As Bitcoin Breaks All-Time Highs Near $18,000 Its Future Has Never Been So Uncertain

Bitcoin has yet again hit another all-time high today of $17,645.89 on the Coindesk Price Index.

Yet, while much of the traditional financial world are piling into bitcoin, the direction of bitcoin has perhaps never been so unsure.

I’ve posited my conspiracy theory of how Blockstream and others may have surreptitiously hijacked bitcoin. But, whether that is the case or not, one thing is absolutely for sure; Bitcoin has changed dramatically in the last year from its initial intention and objectives as outlined by Satoshi’s white paper.

The title of the white paper itself, after all, was “Bitcoin: A Peer-to-Peer Electronic Cash System.”

And, now, according to many of the Bitcoin Core developers, bitcoin’s objective is no longer to be an electronic cash system.

This is a massive change that seems to have gone unnoticed or unchallenged by most. Yet, it could potentially mean the death of bitcoin.

Many of bitcoin’s detractors like to point out that bitcoin has no intrinsic value. Of course, nothing has intrinsic value, so they are making a non-argument from the get-go.

But, when pointing out why bitcoin has subjective value, some of the main points were:

1.)It is a digital cash that facilitates transactions perfect for the digital age

2.)It is cheaper to use than traditional cash and transfer systems

3.)It is faster than traditional cash and transfer systems

Now, with the direction Bitcoin Core is taking bitcoin, none of those points are fully true any longer.

But, all of those points would still be true if the bitcoin block size was just increased from 1mb to 8mb.

As a reminder, 1mb is less than what was held on this archaic storage medium from the 1980s.

Bitcoin Cash forked from Bitcoin on August 1st in a dispute that the block size would fix the speed and cost problems associated with bitcoin’s growth. And, it has been partially proven right. Bitcoin Cash transaction fees, on average, cost less than $0.20 USD while the average bitcoin transaction fee sits over 100x higher around $21 USD and bitcoin cash confirmations take on average 8.5 minutes while bitcoin confirmations take at least an hour on average. Plus Bitcoin Cash can do roughly 31 transactions per second while bitcoin can only do between 4-8 per second even with Segwit.

Yet, Bitcoin Core proponents say that increasing from the ludicrously tiny 1mb to 8mb is too dangerous!

Instead, they have created an entire mishmash of very convoluted and complicated side chains that, so far, have not fixed the cost and speed problems.

And, that is assuming they even want to fix those problems. According to many Core developers, they think high transaction fees are a good thing and show the value of the network.

When pushed and asked when or how bitcoin will ever be usable in day-to-day transactions in the future, the answer is always “the lightning network” and the estimated time of arrival is always, “we don’t know.”

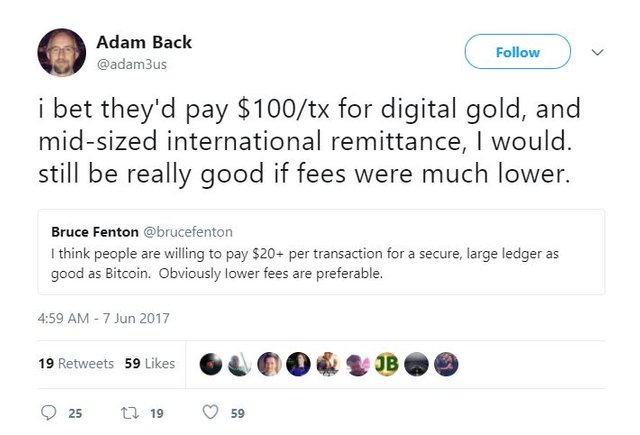

Here is one of Bitcoin Core’s top developers, Adam Back’s, answer to that very question:

"So I mean for today, you could have, some bitcoin business have a tab, so you pay them and you work your tab there and presumably you can cash your tab out if you don't use it. If you have repeat custom... or maybe the shops in the local area could make a shared tab or something in anticipation of... you know somebody in the local area ... technology expert could make a local bitcoin tab that's interoperable between the shops and some sort of app to do it."

Yes, that was his answer. And, scarily, he did not appear to be massively intoxicated. That was his sober answer… that maybe, in the future, you can get a bitcoin tab at your local shop if someone creates the technology so that you can use bitcoin to maybe buy things. Maybe.

In the meantime, bitcoin is the DMV of cryptos. Long lines waiting to pay expensive fees and a lot of frustration.

