A Recession Indicator Flashed For The First Time Since 2007 Today

As of today, a key indicator for a coming recession has flashed.

The 10 month US Treasury yields have fallen lower than the 2 month's today. There is a lot of chatter in the financial news channels about this occurrence due to its long proven indication of the "R word"..Recession.

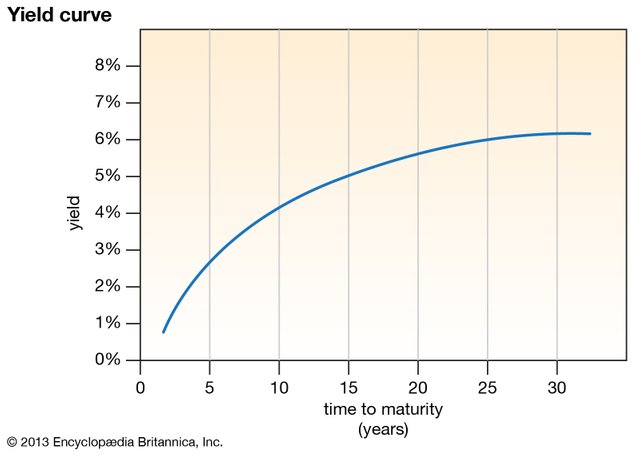

I am not an economist by any stretch of the imagination. However, I do understand the widely accepted idea of holding government debt as a safe bet, for a return on money, when its issued from one of the strongest countries on the planet. This dynamic is called the US Treasury Bond market. Economists use the Bond market to measure the health of the economy. When there is a healthy growing economy, then longer termed U.S. Treasuries will be less in demand, for their last perceived security and reliability, due to project growth of the economy. Therefore, the yield of these longer termed U.S. Treasures will begin increasingly level off. On the other end, the shorter termed U.S. Treasuries will look more attractive for investors who do not want have their cash locked in a Treasury in a growing economy. This ideal is graphed in a "healthy" Yield curve chart below.

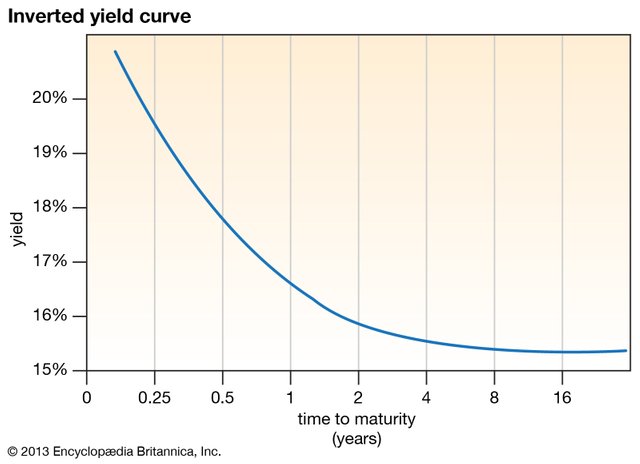

Typically as global growth weakens, more and more of these treasuries are being sought out, by investors, for whatever fixed income they can generate over time. Once this migration into 10 year termed Treasuries becomes much greater than the shorter termed 2 year treasuries, it signals a high probability of a coming recession. It has been ordained that a key indicator for recession is an inversion of the 2 year and 10 year yield curve from the previous chart. The chart below shows an inverted 2 -10 year yield curve.

This signal has been looming for sometime and has finally manifested itself. I believe the U.S. President, Donald Trump, understood this-which prompted him to put a hold on additional tariffs on China. Also, maybe why he has pushed strongly pushed for the Federal Reserve to instate Quantitative Easing to boost economic growth and save the curve from inversion. No matter the speculative politics, we are here now and I suspect the drastic measures to be taken next month when the Federal Reserve makes the likely decision to begin Quantitative easing by printing money to bail in, bail out to get consumers borrowing and spending money up to our ears. However, easing can only occur with the Federal Reserve lowering the yields by increasing the money supply. This could unwind a proposal of extreme measure to go towards negative yielding rates if they deem fit to keep things from slowing down. This has been forecasted by Pimco, an investment firm.

Now that the signal is clear, the next move by The Government and Federal Reserve would likely have to be swift and extreme at this point. What do you think?

If you enjoyed this blog, please share and upvote. Do your part and get this information out to help others. God Bless.

- Dewon Trades

Congratulations @dewontrades1! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!