(Draft) In 10 Years the Worlds Largest Bank will have no Bankers

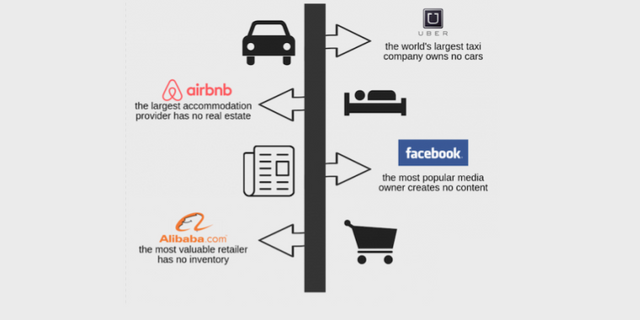

The P2P Age is upon us. The world's largest Taxi company doesn’t have any taxi’s. The world's largest hotel company doesn’t have any hotels. And as we move ever forward my claim is that

My Claim: In 10 years the World's largest Bank will not have any bankers.

Today in 2018 this claim seems crazy and unlikely. But, the same claim probably seemed seemed just as crazy and unlikely for Airbnb in 2008 and Uber in 2009. A decade after their creation, these companies stand on top as the largest in the world by a significant margin.

Through ups and downs and no shortage of controversy, these companies were able to create a working P2P system. And their extremely rapid growth can be attributed to their ability to harness the efficiency and scalability of peer to peer thinking.

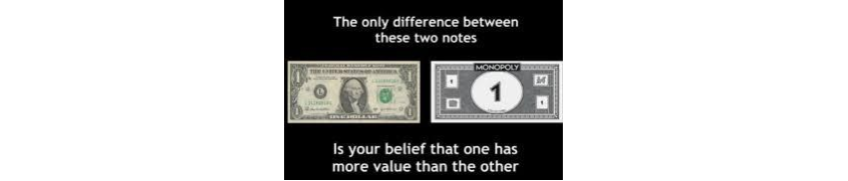

My claim is not for fiat money

.png)

Before you stop reading I want to assure you that I am not going to try and claim that JP Morgan Chase and its $2.53 Trillion of assets is going to be surpassed by P2P “Bankbnb” in around 10 years. There are many reasons for this and I likely agree with your arguments. But, I do not take back my claim that in 10 years the world's largest bank will not have any bankers. This I still believe will hold true. But, it requires some further explanation and defense.

First vocabulary-

Bank as used literally in my claim

- Bank: A financial establishment that invests money deposited by customers, pays it out when required, makes loans at interest, and exchanges currency.

Notice in this description there is no mention of creating money out of thin air via fractional reserve banking (JP Morgan type banks do this) or printing fiat money (Central Banks do this). Those things are not included in my claim.

I will concede that both of those institutions fall under the term “Bank”. But from a strict interpretation of Bank-“that invests money deposited by customers” I believe they should be categorized differently as they create money out of thin air allowing them to invest nearly 10x the money that was deposited by customers.

Money: a medium of exchange that facilitates trade in goods and services.

Notice: real money like Gold or Bitcoin are not printed out of thin airFiat: a formal authorization or proposition; a decree.

- Fiat Money: “Money by decree” or money only because the government says its money using laws and violence to force its acceptance as money.

Don’t get me wrong fiat money is very real money. Even though its printed out of thin air and is not backed by anything. Almost all people in the world accept it(by force) as money. And because of this, it is actually a very liquid and usable money.

One could make the argument that my claim should be “The world's largest non-fiat bank will not have any bankers”. But in my bank definition above, there is nothing about printing money out of thin air. So I would argue that current banks should be called fractional reserve banks which cannot be directly compared to the bank in my claim.

- Central Bank: a national bank that provides financial and banking services for its country's government and commercial banking system, as well as implementing the government's monetary policy and issuing currency.

.png)

Notice: Central Banks are not banks by strict interpretation of the above definition. They get print their own fiat money and do not have any customer deposits to invest or earn interest on. So they are more of a government printing press and not included in my claim.

