15 Good Tips for the Daytrader - Detailed explaination

15 Good Tips for the Daytrader

The way forward to becoming a profitable trader may be longer than most believe. Many new daytraders put 10,000-20,000 into their trading account, earn intensive for a few months, lose their money and never return.

If you like a new trader would like to avoid it or if you have a little experience and have survived this first phase, here are 15 tips for how to become a better daytrader:

- Start small / with a minor investment

- Have a strategy and stick to it

- Choose the right platform

- Take good care of stops and targets

- Set up rules for yourself. Write them down and follow them

- Follow the news

- Get to know a few markets and focus on them

- Educate yourself

- Make a log of your trades

- Do not act for short-term - or for long-term

- Trade by following the trend

- Be good to change direction

- Find a trading buddy

- Analyze the market on several time horizons

- Do not chase the market

1. Start small

If you've been following the media, you've definitely heard of daytraders who have earned millions of dollars on a single trade, or two-million million over one year. You might also have an idea that you would like to reluctantly add your own income with daytrading, and maybe start living in 2-3 months.

Forget all this.

If you want to become profitable within daytrading and live over it over time, be prepared for a long process. All experience shows that if you have gone to 0 or have passed through with a little minus after half a year, you should be very satisfied. You can not expect to make money at the beginning. The first half to full year is a period when you really learn something about the markets and where you make all the mistakes that many have done before you.

For the same reason, it's a good idea to start with small bets, because there is no need to bet your entire trading capital, when the chances that you will earn money in this period are unbelievably small. If you managed to work well with small bets over several months, you can always turn up the bets. Begin to trade some very small amounts. That way, there is very little risk of getting lost at the beginning of your trading career. One will avoid many problems if at the beginning of their trading career you never bet more than max. 1 pct. of the value on the trading account on a single trade - and preferably less than 1 per cent

Screendump of the DAX DAX Index. You put the bet at "Quantity" in the upper right corner. Here you can start with small efforts until you get to know the markets.

On the majority of trading platforms, including Markets and ETX, you also have the opportunity to create a demo account, and it is also an option that we would recommend to make use of. It's a great way to start your trading career at no risk at all.

2. Have a strategy and stick to it

Many inexperienced daytraders deal a little with their feelings and intuition. Read if possible. Our article on psychology in daytrading. Despite being relatively new to the market, they can have many opinions about where the market is going. If you are to succeed as a daytrader, you must have a much more controlled approach that follows one or more strategies that are firmly defined.

Psychologically, it can be hard to keep strictly strict rules for one particular set of rules, because one of the reasons why one wants to act is often the desire for more freedom and better opportunities for unfolding. Should you survive as a daytrader, you have to go against its intuition on this point and follow some set rules. It is not a case that the word discipline goes again in all rules of thumb from skilled daytraders. If you can not keep strictly on a strategy that you have laid, it may be that you should try something other than daytrading, because it's simply too dangerous to act a little hist and here from its intuition.

If you are new to the markets, it may be difficult to develop your own strategies, so we suggest that you initially deal with some strategies developed by others.

3. Select the right platform

As a new trader, it can be hard to find out in the big amount of trading platforms. There is a big difference between platforms, but it takes time to find out what's best for the way you shop.

As an active day trader, you will soon be making hundreds of trades every month, and therefore it will quickly matter if the cost per trade is 5 or 10 dollars. Even if you have already chosen a platform, you may want to read the reviews through and see if there are better and cheaper alternatives, because you can save a lot of money if you can reduce trading costs.

4. Have good control of stops and targets

The discipline "Money management" is highlighted by most professional daytraders as one of the most important tools for achieving good results, and first of all, avoiding the big losses. Both within daytrading and stock trading it is very common for traders and investors to let their losses run for too long because they hope that the situation will be reversed. Conversely, one often tends to take their profits too quickly to ensure their profits.

This kind of psychology must be reversed. If you analyze statistics about daytraders results, you will see that the most successful traders do not necessarily have a very high hit rate on their strategies - often it can be around 50 per cent, or even below 50 per cent. But their losses are much less than their winners because they understand to take the loss as soon as the market goes the opposite way to what they were expecting. And when they win, they have the courage to maintain the good deal much longer than others and ensure that their profitable trades are 2-3 times bigger than their losses.

If you can integrate the above into your strategy, you have laid the first foundation to become a successful trader. The first step is to analyze its trades. Are the losses bigger than the winners? Then there is a high likelihood of something wrong. Try experimenting with strategies where risk-reward is at least 2: 1 - that is, the potential gain is at least twice as high as the potential loss.

5. Set up rules for yourself. Write them down and follow them.

Many skilled traders argue that you must have a near mechanical attitude to their trades as soon as they are in them. It makes sense - and better results - to have defined precisely how to act in certain situations. We therefore recommend writing down a number of rules that should be followed. It can be both before and after you enter a trade.

A good example of a rule could never be moving the stop in the direction of the loss. If you are in a losing trade, it may sometimes be tempting to move the stop a bit further, because you hope for a turnaround in the market that can change a losing trade to a winning trade. However, if you move your stop along, you can be quite sure that there is a high risk that the individual loss grows too much and you should therefore keep the stops that you have entered from the start.

Another good rule could be to stop shopping for the rest of the day if you have had three losing trades in a row. Often, it may affect future transactions quite a bit if you are not completely balanced, because it may be difficult to shake losing trades if they get into schools.

Contrary to what many think, there may also be a need to "shake winning trades." If you have had three winning trades in a row, you can get an irrational feeling that you have counted it all out and that all the trades you take then will have a high chance of winning. In these situations, too many traders may be at risk of self-contentment and ending most of today's profits. Therefore, in the case of a series of winnings, it may also make sense to take a break and keep in mind that you must respect the markets.

Many of the best traders formulate a real trading plan, where they carefully define how to handle their strategy. This can be a very good point of view when shopping live on the wild and turbulent markets.

6. Stay updated by following the news

You should not have been trading long in the markets until you know that the news can get the price quite a bit. Most daytraders therefore stay out of the market in the minutes when you know that big news will be announced. I start the day by looking at forexfactory.com, where you can get a good insight into what news will drive the market on a given day. If news is highlighted in red, you know that they are likely to cause some shakes in the market.

Forexfactory.com has an easy and clear overview of the messages that will make the markets move over the course of the day. There are special events that are marked in red under the "impact" column that you have to take into account and it is a good idea to stay out of the market while these important news are being reported.

There are also many traders who try to trade the news and either hold a position over important news or act immediately after a major news has been announced. In principle, we can not recommend this as the market will often be wild and unruly, which in some cases can lead to the wrong way.

If you see big rums during the trading day, which you do not immediately understand, you can try to check Live Squawk, which updates the relevant news from minute to minute. Here you will often find the news that has led to the market moving.

7. Get to know a few markets and focus on them.

Market movements can be analyzed by technical analysis, and although there are obviously common features for the different markets, they also each have their characteristics, which distinguish them from other markets. First and foremost, it is important to know when markets open and are most active in order to achieve the best results.

For example, if you trade the German DAX index, you know that the German stock market opens at. 9 in the morning Danish time, and often is quite active in the coming hours. After 15.30 (Danish time), the market is heavily influenced by developments in the American markets, which, as a trader, must also be kept in mind.

If you want to trade oil, you should be aware that information about Crude Oil Inventories comes out every Wednesday afternoon, Danish time, and you can eventually analyze and build an understanding of how these numbers help to influence the price of oil.

8. Educate yourself.

When you are trading, it is important that you at the same time acquire as much knowledge as possible. With so much information on the web, it can sometimes be difficult to find out where to start and what it's worth spending time on. Below are some suggestions for what you can read to get a better insight into how the markets work.

9. Log your trades

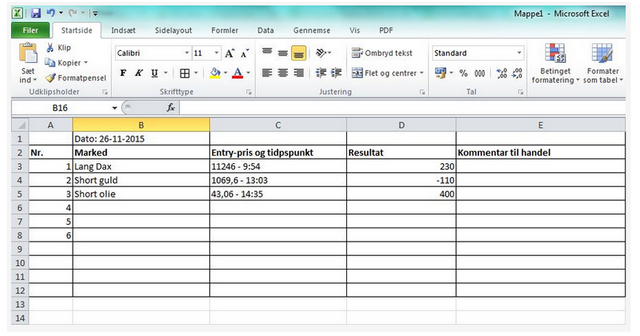

If you want to be really good at daytrade you have to learn from its mistakes and to do it in the most effective way, you must keep a record of all the trades you take. Such a log should be constructed as simple as possible, otherwise many will tend not to get it done.

Below is an example of how a simple log of trades could look. For example, you can create your log as an Excel sheet, or as a Google Doc. The latter has the advantage of accessing the document from several different computers.

Example below

In this trade log, I have tried to make the log as simple as possible, as it should not be too hard to do - because you will not get it done. It may make sense to supplement the log by taking a screen dump of each trade and saving them in a single folder, with a folder for each day. On each screendump you can possibly. draw an arrow that indicates where you went into trading, long or short. If you use screendumps, you may want to omit column C in the above trade-log, which is primarily included in order to find back to the specific trade.

Column D indicates profit or loss on each trade. You can either choose to calculate it in kroner or in points. And in column E, you write a short comment on the deal. Here you should note why you went shopping if you kept up to its strategy, and possibly what could have done better. You can choose to analyze the trades during the day, but we also recommend spending half an hour at the end of the day and go through all the trades. This time is good.

It takes 2-3 minutes to log a trade and take a screen pump. Some may think that it will run out for a lot of time all in all, but time will be well-done. Often it's a good idea to have a short break between your trades, so do not just pass on an adrenaline bus from one trade to another and the trading log gives you a good opportunity to get a little break between the trades .

10. Do not be too short-term - or long term

You've probably heard of daytraders like in seconds and minutes get big wins. This is a discipline of daytrading called scalping. Over time, there have been many daytraders who have been successful with this, but as a rule, we do not recommend focusing too much on the ultra-short trades.

Looking at 1- or 2-minute graphs of, for example, the DAX index, they will often be characterized by a lot of noise and a relatively high degree of coincidence, which makes it much more difficult to earn money in the market. Therefore, we recommend strategies that have slightly larger goals and stops than the very short scalping trades with stops and targets of, for example, 7-10 points in the DAX index. The reason for this is that these fluctuations are within the normal "noise" as it is in the price, which means that the outcome of the trades will be almost random or 50-50. Having a focus on trades that are not ultra-short makes it a little easier to achieve good results in the current markets.

Conversely, there may also be a risk of keeping geared positions for a long time, for example over several days. The longer time you are exposed to the market, the more one's trades tend to be affected by random events. If you hold a position over the weekend, news throughout the weekend can affect the market so that the market can open somewhere else Monday morning than it closed Friday night. Therefore, you should be able to control stops and loose if you trade over a longer time horizon with geared positions.

11. Trade by following the trend

Many new daytraders and investors tend to find a bottom or top in the market and then act in the opposite direction. Even routine traders do this at times. Generally speaking, it's a dangerous strategy to try to predict turns, and if you're not particularly well-trained, you should stay away from it and instead focus on strategies that deal with the trend.

For example, let's imagine that the price of gold has gone down all day. Humanly, one would tend to think that gold is now cheap and that there is an opportunity to buy. In practice, however, one will find that the trend often continues far beyond what was expected. Because when the price has gone down all day and continues downwards, one has scared the big buyers well and thoroughly away, and it gives a self-reinforcing effect.

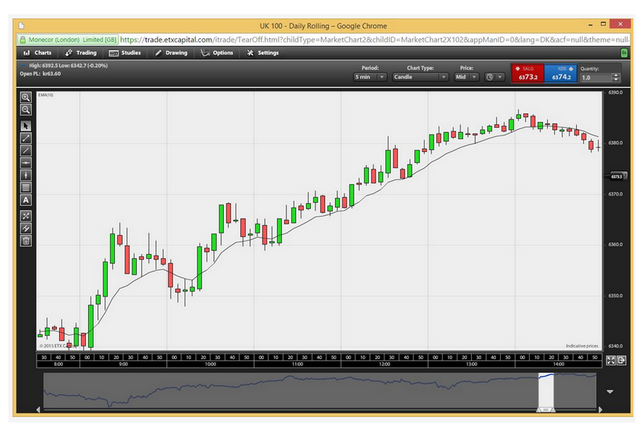

You can use moving averages to get a good picture of the trend in the market. Here the English FTSE index is displayed with an exponentially moving average with a period of 10. In general, it is a good rule not to act against the trend. To get the best possible picture of the market, you can experiment a little with different moving averages, and possibly. Have two different moving averages on their chart.

12. Be good at changing your opinion and and direction

A typical way that daytraders lose money is that they go into the day with a firm idea of what the market is going on on a particular day. They may think that the DAX index is on its way up, so they go long, lose first trade, go long and lose once more, and may lose three times before they see that the market is actually running with the completely opposite movement of what they were counting on. Good traders obviously have a lot of attitudes to where the market is going, but what separates them from more inexperienced traders is that they can change their minds and change their views on the markets in a few seconds. Normally you do not consider changing your mind fast as something positive, but it is so much in daytrading.

13. Find a trading buddy

On the social media there is a lot of debate about trading and shares. You can quickly tear up and get to receive some of the tips that are being given or copy trades from others. We would recommend focusing on analyzing and acting, rather than copying others' trades or advice. If you want to use social media - and that may make sense - we primarily recommend using it to search for trading information. Eg. to ask others for technical analysis, indicators, and so on - and to a lesser extent to discuss and follow other people's concrete actions. In general, we would therefore recommend using social media in ways and instead be focused on trade while the market is open. We can also recommend finding a trading buddy - preferably one that you can put together and discuss strategies and specific deals. A good trading buddy can also help stop you if you suddenly become insane.

14. Analyze the market on several time horizons

As a trader, it is important to be aware of the slightly larger trends in the market. Even though you are trading on a 5-minute graph, it also makes sense to know the development on a daily graph and a medium graph such as a 1-hour graph. This gives you a better sense of where the market overall is heading, and you will also get a better overview of trends on the different time horizons.

15. Do not chase the market

Many beginners may tend to "chase" the market - ie to "chase" the market. Typically, the market is moving strongly in a certain direction. You are sitting now and regret that you did not come along. The market may have risen 50 points, and you could have won a win if you had been with. You are now late into trading to try to get a little profit out of the move. Unfortunately, it happens often at the time when the market either begins to move sideways or go in the opposite direction.

A good advice is not to tear away from the wild dams and take impulse decisions, based on one's own intuition about where the market is going. It is a strategy that will fail with almost 100 percent security. Instead, you should turn cold in the blood, possibly take a break and wait for the next trade opportunity to occur. There are lots of opportunities during a trading day, and it takes good patience to wait for the right opportunities. But if you can, you're one step closer to turning a profit surplus.

Nice read. Good tips will definitely help lots of traders out there including myself. Thumbs up

Thank you @kimutai