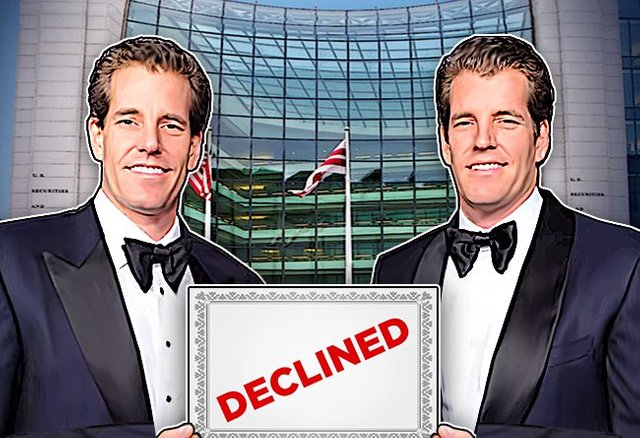

Winklevoss twins bitcoin ETF rejected by SEC

--The Securities and Exchange Commission rejected a second attempt by Cameron and Tyler Winklevoss, founders of crypto exchange Gemini, to list the first-ever cryptocurrency ETF on a regulated exchange.

--Bitcoin fell down to $7,900 after the news hitting. Two-month high this week, which was partially pumped by rumors that the SEC could approve a similar trading vehicle as early as August.

The price of bitcoin dipped 3 percent to $7,880 following the news, according to data from Coinbase.

Last year, the SEC disapproved an application for the "Winklevoss Bitcoin Trust" but in June, the group submitted a proposed rule change. Among other arguments, the agency said in a release Thursday that it did not support the Winklevoss's argument that bitcoin markets, including the Gemini Exchange, are "uniquely resistant to manipulation." It also highlighted issues of fraud and investor protection.

But the agency stated that its mission is designed to prevent fraud or manipulative acts or practices and to protect investors, and that they were concerned about fraud and manipulation of bitcoin, particularly since this is done in a largely unregulated offshore market.

"Despite today's ruling, we look forward to continuing to work with the SEC and remain deeply committed to bringing a regulated bitcoin ETF to market and building the future of money," Cameron Winklevoss, co-founder and President of Gemini said regarding the matter.

The SEC noted that more than three-fourths of the volume in bitcoin occurs outside the United States, and that 95 percent of the volume occurred on non-U.S. exchanges.

As for fact that bitcoin is uniquely proof aganist to manipulations, the SEC "finds that the record before the Commission does not support such a conclusion."

There is another bitcoin ETF application that is still active — the VanEck SolidX Bitcoin Trust. The SEC had no comment about that application.

VanEck and SolidX filed a joint application for a bitcoin ETF, which was published for comment on July 2. According to Dodd Frank rules, the agency needs to take action within 45 days of the publication of that proposal, which falls on August 16.

Bitcoin soared two a two-month high above $8,300 this week, partially because of rumors that the SEC could approve a similar trading vehicle as early as August. While they need to address one proposal by August 16, based on the agency's denial of other ETFs, it could be multiple months before a meaningful announcement.