View This Copy of I-T Summons to HNIs—How Indian I-T Department Harasses Bitcoin Users In India!

Indian I-T department has sent notices to over 500,000 high net-worth individuals across the country over suspicion of tax evasion from gains on Bitcoin purchases/sales. I was able to obtain a copy of the summons that was sent to one such individual and this is what it reads.

The I-T department wants to know everything and doesn't leave a stone unturned when it comes to finding information about our cryptocurrency trades. They are just one step short of demanding our private keys and i'm wondering if we should just give those away too. Suddenly moving the crypto-tax haven of Belarus feels like a fantastic option!

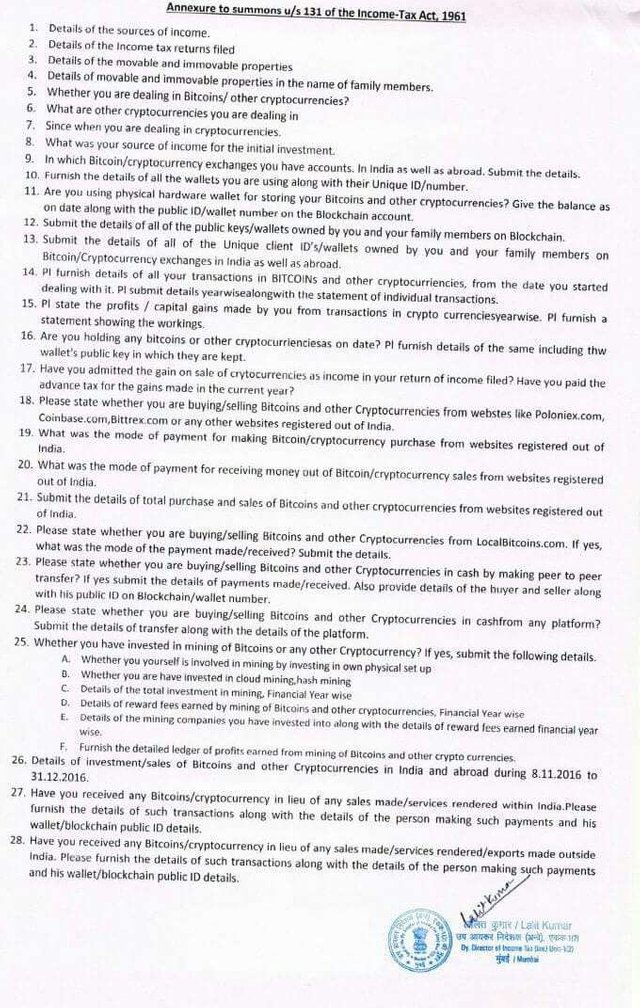

Annexure to summons u/s 131 of the Income-Tax Act, 1961

- Details of the sources of Income.

- Details of the Income tax returns filed.

- Details of the movable and immovable properties.

- Details of movable and immovable properties in the name of family members.

- Whether you are dealing in Bitcoins/ other cryptocurrencies?

- What are other cryptocurrencies you are dealing in.

- Since when are you dealing in cryptocurrencies.

- What was your source of income for the initial investment.

- In which Bitcoin/cryptocurrency exchanges do you have accounts. In India as well as aboard. Submit the details.

- Submit details of all wallets you are using along with their unique ID/number.

- Are you using a physical hardware wallet for storing your Bitcoins and other cryptocurrencies? Give the balance as on date along with the public ID/wallet number on the blockchain account.

- Submit the details of all of the public keys/wallets owned by you and your family members on Blockchain.

- Submit the details of all the Unique client ID's/wallets owned by you and your family members on Bitcoin/cryptocurrency exchanges in India as well as abroad.

- Please furnish details of all your transactions in Bitcoins and other cryptocurrencies, from the date you started dealing with it. Please submit details year wise along with the statement of individual transactions.

- Please state the profits / capital gains made by you from transactions in cryptocurrencies year wise. Please furnish a statement showing the workings.

- Are you holding any bitcoins or other cryptocurrencies on date? Please furnish details of the same including the wallet's public key in which they are kept.

- Have you admitted the gain on sale of cryptocurrencies as income in your return of income filed? Have you paid advance tax for the gains made in the current year?