Fractional reserve banking: A banking system in which only a fraction of bank deposits are backed by actual cash on hand and are available for withdrawal.

“Printing Money out of Thin Air”- definition by examples

- Example #1 Central Banking: Paper bills are printed on large printing machines and deemed money mystical power called government. Paper printed in in a special way with nothing backing it is not money for no other reason than some people in suits tell you.

.png)

- Example #2 Central Banking: Digital numbers which are created on the same ledgers as the printed paper given to commercial banks or governments to lend or spend. Ex. Congress passes bill to create $3 Trillion digital dollars out of nowhere to send to commercial banks ledgers to pay bills to their war vendors.

.png)

- Example #3 Fractional Reserve Banking: Bob deposits $100 into his bank. The Bank keeps $10 in reserve and lends out $90 to Janice. Janice buys $90 Groceries from Bob. Bob deposits $90 in the bank. The bank lends $81 to Janice…. In short a $100 deposit is turned into approximately $1,000 through lending and deposits. $900 of them dollars are created out of thin air via the banking system.

.png)

All sarcasm aside, a proper description of fiat money and central banking cannot be described in this post. If you are interested in the subject (and you should be because most people spend their whole life working for fiat money) I recommend “The Creature From Jekyll Island” by Edward Griffin and economics articles from FEE.org.

Fiat Cryptocurrencies are not included in my claim

Cryptocurrency has been touted by many as the “money of the future” and by others “a ponzi scheme”. But, regardless how you feel about it, at the end of the day cryptocurrency is as real of money as anything. It has the qualities of good money like gold, and the potential to become even more easy to use and efficient than fiat.

Cryptocurrency is a very general term that covers the spectrum of digital assets. And these assets fall on a spectrum centralized and decentralized. There are decentralized cryptocurrencies like Bitcoin(BCH) built on free market competition of miners. Then their are cryptocurrencies like Ripple, created out of thin air all at once and distributed by a centralized company. For the sake of this article I am going to call all the current cryptocurrencies P2P, as for the most part they can all be used by 2 parties without a trusted 3rd party.

There will eventually be fiat cryptocurrencies to utilize the superior technology of the blockchain. But, they will not be P2P or decentralized. Central banks and governments will control them, so they will just be a updated version of fiat banks and not included in my claim.

P2P Cryptocurrencies are the future

.png)

You guessed it, P2P cryptocurrencies like Bitcoin (BCH) are essential to my claim and the currency of the worlds largest bank without bankers. I would encourage you to do your own research on why P2P cryptocurrencies are the future. Equal in research to why cryptocurrency is the future, is why fiat money is doomed for failure. To be short, every fiat money of the past has failed. And every fiat money of today will fail because of the good old expression “you can’t make something out of nothing”.

P2P Banking with P2P Cryptocurrencies

Finally I get to why and how in 10 years the world's largest bank will not have any bankers.

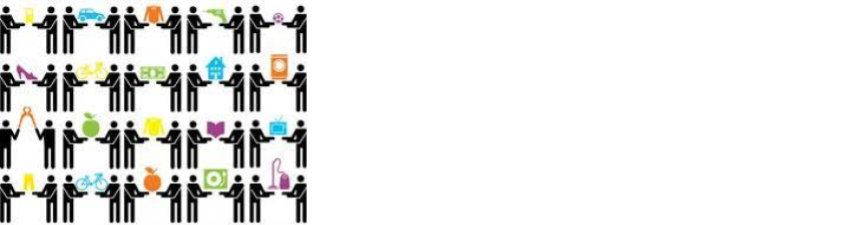

The key is Peer to Peer Thinking. P2P Banking will happen just like Uber and P2P ridesharing, and Airbnb with P2P short term housing. P2P thinking does not need to be very complex. Uber just connects a person with a car and time, to a person who wants a ride. Airbnb provides a easy platform and model for people to rent out their real estate on a short term basis. P2P banking will just connect people with money, to people that want to lend it. No banker necessary.