In fact, if bitcoin isn’t and doesn’t have a plan to be used as digital cash then it really shouldn’t even be called a cryptocurrency… because it is missing the “currency” part.

And, even if the lightning network does come to Segwit bitcoin there are a lot of questions about just how it would function.

This video does a good job of explaining some of the issues:

And, while we wait, unconfirmed transactions continue to pile up. You can see the list in real time here . It is currently over 150,000 transactions that are in the queue waiting.

And, across the world, businesses based on bitcoin being usable as a currency are either going out of business or having major problems.

This week I had the opportunity to interview Amaury Sechet, the lead developer of Bitcoin Cash about all these issues. You can see it here:

Both Roger Ver and Amaury Sechet will be speakers at the upcoming Cryptopulco conference at Anarchapulco in February.

As well, to ensure fairness, Bitcoin Core proponent, Trace Mayer and Bitcoin Core developer Jimmy Song will also be speaking at the event.

Discussions could get heated. And rightfully so. The stakes have never been higher.

Bitcoin worked 10x better a few years ago when it was 10x cheaper. I think it has the huge advantage of first mover and the idea that has been engrained in everyones minds from the beginning. A lot of value can also be seen in the fact that all other cryptos are pegged against its price and that you can't buy many of the cryptos out there unless you already own some BTC.

Whenever I transfer any sort of crypto I always convert it to BCC or XRP, no point in waiting hours r possibly days for a transaction which also costs exorbitant amounts. This greed by core developers could lead to its demise if they are not proactive, because you know there are lots of other coins out there just waiting for the opportunity to dethrone BTC

I thought "buy the bottom" was a euphemism for having sex.

I totally agree to your point @jasonshick. Bitcoin became incapable of being a cash transaction currency and moreover, it is used as a tool for making money. I am damn sure it will be replaced by other cryptocurrencies. Nowadays ether is also used as a tool to make money.!!!

I plan to HODL mine until it is so mainstream that it is a currency.

spot on Jeff. I'm grateful to Bitcoin for the profits but I lost faith in it long term.

Great to hear BitcoinCash will have a privacy feature. My favourite coin at the moment is Monero.

Bitcoin is already outdated technology, that is being used as an object for speculation, instead buy the coins I recommend:

EOS (Long term)

Steem (Now)

Bitshares (Now)

Bitconnect (short term)

Follow me here for the best free crypto advise: @lasseehlers

EOS is my next endeavor right now. I see this one really becoming a force in 2018.

Yes, Bitcoin is outdated. And I also think EOS will be next big player in 2018.

It was also outdated a month ago, but speculators don't seem to care.

I'm a programmer working with the bitcoin github code and haven't seen anything that could compromise security or allow it to be co-opted by the banks. Now the most serious issue would be that maybe Blockstream is sabotaging the scaling debate deliberately to destroy bitcoin. All I can say is that as a programmer 8 MB is a short term solution to a larger problem. I agree with you that larger block size isn't really much of an issue as long as SHA256 gets it's difficulty adjustment for the nonce.

The real issue is that there really is a better way to do encrypted anonymous transactions using bitcoin. Whether they can deliver or not is up to the market to decide. I recently debunked a different conspiracy that bitcoin is a deep state psy-op by Catherine Austin Fitts. These conspiracies will start flying fast and furious over the next couple of years. The best way to know is to dive into the code which is open source.

Here's an excellent video that explains the issues. Can we suspect that Andreas Antonopoulos to be a deep state operative or is he really explaining the technical issues?

I think the video explaining the Lightning Network above should be put to Andreas Antonopoulos point blank. I'd like to see what he has to say.

Yeah really, we only accept 10,000% profit or higher... anything less is just err... 'coffee beans'

I've heard it was a deep state psyop also, and ran by the NSA. Boy do these people come up with some ridiculous ideas, such as the one where it's building AI to take over the world!

You know about this one?

https://steemit.com/bitcoin/@poias/bitcoins-s-strange-block-7438-and-the-185-billion-possible-payoff-steemit-investigative-report-pt-1

Thanks for sharing Andreas' video.

Definitely worth watching for anyone who wants to get a better understanding of the difficult and vital decisions being made to keep bitcoin safe.

Andreas shows

Good $h-stuff @zoidsoft. When people with a huge following head down the conspiracy theory trail, it’s good to have a Bitcoin programmer here to let em know it’s the wrong trail.

An interesting thing to observe in conspiracies : they are always full of drama and fear.

Why ? Because they focus incredibly on single details. And life is not about single details, life is about global energy.

