Bitcoin wealth distribution

Before we break down the spread of Bitcoin wealth, let's define what is Bitcoin as simple as we can. It's really a type of currency, like dollars, euros or yen. The main difference is that there is no government entity backing it up, and it instead exists online. This is achievable thanks to a groundbreaking technology called the blockchain.

In the traditional market, companies, banks, and other organizations have to keep an accurate record of every transaction in order to help identify fraud and criminal activities. With the help of blockchain, these same transactions are broken into tiny parts which are routed through a worldwide decentralized computer network and leads them to a receiver who can then re-assemble the parts together.

The technology tends to be challenging for an average user to understand, and this presents a barrier for companies and people who want to work with it to adopt it on a bigger scale, that's why people typically turn to a merchant like Coinbase to manage their transactions. We can look at this similarly as we carry physical cash in our wallet or manage our assets with an online banking service. We can think of Coinbase as a mix of the two, online wallet. We utilize it to buy stuff and pay for services.

Unlike the online banking service, if someone gets holds of your money, you can not dispute those transactions and the thieves can be untraceable. People have to look at online wallets as their own banks and therefore manage and secure their funds the same way as they do.

Similarly, as in the regular fiat market, wealth distribution remains a challenging analysis worth investigating. Crypto exchanges and online wallets would have a much clearer idea of the current distribution, however, their published statistics are quite limited.

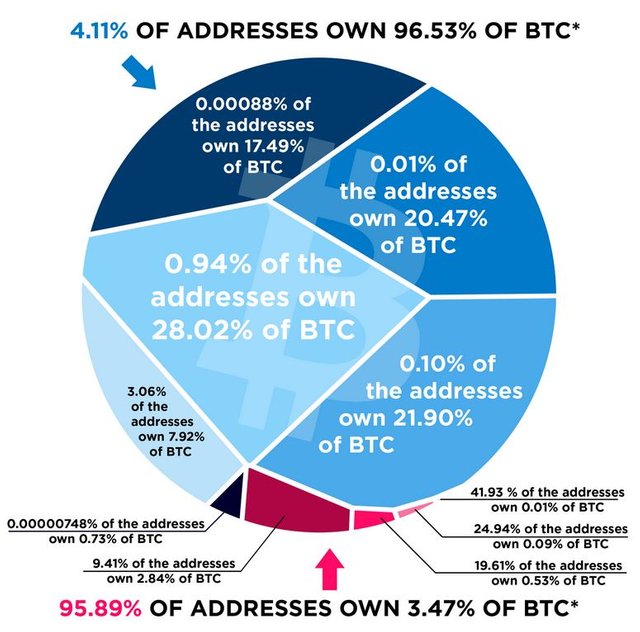

The following graph represents datasets collected by cryptoaware.org and designed by howmuch.net which shows the whole bitcoin market, currenly valued around $65 billion. The value of the bitcoin market was divided by the total address and It revealed that over 95% of all bitcoins in distribution are controlled by approximately 4% of the market or that only 1% of the addresses control 50% of the market, which ironically is a similar wealth distribution in comparison to the traditional fiat monetary system.

There are two things we need to keep in mind though while observing this graph:

- The first thing is that analyzing the actual Bitcoins wealth distribution can be of a misleading nature because addresses are not people and this is true the other way around as well. Single Bitcoin address can represent multiple individual entities and a single entity can represent multiple addresses. A simple example of this would be a crypto exchange or online wallet, where the asset is being held for millions of different people while in the same time most active Bitcoin users have hundreds of different addresses and these addresses are not looked at as partial wallets.

- The second important thing we need to remember has to do with anonymity and its limitation regarding Bitcoin. In the current stage, Bitcoin remains only partially anonymous. If you require to remain fully anonymous, you have to use untrusted Bitcoin payment hubs which enable users to group similar transactions collectively making it look like multiple entities are using the very same Bitcoin address when in truth they do not.

What we can learn from this is that bitcoin and other crypto assets for that matter with blockchain as their underlying technology are still in a beginner stage of adoption. The market cap is extremely low in comparison to other world markets and combining this with the centralized nature of their wealth distribution in an unregulated market, makes this one of the most volatile assets in the world and until these circumstances don't change, rollercoaster rides should be expected.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.

This post has received a 18.71 % upvote from @boomerang.

Congratulations @exgap! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard: