Monthly Crypto Commentary — February 2019

Additional signs point to the end of the crypto bear market and crypto is decisively entering the mainstream.

QUICK SUMMARY

Several market technical indicators turned bullish, providing further hints for the end of the crypto bear market.

Crypto is entering the mainstream as three global industry leaders announced or made a decisive move into crypto.

First pension funds invested in crypto, more to join in the following months.

MARKET OVERVIEW

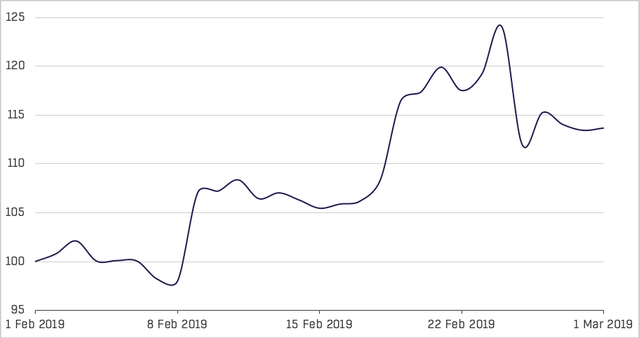

After six months of negative returns, February shed a ray of light into the crypto market. The first week of the month was relatively flat but in the following four days, the market gained 10.6%. The move up was followed by a few days of consolidation and then, over the next nine days, we witnessed another spike of 17.6%. The market cooled down a bit in the last days of February but the month ended with a total positive performance of 13.6%.

Solidum 20 Market Cap Weight Index | February 2019 (Source: CoinMarketCap, own calculations)

At Solidum Capital, we base our decisions mostly on the fundamental analysis, whereas numerous market participants base their trading decisions on technical patterns. Therefore, technical signals are important to observe even for fundamental investors.

The technical picture of the market showed positive changes since several indicators turned bullish in February. Bitcoin’s MACD is showing its most significant bull signal in the last 13 months, indicating that the momentum is moving upward. The money flow index (MFI) created a divergence which is widely considered as an early sign of a change in the trend. Furthermore, Bitcoin saw a crossover of its 50- and 100-week moving averages, which hasn’t occurred since 2015.

CRYPTO DECISIVELY ENTERING MAINSTREAM

Three global leaders in their industries announced or made decisive moves into the crypto world in February.

JPMorgan, the world’s largest bank by market capitalization, has created their cryptocurrency, JPM Coin, which will be used to instantly settle transactions. The bank acknowledges “endless application” possibilities of blockchain technology in the financial industry.

Samsung, the world’s largest smartphone company, introduced a crypto wallet in their new flagship phone, Galaxy S10. The wallet will initially support Bitcoin, Ether, and two crypto tokens but more will follow. This solution will greatly improve the user experience and we can expect all phone manufacturers to introduce crypto wallets in the near future.

Facebook, the world’s largest social media company, is developing its own cryptocurrency. They plan to integrate WhatsApp, Messenger, and Instagram which will allow the exposure of cryptocurrencies across the combined 2.7 billion people using these three services every month.

Facebook, JPMorgan, and Samsung are making decisive moves into crypto. It is hard to think of clearer evidence that crypto is entering the mainstream.

FIRST PENSION FUNDS INVEST IN CRYPTO

In recent months, I’ve been writing extensively about the institutional investors tipping their toes in the crypto market. It is important to note that there are different types of institutional investors. Family offices and university endowments are more proactive and are quick to adopt new investment opportunities, while pension funds and insurance companies are much more conservative and start exploring new investment opportunities at a later stage.

In February, two US pension funds decided to invest in one of Morgan Creek Digital crypto funds, marking the first time for a US pension fund to directly invest in cryptocurrencies. This is yet another important milestone and further validation for the crypto ecosystem.

As Fidelity, one of the world’s largest traditional asset managers is preparing to launch their institutional crypto services in March, we can expect even more institutional investors to enter the market which will further increase the demand.

CONCLUSION

In my December commentary, I indicated that 14 December 2018 could have marked the end of the 11-month long bear market, and there are more and more signs confirming it.

I believe that the current market conditions present a very good entry point and every dip in prices should be perceived as a buying opportunity.

If you find value in this article, please share it with the community.

Share your thoughts in our Telegram Group and help us ignite an active discussion within the crypto community.

I also regularly share my thoughts on crypto markets on social media. You can find me on Twitter,LinkedIn, Instagram and Facebook.

CLICK HERE if you want to receive our news to your inbox?

Solidum Capital offers easy and proven cryptocurrency investment solutions for both, beginners and experienced investors. Learn more on our website: https://solidum.capital/

Solidum Capital also manages the Solidum Prime digital portfolio on the ICONOMI platform. You’re also welcome to read our Solidum Prime Monthly Report for January 2019.

Follow us on: Facebook | LinkedIn | Twitter | Telegram | YouTube

DISCLAIMER: This article is for informational and discussion purposes only and does not constitute a marketing message, an investment survey, an investment recommendation, or investment advice. The article was prepared exclusively for a better understanding of market dynamics.

Congratulations @gregzupanc! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!

@gregzupanc, thank you for supporting @steemitboard as a witness.

Click on the badge to view your Board of Honor.

Once again, thanks for your support!

Do not miss the last post from @steemitboard: