5 psychological phenomena that could hinder the profit of traders and investors

Are you a new trader/investor? Here is the list of psychology biases that could hinder your profit.

Confirmation bias: Confirmation bias is a term describing a psychological phenomenon when a person accepts information only confirming their own belief or hypotheses. How does this bias affect traders/investors performance? Each TA trader has their own method to find the entry and exit point. Each method can be created according to the experiences each trader has. Some traders may have odd methods which may not be accepted by other TA traders. however, they work for them. On a side note, professional trader is the one who always looks out for new methods to test and evaluate the pros and cons of their method. Therefore, we recommend you to learn as much as you can while trading and investing.

https://cdn-images-1.medium.com/max/2000/0*GRN9nrtNQSD8K9LB

- Outcome bias: a bias that describes a person’s mindset who prefers evaluating the decision based on the outcome rather than the process. This bias can affect significantly the trader. Especially when they are overconfident in their trading abilities. In crypto market, it’s hard to predict the direction of Bitcoin. The price gap between each pump and each dump is so huge that a newbie can even take themselves as a genius if they happened to buy BTC the day before the pump. Hence, it is recommended to assess your own decision whatever the outcome is. You need to evaluate the risks, the mistakes, the errors that you have taken/made and evaluate how it affects the result.

https://cdn-images-1.medium.com/max/1600/0*jPdktnOj7JTVzoal

- Information bias: a cognitive bias which makes people seek more information, although not affecting the actions. To traders, using different indicators is a good way of identifying the trend of BTC. However, some indicators have very high accuracy to identify the trend such as MACD, Stochastic and RSI which could make other indicators become irrelevant in making long/short decision. Additionally, using too many indicators can exhaust your brain and it could affect your thinking. Therefore, we recommend you to build your own trading and investing method and filter out “noise”.

https://cdn-images-1.medium.com/max/1600/0*l6wyfzn-MTrSqU5-

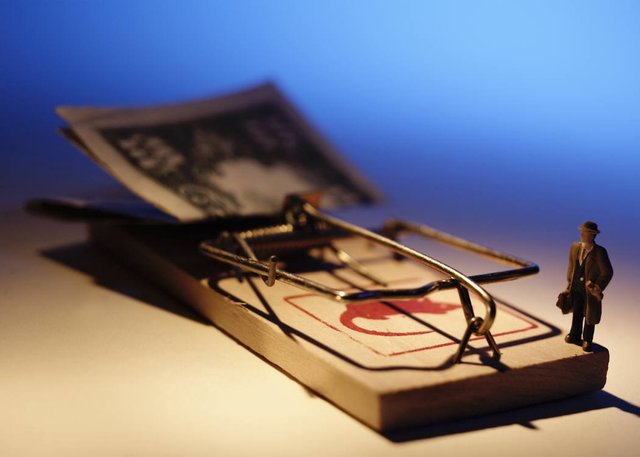

- Choice-supportive bias: choice-supportive bias is a phenomenon where a person feels positive about their choice despite its flaws. Example: Bitconnect is a good coin, you can earn 40% of your money just by inviting your friends, your social circle, etc. The more you invite, the greater your profit. The day after you bought Bitconnect, the price went up. You feel good about what you bought and decide to hodl it. In fact, Bitconnect is just a ponzi scheme. If you had decided to hodl for more than a year then you would probably have gone bankrupt. On Jan 14th, 2018, a single Bitconnect coin worth ~300 dollars. Three day later, it dropped ~88% of its value which is ~35 dollars! At this point, no one would be happy about their initial decision. Thus, we recommend you to #DYOR without biased thinking.

https://cdn-images-1.medium.com/max/1600/0*OSBn5LwHB5ZmwSFK

- Loss aversion: loss aversion is a psychological state of subject where the investor tends to avoid losses but prefers to acquire equivalent gains. A simple example: A trader would rather set their sell target as high as they want but not their stop loss. They love that pleasure from gaining but hate the feeling seeing their stop loss triggered. Having tight stop loss is a good strategy to minimise the risk. However, there have been some cases like this: a trader sets their stop loss at 99 sat, the coin drops down to 98 sats then bounces back immediately! At this moment, a lot of new traders will let the emotion control their mind rather than their brain, which could make them lose even more than before. Therefore, never let your emotion control your action!

https://cdn-images-1.medium.com/max/1600/0*sOKDzgyWrmAPadlf

Those are our top 5 psychological phenomena that could affect the result of traders and investors.

What do you think about these phenomena? Let’s us know in the comment section.

For the best crypto education join: https://t.me/cryptomedics

Disclaimer: information provided by @cryptomedics does not constitute as investment advice, financial advice, trading advice, or any other sort of advice, and you should not treat any of the website’s content as such. Do conduct your own due diligence and always do your own research before investing. If you like our content, show us some love, upvote, resteeem it and join our Telegram Discussion or the Main CryptoMedics Channel.

Congratulations @cryptomedics! You have completed the following achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

SteemitBoard and the Veterans on Steemit - The First Community Badge.

Resteemed your article. This article was resteemed because you are part of the New Steemians project. You can learn more about it here: https://steemit.com/introduceyourself/@gaman/new-steemians-project-launch