Why Am I Cracking Open a Graded Casascius Physical Bitcoin?

Cryptocurrency prices are down and times are tough. Is that enough explanation for you? I didn’t think so. And it’s not accurate anyway (DKP cracked open his BTC so he could spend it...no, that’s ‘fake news’). I’m not spending it.

What are Casascius physical bitcoins?

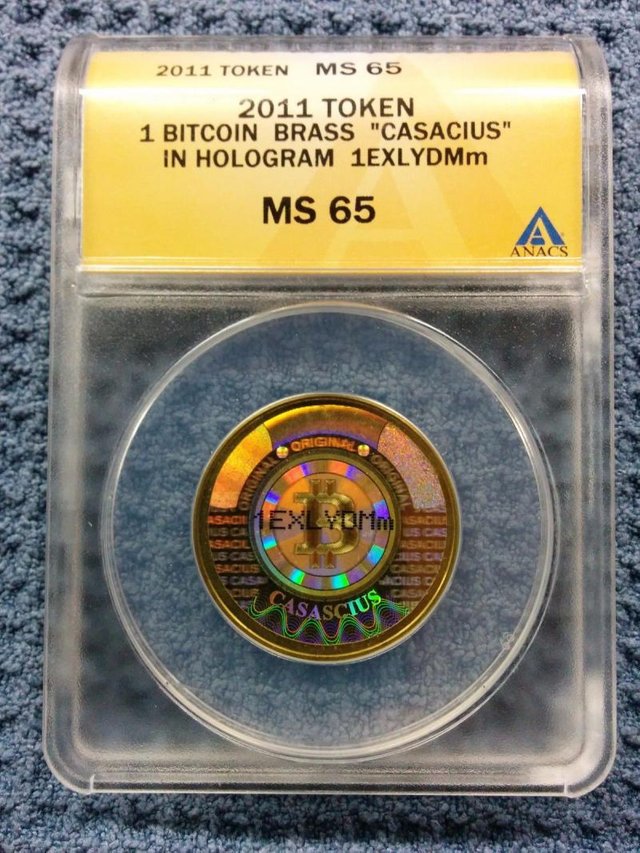

First, here is some background. One of my prized possessions is an early 2011 physical bitcoin made by Casascius Mint. These Bitcoin-loaded tokens were produced for only three years and the early 2011 ones contain a spelling error that makes them more valuable than later ones. This physical bitcoin is a rare piece of cryptocurrency history.

Forward and reverse images of a 2011 Casascius coin graded and slabbed in protective plastic cover by ANACS. Source: forum.coincompendium.com @ badon.

The last time the Bitcoin price spiked to new highs, coins like this were selling at up to $30,000 apiece, though some sellers asked much more. (And I will tell you right now I do not keep this in my home, so don’t even think of inviting yourself over to look for a hidden coffee can under my back porch…this coin is secured in a vault many miles from where I live.)

In 2011, Casascius (a.k.a. Mike Caldwell) began producing these for visionary cryptocurrency investors who wanted a physical wallet and keepsake in the form of a memorable coin. Remember that the price of one bitcoin on January 1, 2011 was a cool 30 cents before hitting $15 in the middle of that year. Yes, you can dream now of going back in time. Don’t we all wish we’d scooped up a little more at 30 cents? $30? $300? Even $3000 seems cheap now. HMOTH = hitting myself over the head.

Caldwell created the coins with a hologram sticker affixed on the back; the sticker has the BTC address of that coin. If you remove the sticker, you can read its key. Then, of course, you can access the BTC online and spend it if you want. Once its balance has been spent, the token itself becomes nearly worthless, as many of them have. Of course, you still see people trying to sell the spent tokens online to unwary buyers who still are not sure what a “bit coin” looks like.

Peeling off a hologram to get the key to the BTC. Source: adammonsen.com.

From 2011-2013, Casascius Mint loaded these physical coins with bitcoin before selling them at conventions and online. But in November 2013, Caldwell received a nasty note from the U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN). FinCEN considered his work (minting currency and selling it to others) to be a money transmitting activity, which requires a license.

In response, Casascius stopped making the pre-loaded bitcoin tokens. It has continued making the tokens, which people can load themselves with BTC and then add the hologram sticker. But for collector’s purposes, a buyer-loaded token is not very exciting or reliable.

So Casascius Mint’s three-year run of minting physical bitcoin effectively ended in late 2013. That means that only three years’ worth of these collector tokens exist (2011-2013) in very limited quantity. And at any one time, there are very few people selling theirs. Therefore, they trade at a collector’s premium above the price of bitcoin. In addition to coin tokens, Casascius also minted some bars, which are even rarer.