Peer to Peer Thinking

All P2P companies fit generally into this same line of thought.

My company (company name) creates a technology platform to connect people with Valuable idle asset that want to provide value provided for compensation from people that desire (Desired service) .

Company Name Uber Airbnb

Valuable Idle Asset Car real estate

Value provided Time+driving Housekeeping/Hosting

Desired Service Transportation short term housing

For a Peer to Peer Bank simply fill in the blanks:

My Company _Btcpop creates a technology platform to connect people with _Cryptocurrency holdings that want to provide Time Value of Money for compensation to people that desire borrowing cryptocurrency.

These type of companies are able to become the biggest in the world in a short amount of time because they are built to scale. At their base, they are just a system and way of thinking. Besides a website or app, very little infrastructure is needed. All the infrastructure already exists in the hands of the service providers, P2P companies just provide a way for them to utilize and profit off their assets by connecting them with customers.

.png)

Banking with Bitcoin (and other cryptocurrencies)

“Banking with Bitcoin” is a bit of a contradiction. Bitcoin has long been touted as a P2P currency that doesn’t need banks. And it's true, you don’t need a bank to use Bitcoin. However, there will still always be a need for banking or financing.

This topic can go quite in depth. But at a high level the 5 basic services of a bank today are:

.png)

- Provide High Security at a Low Cost

- Make Money Digital and Easier to use

- Pay interest on deposits by lending them out to earn interest

- Provides Credit to Borrowers

- Interest Bearing Savings Accounts

Banking with Bitcoin instantly cuts out the first 2 services a bank provides

- Banks provide high security at a low cost to customers by spreading out the cost of vaults and security personnel through its services. Bitcoin on the other hand digitally achieves a much higher level of security at almost no cost at all.

- Bitcoin is already digital and easy to use, so a bank provides no value here.

This is where Banking with Bitcoin intersects with “normal banking”. Services 3-5 still need to be provided in a Bitcoin economy, But the issue of trust and ownership makes this part difficult with Bitcoin.

When you own the private keys of Bitcoin, you own it 100%. Practically nobody else in the world can take this Bitcoin from you. So if funds were given to a bank like in the fiat world. The bank and any banker would 100% own the Bitcoin. Sure laws or sueing people can help you try and get your Bitcoin back, but the protocol doesn’t care and if the Bitcoin are gone they are not coming back.

P2P Solution

So the simple solution to giving up your Bitcoin is to not give them up. By being your own bank and Banker, you get to remain in control of your Bitcoin the whole time. So if you want to invest your Bitcoin, you can. If you want to borrow Bitcoin leveraging your reputation/collateral, you can. If you want to just leave it in a savings account and earn low interest while Btcpop takes on default risk lending it out, you can.

The P2P Bitcoin Banking industry is extremely young. But, the infrastructure already exists, all that needs to be done is connecting the people.

Time will Tell

In the end one can speculate all they want about the future but nobody knows anything for certain. It could take cryptocurrency the whole 10 years just to get reasonable adoption. Which would make it impossible for the largest bank in the world to be bankerless.

However, the precedents are set, and Peer-to-Peer commerce has a proven track record of success and scalability. P2P money is a natural segway into P2P banking, and cryptocurrency adoption so far has been staggering. So my bet is set, and I am very bullish on time tested and proven systems like that of Btcpop.co will enable Bitcoin users to be their own bank and banker.

This already exists :)

https://www.mirror.co.uk/news/world-news/robots-greet-customers-worlds-first-12417793

Just kidding. I hope P2P takes over but as we see time and time again the problem is random people do not payback obligations if they can get away with it. Banks at least report defaults to the credit rating agencies so that negative consequence has to come into P2P lending for it to be a success long term (especially for unsecured credit).

yeah I agree, but I believe a rating system will materialize and when online reputation becomes valuable and necessary it will be protected at a credit score is....will just take time