How to safely short Bitcoin

Bitcoin (BTC) has been all the rage lately, but if you have used it or researched it, the logical conclusion is that, “Bitcoin is overvalued relative to other useful blockchains”.

Few facts about Bitcoin:

- Slow and costly to send transactions

- Not much useful development

- Volatile

- LN (Lightning Network) is not helping with transaction congestion

- segwit + 1MB block cap (4MB but it never hardly gets past 1.3MB) have proven ineffective in periods of high volatility

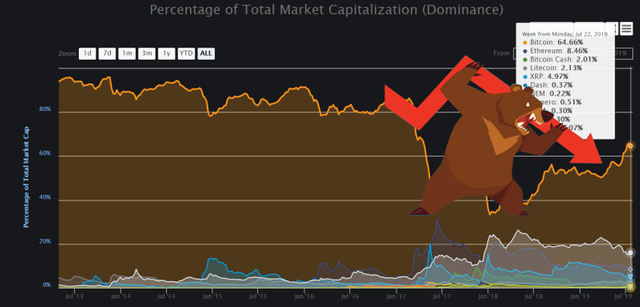

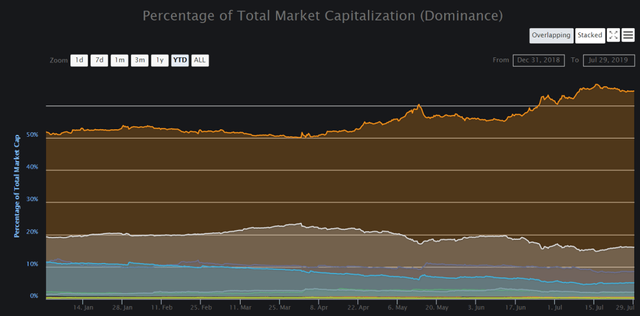

Besides slow, expensive, and overly secure transactions, I have yet to see another useful Bitcoin service. But, defying all of these information, Bitcoin’s market cap continues to rise and dominate!!

Besides slow, expensive, and overly secure transactions, I have yet to see another useful Bitcoin service. But, defying all of these information, Bitcoin’s market cap continues to rise and dominate!!

So, now, more than ever, is the time to sell overvalued BTC into undervalued useful altcoins such as ETH, BCH, EOS, MKR, and arguably a few other good ones. And a long term set interest rate Bitcoin loan is one of the safest tools to make this trade.

How to Short BTC / Altcoins safely

A famous quote:

“Markets can remain irrational longer than you can remain liquid”– John Maynard Keynes

Keeping the above quote in mind, it’s important to take this trade on with ample caution. And, in order to be conservative and cautious, it’s important to find the right tools for the trade.

Below is a comparison of the tools available for this task. `

Margin lending, High Volume but Risky way

The most popular and high volume way to do this trade would be margin lending. The process for doing this trade is pretty simple.

- Deposit collateral

Deposit in the form of USDT, BTC, or other supported altcoins into a margin lending exchange. - Then short sell BTC on margin.

This amounts to borrowing BTC against your collateral, than selling that BTC for another asset (likely USD). If your short is a success you can buy back the BTC you borrowed at a lower price later and keep the profits.

While margin lending is the most liquid and possibly the easiest way to short BTC, there are some drawbacks…

- Margin Call.

First is the risk of getting margin called and selling the bottom. This happens if your collateral falls below a certain threshold where you no longer have sufficient collateral, so it’s sold off in a market order. With cryptocurrencies history of “flash crashes” this should be a significant concern when trading on margin.

- Unpredictable Funding Rates.

Another downfall of margin lending is unpredictable funding rates. This is less of a concern, but if you are not a day trader and trading a long term trend, this can add up quickly and become quite expensive.

During periods of high volatility or some sort of exchange risk, funding rates have gone up as high as 5%/day or (1852% APR). This of course was an exception, but even 100% APR for a few days can quickly make a decent trade unprofitable.

- Bitcoin Loans, a Safer Alternative

Arguably the safest way to make a long term short position on Bitcoin is with a Bitcoin loan. There are a few different places you can get a Bitcoin loan. Some are centralized, and some new ones are relatively decentralized like WBTC loans using Ethereum network.The oldest type of Bitcoin loan is P2P. Due to Bitcoin’s nature as a P2P money, when it comes to getting a Bitcoin loan, P2P Bitcoin banking is a natural fit. Users keep control of their BTC and don’t turn it over to a banker like traditional banking models.

Btcpop.co is the oldest P2P cryptocurrency lending platform. Btcpop has a P2P market where depositors choose on a case by case basis whether the risk/reward proposal is sufficient to fund your loan. - Set your own terms

The main benefit of taking out a Bitcoin loan to short Bitcoin is the ability to have stable set terms and a predictable interest rate. For example, if you are trading the long term BTC/ETH pair and have a time preference of years instead of weeks or months for the trade. Almost every investor would advise on not holding a margin position for longer than days/weeks. But, a Bitcoin loan is different and can be held safely a lot longer.

Short BTC to go Long (Buy) Other Coins

Bitcoin loans offer a method of shorting the Bitcoin price against other assets. For example, if you are very bullish on EOS and Bearish on BTC you can satisfy both investments with one trade.

- Take out a Bitcoin loan.

- Use that Bitcoin to buy EOS in the common EOS/BTC trading pair.

At the time of writing EOS/BTC price is .00044 BTC which is historically low

2 times EOS has rallied up to around .0011 BTC or higher from around the .00044 BTC price, which is a potential 250%+ gain. If this fits your risk reward tolerance and your willing to wait months for a larger cycle like this a multiple month. Bitcoin loan would be a lot safer than margin lending for that length of time.

This can of course be done for nearly any other cryptocurrency as BTC is a base trading pair for almost all of them. BCH, ETH, MKR, you name it they are all approaching or at historic lows relative to BTC.

Short BTC by Selling it to Fiat/Stablecoins

If you think the BTC price is too high relative to the USD, you can take a loan for BTC, withdraw the BTC to sell for USD on another exchange, and then buy back the BTC later (hopefully at a lower price) to make your loan payments.

This is slightly riskier in the sense that USD is completely uncorrelated with BTC unlike altcoins. And History has shown that BTC/USD moves in massive volatile cycles and if you get on the wrong side of one, it could get expensive very quickly.

However, there are times like back when BTC was $20k that shorting BTC regardless of the risks can be very profitable. And if you don’t want to be margin called, a Bitcoin loan could be the safter long term trade option for you.

A BTC loan is beneficial in the long term trade because your funds won’t be liquidated so long as you keep up on your payments. For example if you shorted BTC at 15k in December 2017 on margin, you would have likely gotten liquidated when BTC shot up to 20k.

However, if you took a Bitcoin loan, you would have only had to make a couple payments while your trade was underwater, and then by January of 2018 your trade would have been back in profit and you never risked getting liquidated during this period..

Derivative trading, Most Risky

The last way to short BTC, and one of the most popular is to do it on a derivative platform such as Bitmex or Deribit. While these platforms are the most liquid place to trade and you can move massive volumes through them, they do hold unseen risk as there is no actual BTC being traded.

Practice Caution

None of the information above constitutes financial advice.

Trading on leverage (taking out loans) especially with cryptocurrency is a very risky endeavor. While the profits can be enormous, the losses can be severe and instant.

This article is for informational purposes to share Bitcoin loans as a potentially safer alternative to getting (Rekt) or liquidated margin trading on an exchange.