Why Bitcoin Mania Is NOT Tulip Mania

Bitcoin - and the entire cryptocurrencies universe - is expanding with unprecedented speed. With the $4000 psychological level broken en fanfare, even the most skeptical individual is now at least paying attention to the phenomenon. And boy, there are a lot of skeptics out there.

Among them, a specific thought train is gaining speed, namely the "Tulip Mania" comparison.

What Exactly Was This Tulip Mania?

I like to get my facts straight, whenever I can, so here's a little excerpt from Wikipedia:

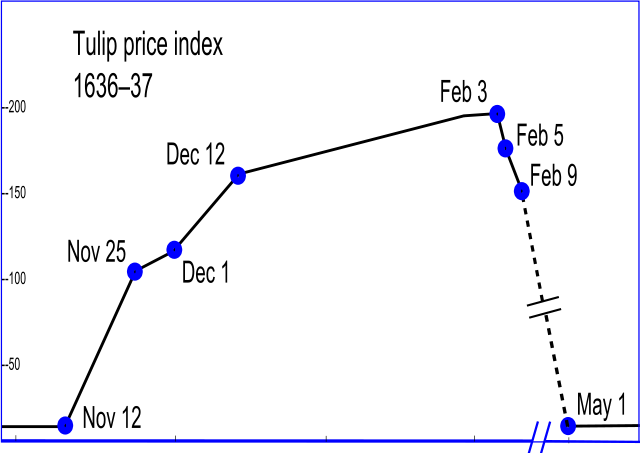

Tulip Mania [...] was a period in the Dutch Golden Age during which contract prices for bulbs of the recently introduced tulip reached extraordinarily high levels and then dramatically collapsed in February 1637. It is generally considered the first recorded speculative bubble (or economic bubble). [...] The term "tulip mania" is now often used metaphorically to refer to any large economic bubble when asset prices deviate from intrinsic values.

Here's also an images depicting the rise and fall of the tulip bulbs price:

By JayHenry - Own work from data of Thompson, CC BY-SA 3.0, Link

Well, with all due respect, I think the comparison between Tulip Mania and Bitcoin Mania (because yes, I do think there is a little bit of madness here, from Greek - μανία madness, frenzy) is widely inappropriate.

Here are the reasons:

1. Tulip Mania Short Time Window

The tulip mania extended for almost a year, from November 1636 to February 1637. Bitcoin is a phenomenon lasting for more than 8 years, although the hype, or the popular frenzy started almost a year ago. Tulip mania was also a seasonal phenomenon, tied somehow to the actual lifetime of the overpriced product (the tulip bulb).

2. Bitcoin Is A Collective Product

The tulip bulbs were initially a very rare merchandise, owned by a few. As they become more and more popular, the price fell dramatically. Because each individual owned a specific part of the market, you could easily price the actual value. In the case of Bitcoin, nobody owns the market. There is no bulb, only a web of constant relationships (between miners, traders and holders) which is supporting the ecosystem.

3. Tulip Mania Happened On A Slow Communication Infrastructure

If we compare the access to information of that bubble to the access of information of today, we can easily spot some fundamental differences. Based on the confusion about the bulbs, one could easily spread misleading information about it, creating higher expectations. Today, even though the "pump and dump" actions are heavily manipulating media, you can at least find reliable sources of information, if you really want (starting from the Bitcoin white paper, out to the Twitter accounts of the key characters in this movie). So, in this case, a potential crash based on the "people will eventually find out the truth about this" is less likely, because most of the people already know the truth about this.

4. Bitcoin Fungibility

Considered great "stores of value" tulip bulbs had, unfortunately, a very low fungibility. In other words, you couldn't exchange them anywhere and with anybody. They were confined (at least) to a specific geographical setup. Also, one could add the fact that you need some specific knowledge to preserve that store of value. Bitcoin, on the other hand, is fungible wherever there's electricity and internet (that would be probably 70% of the entire population of the world right now) and, lately, internet is not even a requirement, with the launch of the Bitcoin satellite.

5. Social Implication Of The Bitcoin Technology

In many ways, tulips were just small pieces of real estate. You just invested in them, hoping the price will rise. They had no other potential. Whereas Bitcoin, and the entire blockchain technology, is boasting an impressive number of social and governance features, from voting to prediction markets. So we're not talking about a speculative bubble in a specific store of value, we're talking about a disruptive technology.

One Word Of Caution: You Can Get Screwed Even With Bitcoin

So while there's obvious - at least for me - that we're not in a similar Tulip Mania bubble, it's certain that we're living very disrupting times. Some of the financial processes we took for granted since we were born are starting to change. Some will be improved, some will be eliminated and, most likely, some new processes will be implemented.

During this whirlwind - which is unfolding as we speak - it's very likely that some of us may be caught with their pants down. It's a risk that we should be aware of.

Like, you know: trade only what you can afford to lose, use sunscreen, don't text and drive, don't drive and drink.

You know the drill.

