen 3 major bottoms around the 6k-7k level. Which is an indication of forming higher lows and confirms a macro bullish trend (Green Line on Chart).

Recent selling pressure (red and orange line) is showing that BTC heading down in the short term, but in the big picture run the bulls are still in control.

All in all BTC is bullish, but will not see major moves in the short term. He's expecting more horizontal movement with BTC achieving higher prices over months. The old highs will probably be seen again in 2019.

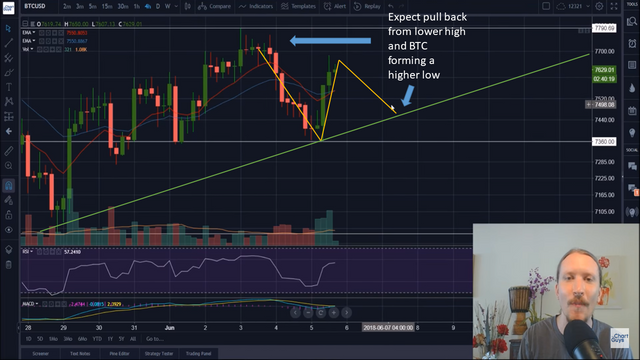

@chartguys (NO NEW UPDATE)

Type of Trader: Short Term Trader

The bulls won some ground after recent pull back. On the four-hour chart the higher low seems to be in place,

On the 4-hour the coming pattern he's anticipating is an lower high, under $7791, and then a HIGHER LOW above $7360. For him this is the most likely way it will play out. Another option might be a bullish continuation, but he also mentions the least likely scenario would be to break the $7360 level, forming a lower low. He believes this is not very likely as the recent rally was accompanied by healthy bullish volume.

The Moon

Trader Type: Long term trader/investor

BTC broke through the 20 day MA, which has been acting as stiff resistance. If BTC can settle above the 20 day MA and use it as support, it will we a major win for the bulls.

On the hourly chart BTC is battling with a resistance level around $7753. Keep an eye on that level. We need to break $7753 for higher prices. If BTC is unable to break this resistance, the double top at this level would indicate lower prices coming. That said, this is on the hourly chart, which is in the very short term and referring to relatively small moves. Another resistance to watch out for is the $8k level, which is also a big psychological resistance.

Coin Mastery

Trader Type: Long term trader/investor

He used the Fib retracement tool from swing low in April to swing high in May and came up with a few interesting levels. On Bitmex the short term resistance around $7700 correlates with the 0.786 fib level. BTC is testing this level, and Coinmastery speculates that BTC might break that resistance with conviction in the short term.

Moving Averages:

The short term MA (yellow) is converging with the longer term MA. If it start crossing, it would be a bullish indication. So keep your eye on that. The 100 EMA is acting as resistance. BTC barely broke it, and the hope is that the 100 EMA starts functioning as support.

@tradedevil

(NO NEW UPDATE; JUST MISSED UPDATE WITH LAST POST)

Type of Trader: Short Term Trader/ Day Trader / E.W. Analyst

BTC Primary count: BTC finished a second wave with the recent low at $7000. This is still his primary count, with his bullish bias. However, if BTC falls below the $7000 level that leg down cannot be the second wave, and he'll have to re-asses.

Using the Fib. Retracement Tool from swing low to swing high, BTC has some serious support around the golden zone ($7474) and this should lead to a push much higher around the $7893 level. If we do not see a major move up from the $7474 level with higher buying volume the count would have to be revisited.

Elliot Wave aside, from swing low to swing high BTC is a buy at the $7474 level and has a 9 to 1, risk to reward ratio, which is a very safe trade.

Secondary Bearish Count:

Bitcoin is in a ABC pattern, and currently busy finishing the C leg down. For this count his buy zone is around the $6600 level.

chris L $ChartVampire$

Type of Trader: Short Term Trader/ Day Trader

He is of the opinion that BTC is still in a 'danger zone' / no trade zone.