- Please state whether you are buying/selling Bitcoins and other cryptocurrencies from websites like Poloniex.com, Coinbase.com, Bittrex.com or any other websites registered out of India.

- What was the mode of payment for making Bitcoin/cryptocurrency purchase from websites registered out of India.

- Submit the details of total purchase and sales of Bitcoins and other cryptocurrency sales from websites registered out of India.

- Please state whether you are buying/selling Bitcoins and other cryptocurrencies from LocalBitcoins.com. If yes, what was the mode of payment made/received? Submit the details.

- Please state whether you are buying/selling Bitcoins and other cryptocurrencies in cash by making peer to peer transfer? If yes, submit the details of payments made/received. Also provide details of the buyer and seller along with his public ID on blockchain/wallet number.

- Please state whether you are buying/selling Bitcoins and other cryptocurrencies in cash from any platform? Submit the details of transfer along with the details of the platform.

- Whether you have invested in mining of Bitcoins or any other cryptocurrency? If yes, submit the following details.

a. Whether you yourself is involved in mining by investing in own physical setup?

b. Whether you have invested in cloud mining, hash mining?

c. Details of the total investment in mining, financial year wise.

d. Details of reward fees earned by mining of Bitcoins and other cryptocurrencies, Financial year wise.

e. Details of the mining companies you have invested into along with the details of reward fees earned financial year wise.

f. Furnish the detailed ledger of profits earned from mining of Bitcoins and other cryptocurrencies. - Details of investment/sales of Bitcoins and other cryptocurrencies in India and abroad during 8.11.2016 to 31.12.2016.

- Have you received any Bitcoins/cryptocurrency in lieu of any sales made/services rendered within India. Please furnishing the details of such transactions along with the details of the person making such payments and his wallet/blockchain public ID details.

- Have you received any Bitcoins/cryptocurrency in lieu of any sales made/services rendered/exports made outside India. Please furnish the details of such transactions along with the details of the person making such payments and his wallet/blockchain public ID details.

Look at these points and it does feel like a harassment but this doesn't come as a surprise to me at all. India is not the easiest place to do business. There's a lot of red-tape and bureaucracy.

Be sure to read my guide on filing your returns if you have any gains from Bitcoins/cryptocurrencies.

If you consider taxation of cryptos as theft, India has arrived at the scene!

The change in our government hasn't made a major difference to curbing black money. India has a very closed, restrictive banking system with hard rules and strict implementation, especially concerning areas such as money laundering. Sending money abroad is a complex and complicated matter usually. However, demonetisation did nothing to reduce or prevent black money from being laundered out of the country.

The government on one hand cautions it's citizens from using Bitcoin, on the other all our exchanges have a free hand at operating the way they want to.

Basically, the Indian government now views cryptos has a great new source of income to line up it's pockets. Taxing users heavily and demanding to know every single detail and transactions made in Indian or foreign cryptocurrency exchanges seems to be it's only solution, instead of legalising Bitcoin and alt-coins.

Hopefully they will build a framework in the year to come and make it easier for all crypto investors from India to participate in this space instead of creating ambiguity in taxation, confusion and forcing users to pay up without creating a friendly atmosphere to trade.

It's still too early to say as to what is going to happen in this space but the cryptocurrency space is just booming in India and rest assured, it isn't going to fade anytime soon!

If you like my work kindly resteem it to your friends. You may also continue reading my recent posts which might interest you:

- Steemit Mentioned In: How to File Tax Returns in India for Your Bitcoin Profits—My Latest Feature In TheQuint!

- 4 Tips For Steemit Account Recovery & Wallet Security!

- Steemit.Chat Contest #10 + Contest #9 Winners Announcement!

Crypto is basically exposing their priorities. How can they claim taxes to a currency that they haven't issued without being hypocrites? Not only that, they try to make it nearly illegal while also trying to make as much profit from it as they can.

Thanks for showing this to people, we all need to come up with a solution together.

I recently got a notice from Citibank India for violating FEMA regulations. I have not yet filled the form they requested me to submit. Will be doing it once I get some more feedback from the community on my post.

How can you tax money that you don't recognise as money?