Factors affecting value

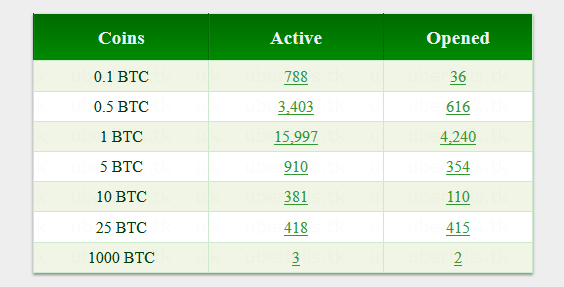

How far above the BTC price do these tokens trade? That can depend on several variables. First, taking off the hologram basically destroys their value as a collector’s item. But plenty of people have opened their coins to redeem the BTC contained there. The number of such coins are tracked on the Uberbills.com site. Casascius minted more 1 BTC coins from 2011-2013 than any other denominations. At last look, there were 15,997 active coins in this mintage, of which 4,240 had been spent. No one knows how many have been lost or opened by their owners.

Uberbills.com

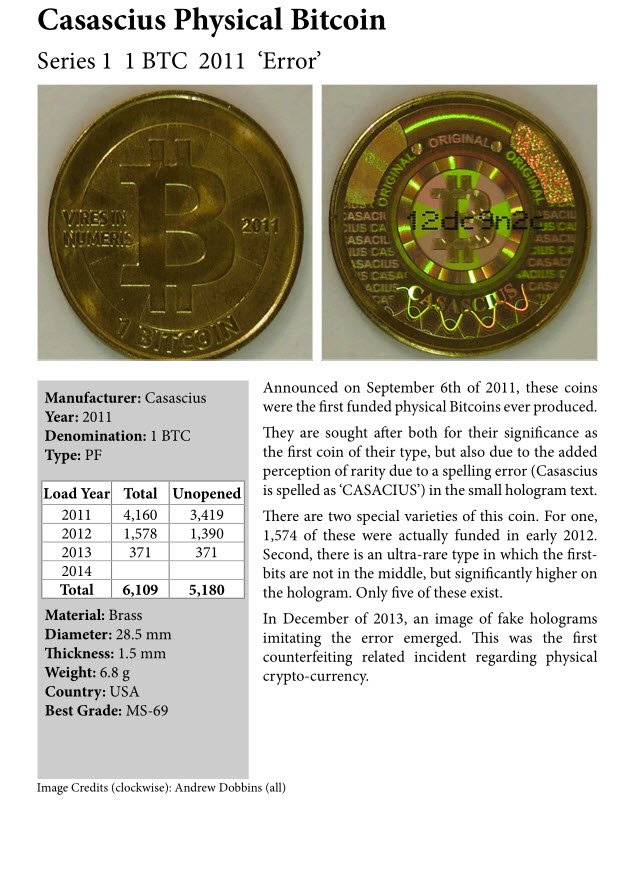

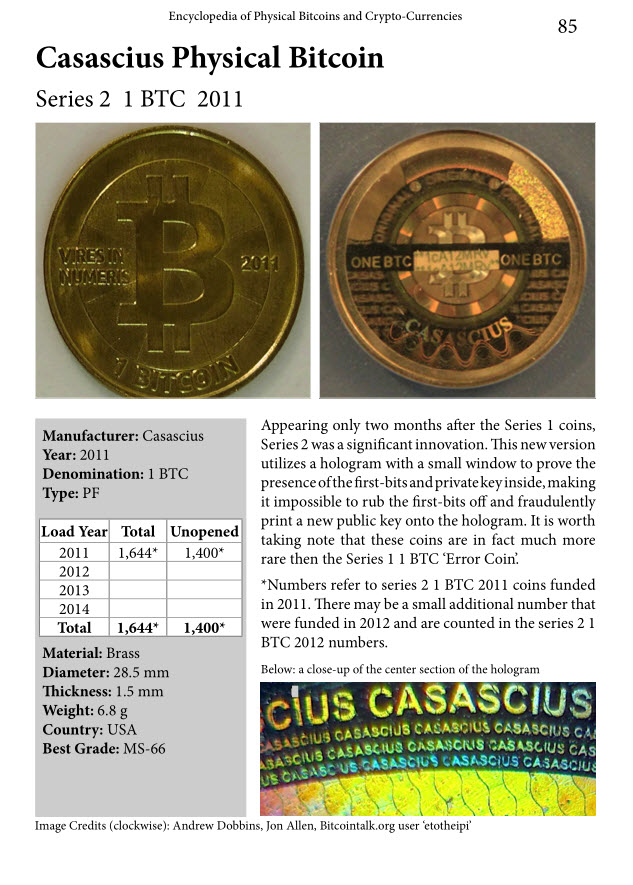

Second, the early 2011 Series 1 coins have a spelling error on the hologram (“Casacius” instead of “Casascius”), so those are worth more. Few coins were minted with that error; I have never counted to see how many have been redeemed or are still loaded from that set, but it’s safe to say my 2011 coin is one of a few thousand in existence.

