Bitcoin sentiment - is the Bitfinex margin crowd smart or dumb?

Positioning data in traditional markets

In the world of forex, the crowd is largely accepted to be "dumb" - when the market moves, the majority of retail participants will be on the wrong side of the market and get squeezed (liquidated or trailed out). As the majority of retail forex traders lose, forex sentiment is generally accepted to be a contrarian indicator.

In contrast, the CFTC's weekly Commitment of Traders (COT) report is largely made up of sophisticated, institutional investors, "smart" traders who are presumed to be on the right side of the market. Traders look to the weekly COT report to see what the smart money is doing, rather than what the dumb money isn't.

Positioning data in the crypto markets

Unlike the forex market, the vast majority of speculation in the crypto markets occurs in the spot market and participants are heavily biased towards buying and holding. However, we do have margin markets in crypto and we do have positioning data for these markets. The question is though, how should we look at this data? We know the majority of retail forex traders lose, but as far as I know, there have been no such studies conducted on this very specific sub-set of Bitcoin traders - margin traders at Bitfinex.

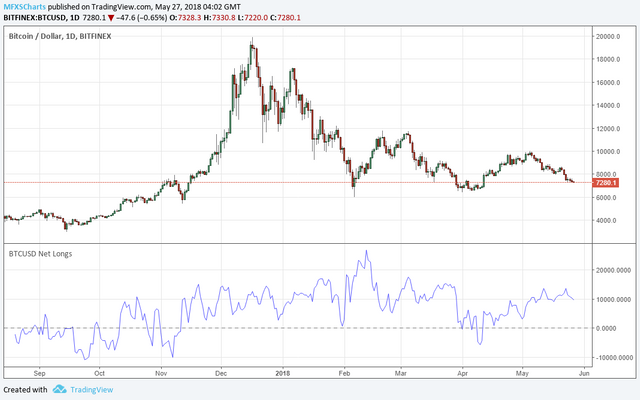

Here's a look at the BTCUSD chart along with my BTCUSD Net Longs indicator. If the blue line is above the dotted 0 line, margin traders at Bitfinex are net long and if the blue line is below 0, the margin crowd is net short:

What we notice right away is that traders tend to be net-long, irrespective of trend. Bitfinex margin traders were net long from early November right through to the beginning of April, even though Bitcoin was trending down for the vast majority of that time. This doesn't really come as much of a surprise though - we already knew Bitcoin traders at the aggregate level are pre-disposed to buy and hold.

Picking tops

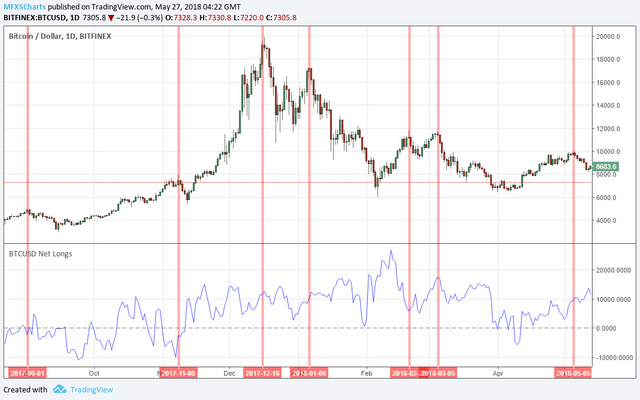

Let's take a look at positioning at structural tops - for the purpose of this study I am defining a structural top as a peak in price that has at least 7 days of net bullish price action prior and at least 7 days of net bearish price action following the peak:

There are 7 instances of structural highs since September, 2017. Of these 7 instances, traders were only net short on two occasions. Interestingly enough, the two times the majority of margin traders were correct, BTCUSD was actually trending up.

Picking bottoms

Let's take a look at structural bottoms:

There are 8 instances of structural bottoms since September, 2017. Of these 8 instances, traders were net long on 6 occasions. Though really, this shouldn't come as much of a surprise as we already identified a general tendency for traders to be net long. Regardless, margin traders at Bitfinex appear to be better at picking bottoms than tops.

Overall

At the aggregate level, we have 15 instances of structural tops or bottoms. Of these 15 instances, traders were on the right side of the market on 8 occasions (53% of the time) and on the wrong side of the market on 7 occasions (47% of the time).

Conclusion

At first glance, the Bitfinex margin crowd seems to have a slight edge when it comes to reversals. However, this edge is rather insignificant in numerical terms (1/15) and may stem solely from a small sample size. Toughening the structural extreme definition to force at least 7 days between two consecutive tops or bottoms would eliminate the observed edge. Even if the sample is representative and the less restrictive definition valid, any edge comes from sheer stubbornness/a permanently bullish bias, rather than exceptional skill or timing.

This bias makes implementing net-positioning data into a trading strategy very difficult - checking whether traders are net long before shorting is not going to filter out many sell signals and traders are rarely on the wrong side of a bullish reversal. That second piece of information is interesting, in that a net-short position is not usually a pre-requisite for a bullish reversal, but that is far from a silver bullet (or holy grail).

Removing net-long reversal instances from the set doesn't get us very far either - we have 2 tops and 2 bottoms when traders are net-short. It looks like I might have to delve a little deeper into positioning data if I'm to find any thing worth implementing, or perhaps there's nothing to find?

Really well written mate. It amazes me what knowledge is available for no cost on this platform. Where you'd go to find a similarly interesting and considered writeup I dont know. I also like how dispassionate your article is; searching for signals in the data rather than relying on bias or emotion. Of course writing bots must rely on the former. Keep up the great work.

Thanks mate, a lot of work there, would have been great to find something a little more actionable at the end, but I had a feeling results would be ~mixed from the outset.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

Useful information for steemian

Always success

As a whole proves - no one in a position to predict correctly which is universal truth.

NEO and the Ontology Foundation Contribute RMB 4 Million to New Joint Venture

The NEO Foundation and Ontology Foundation have joined forces to improve the development of API standardization, a sharing ecosystem of smart contracts, building open standards for smart contracts, and cross-chain technology innovation. Following the MoU signed earlier in May, the two projects announced on the 24th of May that they had contributed RMB $4 Million to the joint venture.

More details and Source: http://za.gl/4yAFp

NEO and the Ontology Foundation Contribute RMB 4 Million to New Joint Venture

The NEO Foundation and Ontology Foundation have joined forces to improve the development of API standardization, a sharing ecosystem of smart contracts, building open standards for smart contracts, and cross-chain technology innovation. Following the MoU signed earlier in May, the two projects announced on the 24th of May that they had contributed RMB $4 Million to the joint venture.

More details and Source: http://za.gl/4yAFp