The coopting by the institutons wont be found in the code.

If so, then they can't control it because the code is in complete control of the transactions and mathematics replaces centralized authority. The exchanges such as Coinbase have KYC and AML. But the first video has a major flaw in stating the lightning hubs will be operated by the banks. The problem with this is the fact that if you bought your bitcoin from another user and then sent it to an unused address in your hardware wallet, then it has no KYC and AML. You can make assumptions that this is either a new user or a user sending it to another location in their same wallet.

So if these hubs are going to operate as "banks", then when you send a transaction from your hardware wallet whose address has never been used before, they will have to insert a form in between each transaction to collect your social security number, your name, address, etc. Will you fill this form out? Of course not. This puts them back into using imperfect chain analysis tools that can make educated guesses but don't have certainty.

My understanding of hubs so far is a bit different. They aren't supposed to be operated by anybody but represent a pool of assets from many different sources that search for routes to settle direct P2P in the event that one party doesn't have enough bitcoin to settle a transaction between two parties.

It's kind of like this situation. Suppose someone in front of you in line at a convenience store has a 100 dollar bill and you're behind them and they are talking to the merchant who doesn't have enough change for a 100 dollar bill. You overhear the conversation and instead of trading with the merchant directly, what I've done is given 5 twenty's to the customer in front of me in exchange for that 100 dollar bill (plus a 10 cent fee). Then the customer can complete the transaction with the merchant for one of his 20 dollar bills instead. In this situation I operated as a hub. I didn't ask for his name, social security number, phone number, etc.

So the simple solution is this. If you've never provided KYC info on yourself and a node pops up asking for KYC, just say no. There will be other hubs willing to do this for you without it.

I am new to crypto currency, do you have any suggestions to what currency to invest in?

EOS - The resulting technology is a blockchain architecture that scales to millions of transactions per second, eliminates user fees, and allows for quick and easy deployment of decentralized applications.

Thank for the tips!

Btw, I'd recommend bitcoin (btc) as the best crypto to buy.

I hope you’re right! It’s quite expensive to by bitcoin so it will be later...

Ha, tandglese. Love it. For asking for advice then saying thank you, you've earned nearly a dollar already. Maybe you should stick with steem as your crypto. You're doing quite well so far.

I heard that it is a good idea to have more than one currency, so I plan to follow that advice.

Yes, EOS is a sleeping giant. Many people buy into Bitcoin just because of the name, but dont realize how flawed it's become. EOS seemed the most promising to me since it was announced beacause of the scalability and speed of the network and all transactions are free. What more needs to be said? It's going to be huge

You know things about EOS...lets me ask you this...what function will the "token/coin " have?

“What are 1,000% gains?”

get it? Like Jeopardy

I will have a 1000 EOS!

Agreed. Go EOS. There’s still plenty of time to get in on it too. As for the BCH, thanks Jeff, hopefully you’ll recant this conspiracy rant within a few days like you did the last time.

here's some facts that can back up that conspiracy "rant"

https://steemit.com/bitcoin/@poias/bitcoins-s-strange-block-7438-and-the-185-billion-possible-payoff-steemit-investigative-report-pt-1

Cool then, without clicking it I already know what it says. “Humanity,” we can’t all just agree that BTC and BCH and ALL altcoins are cool and they can co-exist, nope! One has to be better than the other, kinda like the R and the D people pretend they know so much about. Just to be clear, both take power out of banks’ hands, right? Just checkin....

so ya... i'd try to destroy what was trying to destroy me... 20k btc doesn't help it hinders.... now we get force fed the "safe" chain

Roger is paying Jeff good to promote BCash.

“He’s speaking at anarchopulco.”

Ya well Satoshi makes me breakfast.

the base always needs to be built to suit the structure. Ethereum needing its own lightning network (Raiden) to handle a relatively small app like crypto kitties, while EOS is already built from the ground up to handle large workloads for apps and games and datacenter uses, without needing to graft on a foreign branch to do the work the base design couldn't handle.

we are truly in blockchain's infancy. more blockchain wizards like dan larimer will need to come out of the wood works for long term design and longevity. bitcoin is suffering from queen bee problems and hive splitting, and unfortunately instead of btc remaining as intended by the whitepaper and scaling blocksize, an "altcoin" had to split off to maintain the original design. It was highjacked, and it will be the downfall when ripple, bch and monero blow past btc.

Long live Bitcoin Cash!

Interesting viewpoint.

20k is coming