Source: Encyclopedia of Physical Bitcoins and Crypto-currencies (full reference to source at the end of this post).

Third, some have BTC addresses beginning with desirable letter or number combinations, such as “1Pi” for those who like math or containing lucky numbers or letters spelling some word like “art” or “zip”, etc. Some people are willing to pay more for a lucky address, vanity address, or something with sentimental value.

Fourth, you can’t always trust what you’re buying, and there was one instance of counterfeiting with these coins, so professional coin grading services provide added reliability in the quality of the token. Some grading services will not touch crypto tokens, but ANACS will. Though coin collectors will tell you it’s not quite as reputable as the top grading services, the American Numismatic Association Certification Service (ANACS) is a highly respected grader that will verify and slab cryptocurrency tokens for you.

An ANACS-certified physical bitcoin, slabbed in a protective cover. Source: goldeneaglecoin.com.

Having the coin professionally graded and locked in a protective container verifies its authenticity. Through the grading process, the token also is assigned with a numeric grade representing its quality. A mint-quality coin in perfect shape will have a higher graded number than one with scratches on the surface. So dealers and buyers of Casascius coins will pay more for highly-graded ANACS coins. But even when a coin has a lower graded number, the ANACS certification provides reliability, which bumps up the value. And the protective nature of that sonically-sealed, hard plastic slab cover also cannot be overestimated because it means no one is touching that coin.

Submitting a coin for ANACS grading and conserving costs around $60, but that simple step conceivably can add thousands of dollars to its value.

So Why Am I Cracking Open My Coin?

If getting your physical bitcoin token graded and slabbed can add hundreds or thousands of dollars to its value, then the dumbest thing you can do is eliminate that extra value by cracking it open. And that’s what I’m doing. But I’m not doing it because I want to spend the BTC on the coin.

The reason I’m cracking my coin is because ANACS graded these very conservatively in the early days of Casascius coins. For the last couple of years, rumors have swirled online that ANACs has loosened its practices somewhat for cryptocurrency tokens. People have reported consistently higher grades. And so coin owners have been cracking open their slabs and re-submitting the same coins, often receiving a higher grade the second time.

This is significant because buyers will pay a premium for higher graded coins. For example, if my Casascius token graded at MS 62 the first time, that is a relatively low grade among “mint state” coins. The range for mint state coins covers 60-70. Some owners re-submitting their coins recently have been receiving a couple of grades better the second time. So if my MS 62 comes back with an MS 64 or 65 the second time, that is indicative of a coin in better condition. And buyers may well bid higher for an MS 64 or 65 coin (in the midrange of mint condition) than the same type of coin in a lower MS 62 condition.

What’s the worst that can happen? If I can get it out of the protective slab in one piece, then the worst that can happen is that I’ll waste about $60 to re-submit it to ANACS for grading. If it comes back with the same grade, I’ve wasted about $60. While possible, I don’t think the grade will be lower based upon the online chatter about looser standards prevailing at ANACS recently. And the reason for trying is that this could come back one or more grades better. Because that could be worth thousands of extra dollars when I finally sell this, it’s worth taking that chance.

And hopefully, sledgehammering this plastic cover open won’t destroy my kids’ college fund. I wonder if there’s such a thing as sonically unsealing. If I scream at it, will this thing pop open? Forget the sledgehammer; I need a jackhammer for this thing. Or will I find out what gold does to a man's soul?

1980s nostalgia still has a hold over me after my last post, so here's Peter Gabriel with some "this is the new stuff" Sledgehammer.

Sources:

https://www.wired.com/2013/12/casascius/

https://en.bitcoin.it/wiki/Casascius_physical_bitcoins

http://www.anacs.com

Ahonen, Elias. Encyclopedia of Physical Bitcoins and Crypto-Currencies (self-published by Elias Ahonen, 2016), available at https://www.amazon.com/Encyclopedia-Physical-Bitcoins-Crypto-Currencies-Ahonen/dp/0995089906 .

Top image from Casascius Mint (public domain).

And in case I wasted this reference, dust to dust. Source: Treasure of Sierra Madre, Warner Bros.

Wow, please be careful, don't scratch your Casascius D:

You know, I'd been reading about Casascius three weeks ago. I'm always researching ways to solidify my crypto earnings and this was my obvious starting point. I spent a whole afternoon reading about the guy's story in various news sites.

I think that it's very sad what the FBI did to his business. It's not emitting money if the money has already been emitted. He was just creating storage mediums with a collectible value.

However, it's still super good that it happened. He earned his place in the history of cryptocurrencies and his name will be remembered for quite a long time now. :)

The 2011-13 Casascius ones are hard to find and expensive, but I still think they are worth picking up if you can find a deal on a real one during a pullback in the markets. I wish someone minted some smaller denominations of loaded crypto coins. The unloaded tokens are worthless. The Lealana coins were pretty good; they mostly made LTCs and a few BTCs also, but you don't see many being sold these days aside from the "Buyer funded" ones. The Satori casino chips are low denominations and, though I have a preference for metallic coins as opposed to plastic chips, people seem to bid those Satori chips above their actual value whenever there is a BTC pump (probably because there isn't much else like that out there). There are a few other physical bitcoins that came loaded, but most are obscure and don't have too much collector value.

Ooooh, I hadn't read about all of those other projects. It seems that the ones minted by Casascius are unique not only in their concept but in their fame and history. That's what separates it in value from the others.

I would prefer metal coins too since they give an air of further solidity. However, these days, you can just put a hardcover over them and send them off to a safe house where they shall stay undamaged until the end of days... or the time when they're sold. We could say that preference is the only "real" difference between them nowadays, since they'll be equally durable, and just as valuable if they have a similar collector value.

I don't get the point of buyer funded ones. If it's a collectable but it's modified by the buyer, it doesn't make any sense at all for future buyers. Perhaps for someone who just wants one saved in their home with a cover on it. Like a Rembrandt that you know is a Rembrandt but you had to 3D-print it. It's unique to you, but you printed it, so it loses value for others, but it's just as pretty for yourself.

here, have a vote!

FBI did really bad here. More freedom for cryptos!

Challenge, where you can win up to 100s $SD!

If you want to, you can try it here:

https://steemit.com/contest/@guessandgain/guess-and-gain-6-2-day-win-usd

what you mean is: cryptocurrency is like a stocks, while Casascius Physical Bitcoin is like real state?

Omg, it actually can work out. With the coin and the code behind it.

They need a licensed seller that can be trusted though.

Iya jangan da penipuan

I was thinking you could open it and spend some of your BTCs on Steem. I wish I was in this crypto thing even in 2016. I started June 2017.

That's very interesting to read informative post @donkeypong. I've never heard before about Casascius Physical Bitcoin. But now am mostly knowledge and updated. Its seems much valuable. Have you any idea to sell them?

There's plenty of demand when it comes time to sell, though it's not in my plans for a while. eBay and bitcointalk are frequent places you see them offered for sale.

Pretty awesome coins. Sound would be interested. Great description of physical BTC with past history market analyse. More important to find us. Thanks @donkeypong.

Imagine if you had one of those coins with 1000 btc! damn! I imagine those coins in the chart with a value of 0.1 have the less open percentage because they probably where bought or given to people that didn't really care that much and loss them? or maybe there's a different reason for it?

We can track who opened and redeemed them, but not who lost them. We may never know. And the same is true of some crypto accounts for which owners have lost their keys or forgotten.

wow. a very valuable coin. how much can it cost now?

Today, probably $10,000. On a good day, $20,000 or more.

the price was fantastic

Good day as in BTC back at USD 14k?

The thing I love about (physical) coins is the statement they make about the era in which they were minted. They say so much about history - I've learned things I'd never have imagined researching without first wanting to understand what a coin was telling me.

Yes, certainly. I have many that are worth far less than this one and it's not always about the value. They are a aprt of history and culture, representing a time and place. I love old coins and stamps as well.

Hire me to operate as designer of the piece of hardware in by which this coin is inserted and read by its reciever and uses the composition as in fact the universal first stage retro/rocket, launching its hidden arms to go forth, seek with knowledge , and put that cgoin in motion,- not to anyone but everwhere, to digatily , under your discretion and request, any amount in molecular acuracy can be sent and the. Reciept the coins weight has been altered and recorded and respun and vonnected to your computer to boost its speed and mining capabilities to seek out to repair or replace itts molecular structurre, on its on for the user in command.

That might fit in # poetry.

I can think of another tag or two as well