The Biggest Cryptocurrency Hacks and Scams

Pundits and commentators have long worried about the security of decentralized cryptocurrencies. In fact, detractors often complain that investing in cryptocurrencies carries far too much downside for the average investor—even if the price goes up, you can still lose it all to hackers. We just saw two more crypto hacks at Bithump and Coinrail, totalling a combined $71.5M. So let’s to take a step back and analyze the history of cryptocurrency hacks.

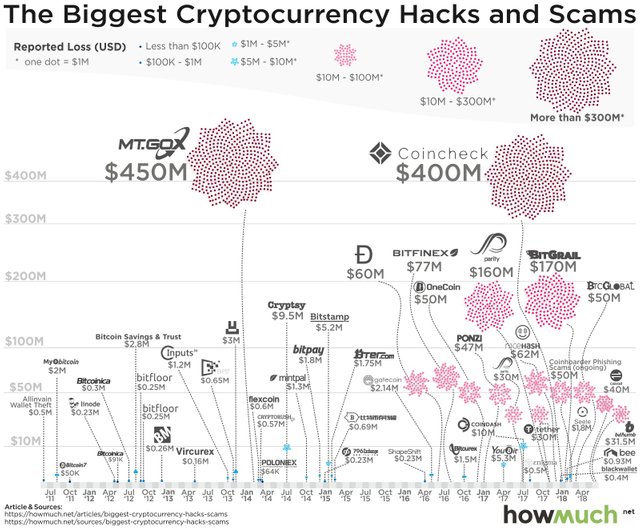

We created our new graph by taking data from CryptoAware.org, which recently published a list of highly significant crypto hacks and scams. There’s no central record keeper for this sort of thing, so CryptoAware undoubtedly missed some. We combined a cluster graph representing the size of the hack on a timeline with the logo of the exchange or wallet provider that fell prey. This approach lets you easily see how often and to what extent the crypto-market has sustained attacks over the last several years.

A general trend is immediately obvious about our visualization: cryptocurrency hacks have generally become more common and more valuable over time. $10M+ hacks started happening with some regularity after the summer of 2016, right when the crypto-market started taking off. Prior to that time, there was exactly one hack over $10M, the infamous Mt. Gox hack in 2014. More on that in a minute. The second-most devastating hack happened very recently in a Tokyo exchange called Coincheck, for the somewhat obscure NEM coins. The only other two cryptocurrency hacks worth more than $100M were Parity’s Ether wallet hack ($160M) and BitGrail’a Nano hack from early this year ($170M). The latter is still causing lots of consternation within the cryptocurrency community. All things being equal, the average crypto-hack comes out to about $37M.

The critical thing to remember about our graph is that it represents the value of the cryptocurrency theft at the time it occurred. This creates a fair comparison because the value of cryptocurrencies changes literally every second of every day. But keep in mind what this really means: the Mt. Gox hack represented $450M in crypto-wealth as of early 2014, back when Bitcoin cost about $560. As of this writing on May 1, 2018, those same Bitcoins are worth just over $9,000, or a total of about $7,252,000,000. Think that’s incredible? Back in December of 2017, the stash would have been worth $15B+. That’s 10% of the entire Bitcoin market cap today and several times bigger than the biggest bank robberies ever.

This raises two important questions. First, what would somebody do with so much cryptocurrency? Obviously, the value of the currency would plunge as news broke of such a massive heist. Since there is no central governing authority, it is relatively easy to launder cryptocurrencies through different exchanges, which makes it possible to convert the coins into a country’s accepted currency. Second, can cryptocurrency exchanges and wallet providers come up with some sort of system to prevent hacks without government regulations? The Wild West nature of cryptocurrencies—price manipulations, flash crashes, hacks—all indicate that these platforms have to do a better job securing value. Suppose 10% of the entire Bitcoin market were to disappear tomorrow. What are the chances that central governments will outlaw exchanges then?