I'm a serial entrepreneur, blogger and ultrarunner. You can find me mainly on my blog at Dragos Roua where I write about productivity, business, relationships and running. Here on Steemit you may stay updated by following me @dragosroua.

https://steemit.com/~witnesses

If you're new to Steemit, you may find these articles relevant (that's also part of my witness activity to support new members of the platform):

Thanks for the background. I think you make solid points about the differences.

I see this more as a digital gold rush with too many speculators now jumping in on the promise of riches. With that metaphor, many people will likely go home disappointed

The problem of bubbles is not the lack of wealth creation is the opportunity cost of the subsequent depression. 2014 was not a particularly funny year for people that invested in Bitcoin, now imagine the same but on a global scale. The tulips bubble is not an interesting example. Let's check the Japanese economic bubble or the real state Irish bubble. Both encompassed almost two decades to burst. But destroyed generations that have the burden of the debt. Deflationary systems work as pyramids or the last fool pays.

Before that BTC will probably reach a million dollar per BTC and your children will pay the tab.

Thanks for the comment but I don't see this comparable with the two examples you gave. Can you give me more arguments?

Sure. Let me expose the cause for the bubble nature of Bitcoin and then compare it to real-world bubbles that have used real assets and lasted long periods of time.

As a deflationary self-interested decentralized system, Bitcoin was made to last at least till 2021 when the next halving happens.

Off course that only if developers can make the network strong enough to be secure, thus the system was pegged to Moore's law for the hashing to expand. Curiously enough By 2020 this will be a problem as the distance between the atoms of silicon will be just close to 8 atoms and quantum effects on normal computation will drastically reduce the expansion we see today. This is already a problem as scalability problem has been creeping up.

The next thing is that Bitcoin's price is calculated based on circulating supply, but that number is erroneous. The genesis block is out of reach, unless Satoshi moves them, and close to 1.5 million coins of the ones that have circulated since the early days have effectively been lost by people that lost their keys. So in reality, as adoption increases more and more coins get lost due to small amounts lost in wallets "forever". There are in fact fewer possible to access bitcoins than most people think.

If banks start using BTC as a reserve currency the volume of transactions will increase exponentially, but if that happens the price will drop. Currently, the network only sees liquidity of 5% of all bitcoins every day. Thus the core team wants to diminish the amount of big transaction by maintaining the blocks size, it works in many ways. As it addresses two problems, transaction volume and scalability. If the volume and distribution increase the price will drop dramatically. It also increases the fees and diminishes the need to continue expanding miners. Companies could mine at a loss. Thus, is actually good losing miners for the price to increase.

The next thing is the valuation of big holdings, as companies like ICOs receive huge amounts of Bitcoin they start increasing in value regardless of them producing anything of worth. Is not distant in the future you could see big firms buying failed ICO companies just to buy their bitcoins.

All of this creates a safety net to overestimate the value of Bitcoins enormously for quite a long time before any crack can appear. The more companies buy Bitcoin the more they increase in value, the less liquidity in the market (Bitconnect is an early example of this at an early stage, they have consistently risen in price just by buying bitcoins. They want to become one of the biggest comunal wallets) by current projected distribution you could expect something like only a 1% of all Bitcoin being in the market. Billions working for satoshis and high-end companies trading on Bitcoin backed currencies. Nothing stops people from creating futures and bonds based on Bitcoin. Finally when liquidity dries the whole thing collapses.

This same pattern of scarcity, self-currencies has happened before in the past many times. During the 19th century each bank, backed by gold had their own currency. Most of the time they got robbed. (in this case, remember in cryptocurrencies access equals ownership, so hackers have a huge incentive to rob) There were many reasons why a unified central banking currency was created. Banks were being robbed all the time (thus the tropes from the movies, just like ICOs and regular people get hacked all the time)

Now with the Irish real estate bubble.

https://en.wikipedia.org/wiki/Irish_property_bubble

Spanned since the 1990's to 2007. The premise of scarcity is the same. The land is limited, thus the scarcity and there was an opportunity to invest in a promising place since the GDP was increasing faster than in the European Union by 7%. The Irish market was not regulated as it never required preparation for such demand and had no financial supervision, thus the prices were free to skyrocket as the number of potential buyers and construction expanded. It took years for the bubble to burst. Now Ireland has a crisis of young people migrating because they have no jobs.

Equally, Japan has not been able to recover from the bubble, they had a huge internal debt that they will most probably have to default and their youth works 12 hours a day on average.

The problem doesn't lie in Bitcoin, lies in greedy people. You can't stop people from making side bets and overestimating value. The real value of a Bitcoin should be around $200 if we price the network and take into account 100% liquidity yet is not the current price, but it will be as high as $1.000.000 in 3 years of that I'm sure and It will create a depression. Because we are humans.