In any case if every high net individual that got this paper (500000) got together and shoved this paper up the indian tax man's ass then there would be a good proctology coin to invest in👍

@stadex lmao! :D If only they'd do that.

Hahaha I hope that will be a thing!

Thank you @rhdmedia

Centralised mindsets want to make profit from Decentralised currency in the form of tax by exploiting people .

There isn’t a lot of centralized mindset s in centralized currency though, to be fair, look at the distribution of btc. But yes, you speak truth.

The current Indian government is confused. Unable to do anything against the corrupt who have hoarded lots of black money, they are in turn going after middle class people who are earning through smart investment.

If it is unsafe to invest, let personal discretion.

Is it only me that things that the best "defense"/"action" is to not answer on any question?

The government stance is very ambiguous on Cryptocurrencies. They are trying to make money out of Cryptocurrency profits but at the same time they want to curb cryptocurrencies as they fear they will promote tax evasion and criminal activities.

So if the government is smart enough they should declare the following.

I think this is a favorable middle ground for the time being. 2018 will be a critical year for cryptocurrency adoption in India. This will be the first financial year where many people will file their taxes and that legitimize the status of cryptocurrencies in India.

Personally I would be happy to pay 10% tax on all my crypto profits and link all my digital assets to government identities or banks.

Great point.

I don’t think 10% would be a very unfair number to ask (even though I don’t like them and don’t want to give anything) if it were just on trades between crypto and fiat. It seems in some countries they say they want to tax every transaction which is insane and unrealistic and just reduces their popularity further. I’m not Indian so I don’t have to deal with this yet, but I wish you guys the best and hope we can come up with a solution! Don’t be discouraged, we are pioneers of something that will change everything!

But to not answer is not fair. And I am not seeing the future of crypto currencies.

Cryptocurrencies are the future. It's just that we are shown a distorted view of reality by mainstream media.

I agree but it is a difficult question. Eg if they get bank statements showing transactions to coinbase and you didn't declare this then GAME OVER.

What if you say that you forgot/lost your private keys? How will they tax it then?

How will they tax the "thief" that has stolen your private keys and lives in other jurisdiction?

@liondani all great points man. But with corrupt govts anything they say is the rule. I dont know the answer to your questions yet but I hope to find out more as we go into 2018.

thief are at large, my friend's coin.ph wallet almost hacked since he doesn't turn two factor authentication ON, he is still lucky the thief not that expert or might just an apprentice one.

Great info on bitcoin. Thank you for the knowledge and for this post!

You're very welcome! :) Thank you for stopping by.

This is good to know!..

The flip side of this, which i was writing about last week, is that Governments are now looking to make SO much tax from this that it is One reason why crypto will not be stopped!..

that list is insane.. i would never be able to provide a list of all my trades!

Next it will be the IRS. You didn't think they would forget about you, did you?

you did a Great research on it .resteemed

Damn this is too much info...really ???

These are very many details,source of capital for initial investment,any exchange you are using,crypto you are holding....damn...!!

So what's the reaction of the people who were sent this to....??? I need to know their response

Thats even worse:

Governments are always abusive!

As per my sources they have had to respond as they also received calls from the tax department asking them to comply. I'm not sure of the extent of the responses given but they have complied.

This why we should inform the next one... people end up being harassed without knowing the guys doing the harassment probably do not know much too. In any case, if they do, then is to be considered theft too. No Government will win anything if trying to enforce GPL code to comply with law enforcement. They think they will... but they are just turning their heads straight into mud.

I have no many people I know from India, but I have done my bit to share this.

this is good decision otherwise all black money is converted into cryptos and distribute all over the world.....nice post @firepower ...

Banks are money laundering for criminals already. Crypto won't make it different.

@itsokaytoeatmayo you are right!

Do you think Government is able to trace all blackmoney? Sabhi apne matlab ke liye kaam karte hain.

Governments are by far the biggest users of black money. All of it they stole from you.

Check out Catherine Austin Fitts – We Need Our $40 Trillion In Stolen Cash Back

This is the type of things that makes the people hate their government. It is difficult enough to learn and go thru the hurdles in crypto investing that even the government wants a cut.

The time for them to compily this list of request could have been use for better things like how to cut government expenses so they do not take their citizens so much.

True that!