Name Reported Loss (Crypto) Reported Loss (USD) Occured on Sources

MyEtherWallet

DNS hack 215 ETH $152,000 April 2018 Forbes

Coinsecure Theft 438 BTC $3,300,000 April 2018 Coindesk

South Korean Bitcoin N/A $20,000,000 April 2018 Coindesk

Pyramid Scheme

GainBitcoin India

Ponzi Scheme N/A $300,000,000 April 2018 Cointelegraph

Dantang coin Ponzi N/A $13,000,000 April 2018 CryptocurrencyNews

iFan/Pincoin Token Scam N/A $650,000,000 April 2018

BTC Global Ponzi Scam N/A $50,000,000 Mar 2018

Coinhoarder Phishing Scams N/A $50,000,000 Feb 2018

Seele ICO Theft 2,162 ETH $1,800,000 Feb 2018

Bee Token Phishing 890 ETH $928,000 Feb 2018

BitGrail Theft 17,000,000 NANO $170,000,000 Feb 2018

BlackWallet Theft 670,000 XLM $400,000 Jan 2018

Coincheck 500,000,000 NEM $400,000,000 Jan 2018

NiceHash Hack 4,700 BTC $62,000,000 Dec 2017

Parity Wallet suicides 513,774 ETH $160,000,000 Nov 2017

Tether Token Hack $30,950,010 USDT $30,000,000 Nov 2017

Enigma Project Scam 1,500 ETH $500,000 Aug 2017

Parity wallet hack 153,000 ETH $30,000,000 July 2017

Coindash ICO hack 43,500 ETH $10,000,000 July 2017

Yabizon (Youbit) 3,816 BTC $5,300,000 April 2017

Asian-European

Currency Ponzi Scam N/A $47,000,000 Jan 2017

OneCoin Pyramid

Scheme (ongoing) N/A $50,000,000 Dec 2016

Bitcurex 2,300 BTC $1,500,000 Oct 2016

Bitfinex 120,000 BTC $77,000,000 Aug 2016

DAO hack 3,600,000 ETH $60,000,000 June 2016

Gatecoin 250 BTC /185,000 ETH $2,140,000 May 2016

ShapeShift 469 BTC/5,800 ETH/1,900 LTC $230,000 April 2016

Kipcoin 3,000 BTC $690,000 Feb 2015

Bter 7,170 BTC $1,750,000 Feb 2015

Bitstamp 19,000 BTC $5,200,000 Jan 2015

796 Exchange 1,000 BTC $230,000 Jan 2015

BitPay 5,000 BTC $1,800,000 Dec 2014

Mintpal 3,894 BTC $1,300,000 Oct 2014

Cryptsy 13,000 BTC/300,000 LTC $9,500,000 July 2014

Poloniex 97 BTC $64,000 March 2014

CryptoRush Theft 950 BTC/2,500 LTC $570,000 March 2014

Flexcoin Theft 896 BTC $600,000 March 2014

Mt Gox Hack 850,000 BTC $450,000,000 Feb 2014

Picostocks Hack 6,000 BTC $3,000,000 Nov 2013

BIPS Hack 1,295 BTC $650,000 Nov 2013

Inputs.io Hack 4,100 BTC $1,200,000 Oct 2013

Vircurex 1,454 BTC $160,000 May 2013

itmarket.eu

(related to bitcoinica

hack in May 2012) 20,000 BTC $260,000 Dec 2012

Bitfloor Theft 24,000 BTC $250,000 Sept 2012

BitFloor Hack 24,000 BTC $250,000 Sept 2012

Bitcoin Savings & Trust 265,000 BTC $2,800,000 Aug 2012

Bitcoinica 3 40,000 BTC $305,200 July 2012

Bitcoinica 2 18,000 BTC $91,000 May 2012

Linode Hack 46,700 BTC $228,000 March 2012

Bitcoin7 11,000 BTC $50,000 Oct 2011

MyBitCoin Theft 154,406 BTC $2,000,000 Aug 2011

Coinrail N/A $40,000,000 June 2018

Bithumb N/A $31,500,000 June 2018

Cryptocurrencies have had some struggles, but what does that mean for the future? We think of these hacks as growing pains: any new industry will have companies that cut corners on security and pay a price. The free market usually takes care of these organizations—they go out of business. Additionally, even though the size of these hacks is certainly eye-popping, keep in mind that the entire cryptocurrency market is worth about $423B right now. Yes, losing tens of millions to hackers is significant, but these problems won’t cause most people to panic about the security of the crypto-movement writ large.

You have a minor misspelling in the following sentence:

It should be occurred instead of occured.Please Upvote➜https://steemit.com/christianity/@bible.com/verse-of-the-day-revelation-21-8-niv