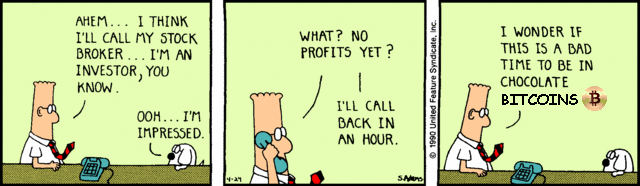

How to hedge your risks in a shaky crypto market?

If you have been following cryptocurrency market this weekend, you know it's been a rollercoaster ride and if you're like me, you've experienced more emotions than from binge watching last season of GoT in one go! Just kidding. The current situation with BTC and the competing BCH is not funny though. There is a lot of uncertainty about what is going to follow. The past few days have been quite exhausting.

Here you are, content with yourself by having part of your portfolio in ‘safe’ positions (ie. Bitcoin), seeing beautiful gains over the past few months and perhaps you have even started to encourage your family and friends to join you on this exciting journey (cough, myself). Then comes Saturday, 11th of November and you start getting a bit concerned.

As someone who is actively participating in the cryptocurrency market you might be wondering: “What can I do to minimize the risk of my portfolio and position myself in a best possible way that will be more resistant to market fluctuations?”

Funny enough I think, as much as this weekend has given us a bit of a problem, it has incidentally pointed out the solution as well.

Well, you will know that part of the success behind BCH move this weekend was due to the support of miners and transition of the hashrate power across to the BCH network, see the hashrate chart from fork.lol

This was a purely opportunistic move by miners. As the difficulty in the Bitcoin network kept raising, due to more and more miners competing for blocks, it was less profitable for an average miner to support Bitcoin mining. This is because Bitcoin’s difficulty adjusts to ensure those blocks are found roughly every 10 minutes. By switching over to Bitcoin Cash, miners will receive bigger rewards, as BCH difficulty is less than BTC right now. This will also mean that the difficulty of Bitcoin will adjust down with time and those miners who remained will see an improvement.

The important thing to note is that the mining power is transferrable. You can mine coin X but also coin Y. Isn’t that great?

Hang on, are you really saying ‘mining’ is the answer? Are you crazy? Everybody knows that it’s too difficult to mine Bitcoin these days.

Well, is it? We know for sure that for an individual, mining at home is still technically possible but if you can’t generate enough hashing power, it will cost you more to run your infrastructure than you will be able to earn. This article breaks it down really nicely.

However, there are other mining options available at your disposal that you should consider, as they can help you protect yourself from situation like the one this past weekend, where you were left with little control, not really able to do much even if you wanted to (I'm referring to the 200k transaction queue for Bitcoin). I will cover them in my next post.