Bitcoin TA - summary of analysts - 12. May 18

Regular daily update on BTC ta analysts opinions.

**My summary - short-term sentiment: bearish ** (last: bearish)

- Yesterday we got an update from all analysts. Today only @lordoftruth has an update till now.

- We are still correcting - 7'770 to be watched as possible swing low.

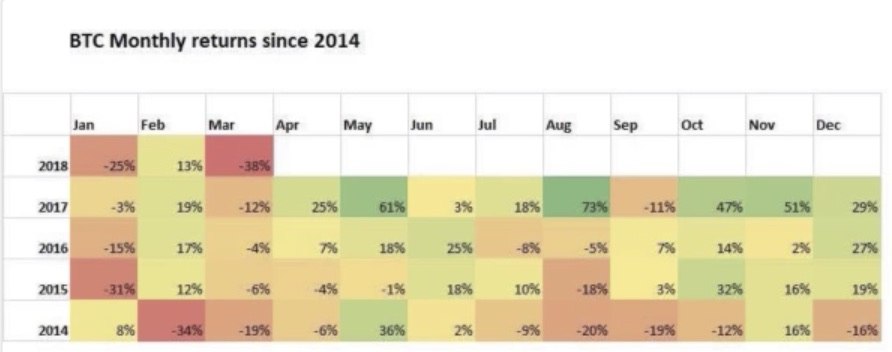

- Just realized I have been ahead of time. May is usually a strong month. Lets see how it plays out in 2018.

News about the blog

I need to revise my 2018 long term table. I need to add a 2018 and 2019 target an be more precise on the sentiment here. Will do that after I am back in Switzerland.

We lunched the bounty project beta. If you are interested and you like to create a bounty on your own have a look at this post

Analysts key statements:

Tone:

- Weekly: Weeks looks bad. We are hold up by 7 week MA. To maintain green count we need to close next week over 8'800.

- Daily: He expects that we are going down till the 15th with a swing low at around 8'300 - than 4 day bounce and than lower.

@haejin:

Bitcoin (BTC) has likely put in the full five waves. Correction will likely decline towards the 0.618 Fib level. Soon, the B wave bounce should occur. Since the decline . Thus far looks like an ABC; the correction could be the Flat type (3,3,5).

@ew-and-patterns:

This morning the waves show a potential for blue wave 2 being in progress already! He sees us going down to the area of 8'400 - 8'000 and considers this a buy opportunity. For Wave 3 he sees a potential of minimum 14'000.

@lordoftruth:

Bitcoin price continues to suffer losses on Friday and failed to keep above the key 9'000 and most likely we will see a decline below 8'000 area.

Hourly MACD in the bearish zone and RSI is currently near the extreme oversold levels.

Keep an eye on the 4th station at 7'770, as a buying opportunity.

Todays trend is neutral. Expected trading for today is between 7'770 and 9'050.

@philakonesteemit:

We see a massive rejection at 10'000 range and have now hit a 0.618 golden ratio fibonacci retracement level. I do not believe it'll hold and we can see 9'050 to 9'150 range. If that doesn't hold we go for 8'200 to 8'620 range.

@passion-ground:

If the preferred bullish count is to remain in place, bitcoin could go down as low as 7'887, which is a 0.618 fib retracement of the entire bullish advance from lows printed on April 9th. Short-term trend is down, and the 9'577 level is “key” upside resistance. If crossed we will see a short-term move above the recent print high of 9'948. If 9'577 holds we will see further downside consolidation before next bullish run higher.

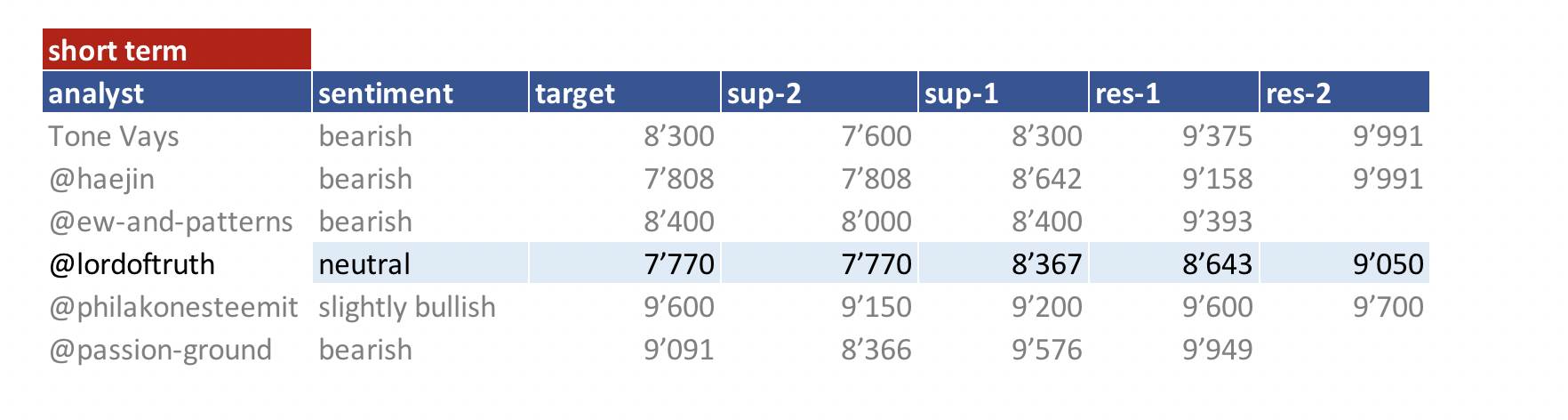

Summary of targets/support/resistance

Reference table

| analyst | latest content date | link to content for details |

|---|---|---|

| Tone Vays | 11. May | here |

| @haejin | 11. May | here |

| @ew-and-patterns | 11. May | here |

| @lordoftruth | 12. May | here |

| @philakonesteemit | 07. May | here |

| @passion-ground | 10. May | here |

Definition

- light blue highlighted = all content that changed since last update.

- sentiment = how in general the analysts see the current situation (bearish = lower prices more likely / bullish = higher prices more likely)

- target = the next (short term) price target an analysts mentions. This might be next day or in a few days. It might be that an analyst is bullish but sees a short term pull-back so giving nevertheless a lower (short term) target.

- support/res(istance) = Most significant support or resistances mentioned by the analysts. If those are breached a significant move to the upside or downside is expected.

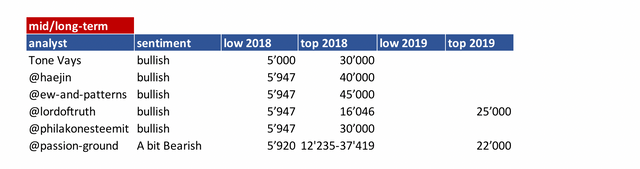

- bottom = -> now renamed and moved to long term table. Low 2018

- low/top 2018 = what is the low or the top expected for 2018?

Further links for educational purposes:

- From @ToneVays: Learning trading

- From @philakonecrypto: Like in every post you find links to his amazing educational videos. For example here

- From @lordoftruth: Fibonacci Retracement

- From @haejin: Elliott Wave Counting Tutorial

*If you like me to add other analysts or add information please let me know in the comments.

good information.love to read it....It helpful for me. I have some steem loan. I really need it. God bless you