Comparing Bitcoin with banks is, IMHO, inappropriate. Banks are an investment vehicle working by delegation and trust. The vast majority of financial blunders are made by banks and their centralized decision making, NOT by individuals. Bitcoin is very different, you can't move significant amounts of money similar with how banks are doing, like in time and volumes. So I don't think it helps us understand the phenomenon if we're comparing Bitcoin with banks. It certainly is a currency, but it's not following the traditional ways of processing money. I do not know which these ways are and for what is worth I think we're assisting at the very birth of these processes as we talk.

On what grounds your affirmation about the "normal" Bitcoin pice ($200)? Very curious how you got to that one...

No, act in good faith in this thought experiment. As modern banks have not existed before the big bang as a source of primordial evil, they got invented for a reason and it was the increased amount the new world had in gold currency.

Core developers have told that soon as Bitcoin increases in value Bitcoin transactions will mostly be done by banks (financial institutions) on chain, and almost everybody that has not a significant amount of Bitcoin would have to use off chain alternatives like the lightning network. Coinbase already is valuated as the first banking system of Bitcoin, naturally owned mostly by NASDAQ, just like blockstream.

We are in the early days of Bitcoin banking as mainstream adoption is not completed and BItcoin is relatively distributed as of now.

The bitcoin network has a value by developers, foundation association (like the Linux Foundation does) and by hashing power.

9 million terahashes per second. By ASIC miner machines the average cost is close to $200/TH. This is close to 1.8 billions of dollars in computational power. Cost of running the network as of electricity depending on place of the world, in 24 hours is close to 10 millions of dollars a day. Add a couple more millions per rent and other operational costs.

The foundation must be close to 500 millions of dollars. So, for an operational year, as most companies are valuated on average (remember Linux is distributed and yet it has not added price) that's 3 - 6 billions of dollars. Divide in 16.5 million bitcoins and there you go.

The rest is branding. So yeah, 65 billions of dollars in branding and trading pumping. But don't worry it will increase in value more, a lot more.

As somebody who went through the process of selling a company which he founded and grew, I dare to think that your valuation process is highly biased. You're confusing value of assets (Bitcoins) with shares in a company (a potential company that is the Bitcoin "manager"). In our case, there's no such thing, but even in that case, any due diligence process will take into account far more than just the rough, financial numbers. There are things like intellectual property, social impact, market contingency and alike. And it will take into account, primarily, the market price for any goods or assets.

And the market price right now for Bitcoin is tickling the $4000 mark. It may be that the market is inflated right now, but if you ask me, I don't think it is. Of course, a correction may be due, but the influx of value in the network gained too much momentum to be stopped or to fall abruptly.

Yeah, valuation as shares is what I did. It would most likely not apply as it's open source. It would actually be chaper as an open-source valuation. Intellectual property applies maybe to Satoshi, but not to Bitcoin as it's open-source, the impact is already in the foundation equation. That's the reason Blockstream has probably applied for defensive patents, as of now Bitcoin can claim nothing extra for valuation.

Most of the current price is branding and over-trading small volumes.

This market is not due for a significant correction (I prefer the term fall in price, is less biased) is most likely getting ready for an explosive expansion. If the price is what you worry about, don't. It will increase beyond your wildest dreams. The consequences of this will most likely not be paid by us.

I enjoyed reading your article. I agree that there is really no comparison between tulip mania and bitcoin mania. Tulip mania is from a different era all together and there is no bubble in bitcoin :)

This is mind-blowing.

Well, if we take a closer look at world economy - it always collapses and rises and making some hype. So it is a matter of time when bitcoin will collapse. Maybe not so hard like Tulip mania, but nevertheless. The only think that bothers me is how US goverment will regulate crypto currencies at some point and how it will influence the market.

This is awe-inspiring.

I can't stop watching/reading/listening.

Steem.supply is a great tool , thank you for created it :)

@dragosroua - Sire, love your work Sire. This is very useful post Sire. Therefore, I will resteem it Sire.

+W+ [UpVoted & ReSteemed]

The hype around bitcoin I agree isn't like Tulip. We are constantly being told that bitcoin is in a bubble but we have heard that from the dawn of the existence of the blockchain.

We have seen this slow growth over the users with a few stumbles only when the volume of transactions where minuscule compared to now and as time goes the volatility will decrease.

However I guess we should all be ready for the worse.

As Satoshi Nakamoto said: I'm sure that in 20 years there will either be very large transaction volume or no volume.

Do you have any link for that quote?

https://bitcointalk.org/index.php?topic=48.msg329#msg329

Why bitcoin mania is not tulip mania - i agree

I would add 1 more thing. Crypto currency like bitcoin is a modern currency reform and tulip is not reform at all :) I was just reading how bitcoin is not in a bubble, it's just a currency reform and we are lucky to be in early stage of it.

Great breakdown. But it's kind of ridiculous that it's even necessary. There really is no comparison. It's almost like saying, "Yeah, when I was a kid I opened a lemonade stand and it didn't really go anywhere so I don't think Bitcoin will either."

Now that's one way to say it even better :))

yes sir u right and ur share about tulip is good in details i read it first time and now i know some thing about this mostly ur posts are newly for me about crypto and i try to get some thing new