He'll consider a bullish scenario once BTC reaches the $7828 level or consider shorting the market if BTC falls to the $7490 level. He's currently out of the market.

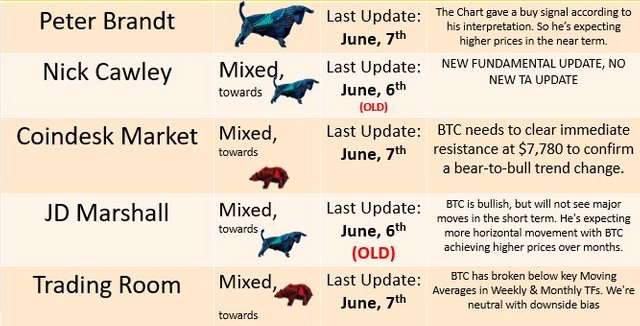

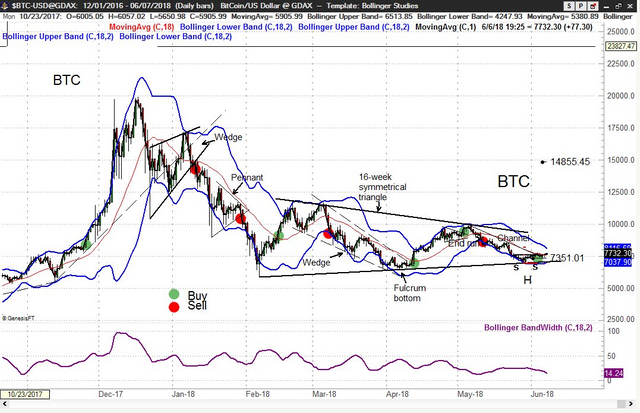

Peter Brandt

Type of Trader: Short/Medium Term Trader

Peter just gave a buy signal for BTC. He saying that the chart is a buy signal at this stage, thus indicating higher prices in the near term.

Nick Cawley (NO NEW UPDATE)

Type of Trader: Short/Medium Term Trader

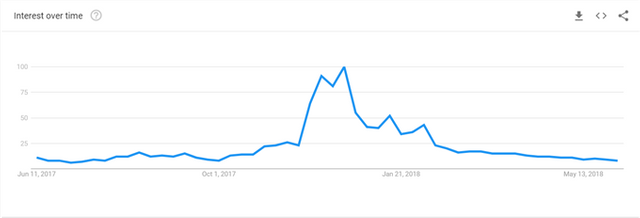

A look at Google analytics show that searches for Bitcoin (BTC), Ether (ETH), Ripple (XRP) and a range of other cryptocurrencies have fallen dramatically after the market slumped at the start of the 2018. While investor interest has fallen, the number of net-long retail customers remains near to all-time high levels, suggesting investors continue to hold positions despite lower prices. The Google trend data may suggest that investors looking for quick returns have moved on and that going forward the market will continue to mature. Recent trading ranges give credence to this with support levels holding, allowing the market to push gently higher.

GOOGLE TRENDS - BITCOIN

Trading Room

Type of Trader: Short Term Trader

BTC has broken below key Moving Averages in Weekly & Monthly TFs. W're neutral with downside bias. Bullcase is possible if we break above 8800. Bear Case below 6950 now. Expect boring price action until break.

Crypto Guru (NO NEW UPDATE)

Type of Trader: Short Term Trader

Mini Falling Wedge (teal) within a Massive Wedge (yellow). We faced the same exact situation at the start of Feb & April; except this time he believe we're ready to break through the Massive Yellow Wedge.

Coindesk Markets

Type of Trader: Short Term Trader

OUTLOOK: Bullish abv $7,780. Daily chart shows upside break of falling channel + higher lows as represented by rising trendline. BTC needs to clear immediate resistance at $7,780 to confirm a bear-to-bull trend change.

Also, a shout out to @famunger for his daily Analyst Summaries.